The global business email market is slated to register USD 33.6 billion in 2025. The industry is poised to witness 6.1% CAGR from 2025 to 2035, reaching USD 60.7 billion by 2035.

The market is expected to show significant growth rate as businesses, government offices, and small firms become more reliant on secure and efficient communication platforms. More organizations are setting their sights on innovative business email solutions with ever-increasing demand for secure collaboration, data protection and workflow productivity.

This is increasing the demand for cloud-based email to eliminate system updates and the maintenance of IT infrastructure and robust email encryption tools for improving security and enhancing operational efficiency, thus, expanding the use of artificial intelligence spam filtering, in turn, propelling the market growth.

Business email is a professional communication tool used by organizations and individuals for official correspondence. Unlike personal email accounts, these emails are usually associated with a custom domain, which boosts credibility and brand identity. These email accounts provide robust security and other features that are not always part of free personal email accounts.

These email solutions are the foundation of effective business communication, marketing, and client interaction, offered by providers like Google Workspace, Microsoft Outlook, and Zoho Mail, ensuring reliability and security in professional correspondence.

Advancements in AI, automation, and cybersecurity are transforming business email services to make them more intelligent and secure. To combat cyber threats and keep sensitive data, business email platforms are getting integrated with AI-based email management, real-time phishing detection, and end-to-end encryption.

Machine learning algorithms, when increasingly leveraged, allow assisting with malicious activity detection and preventing data breaches, and is driving demand for the solution. In addition, organizations are caring to go away up to ensure their email communications are in compliance with rigorous data protection regulations such as GDPR, HIPAA and CCPA.

With remote and hybrid work becoming the new normal, cloud-based email hosting solutions are becoming the new favorite that can give staff secure and efficient communication systems anywhere on the globe with internet.

In addition, the industry is observing enormous growth regarding the use of AI-based virtual assistants that manage emails and feature sorting emails, intelligent replies, and context-priority-based organization of emails. At the same time, cloud-native email security offerings continue to converge with security information and event management (SIEM) platforms to enhance real-time threat detection and response.

On the other hand, the ramping trend for subscription service for email, as well as managed email security solutions, offers a unique incremental opportunity for growth particularly for small and mid-sized businesses that are in search of cost-effective yet robust communication platforms.

As the digital landscape continues to grow and evolve, the need for dependable, secure, and functional enterprise-grade business email solutions will remain pivotal to global enterprises as a mechanism to facilitate effective corporate communication, regulatory compliance, and protection against evolving cyber risks.

As technology evolves and the need for intelligent email management rises, the industry will continue to grow consistently, determining the future of enterprise communication as well as the cybersecurity strategies.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 33.6 billion |

| Industry Value (2035F) | USD 60.7 billion |

| CAGR (2025 to 2035) | 6.1% |

Explore FMI!

Book a free demo

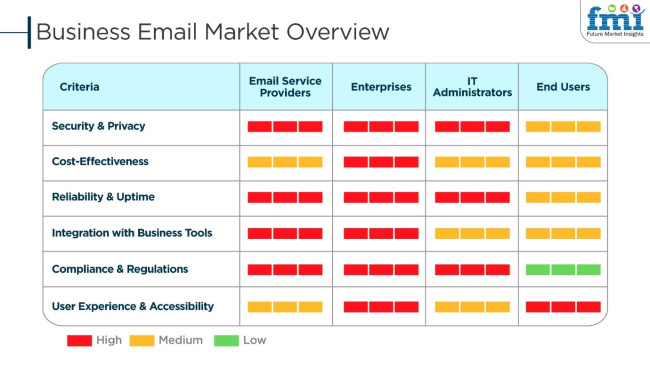

The global industry is expanding due to the need for secure, reliable, and professional communication tools in organizations. Business email solutions provide enhanced security, integration with productivity software, and data protection compliance with laws such as GDPR and HIPAA.

Email service providers emphasize security, reliability, and hassle-free integration with business applications such as Microsoft 365 and Google Workspace. Businesses require cost-effective solutions that provide uninterrupted communication and collaboration.

IT administrators are concerned with email security, spamming, and regulatory compliance to protect corporate information. End users, such as employees and professionals, require a simple-to-use interface, mobility, and reliability in their email services.

Some of the key trends influencing the industry are AI-driven email security, end-to-end encryption, cloud solutions, and phishing prevention technology. Challenges such as email fraud and cybersecurity threats remain, but advances in AI-enabled email filtering and automation are fueling industry growth.

| Company | Permira and Squarespace |

|---|---|

| Contract/Development Details | Permira, a private equity firm, announced plans to acquire Squarespace, a leading website building and hosting service, to strengthen its presence in digital and email marketing solutions. |

| Date | Projected: Q4 2024 - Early 2025 |

| Contract Value (USD Million) | Approximately USD 6,800 - USD 7,000 |

| Estimated Renewal Period | 5 - 7 years |

In late 2024 and early 2025, the industry experienced significant activity, with Permira planning to acquire Squarespace for approximately USD 6,800 - USD 7,000 million. This strategic move aims to expand Permira’s influence in the digital marketing and business email solutions sector, emphasizing the growing demand for integrated communication and hosting services. The acquisition reflects a broader industry trend toward consolidation and investment in platforms that offer comprehensive business email and web hosting solutions.

Challenges

The industry is threatened by increasing cyber-attacks, phishing, and regulatory complexities. Companies need to update email security systems regularly to avert hacking, malware, and unauthorized access. Compliance with local data privacy regulations and integration with existing IT infrastructure are also areas of concern for email service providers. Resistance to AI-based email automation and fear of data sovereignty are additional hindrances to industry growth.

Opportunities

In spite of these challenges, strong industry opportunities are present. Email filtering through AI, blockchain-based email verification, and sophisticated threat detection are revolutionizing email security and business communication. 5G connectivity expansion and cloud-based collaboration tools are enhancing email performance and accessibility.

Secure digital communication initiatives by the government and the increasing demand for enterprise-level email solutions are fueling industry growth. The creation of AI-based email assistants and multilingual email translation tools is also expanding industry opportunities.

Between 2020 and 2024, the industry expanded as companies began to adopt cloud-based tools for remote and hybrid work. Security requirements made encryption more advanced. Companies sought hassle-free integration of email platforms with productivity applications, CRM solutions, and project management tools to streamline workflows.

AI-driven automation features, such as intelligent responses and predictive email filtering, gained traction to counteract email overload. However, interoperability concerns, data breaches, and regulation needs drove organizations to the marketplace for secure, privacy-protecting email solutions.

In 2025 to 2035, autonomous management of email through AI-powered autonomous email management, secure encryption through quantum secure encryption, and decentralized protocol for emails will transform corporate communication. The use of blockchain-based email authentication will witness a significant paradigm shift toward securing emails, while AI-based assistants will send automatic responses and prioritize messages based on their importance.

In its peer-to-peer decentralized space, this will shield against tracking by central servers and boost privacy. Virtual email experiences enabled with voice and video messaging will be the norm, and AI-powered workflows and green cloud storage will eliminate duplicities.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments enforced stricter data protection laws like GDPR and CCPA, requiring enhanced email security. | Quantum-secure email encryption, blockchain-based authentication, and decentralized compliance frameworks will define future regulatory policies. |

| AI-powered spam filtering, cloud-based email storage, and real-time phishing detection enhanced email security. | Quantum-proof encryption, AI-based email mistakes detection, and secured communication networks will bring a change in email security. |

| Email continued to be the leading business communication platform, integrated with productivity and CRM applications. | AI-based autonomous email management, voice-enabled emails in real-time, and peer-to-peer encrypted emails will revolutionize industry applications. |

| Companies embraced cloud-based email solutions with AI-based inbox sorting and automation. | Edge computing-driven email processing, decentralized email systems, and sentiment analysis using AI will characterize corporate communication. |

| Optimized storage using cloud-based email platforms and low operating expenses saved companies’ money. | Cloud storage optimized for AI, carbon-neutral data centers, and energy-saving email processing will make it more sustainable and cheaper. |

| AI-driven email analytics helped organizations track engagement, detect anomalies, and enhance security. | Quantum-enhanced predictive email insights, AI-powered communication efficiency tracking, and real-time sentiment analysis will improve business communication. |

| Industry challenges included email overload, security breaches, and interoperability issues. | AI-driven email workflow automation, blockchain-based secure messaging, and decentralized data storage will improve accessibility and security. |

One of the major challenges in the industry is the threats of cyber security and data breaches. Phishing attacks, ransomware, and business email compromise (BEC) scams are predominantly the targets of emails. The effects of a security breach may entail financial losses, reputational damage, and even legal consequences.

Industry competition and pricing may additionally trigger risks. These emails are largely in the hands of tech giants like Google who offers Gmail for Business and Microsoft with its Outlook 365 which makes it so much challenging for small suppliers to distinguish themselves and capture a industry share. Without a strong value proposition for customers that includes features like improved security, customization, or AI capabilities, it is easy for the smaller companies to be at risk of relevance lost.

The industry is also affected by the changes in technology trends. The AI-driven automation, which is provided free of charge through the cloud, and the integration with collaboration tools such as Slack and Microsoft Teams are factors leading to the transformation in the way the companies make use of their email. Businesses that do not strive for innovation will face the risk of extinction in a workplace that is becoming more and more digital.

The business-to-business (B2B) segment is expected to account for a significant and growing industry despite the relatively larger share of the B2C segment due to enterprises and other organizations, including SMEs and corporate organizations, looking for secure, scalable, and feature-rich email solutions.

Businesses use professional email services for internal communication, interaction with clients, and workflow automation. B2B email solutions emphasize security, integration with enterprise applications (such as CRM and ERP systems), and compliance with industry regulations like GDPR and HIPAA.

Enterprises such as Microsoft Corporation (Outlook 365), Google LLC (Google Workspace - Gmail for Business), and Zoho Corporation offer one of the safest email solutions that include advanced encryption as well as AI-powered spam filters and integrated collaboration tools.

The cloud-based segment is leading with the rising adoption of work from home, the need for scalability, and cost-efficiency. Businesses can have access to cloud-based email, in-depth usability, automated designs, and increased security without a corporate data center. Organizations prefer cloud-hosted email services for their built-in data recovery, AI-powered threat detection, and integration with productivity suites, such as Google Workspace and Microsoft 365.

Top players contributing to the enterprise-level cloud email market with encrypted storage, AI-powered spam filtration, and third-party integration include Google LLC (Google Workspace - Gmail for Business), Microsoft Corporation (Outlook 365), and Amazon Web Services (AWS WorkMail). Cloud-based email serves an especially up-and-coming industry in startups and SMEs, as the subscription-based pricing structure greatly reduces upfront spending while ensuring business continuity.

| Countries/Regions | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

| UK | 8.9% |

| European Union | 9.1% |

| Japan | 9.0% |

| South Korea | 9.4% |

As per FMI, the USA business email market is set to expand at 9.2% CAGR during the period of 2025 to 2035 because of the growing usage of email security, cloud platforms, and automation software. Business and technology companies are adopting these solutions to spur automation, improve collaboration, and respond to stringent data privacy regulations. Organizations are also compelled by laws to deploy encrypted messaging and email analytics in real-time to better secure the enterprise.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Email Security | Businesses invest in phishing defense and anti-spam filtering. |

| Migration to Cloud-Based Email Platforms | Companies adopt scalable, flexible, and secure cloud-based solutions. |

| Regulatory Compliance and Data Security | Stringent USA cybersecurity regulations increase the need for encrypted email communication. |

FMI is of the opinion that the UK industry will expand at 8.9% CAGR during 2025 to 2035, owing to growing demand for encrypted email, filtering software, and security upgrades. Cloud collaboration software and real-time email management solutions are being adopted by organizations to enhance productivity. Businesses are also inclined toward using secure email solutions by stringent data protection legislations.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Email Security | Firms implement scalable email solutions with real-time analytics. |

| Regulatory Compliance & Data Privacy | Cybersecurity regulations encourage investment in encrypted email solutions. |

As per FMI, the EU industry is anticipated to register 9.1% CAGR during 2025 to 2035, driven by Germany, France, and Italy. Data protection laws such as GDPR necessitate investment by businesses in secure email communication, compliance management, and authentication systems. Widespread adoption of encrypted messaging and cloud-based collaboration tools further fuels the industry growth.

Growth Drivers in the EU

| Key Drivers | Details |

|---|---|

| Adoption of GDPR-Compliant Email Solutions | Businesses invest in privacy-focused email platforms. |

| Advancements in Threat Intelligence | Enhanced analytics improve email security and phishing protection. |

| Expansion of Cloud-Based Collaboration Platforms | Organizations integrate productivity tools with secure email solutions. |

FMI is of the opinion that the Japanese business email market will grow at 9.0% CAGR between 2025 and 2035, driven by investments in email security, compliance, and automation. The country's focus on secure digital communication and data protection fosters adoption of encrypted email solutions in finance, healthcare, and manufacturing sectors.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Email Automation | Companies improve workflow efficiency with automated emails. |

| Cybersecurity & Compliance | Businesses prioritize secure communication tools to prevent data breaches. |

| Encrypted Email Solutions | Organizations enhance security through encrypted business communication. |

The South Korean industry is poised to register 9.4% CAGR in the period between 2025 to 2035 as a result of government action in cybersecurity and rising demand for secure email messaging. Organizations are embracing state-of-the-art filtering solutions, phishing defense, and cloud emails to increase efficiency and security. The growth also benefits from advancements in 5G connectivity and cloud infrastructure.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Government Support | Policies encourage investment in secure email services. |

| Email Security | Businesses adopt real-time spam blocking and phishing protection. |

| 5G and Cloud-Based Email Services | Improved connectivity enhances efficiency and scalability. |

The industry is changing and fast-moving due to the growing requirement for security in AI and collaborative communication solutions. Powered by the increasing adoption of cloud-based emailing services, end-to-end encryption, and AI-driven automation by organizations to improve productivity, compliance, and cybersecurity, competition is already spiking in this industry.

The world's major players dominate the industry, such as Microsoft's Outlook 365, Google's Gmail for Business, Apple Mail, ProtonMail, and Zoho Mail. These mail services grant enterprise-grade security, advanced threat protection, and seamless integration into productivity suites. Apart from these well-known names are those upstarts and niche players in the cybersecurity arena, specializing in AI-powered spam filtering, phishing detection, and zero-trust security frameworks.

The companies that add better encryption in tandem with compliance with changes in data privacy laws (GDPR, CCPA) and AI-driven threat detection will remain well-positioned in this industry. Other factors that will keep shaping the competitive landscape include alliances and solutions integrating email with collaboration tools and enterprise software ecosystems.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Microsoft Outlook | 25-30% |

| Gmail (Google) | 20-25% |

| Apple Mail | 12-17% |

| Zoho Mail | 8-12% |

| ProtonMail | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Outlook | Provides enterprise email solutions, AI-driven productivity tools, and seamless integration with Office 365. |

| Gmail (Google) | Offers AI-powered email filtering, cloud storage, and smart reply features. |

| Apple Mail | Delivers secure and private email communication with deep iOS and macOS integration. |

| Zoho Mail | Develops email solutions with end-to-end encryption and workflow automation. |

| ProtonMail | Focuses on encrypted email solutions, data privacy, and secure communications. |

Key Company Insights

Microsoft Outlook (25-30%)

Microsoft Outlook leads the business email market by offering enterprise-grade security, AI-furnished productivity enhancement tools, and smooth integration with Office 365.

Gmail (Google) (20-25%)

Gmail provides a powerful email interface offering AI filtering of spam, cloud collaboration, and smart inbox management.

Apple Mail (12-17%)

Apple Mail focuses on privacy and security with encryption, integrates seamlessly across your devices, and comes with a very user-friendly interface.

Zoho Mail (8-12%)

Zoho Mail provides encrypted business email, workflow automation, and AI-powered inbox management.

ProtonMail (5-9%)

The expression of ProtonMail is highly secure, using encryption to protect emails with a focus on privacy and data protection.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 33.6 billion in 2025.

The industry is predicted to reach USD 60.7 billion by 2035.

Key companies include Microsoft Outlook, Gmail (Google), Apple Mail, Zoho Mail, ProtonMail, FastMail, GMX Mail, Hushmail, Mail.com, and Tutanota.

South Korea, slated to grow at 9.4% CAGR during the forecast period, is poised for the fastest growth.

Cloud-based emails are widely used.

By channel, the industry covers business-to-business (B2B) and business-to-customers (B2C).

In terms of deployment, the industry includes cloud-based and on-premises.

In terms of region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.