The burn matrix devices industry is valued at USD 31.27 million in 2025. As per FMI's analysis, the burn matrix devices industry will grow at a CAGR of 4.6% and reach USD 49.56 million by 2035. The rising incidence of burn injuries across the globe, along with advancements in the field of wound care technologies, is expected to support steady growth of the burn matrix devices sector throughout the forecast period.

In 2024, the industry for burn matrix devices saw major developments, especially with the incorporation of regenerative medicine methods. Companies started integrating stem cells, growth factors, and bioactive molecules into burn matrix devices to promoting faster tissue regeneration and enhancing the results of wound healing.

The focus also shifted intensely towards biocompatible and bioresorbable materials, which helped to promote better tissue integration and decrease the risk of infection, avoiding device removal surgery.

This growth is due to the increasing adoption of advanced wound care solutions, better access to healthcare facilities in developing regions, and enhanced patient and provider awareness. Technological innovation, improved biocompatibility of burn matrices, and government initiatives targeting the updating of trauma and burn care infrastructure will likely play a major part in the growth of this sector.

Key Market Insights

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 31.27 million |

| Industry Size (2035F) | USD 49.56 million |

| CAGR (2025 to 2035) | 4.6% |

Explore FMI!

Book a free demo

The burn matrix devices sector is expected to grow, as these devices mimic highly innervated and vascularized tissue, providing a wound-healing substrate that allows immune cells to infiltrate. The growing prevalence of severe burns, particularly in developing regions with fast-improving health care systems, is the key factor driving the industry.

Companies that invest the most in biocompatible, customizable healing technologies will flourish, and conventional wound care companies may lose ground if do not innovate.

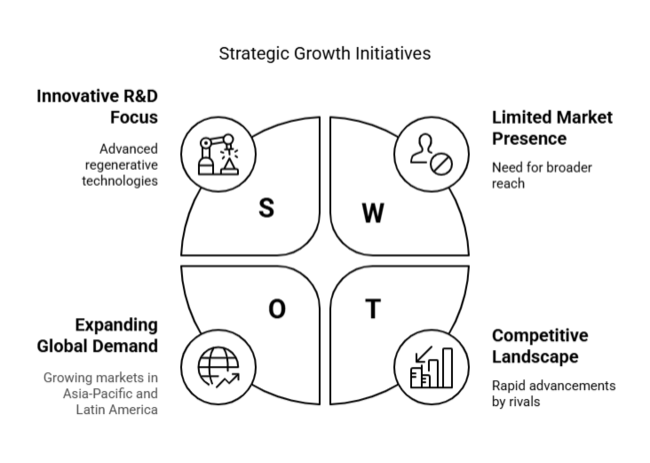

Invest in Regenerative and Bioengineered Technologies

Executives must give high priority to R&D investments in regenerative technologies like stem cell-enriched burn matrices and bioengineered skin substitutes to remain ahead of the curve and enhance patient outcomes.

Align Product Development with Emerging Industry Needs

Modify product lines and price structures to address the particular needs of fast-growth markets such as Asia-Pacific and Latin America, where growing burn rates and expanding access to healthcare are propelling demand for cost-effective, advanced technologies.

Build Strategic Alliances and Distribution Channels

Establish alliances with regional distributors, trauma centers, and hospitals to drive segment extension; pursue M&A opportunities that provide proprietary technologies or extend access to under-served geographies.

| Risk | Probability - Impact |

|---|---|

| Regulatory Delays in Product Approvals | Medium - High |

| High Cost of Advanced Burn Matrix Technologies | High - Medium |

| Limited Reimbursement Policies in Key Sectors | Medium - High |

| Priority | Immediate Action |

|---|---|

| Expand Emerging Industry Access | Conduct feasibility study on local manufacturing or distribution hubs in Asia-Pacific |

| Accelerate Product Innovation | Initiate clinician and OEM feedback loop on next-gen bioengineered matrix features |

| Strengthen Commercial Channels | Launch targeted incentive pilot for burn care specialists and hospital procurement teams |

To stay ahead, in the company floating sector of best burn matrix devices, the client needs to bet heavily on investing in regenerative tech and product customizations specific to the sectpr, particularly Asia-Pacific and Latin America. This signals a movement away from generic solutions for wound care towards precision-engineered technological, bioactive solutions.

Accelerated R&D partnerships, alignment of regulatory strategy, and commercial expansion through partner distributors and hospital networks should be added to the roadmap.

| Countries/Region | Policy & Regulatory Impact |

|---|---|

| United States | The FDA classifies burn matrix devices as Class II or Class III medical devices depending on composition. Companies must secure 510(k) clearance or Premarket Approval (PMA). New FDA guidance on regenerative medicine (e.g., HCT/Ps) adds compliance complexity, particularly for stem cell-infused matrices. |

| Canada | Regulated by Health Canada under the Medical Devices Regulations, requiring a Medical Device License (MDL). Devices with biological components undergo added scrutiny under the Biologics and Genetic Therapies Directorate (BGTD). |

| European Union | Under the EU Medical Device Regulation (MDR 2017/745), burn matrix devices must meet strict clinical evidence requirements and undergo CE marking via Notified Bodies. Sustainability criteria are gaining importance in public procurement. |

| United Kingdom | Post-Brexit, devices must obtain the UKCA mark for sale in England, Wales, and Scotland. Devices previously CE-marked need transition approval. MHRA is planning a reform aligning closer with FDA’s faster review pathway. |

| Japan | Regulated under the Pharmaceutical and Medical Device Act (PMDA). Requires Shonin or Ninsho approval depending on risk classification. Adoption is slower due to extensive documentation and long approval times. Government support is limited for high-cost biologics. |

| South Korea | Overseen by the Ministry of Food and Drug Safety (MFDS). Mandatory KGMP (Korea Good Manufacturing Practice) compliance is required for domestic and imported devices. Devices with advanced biologics must undergo Safety and Efficacy Review (SER). |

| India | The Central Drugs Standard Control Organization (CDSCO) oversees Class B-D devices. Burn matrices with biological components fall under Rule 20 of the Medical Devices Rules, 2017, requiring Import Licenses and Essentiality Certificates. Regulatory clarity remains a challenge. |

| China | Governed by the National Medical Products Administration (NMPA). Devices classified as Class III need local clinical trial data unless exempt. Certification under China Compulsory Certificate (CCC) is often required for commercial distribution. |

| Brazil | Regulated by ANVISA. Burn matrix devices typically fall under Class III, requiring Cadastro or Registro depending on risk level. Increasing demand for locally conducted clinical trials for higher-risk categories |

The burn matrix devices sector in the United States is expected to grow at a CAGR of 3.7% between 2025 and 2035. Factors such as rising cases of burn injuries, innovations in wound care technologies, and a robust healthcare system drive this expansion.

The sector for burn treatment solutions is also growing as research and development activities to improve the effectiveness. Nevertheless, a complex regulatory framework at the same time as the associated cost of advanced burn care products could delay sector growth.

Partnerships among major industry players and research organizations are projected to support innovations and cater to the unmet needs in burn care management.

The burn matrix devices sector in the United Kingdom is expected to witness a CAGR of 3.8% during the projected period. This can be attributed to factors such as the increasing prevalence of burn injuries, growing awareness regarding advanced wound care solutions, and a well-established healthcare system.

The extensive promotion of patient outcomes and the adoption of emerging medical technologies also drive UK sector growth. Furthermore, government programs to significantly improve healthcare services and the allocation of funding for burn care research act as major contributors to sector growth.

The burn matrix devices sector in France is estimated to witness a CAGR of 4.0% throughout the forecast period. This growth is supported by well-developed healthcare infrastructure and a rising focus on advanced wound care management. The rise in burn cases, especially in the industrial sector, has increased the need for effective treatment solutions.

The French government supports medical research and innovation, which encourages the development and use of new burn care products. However, its sector looks challenging due to a strict approval process for drugs and pressure on prices from a public healthcare system.

The burn matrix devices sector in Germany is expected to witness a CAGR of 4.2% between 2025 and 2035. This is supported by the nation's robust healthcare system, advanced standards of medical care, and heavy investment in healthcare technology. Increasing collaboration between academia and medical device companies drive innovation in burn care solutions.

However, the sector must overcome hurdles like stringent regulatory requirements and the need for supportive clinical evidence before new products can be approved. Focusing on quality and efficacy will be key for companies seeking success in this sector.

The Italian burn matrix devices sector is anticipated to grow at a CAGR of 3.9% over the forecast period. The growth further is being driven by the growing awareness of advanced wound care therapies as well as the slow yet steady improvement in healthcare facilities across the nation.

Italy also emphasizes patient care and outcomes that have led the country to implement new medical technologies. Moreover, the complicated regulatory landscape may postpone product launches. To address these challenges, enterprises are investing in segment education and building partnerships with local healthcare providers to penetrate and gain traction with their products.

The burn matrix devices sector in South Korea is estimated to register a CAGR of 6.0% over the forecast period. This growth is fueled by the nation's sophisticated healthcare systems and demand for cutting-edge medical treatments.

Market expansion is further reinforced by South Korea's focus on technological innovation and swift implementation of novel medical devices. The positive growth trajectory of the sector is further supported by government initiatives to enhance healthcare services and boost medical research.

Despite the potential for significant benefits, factors including pricing pressures and the requirement for extensive clinical validation could influence sector entry and growth. Local partnerships and clear clinical benefits will be critical to success in this sector.

The burn matrix devices sector in Japan is expected to have a CAGR of 6.2% during the forecast period (2025 to 2035). This growth is driven by various factors, including a rapidly aging population, rising incidence of burn injuries, and increasing focus on healthcare innovation.

Japan is known for having an efficient healthcare system and cutting-edge medical technologies, which can accelerate the adoption of innovative burn treatment solutions. Also, government support of medical R&D drives the availability of new-to-the-market products.

Businesses seeking to penetrate or expand within this sector must implement an emphasis on compliance with regulatory standards as well as invest time towards relationships with key opinion leaders to boost product legitimacy.

Between 2025 and 2035, the burn matrix devices sector in China is expected to grow at one of the strongest CAGRs of 6.4%. This growth is attributed to a combination of burgeoning industrial activity (increasing the risk of burn injuries), rapid modernization of the healthcare system, and a rise in government funding for high-quality medical devices.

The availability of advanced wound care products, especially in metropolitan areas, has been enhanced by targeted health campaigns focusing on public awareness of wound care, eventually leading to better education on local trauma management.

The burn matrix devices sector in Australia and New Zealand will achieve a moderate growth of 4.8% CAGR during the forecast period 2025 to 2035. Australia, in particular, has a high incidence of thermal and bushfire-related burns, which has made advanced burn care a national clinical priority.

Australia’s Therapeutic Goods Administration (TGA) regulates medical devices and is open to innovations in regenerative wound healing. As a result, sector entry has been relatively smooth compared to countries with stricter regulatory pathways.

There are also Australian-based research grants and funding (NHMRC white papers funded initiatives) supporting wound care research. New Zealand closely aligns with TGA regulation, helping to make dual-business strategies efficient.

The burn matrix devices sector is expected to witness a CAGR of 5.1% from 2025 to 2035, owing to the high unmet need along with the rising awareness and enhanced access to sophisticated healthcare technologies. India has some of the highest burn incidence rates in the world, often due to domestic accidents, open flame cooking, and electrical hazards.

Scheme like Ayushman Bharat - under which a large segment of the population has a health insurance cover - has significantly increased access to burn care services, and many states are now incorporating advanced wound management for admitted burn patients in public sector hospitals.

The segment is projected to surpass the others with a projected CAGR of 5.6%. Over the period 2025 to 2035, the second degree burns segment is expected to be the most lucrative application segment of the burn matrix devices sector.

This results from a high global incidence of second-degree burns, the rising clinical inclination for advanced matrices in managing partial-thickness injuries, and wider uptake across trauma centers and acute-care settings.

Medical practitioners are increasingly using matrix-based products for second-degree burns because they have been established to promote faster epithelial regeneration, reduce scarring, and minimize pain and infection risk.

The hospitals segment, which falls under the broader institutional sales category, is expected to be the lucrative distributional channel in the burn matrix devices sector between 2025 and 2035. Burn injuries, particularly moderate to severe burns, often require immediate advanced medical care, making hospitals the primary treatment centers.

Hospital demand represents a large portion of demand, as burn matrix products are frequently used in emergency department, burn units, and intensive care settings. Moreover increasing incorporation of burn matrix related devices in hospital formularies and country wide reimbursement systems is projected to augment prospects for burn matrix segment in the near future.

Leading companies dealing in the burn matrix devices sector are competing on multiple strategic fronts - product innovation, competitive pricing, global expansion, and strategic initiatives. Healthcare organizations, which are making large investments in biologically active and composite matrix solutions for chronic and complex burns.

These innovations that prioritize faster healing, better skin regeneration, and shorter hospital stays lie at the intersection of clinician and patient affinities. The growth strategies reflect a move to diversify portfolios and to penetrate global sector.

Burn matrix devices are utilized in wound therapy, for the treatment of burns and other injuries to the skin. They facilitate healing, minimize scarring, and avoid infection by offering a supportive matrix for tissue growth.

Burn matrix devices are most effective in second-degree burns, as they can speed up the regeneration of the skin, ease pain, and prevent infection by creating a protective covering over the injured area.

These products are usually distributed via hospitals, long-term care facilities, retail pharmacies, and institutional sales. Hospitals and healthcare professionals are major distributors of advanced treatments for critical care.

Areas with large rates of burn incidences and developed healthcare infrastructure, such as North America, Europe, and East Asia, are likely to demand the highest quantity of burn matrix devices owing to their wide healthcare facilities.

Burn matrix device innovation involves creating bioengineered devices, such as those with stem cells, collagen, and other materials, which increase the healing rate and lower scarring. Device customization to suit the types of burns is also a direction companies are going in.

The industry is segmented into Second Degree Burns, Pressure Ulcers, Diabetic Ulcers, Surgical Wounds, Others

The industry is segmented into Institutional Sales, Hospitals, Long Term Care Centers, Retail Pharmacies

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Africa

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.