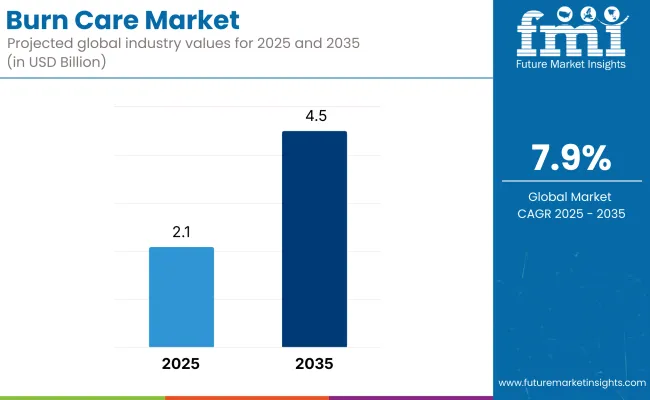

The burn care market is estimated to be valued at USD 2,023.5 million in 2025 and is projected to reach USD 4,660.1 million by 2035, registering a CAGR of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.1 Billion |

| Projected Market Size in 2035 | USD 4.5 Billion |

| CAGR (2025 to 2035) | 7.9% |

The burn care market has been evolving rapidly, driven by increasing incidence of thermal injuries, improvements in treatment protocols, and rising investment in advanced wound care technologies. Healthcare providers have prioritized adoption of innovative dressings, biologics, and skin substitutes to improve healing outcomes and reduce complications such as infection and scarring.

Manufacturers have focused on developing products that promote faster epithelialization, maintain optimal moisture balance, and enable atraumatic dressing changes, supporting wider adoption across acute and chronic burn management. Payers have increasingly recognized the cost-benefit of advanced wound therapies, reinforcing reimbursement support for evidence-based products

Burn Wound Dressings is estimated to holds a revenue share of 67.8% has been attributed to burn wound dressings, reflecting their critical role as first-line therapy across a wide range of burn severities. Utilization has been supported by the clinical need to maintain a moist wound environment, manage exudate, and protect against microbial contamination.

Advances in dressing technologies have introduced materials that enable extended wear time, atraumatic removal, and delivery of antimicrobial agents, improving patient comfort and compliance. Hospitals and burn units have prioritized procurement of evidence-supported dressings that accelerate healing and reduce the risk of infection-related complications.

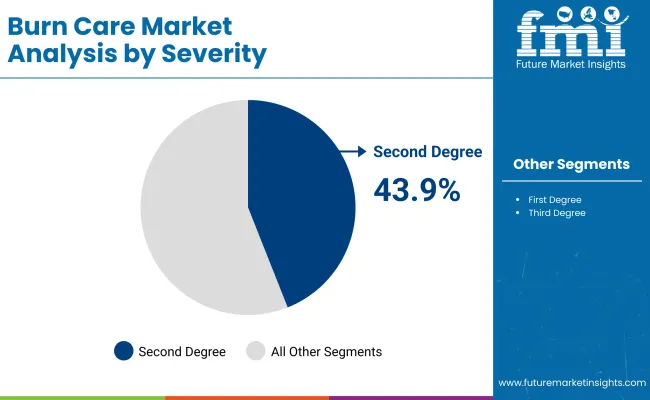

Second Degree Burns is estimated to holds a revenue share of 43.9% has been attributed to second-degree burns, reflecting their prevalence and the clinical complexity of managing partial-thickness injuries. Treatment of these burns has been prioritized due to the heightened risk of fluid loss, infection, and hypertrophic scarring if not effectively managed.

Hospitals and specialized burn centers have emphasized standardized protocols involving advanced dressings and early excision techniques to optimize outcomes. Investments in training and infrastructure have been directed toward scaling care capacity for moderate to severe cases.

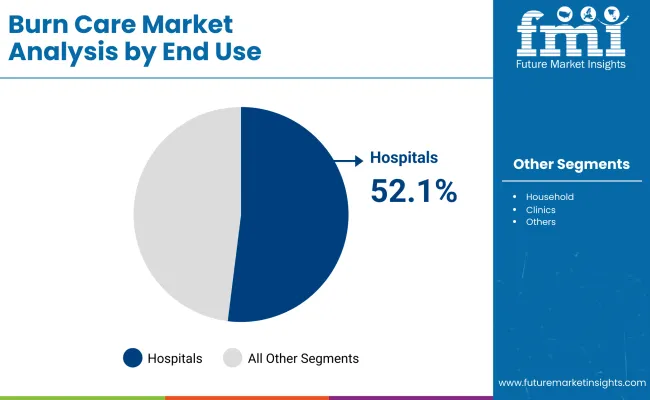

Hospitals have accounted for 52.1% of market revenue, driven by their central role in delivering specialized burn care across acute, subacute, and reconstructive phases. Adoption has been supported by the availability of dedicated burn units equipped with advanced wound care technologies, infection control measures, and critical care infrastructure.

Multidisciplinary care teams have prioritized evidence-based protocols integrating surgical debridement, antimicrobial dressings, and rehabilitation services to address the complex needs of burn patients. Investments have been directed toward staff training, technology upgrades, and expansion of dedicated bed capacity to address rising caseloads.

The competitive landscape in the burn care market has been shaped by companies investing in advanced wound dressings, bioengineered skin substitutes, and antimicrobial therapies to improve healing outcomes and differentiate their portfolios.

Leading manufacturers have prioritized expanding production capacity and securing regulatory approvals for next-generation products designed to accelerate epithelialization and reduce infection risks. Strategic partnerships with hospitals and specialized burn centers have been established to support clinician training and protocol adoption. Companies have also invested in digital platforms to enable remote monitoring of wound healing progress and enhance patient engagement.

High Treatment Costs and Limited Access to Advanced Burn Care

Global scarcity of skilled burn care specialists and healthcare workers also acts as a hindrance to the market slow down. There is limited access to specialized burn care centres in the world, especially in low- and middle-income countries, where health systems and hospitals are underdeveloped. Furthermore, post-burn complications like infections, scarring, and long-term rehabilitation needs add to the overall healthcare burden, making affordability and accessibility major issues.

Advancements in Regenerative Medicine and Skin Substitutes

The burn care market with a growing focus on regenerative medicine, bioengineered skin substitutes, and novel therapies for wound healing. Advancements in stem cell therapies, nanotechnology-based dressings, and 3D bio printing of skin are changing the way doctors approach burn treatment.

Moreover, with the growing utilization of telemedicine and the development of AI-based wound assessment platforms, not only the patient management is preserved, but access to specialized treatment is increased as well. Growth in the Advanced Wound Care Market for Innovative, Affordable Products and Customized and Effective Burn Treatment Products.

The United States burn care market is flourishing because of the rising demand for new born healing solutions to deal with necessities of growing burn patients. More than 450,000 burn injuries in the USA require medical treatment every year, and demand for advanced wound care products, skin grafts and bioengineered tissue substitutes is robust, the American Burn Association (ABA) estimates.

A number of next-generation burn care products, such as antimicrobial dressings, hydrogel-based therapies, and biologics, have undergone clinical evaluation, and FDA approval for some to promote healing and reduce the likelihood of infection. Additionally, rising prevalence of diabetes and chronic wounds is augmenting the use of enzymatic debridement and moist wound healing therapies.

Government funding for burn research, along with the establishment of specialized burn centers and trauma hospitals also facilitates market growth. The other major factor is the military and defence segment which calls for increased investments in burn treatment solutions owing to high cases of burn injuries as a result of the combat.

| Country | CAGR (2025 to 2035) |

|---|---|

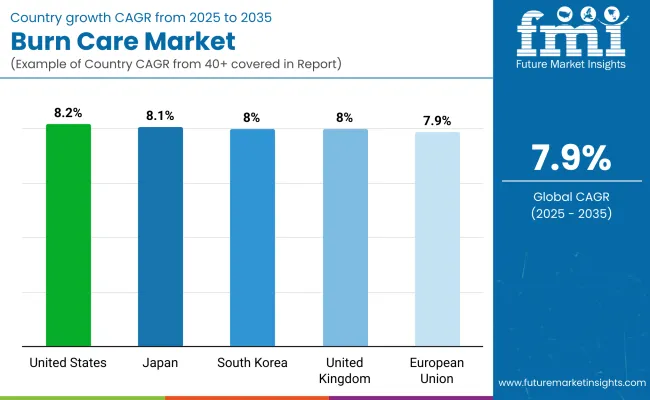

| USA | 8.2% |

Rising awareness related to burn injury management, increasing investment in healthcare infrastructure and high demand for bioengineered skin substitutes are some of the factors boosting growth in the burn care market in the United Kingdom. NHS innovations to develop trauma and emergency care services are helping to establish the use of novel burn dressings, including hydrocolloid dressings, and antibiotics.

The UK has a world-leading research base in regenerative medicine and stem cell therapy, both of which are driving developing in skin grafts and bioengineered scaffolds for use in patients with severe burns. In addition, stringent healthcare quality standards mandate hospitals to adopt evidence-based and cost-effective treatments for burn management.

The rise in instances of home accidents along with industrial burns and fire-inflicted injuries are the key factors pushing the growth of the market. Furthermore, partnerships between biotech companies and research universities are speeding up the development of next generation burn healing products, such as nanotech-based bandages and growth-factor therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.0% |

The burn care market in European Union (EU) is on a course for a pungent growth ride, making way on swelling healthcare expenditure, favourable regulatory landscape for innovations in burn treatment, and growing incidences of burn injuries. European Union (EU) policies, including the Medical Device Regulation (MDR) and Horizon Europe grant funding, aim to incentivize innovation in advanced wound care products, including hydrofiber dressings, silver-based antimicrobials and bioengineered skin substitutes.

In the fields of clinical research and regenerative medicine, Germany, France, and Italy are leading the way in burn care innovations. Another factor propelling demand for moist wound healing technologies and enzymatic debridement solutions is the aging population and increasing incidences of chronic disorders like diabetes.

In addition, increasing concerns about workplace safety and burn injuries in industrial facilities are driving investments in emergency burn kits, skin regeneration treatments, and autologous cell-based therapies. There is also increased uptake of biodegradable and plant-based wound dressing materials, driven by the EU’s focus on sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.9% |

The key factors driving the Japan burn care market has been biotechnology innovation, high investment in regenerative medicine, and government-driven healthcare modernization initiatives. On the other hand, more research is being conducted on bioengineered skin substitutes, hydrogel dressings, and nanotechnology-based burn treatments by Japanese MHLW initiatives.

The progressive growth of wound care therapies is driven by an aging population in Japan that leads to increased chronic wounds and non-healing patients. Additionally, a strong emphasis on robotics and AI-based healthcare solutions in the country has led to the development of smart dressings and automated burn-stabilization guidelines.

These are also known as burn scar management and skin regeneration therapy products, because the market in Japan has been heavily influenced by the cosmetic and aesthetic industry. In addition, joint ventures between pharmaceutical organizations and scientific institutions are driving innovative burn healing solutions into the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

Increasing healthcare expenditure, growing usage of aesthetic scar prevention and advancing wound care technologies are some of the factors that have been driving growth in the South Korean burn care market. The MOHW is not that when it comes to the promotion of biotechnology research, which is where the advances in hydrocolloid dressings, growth factor therapies and 3D printed skin substitutes will follow.

Demand for advanced cosmetic surgery is a contributor to the relatively high availability of cosmetic surgery in South Korea, as patients seeking effective scar minimization treatments after burn injuries drive demand. The rising incidence of burn injuries primarily in workplace & industrial settings is also expected to fuel the growing demand for high-performance burn dressings & advance burn treatment solutions in the market.

It is the South Korean advances in nanomedicine and bioactive wound dressings that are scaling up recovery rates for burns, but foreign pharmaceutical companies also enter into accord with the Korean firms to fast-track the development of smart burn dressings (dressings that respond to skin infections) for burn care..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

The increasing utilization of advanced wound dressings, skin grafts, and biologics, combined with enhancement in healthcare infrastructure and reimbursement policies, is driving the expansion of the market. Moreover, their increasing prevalence on account of burn injuries owing to industrial accidents, household burns, and fire are propelling the demand for efficient burn care products.

Key Development

In 2025, AVITA Medical, Inc. showcased wound care portfolio, including RECELL®, Cohealyx™, and PermeaDerm®, in the American Burn Association (ABA) 2025 Annual Meeting and showcased expanded evidence base and commitment to improving outcomes in burn and wound management.

In 2025, KeriCure Medical and CNTR Begin First Clinical Trial on Cutting Edge Spray-on Wound Dressing for Burns.

The overall market size for burn care market was USD 2.1 billion in 2025.

The burn care market is expected to reach USD 4.5 billion in 2035.

The growth of the burn care market will be driven by increasing incidences of burn injuries, advancements in wound healing treatments, and rising demand for innovative dressings and skin grafting technologies.

The top 5 countries which drives the development of burn care market are USA, European Union, Japan, South Korea and UK.

Hospitals and Households to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Burn-off Oven Market Forecast Outlook 2025 to 2035

Burn-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Burner Washers for Waste Gas Treatment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Burn Matrix Devices Market Insights - Size, Share & Industry Growth 2025 to 2035

Burnisher Market

Sunburn Relief Products Market Size and Share Forecast Outlook 2025 to 2035

Afterburner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Burner Market

Propane Floor Burnishers Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Industrial Burner Market Growth - Trends & Forecast 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA