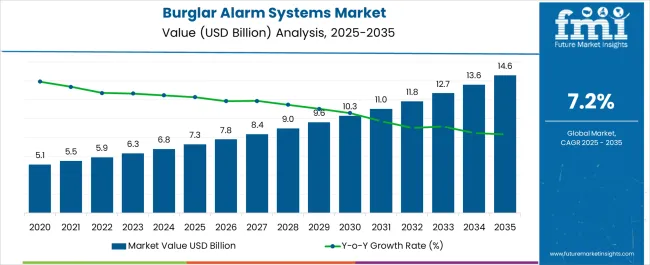

The Burglar Alarm Systems Market is estimated to be valued at USD 7.3 billion in 2025 and is projected to reach USD 14.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Burglar Alarm Systems Market Estimated Value in (2025 E) | USD 7.3 billion |

| Burglar Alarm Systems Market Forecast Value in (2035 F) | USD 14.6 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The burglar alarm systems market is evolving rapidly due to growing concerns around property security, increased urbanization, and rising integration of smart home technologies. Technological advancements in sensor precision, wireless connectivity, and energy-efficient components have allowed for more cost-effective and scalable deployment of alarm solutions.

Governments and municipal bodies are actively promoting security infrastructure improvements, while insurance companies are incentivizing installations through premium reductions. The emergence of cloud-based monitoring platforms and remote-access mobile applications has further strengthened end-user adoption across both residential and commercial sectors.

As consumers demand responsive, low-maintenance, and integrated safety solutions, manufacturers are focusing on modular designs and AI-powered analytics. Looking ahead, the market is expected to benefit from global trends in home automation, do-it-yourself (DIY) security systems, and heightened awareness of asset protection, especially in urban and peri-urban environments.

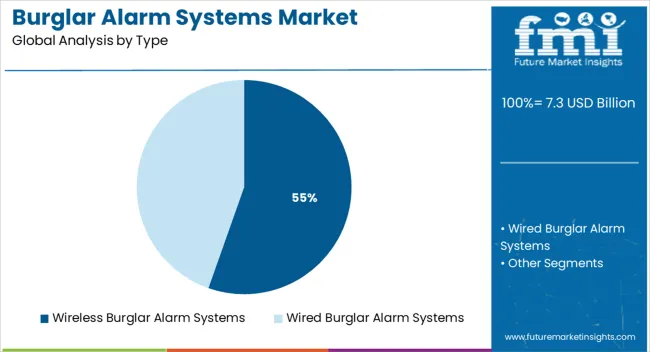

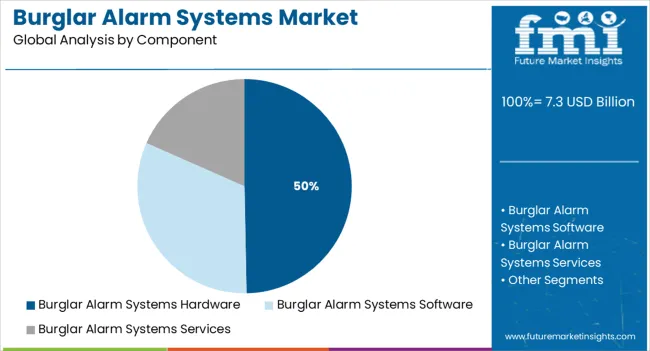

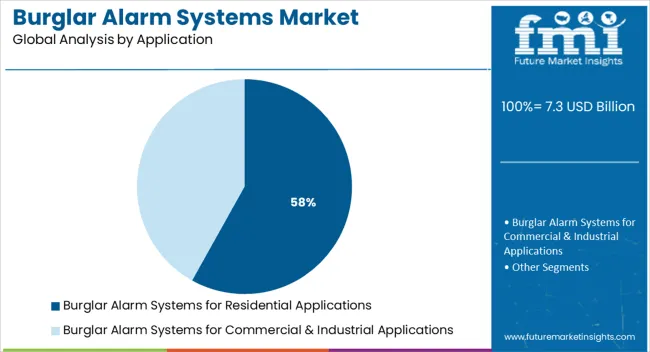

The market is segmented by Type, Component, and Application and region. By Type, the market is divided into Wireless Burglar Alarm Systems and Wired Burglar Alarm Systems. In terms of Component, the market is classified into Burglar Alarm Systems Hardware, Burglar Alarm Systems Software, and Burglar Alarm Systems Services. Based on Application, the market is segmented into Burglar Alarm Systems for Residential Applications and Burglar Alarm Systems for Commercial & Industrial Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wireless burglar alarm systems are projected to lead the market in 2025 with 55.4% of total revenue, positioning them as the dominant system type. This leadership is being driven by the ease of installation, lower infrastructure costs, and compatibility with mobile and smart home ecosystems.

Wireless systems eliminate the need for extensive wiring, making them highly suitable for retrofit applications and leased properties. Advancements in low-power wireless protocols and battery life have enhanced reliability and reduced long-term maintenance needs.

The flexibility of configuration, along with real-time push alerts and remote control via mobile apps, has strengthened consumer trust in wireless security technologies. As smart cities expand and 5G connectivity becomes more ubiquitous, wireless alarm systems are anticipated to remain the default choice for both homeowners and small enterprises seeking adaptable and intelligent security coverage.

Burglar alarm systems hardware is expected to account for 49.7% of total market revenue in 2025, making it the most significant component segment. This dominance stems from the foundational role hardware plays in detection, signaling, and deterrence across residential and commercial deployments.

Continuous improvements in sensor technology, motion detectors, control panels, and camera integration have reinforced the relevance of hardware in achieving fast and accurate intrusion alerts. Manufacturers are enhancing compatibility between hardware modules and cloud-based platforms, ensuring seamless updates and firmware management.

With the increased focus on tamper-proof design, environmental resistance, and aesthetic flexibility, hardware continues to evolve as a critical element of modern security systems. High investments in R&D and IoT-enabling architecture are further expected to expand the performance scope and market appeal of physical alarm system components.

Residential applications are projected to contribute 58.1% of total revenue in 2025, making them the leading deployment category in the burglar alarm systems market. This segment's growth is being driven by heightened safety concerns among urban homeowners, rising crime awareness, and the proliferation of smart home automation.

Demand for accessible and user-friendly alarm systems has grown substantially with the availability of mobile-integrated dashboards and DIY installation models. Enhanced affordability of security hardware and cloud storage subscriptions has further supported widespread residential adoption.

In addition, insurance incentives and real estate value enhancements tied to security upgrades have played a significant role. As consumers continue to prioritize protection of family and property, the residential segment is expected to remain the primary focus for innovation, marketing, and service bundling within the burglar alarm systems industry.

In 2024, North America was the dominant region with a revenue share of more than 40%. Mergers and acquisitions are allowing market participants to spread their wings across the region.

ASSA ABLOY, for example, acquired Spectrum Brands, Inc. - the hardware and home improvement division - in September 2024. Spectrum Brands, Inc. is a residential security solution provider based in the United States. The acquisition is expected to enlarge ASSA ABLOY's product portfolio and strengthen its position in the region's residential segment.

The advancement of novel and improved system technologies is one of the primary factors driving the growth of the North American Burglar alarm systems market. Rapid advancements in development and research have paved the way for the internet of things, remote monitoring, and home automation.

Furthermore, the restoration of various construction operations, notably in the residential segment, contributes to a rise in the consumption of home security systems.

Growing network infrastructure linked to broadband and internet permeability has also been assertive in sustaining market growth. According to a recent report published by Future Market Insight, the market for burglar alarm systems is expected to grow at a 7% annual rate, reaching USD 14.6 Billion by the end of 2035.

In 2024, the residential segment dominated commanded a market share of more than 55%. Intruder alarm systems are gaining prominence in both the residential and commercial sectors. One of the most vulnerable industries is going to be banking, healthcare, and education. Several merchandise standards have been released by organizations in order to produce effective alarm systems.

Commercial properties may be enticing to burglars because they are typically in high-traffic areas with higher crime rates. Because other industries have incorporated security measures, the surrounding atmosphere has an impact on its safety.

As a consequence, commercial intruder alarm systems are sophisticated and comprehensive, and they are frequently created to safeguard much larger areas. All across the facility, multiple layers of security systems, such as video surveillance cameras and controlled access cards, are installed.

Intruder alarm systems have significantly developed in recent years. Advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) have disrupted the overall security systems market. Demand for home security systems is expected to rise as the use of smart homes in smart security systems.

Future technologies, such as the IoT enable the introduction of smart homes. Furthermore, advances in sensor data fusion technology have raised end-user demand for advanced security systems.

The market growth has been rapid as technology improves every year, making the industry more effective. Burglar alarm systems are integrated into residential security systems, home security, and building management solutions to provide a secure foundation by lowering costs.

Integration of intruder alarm systems with video security systems is a prevailing market trend. Companies such as Honeywell, Assay Abloy, and Johnson are constantly developing and optimizing intelligent sensor technologies to cater to the varying security demands from end-user.

The prominent factors propelling the global burglar alarm systems industry are the evolution of DIY home security systems due to their low cost, ease of installation, and smartphone-enabled operation. North America is one of the major adopters of the home security system, with the USA being at the forefront.

Factors such as the cheaper cost of these systems compared to professional security systems are considered to be urging market growth in the upcoming decade. Additionally, the flexibility linked with DIY security systems will aid non-traditional security service providers to augment the overall penetration rate of homes with alarm systems.

Along with this, the massive demand for contactless biometric systems, precisely owing to the pandemic and the high demand for video surveillance solutions for remote monitoring activities are some of the key factors that are projected to create a positive growth effect on the market. Besides, swift growth within the IoT network is estimated to create a pool of growth prospects during the conjecture period.

The security system technology is continuously evolving, and new-fangled technologies are constantly being invented to advance the security of home and business security systems alike. From repetitively refining camera processors to smarter, more capable alarm sensors, these new elements and technologies are making security more active than ever before.

Development of innovative Motion Detectors

While maximum security systems are only focused on motion detection or on other forms of sensing (think door and window contacts), novel forms of high-tech and non-visual sensors have arrived on market in recent years. These comprise everything from radar to advanced sound detection technologies, such as microphones and advanced glass break detector systems.

Similarly, the introduction of audio sensors linked with CCTV cameras is equipped with enhanced audio detection features, thereby enhancing the functionality of home security systems. These sensors utilize the advanced processing technology with creative algorithms, and can now listen for and detect certain pre-defined sounds such as breaking glass, gunfire, and loud behavior.

The main challenge to the global burglar alarm software industry growth is the swelling instances of false alarms due to the failure to assess accurately. Due to such alarms, the operator may not respond to genuine alarm conditions.

False alarms generally happen because of minor slip-ups in the application programs, specifically when the sensor is incapable to read an object which is nearing the boundary. This not only pertains to customer discontent but may also result in the misuse and loss of sensitive customer information and other fraudulent activities.

North America dominated the market with a revenue share of over 40% in 2024. North America is analyzed across three countries in the market study, including the USA, Canada, and Mexico. Market players are expanding their footprints across the region through mergers and acquisitions.

For instance, in September 2024, ASSA ABLOY acquired Spectrum Brands, Inc. - the hardware and home improvement, division. Spectrum Brands, Inc. is a USA-based company and a provider of residential security solutions. The acquisition is likely to expand ASSA ABLOY’s product portfolio and reinforce its position in the residential sector in the region.

One of the principal aspects catalyzing the growth of the North America Burglar alarm systems market is the progression of novel and enhanced system technologies. Snowballing research and development have flagged the way for the internet of things, remote monitoring as well as home automation. Besides, the restoration of constructional activities, specifically in the residential sector, acts as another aspect accelerating the demand for home security systems.

Cultivating network infrastructure linked with broadband and internet penetration has further been proactive in upholding market growth. Future Market Insight’s recently published report summarizes that the market for Burglar alarm systems is likely to proliferate at the rate of 7% to reach USD 14.6 Billion by 2035 end.

Substantial expansion of real-estate and IT sectors across the Asia Pacific is anticipated to drive the demand for smart alarm systems. In recent years, home security solutions and services are witnessing an increasing demand from countries including India, Japan, Singapore, and others, which is likely to contribute to the market growth across the region.

Furthermore, several security rules and standards released by the government would support the market across the Asia Pacific. Technological innovations are expected to contribute to China's significant market share.

China captures a significant share in the APAC market, mainly backed by an upsurge in smart city project initiatives, which has mandated the implementation of technology and measures to diminish the adverse effects of mounting urbanization. For instance, Hangzhou, a city with a population of greater than 9.47 million, is a smart technological initiative designed by Alibaba, a Chinese tech giant.

This city mainly operates through artificial intelligence that uses big data and big computing power to enhance and fix traffic problems. Therefore, by monitoring every vehicle within the city, it has become possible to shrink traffic jams by 15%.

As per the latest analytical report by Future Market Insights, the APAC market for burglar alarm systems is likely to reach USD 2 Billion, documenting a CAGR of 9% throughout the forecast period.

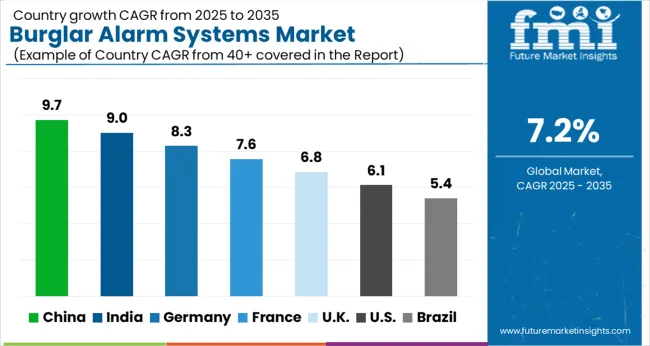

| Region | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazl | 5.4% |

Prominent Burglar Alarm Systems providers are reliant on partnerships, collaborations, acquisitions, and new software launches to stay afloat in the global market.

Constant innovations to ensure a seamless client-customer relationship are the main focus of prominent market players.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.2% from 2025 to 2035 |

| Market Value for 2025 | USD 7.3 billion |

| Market Value for 2035 | USD 14.6 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Component, Application, Region |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Mexico, Brazil, Germany, France, Italy, Spain, UK, Russia, China, Japan, India, South Korea, Australia, GCC, Australia, South Africa, Saudi Arabia, Israel, UAE |

| Key Companies Profiled | ADT; ASSA ABLOY; Banham; Hikvision; Honeywell International Inc.; Inovonics Wireless Corporation; Johnson Controls; Napco Security Technologies Inc.; RISCO Group; Securitas AB; Siemens |

| Report Customization & Pricing | Available upon Request |

The global burglar alarm systems market is estimated to be valued at USD 7.3 billion in 2025.

The market size for the burglar alarm systems market is projected to reach USD 14.6 billion by 2035.

The burglar alarm systems market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in burglar alarm systems market are wireless burglar alarm systems and wired burglar alarm systems.

In terms of component, burglar alarm systems hardware segment to command 49.7% share in the burglar alarm systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

WiFi Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Fire Alarm Systems Market by Solution by Application & Region Forecast till 2035

SCADA Alarm Management Market Size and Share Forecast Outlook 2025 to 2035

Smoke Alarm Market Trends- Growth & Industry Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Wind Speed Alarm Market

Plug-in Pump Alarm Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smoke and Carbon Monoxide Alarm Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA