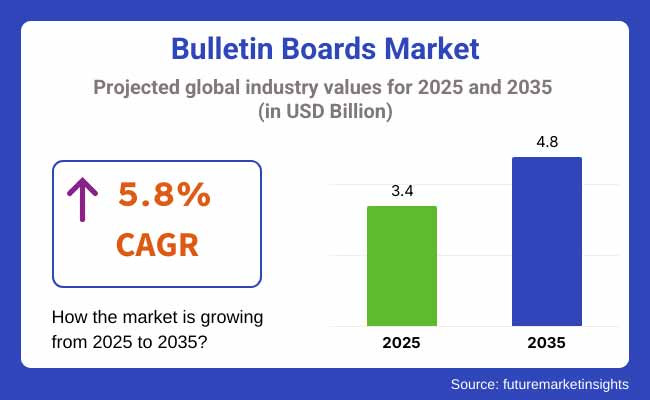

The Bulletin Boards Market is projected to witness steady growth from 2025 to 2035, driven by rising demand in educational institutions, corporate offices, and public spaces. The market is expected to expand from USD 3.4 billion in 2025 to USD 4.8 billion by 2035, with a CAGR of 5.8% over the forecast period.

The adoption of interactive digital bulletin boards, alongside traditional cork, fabric, and glamorous boards, is fueling market expansion. The commercial sector's emphasis on cooperative workspaces, the education sector's need for display results, and the hospitality assiduity's demand for instructional boards are crucial growth factors. Sustainability is also playing a major part, with consumers seeking eco-friendly and recycled accouterments for bulletin boards.

North America is a leading market for bulletin boards, with high demand from seminaries, universities, commercial services, and government institutions. The shift toward digital bulletin boards is gaining instigation, particularly in commercial and retail surroundings, where businesses are using interactive displays for real-time updates and adverts.

Sustainability trends are impacting the market, with seminaries and businesses concluding for cork and fabric boards made from recycled material. The USA is also seeing growth in smart office results, where bulletin boards are integrated with pall- grounded collaboration tools for flawless information sharing.

Europe’s market is driven by the education sector, sustainable construction practices, and plant collaboration trends. Countries like Germany, the UK, and France are witnessing a shift toward modular and eco-friendly bulletin boards, particularly in seminaries, co working spaces, and government services.

The growing trend of cold-blooded work surroundings is boosting demand for digital notice boards in office spaces. Companies are incorporating interactive whiteboards and smart displays into their plant setups to streamline internal communication and donations

Asia-Pacific is a swift-growing region, with China, India, Japan, and Southeast Asia driving demand for bulletin boards in educational institutions and commercial services. The region’s rising investment in smart classrooms and digital workspaces is accelerating the relinquishment of interactive bulletin boards.

Educational institutions are contemporizing, integrating smart and pall- connected bulletin boards to grease real-time pupil and faculty engagement. The demand for affordable and durable bulletin boards is also adding in small businesses, start-ups, and government services.

Challenges

With the rise of smart defences, digital signage, and online communication platforms, traditional bulletin boards are facing competition. Numerous businesses and institutions are shifting to digital results for instant communication, which may limit the demand for physical bulletin boards.

Also, the cost of high-tech interactive bulletin boards remains a hedge for small businesses and seminaries with limited budgets. Affordable mongrel results combining traditional boards with digital advancements-may help bridge this gap..

Opportunities

The market is witnessing a swell in smart bulletin boards, featuring touchscreen displays, remote content updates, and wireless connectivity. Seminaries, commercial services, and public institutions are using interactive bulletin boards to ameliorate communication and engagement.

Sustainability is another crucial occasion. The demand for eco-friendly bulletin boards made from recycled cork, bamboo, and non-toxic bonds is increasing. Companies fastening on customized, sustainable, and multi-functional bulletin boards will have a competitive advantage.

| Country | United States |

|---|---|

| Population (Millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 22.50 |

| Country | China |

|---|---|

| Population (Millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 14.80 |

| Country | Germany |

|---|---|

| Population (Millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 19.70 |

| Country | United Kingdom |

|---|---|

| Population (Millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 18.40 |

| Country | Japan |

|---|---|

| Population (Millions) | 123.3 |

| Estimated Per Capita Spending (USD) | 16.20 |

The USA bulletin board's market is driven by demand from educational institutions, commercial services, and public spaces. Seminaries and universities invest heavily in durable cork and fabric boards, while businesses prefer ultramodern glass and glamorous options. The shift toward home services has also increased consumer interest in ornamental and functional bulletin boards..

China's market benefits from rapid-fire urbanization and adding office structure. Bulletin boards are extensively used in seminaries, government structures, and commercial settings. The rise of digital druthers slightly impacts demand for traditional boards, but eco-friendly and multi-functional variants maintain steady deals

Germany sees a harmonious demand for high-quality bulletin boards, particularly in educational and business surroundings. The preference for sustainable accoutrements similar to recycled cork and aluminum frames aligns with the country’s strong environmental programs. Companies invest in tailored boards with aural parcels for ultramodern office spaces.

In the UK, bulletin boards are popular in seminaries, co-working spaces, and home services. With a growing emphasis on cold-blooded work, workers seek organizational tools for particular workspaces. Fabric-covered and leg-free bulletin boards are gaining traction in creative and cooperative surroundings.

Japan’s market is characterized by compact, space-effective designs suited for small services and apartments. The country’s strong focus on association and productivity energies demands for multi-functional bulletin boards with erected-in itineraries and storehouse features. High-end, minimalist designs are preferred for professional settings.

The market for bulletin boards is registering consistent demand owing to growing applications in offices, schools, and home management. A survey involving 300 customers from North America, Europe, and Asia shows consumer behavior, buying habits, and market forces that are formulating the market.

Material and longevity remain top of the list, with 74% of the sample opting for cork or fabric-covered bulletin boards because of their durability in application and easy of pinning ease. Magnetic whiteboards are utilized by 60% of North American shoppers, especially for home office and office arrangements.

Size and usability drive purchase, as 68% of the sample selects medium to large bulletin boards (24x36 inches and over) for greater visibility and information display. 45% of Asian consumers favour small boards (less than 18 inches) for use in the home and personal environments.

Aesthetics and design do count, with 52% of European consumers seeking decorative bulletin boards that are interior design-friendly, and 65% of office users favoring clean, functional designs with enhanced features such as calendars and planners.

E-commerce is the leading sales channel with 67% of the respondents buying bulletin boards online because of improved price comparisons, product choice, and home delivery convenience. Yet, 40% of Asian consumers still prefer to buy in-store to touch and feel board material and size.

Brand reputation affects buying habits, and 58% of customers purchase sought-after brands like Quartet, U Brands, and VIZ-PRO due to reputation and quality. Yet 40% of budget shoppers seek private-label, low-cost products.

As the demand for functional, multifunctional, and aesthetically pleasing bulletin boards grows, brands with high-quality products, new features, and modest prices will hold their ground on this changing market.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth in magnetic, cork, and fabric-covered bulletin boards for home and office use. Increased demand for dual-purpose bulletin boards with whiteboard or chalkboard surfaces. Expansion of lightweight, frameless, and portable boards for flexible mounting. |

| Sustainability & Eco-Friendly Materials | Shift toward recycled cork, bamboo, and natural fiber boards. Brands introduced low-VOC adhesives and non-toxic pinboard coatings. Growth of reusable sticky-note technology to reduce paper waste. |

| Smart Features & Connectivity | Introduction of app-connected bulletin boards for digital note-taking and reminders. Rise of integrated LED notification lights for high-priority messages. Growth in hybrid analog-digital boards that sync with mobile devices. |

| Customization & Personalization | Growth of custom-sized, framed, and modular bulletin boards to fit different spaces. Brands introduced color-matching options for home décor and office interiors. Expansion of multi-layered boards for pinning, writing, and erasing. |

| Workplace & Educational Adoption | Increased demand for bulletin boards in remote workspaces, classrooms, and coworking hubs. Rise in multi-functional boards for brainstorming and planning. Growth of privacy-friendly, sound-absorbing bulletin boards for open offices. |

| Retail & Consumer Market Expansion | Growth in home organization and productivity tools driving personal bulletin board sales. Brands expanded into aesthetic pinboards for creative spaces and vision boards. Increased adoption of bulletin boards in cafés, restaurants, and public spaces. |

| Regulatory & Compliance Standards | Stricter regulations on chemical adhesives and synthetic board materials. Growth in demand for fire-resistant and durable bulletin boards in commercial and educational settings. |

| Influencer & Social Media Marketing | Home organization influencers showcased creative ways to use bulletin boards on TikTok, YouTube, and Instagram. Brands leveraged DIY productivity and home-office trends to boost engagement. Rise of Pinterest-inspired mood boards and vision board kits. |

| Consumer Trends & Behavior | Consumers prioritized aesthetic, functional, and easy-to-install bulletin boards. Increased demand for sustainable, multipurpose organization tools. Growth in personal productivity and goal-setting board usage. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart bulletin boards with digital and interactive features. E-paper bulletin boards with touchscreen and customizable digital notes. Modular, self-healing boards that repair pinholes automatically for longer durability. |

| Sustainability & Eco-Friendly Materials | Fully biodegradable and recyclable bulletin boards replace traditional synthetic materials. Lab-grown cork and plant-based alternatives improve sustainability. Zero-waste production models reduce manufacturing impact. |

| Smart Features & Connectivity | AI-powered voice-activated bulletin boards allow users to add, remove, or prioritize notes hands-free. Augmented reality (AR)-enhanced bulletin boards display holographic notes and reminders. Smart project collaboration boards integrate with virtual workspace apps (e.g., Slack, Trello). |

| Customization & Personalization | AI-assisted personalization tools allow users to design bulletin boards tailored to their space. 3D-printed, customizable boards with user-defined layouts. Modular panels that can be reconfigured for different purposes (e.g., presentation boards, acoustic panels). |

| Workplace & Educational Adoption | AI-powered meeting collaboration boards automatically organize notes and action items. Gesture-controlled interactive bulletin boards streamline presentations and team discussions. Digital smart walls replace traditional bulletin boards in offices and schools. |

| Retail & Consumer Market Expansion | Subscription-based digital bulletin board services allow users to manage physical and virtual notes. Metaverse-based collaboration spaces integrate interactive digital bulletin boards. Custom bulletin board marketplaces allow users to sell and share personalized designs. |

| Regulatory & Compliance Standards | Government mandates for sustainable materials in office supplies. AI-driven compliance tracking ensures adherence to eco-friendly manufacturing standards. Health-focused certifications for allergen-free and antimicrobial bulletin boards. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote interactive, tech-enhanced bulletin boards. Augmented reality (AR) board visualization tools allow users to preview boards in their space before purchase. Metaverse-based workspaces integrate bulletin boards for immersive collaboration. |

| Consumer Trends & Behavior | AI-powered smart home organization integrates bulletin boards with task automation and smart reminders. Consumers embrace eco-conscious, reusable bulletin board solutions. Fully digital, wireless bulletin board systems replace traditional boards in many workspaces. |

The USA bulletin board market is witnessing steady growth, driven by adding demand for organizational tools in services, seminaries, and homes, the rising relinquishment of customizable and eco-friendly material, and the expansion of smart and digital bulletin boards. Major players include U Brands, Quintet, and Ghent.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The UK bulletin board market is expanding due to increasing preference for home office organization, rising demand for educational and collaborative tools, and growing use of eco-conscious bulletin board materials. Leading brands include Bi-Office, Nobo, and Metroplan.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Germany’s bulletin board market is growing, with consumers favoring high-quality, durable, and ergonomic designs for professional and academic use. Key players include Franken, Sigel, and Legamaster.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

India’s bulletin board market is witnessing rapid growth, fueled by increasing demand in educational institutions, rising adoption of home-office and co-working space solutions, and expanding e-commerce sales. Major brands include Pragati Systems, Wipro, and AmazonBasics.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.2% |

China’s bulletin board market is expanding significantly, driven by adding disposable inflows, growing use of bulletin boards in services and academic institutions, and rising demand for interactive and digital display boards. Crucial players include Dahua, Xiaomi, and Deli.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.5% |

the added need for systematized communication and information display in seminaries, universities, and commercial services is driving the demand for bulletin boards. Educational institutions use bulletin boards for adverts, schedules, and creative displays, while businesses use them for internal communication and productivity shadowing.

Traditional cork and fabric bulletin boards are evolving with digital druthers featuring LED displays, touchscreen interfaces, and pall-ground content operation. These digital bulletin boards offer real-time updates, remote availability, and dynamic content customization, making them increasingly popular in workplaces and public spaces.

the trend of home association and substantiated workspace scenery has led to the relinquishment of bulletin boards for particular use. Homes use them for monuments, timetables, and ornamental purposes, with options like glamorous boards, chalkboards, and pinboards gaining fashion ability among consumers seeking functional yet aesthetic results.

The vacuity of a wide range of bulletin boards through e-commerce platforms has expanded consumer access to customized and specialized options. Businesses and individuals can choose from colourful materials, sizes, and designs to fit their specific requirements. The ease of online purchasing, coupled with bulk-order abatements, has further fuelled market growth.

The bulletin board market is passing steady demand, driven by their continued use in services, educational institutions, and public spaces for communication, collaboration, and association. The rise of cold-blooded work surroundings and digital integration has led to the development of ultramodern bulletin boards featuring interactive, glamorous, and cork-grounded designs. Sustainability is also a crucial focus, with manufacturers introducing eco-friendly accouterments similar as recycled cork and aluminum frames.

The demand for bulletin boards is farther fuelled by seminaries, universities, and commercial services looking for effective ways to display adverts, schedules, and creative content. While traditional cork and felt boards remain popular, glass and digital bulletin boards are gaining traction in marketable and high-tech surroundings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| 3M | 18-22% |

| Quartet (ACCO Brands) | 14-18% |

| U Brands | 10-14% |

| Ghent (GMi Companies) | 8-12% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M | Leading provider of high-quality bulletin boards with self-healing cork, magnetic, and fabric-covered options. Focuses on durability, adhesive technology, and sustainability. |

| Quartet (ACCO Brands) | Specializes in glass, magnetic, and classic cork bulletin boards. Provides innovative workspace solutions for businesses and classrooms. |

| U Brands | Offers modern and stylish bulletin boards for home and office use. Known for its decorative and functional designs, including combination whiteboard/cork board options. |

| Ghent (GMi Companies) | Produces durable, USA-made bulletin boards with a strong focus on school and corporate applications. Specializes in enclosed and mobile display boards. |

Strategic Outlook of Key Companies

3M (18-22%)

Maintains a strong base in the market by offering high- performance bulletin boards with advanced tenacious and tone- mending cork technology. The company continues to introduce with sustainable material and interactive display options, feeding to both commercial and educational sectors.

Quartet (ACCO Brands) (14-18%)

Expanding its presence with satiny, ultramodern glass and combination boards that integrate seamlessly into contemporary office and educational spaces. The company is fastening on decoration design, functionality, and ease of installation to attract businesses and professionals.

U Brands (10-14%)

Gaining market share with aesthetically pleasing and affordable bulletin boards, U Brands is targeting the home office, small business, and academy parts. The company emphasizes swish designs, eco-conscious material, and multi-functional boards for creative and organizational use.

Ghent (GMi Companies) (8-12%)

A trusted name in the commercial and educational sectors, Ghent focuses on producing highly durable and customizable bulletin boards for large-scale institutional use. The company is investing in mobile and enclosed board solutions to cater to modern workspace needs.

Other Key Players (35-45% Combined)

Several emerging and established brands contribute to the market by offering a diverse range of bulletin board solutions, from traditional cork boards to advanced digital and glass options. Notable names include:

Cork Bulletin Boards, Fabric Bulletin Boards, Magnetic Bulletin Boards, Combination Boards, and Others.

Aluminum, Wood, Plastic, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Office Supply Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Bulletin Boards Market is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Bulletin Boards Market stood at USD 2.1 billion in 2024.

The Bulletin Boards Market is anticipated to reach USD 4.8 billion by 2035 end.

Magnetic bulletin boards are set to record the highest CAGR of 6.5%, driven by increasing demand for modern office and educational setups.

The key players operating in the Bulletin Boards Market include Ghent, U Brands, Quartet, MasterVision, Luxor, and MooreCo Inc.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA