The bulk food ingredients market is projected to remain steady over the forecast period due to the growing food and beverage industry processing up to insider maximums. Bulk food ingredients include anything from grains to spices and sweeteners, oils, and dried fruits all necessary for high volume food manufacturing and foodservice.

These ingredients constitute the backbone of countless processed, packaged and ready-to-eat foods, and there is demand from manufacturers looking for consistent quality and stable supply chains. Demand for premium bulk food ingredients has also been driven by increasing consumer interest in natural, organic and clean-label products.

Furthermore, the growing trend towards convenience foods, the rise of plant-based diets in many a country worldwide, and the expansion of fast-casual dining restaurants globally are predicted to support the overall demand in the market. We can expect a consistent growth of the bulk food ingredients market with innovations in ingredient processing, supply chain optimization and sustainability efforts through 2035.

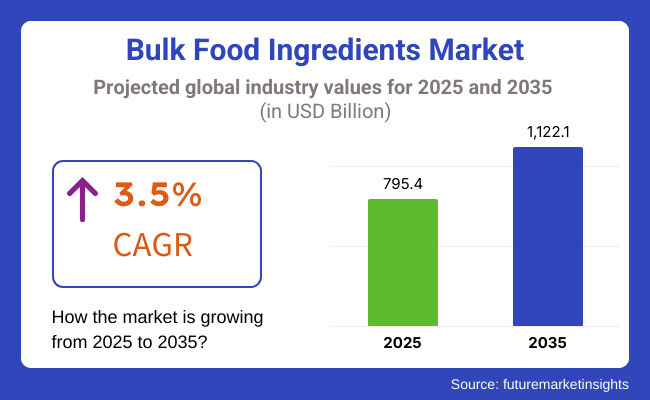

The bulk food ingredients market size was valued at USD 795.4 Billion in 2025 and is expected to reach around USD 1,122.1 Billion by 2035, at a CAGR of 3.5%. This continued growth emphasizes the unwavering demand across the food industry for premium quality and diverse food ingredients that underpin global food production and cater to shifting consumer diets.

Explore FMI!

Book a free demo

Based on the market for processed food products, North America is a key market for bulk food ingredients owing to the mature food processing industry and high demand for convenience and processed food. The United States, and to some extent Canada, have a robust ecosystem of ingredient suppliers and manufacturers who can support large-volume production.

Additionally, the increasing demand for organic, non-GMO, and clean-label ingredients has led to the development of a robust market for premium-grade bulk food ingredients in this region. Plant-based and functional food products also continue to drive innovation for ingredient sourcing and processing.

Europe is a key market as well, with a fair share of food and beverage industry and strong customer demand for quality and authenticity. Germany, France, and Italy have known testing grounds for natural and regional ingredients, and their policies have driven a booming bulk food ingredients business.

The region’s regulatory landscape predicated on transparency and the sourcing of sustainable, responsible ingredients has a spurred demand for organic and traceable ingredients. Demand for bulk food ingredients in Europe is also supported by the continual popularity of artisanal and specialty food products.

Asia-Pacific is witnessing the fastest incremental growth among the regions in terms of bulk food ingredients market revenue, due to urbanization, increased disposable incomes, and increase in the middle class. China, India and Japan are some of the countries that are booming in processed food consumption which pulls greater need for stable quality ingredients.

Moreover, the region's vibrant culinary traditions and emerging foodservice sector have led to increased dependence on bulk spices, grains and other staples. Ongoing investment in infrastructure, supply chain efficiency and innovative techniques to support food production will further drive continued growth in the Asia Pacific area over the next 10 Years.

Challenges

Price Volatility, Supply Chain Disruptions, and Stringent Regulations

Bulk food ingredients market drivers and restraints: Because raw material prices are always subject to changes in climate factors, geopolitical conditions, and agricultural yield variability, higher fluctuation in prices will be a probable hurdle that the bulk food ingredients market will have to face.

High food prices, stemming in part from supply chain disruptions that have made logistics bottlenecks, transportation costly and trade barriers complicated for bulk food ingredients like grains, nuts, spices and sweeteners, are also exerting pressure on food service customers. Moreover, stringent food safety and quality regulations set by FDA, EFSA, and FSSAI necessitate rigorous test, label, and compliance strategies, further elevating operational costs for manufacturers and suppliers.

Opportunities

Growth in Organic Ingredients, Functional Foods, and Sustainable Sourcing

Despite these hurdles the bulk food ingredients market is expected to exhibit strong growth potential with increasing preferences for an organic, non-GMO and functional food ingredients. Nutrient-dense bulk ingredients, such as plant-based proteins, superfoods, and clean-label products for healthier eating are being sought more and more often by consumers.

These initiatives are starting to gain popularity, but so are sustainable sourcing practices like fair-trade certification, regenerative agriculture and eco-friendly packaging. Improvements in AI-powered supply chain management and block chain-based conditions on traceability of food items is also increasing inventory optimization and the authenticity of products, thereby boosting the growth of the market.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety, labeling, and sustainability certification standards. |

| Consumer Trends | Demand for organic, plant-based, and functional food ingredients. |

| Industry Adoption | High use of bulk grains, nuts, dried fruits, and spices in food manufacturing. |

| Supply Chain and Sourcing | Reliance on global agricultural supply chains with vulnerability to climate and geopolitical shifts. |

| Market Competition | Dominated by commodity suppliers, food processors, and bulk ingredient wholesalers. |

| Market Growth Drivers | Growth fueled by processed food demand, urbanization, and increasing health consciousness. |

| Sustainability and Environmental Impact | Moderate focus on organic certification and reduced pesticide usage. |

| Integration of Smart Technologies | Early-stage use of blockchain for food traceability and automated bulk inventory management. |

| Advancements in Food Processing | Development of bulk ingredient preservation techniques and freeze-dried nutrition solutions. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter traceability laws, zero-waste packaging regulations, and climate-conscious sourcing mandates. |

| Consumer Trends | Expansion into precision nutrition, biofortified bulk ingredients, and AI-personalized dietary solutions. |

| Industry Adoption | Increased integration of lab-grown bulk ingredients, alternative proteins, and sustainable crop varieties. |

| Supply Chain and Sourcing | Shift toward localized, vertically integrated supply chains and AI-powered logistics optimization. |

| Market Competition | Entry of sustainable ingredient startups, precision fermentation firms, and smart food supply networks. |

| Market Growth Drivers | Accelerated by circular economy practices, food-as-medicine trends, and high-efficiency alternative food systems. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral ingredient sourcing, regenerative agriculture, and zero-waste production. |

| Integration of Smart Technologies | Expansion into AI-driven supply chain optimization, digital twin farming, and climate-adaptive ingredient sourcing. |

| Advancements in Food Processing | Evolution toward bioengineered bulk ingredients, smart food coatings for shelf-life extension, and precision farming advancements. |

The bulk food ingredients market in USA is expected to grow steadily, as a result of growing demand for processed and packaged food in the region. The increasing inclination of consumers toward organic and natural ingredients is another factor propelling the market growth. Furthermore, increasing demand for bulk components like grains, flours, spices, and sweetener, will be driven by the booming food service industry and the growth of food processing technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

The bulk food ingredients market in the United Kingdom is driving due to the increasing demand for ready-to-eat meals and convenient foods. Sustainable sourcing and clean label ingredients are among market trends shaping the trajectory of behavior. From another end of the food industry, food manufacturers are using high quality bulk ingredients to adapt to changing tastes of health-conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

The bulk food ingredients market is growing throughout Europe as consumers push for healthier, more natural food products. Strict regulations regarding food safety and the consequent rise in investments aimed at plant-based and natural food ingredients are acting as drivers for the market. The increasing adoption of bulk ingredients in bakery, confectionery, and dairy applications is also bolstering the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

Bulk food ingredients continue to observe moderate growth in the Japanese economy. An aging population, along with changing dietary habits that focus more on ingredients for nutritious and functional food products is driving ingredient sourcing trends in the country. And food manufacturers are using high-quality bulk ingredients to elevate products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

Due to rapid urbanization, changing lifestyles, and increasing consumption of packaged and processed foods in South Korea, the Bulk Food Ingredients market is growing. The rise of functional and fortified food products is fuelling the demand for premium bulk ingredients such as protein isolates, dietary fibers, and natural sweeteners.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The market for bulk food ingredients is steadily expanding as manufacturers, foodservice providers, and consumers are looking for cost-effective, high-quality, and readily available food ingredients to be used in large-scale food manufacturing. The rising requirement for processed, convenience foods, functional ingredients, and establishing sustainable ingredients sources propels the market growth. It covers, in detail, the market segment by types (Vegetable Oil, Sea Salt, Sugar & Sweeteners, Tea, Coffee & Cocoa, Flours, Processed Grains, Pulses & Cereals, Dried Fruits & Processed Nuts, and Processed Herbs & Spices) and by applications (Bakery & Confectionery, Beverages, Meat & Poultry, Seafood, Ready Meals, Dairy Products, Snacks & Savory, Sauces, Dressings & Condiments, and Frozen Foods).

The bulk food ingredients market we focus on processed grains, pulses and cereals owing to their broad usage in bakery, breakfast cereals, snack production and food processing sector. These are key ingredients to making large-scale production of bread, pasta, tortillas, ready-to-eat meals, and processed snacks. This segment is further driven by increasing consumer preference for whole grains, fiber-rich pulses as well as organic cereals.

The growth in plant-based diets, functional foods, and gluten-free alternatives has compelled manufacturers to enhance processed grains and pulses with protein, fiber, and micronutrients. In addition to this, modernized food processing technologies such as cold milling and extrusion cooking have improved the nutrient profile and shelf life of these commodity food materials, and are becoming the industry staple in the health-focused food sector.

Dried fruits and processed nuts also occupy a major share in the market, owing to their high nutritional value, versatility, and growing application in snacks, bakery, dairy, and confectionery products. As consumers snacking on-the-go, demand plant-based nutrition, or favor clean-label food trends, dried fruits and nuts are increasingly being utilized in granola bars, dairy alternatives, and protein-enriched foods.

The bakery & confectionery segment is estimated to hold the maximum share in the bulk food ingredients market and it is driven by growing consumer preference for high-end bakery productions, customized confectionaries, and enriched snacks. Things like bulk ingredients (flours, sugar & sweeteners, processed grains, dried fruits, and vegetable oils) are critical for mass production. This, in turn, has spurred a growing number of manufacturers to secure high quality bulk ingredients in line with their consumers' health and wellness preferences, leading to the increased adoption of organic, gluten-free, and low-sugar formulations.

Using better-for-you ingredients comes in handy with demand for inventive functional and indulgent bakery products. Food companies are still getting creative with alternative sweeteners, whole grain flours and plant-based oils as they formulate better-for-you baked goods. In addition, the proliferation of premium chocolate, gourmet pastries, and customized desserts in the confectionery industry has also bolstered demand for bulk sweeteners, cocoa, and processed nuts.

This segment, too, has been performing well, as consumers are increasingly looking for easy to prepare, frozen and pre-packaged meals with little hassle. Key large food ingredients include processed grains, vegetable oils, seasoning, and sauce used in mass production of frozen entrees, meal kits, and instant food solutions. Additionally, the growing trend towards plant-based and high-protein ready meals has continued to stimulate demand for bulk pulses, soy proteins, and alternative flours used in meal production.

The increasing demand for processed food, convenience meals, and also for natural food ingredients in order to avoid allergic reactions is contributing to the growth of the unit-packs market which will act as a driving factor for the bulk food ingredients market. AI-enabled supply chain optimization, sustainable sourcing of ingredients, and functional ingredient innovation to improve quality, safety, and efficiency across food supply chains. Food ingredient manufacturing, distribution, and processing companies are all part of the market, which drives tech innovations such as food ingredient shelf-life extension, AI-driven technology, and clean-label formulation.

Market Share Analysis by Key Players & Bulk Food Ingredient Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Inc. | 18-22% |

| Archer Daniels Midland Company (ADM) | 12-16% |

| Ingredion Incorporated | 10-14% |

| Tate & Lyle PLC | 8-12% |

| Olam International | 5-9% |

| Other Bulk Food Ingredient Suppliers (combined) | 30-40% |

Key Company & Bulk Food Ingredient Solutions

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Inc. | Develops AI-powered ingredient supply chain solutions, sustainable bulk food sourcing, and high-quality food processing ingredients. |

| Archer Daniels Midland Company (ADM) | Specializes in bulk grains, proteins, and sweeteners with AI-assisted production efficiency and quality control. |

| Ingredion Incorporated | Provides plant-based ingredient solutions, AI-powered formulation assistance, and clean-label starches and sweeteners. |

| Tate & Lyle PLC | Focuses on functional food ingredients, sugar reduction solutions, and AI-driven nutritional product development. |

| Olam International | Offers organic and natural food ingredients, AI-assisted traceability solutions, and global bulk food distribution networks. |

Key Market Insights

Cargill, Inc. (18-22%)

Cargill Volume food ingredients (high quality grains, functional food components, cost efficient delivery in bulk via AI powered supply chain)

Archer Daniels Midland Company (ADM) (12-16%)

The company is processing large quantities of food ingredients, using AI for efficiency in processing, plant proteins, and worldwide distribution.

Ingredion Incorporated (10-14%)

Ingredion - supplier of natural and functional food ingredients, enabling clean-label product formulations and AI-powered quality assurance.

Tate & Lyle PLC (8-12%)

AI-powered nutritional profiling and formulation tools to optimize sugar alternatives and fiber-enriched ingredients.

Olam International (5-9%)

Olam creates ingredients for organic and specialty foods with AI-support traceability and bulk ingredient availability sourced sustainably.

Other Key Players (30-40% Combined)

Next-generation food strategy innovations and production are driven by several bulk food ingredient suppliers, specialty ingredient manufacturers, and food processing firms providing AI-driven inventory management, category management, nutrition and sustainability strategies and ingredient sourcing. These include:

The overall market size for bulk food ingredients market was USD 795.4 Billion in 2025.

Bulk food ingredients market is expected to reach USD 1,122.1 Billion in 2035.

The demand for Bulk Food Ingredients is expected to rise due to increasing consumption of processed and convenience foods, growing demand for natural and organic ingredients, and expanding food service and retail sectors.

The top 5 countries which drives the development of bulk food ingredients market are USA, UK, Europe Union, Japan and South Korea.

Processed Grains, Pulses & Cereals and Bakery & Confectionery to command significant share over the assessment period.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.