The global built-in large cooking appliances market is projected for growth. In-built large cooking appliances (ovens, cooktops, and range hoods) can be integrated into cabinetry for a neater, seamless kitchen layout. As the big city get bigger and homes get smaller and small’s homes have to focus on modern living, built microwave ovens are frequently the first choice of all condominiums owners.

Technological advancements like energy-efficient models, smart connectivity, and advanced cooking functions are making these appliances even more attractive.

With new residential construction and remodeling projects on the rise worldwide, the market for built-in large cooking appliances is positioned to grow steadily through 2035.

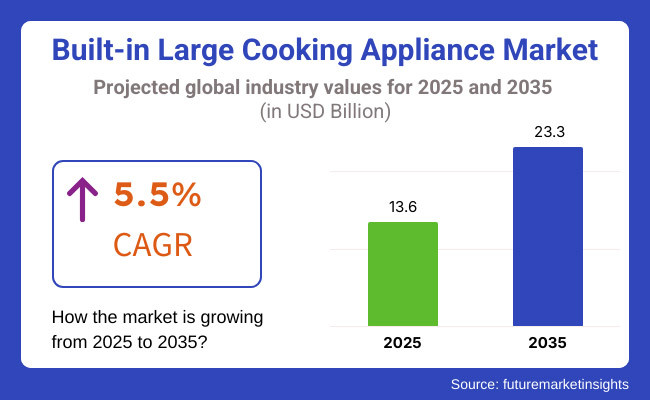

By 2025, the built-in large cooking appliances market is estimated to be worth over USD 13.6 Billion. The market is expected to grow from USD 15.6 Billion in 2022 to USD 23.3 Billion by 2035, at a CAGR of 5.5% from 2023 to 2035. This growth reflects the rise in demand for contemporary kitchen designs, growing adoption of advanced cooking techniques, growing renovation activities across the globe.

Explore FMI!

Book a free demo

North America leads the market for built-in large cooking appliances facilitated by the region’s high repair and renovation culture, and preference towards high-quality, energy-efficient appliances. The built-in ovens, cooktops, and hoods are in high demand across the United States and Canada, driven by new kitchen designs and features.

Moreover, increasing adoption of smart home technologies and connected cooking appliances is also contributing to market growth within this region.

Europe is a second key market because of a well-established manufacturing base and consumers’ longstanding inclination toward integrated kitchen designs. Other countries such as Germany, Italy and the United Kingdom have robust demand for premium, built-in cooking appliances that integrate seamlessly into sleek, minimalist kitchen designs.

European manufacturers are leading the way by launching more eco-friendly, energy-efficient models, compliant with some of the strongest regulations, both of which contribute to the growth of this market.

The built-in large cooking appliance market is also experiencing significant growth in the Asia-Pacific region due to rapid urbanization, a rising disposable income, and a growing middle class. So, one of the reasons why you see demand for built in ovens, cooktops, and range hoods growing is because many countries such as China, Japan and India are on a spending spree towards residential construction and home improvement. Moreover, Innovations in cooking technology, such as integrated appliances, small cooking appliances, and basin technology, are also designed for specific culinary preferences in that region, pushing higher growth in this region

Challenges

High Initial Investment, Space Constraints, and Energy Consumption Regulations

High initial costs related to high-quality material, smart technology integration, and the bespoke installation means that cost is far and away the main failure of built-in large cooking appliances market. Built-in ovens, cooktops and microwaves, on the other hand, require professional installation, which limits their availability in cost-sensitive markets, as compared to freestanding appliances.

They also take up a lot of space, making adoption a challenge in small urban homes and cramped apartments where the appliances typically require custom cabinetry and a remodel of the kitchen. A big problem is compliance with energy efficiency regulations, as governments establish increasingly more stringent standards for power consumption and eco-friendlier manufacturing in an attempt to reduce the carbon footprint.

Opportunities

Smart Kitchen Innovations, Energy-Efficient Designs, and Growth in Modular Kitchens

The built-in large cooking appliances market faces challenges due to the high initial investment, the need for professional installation, and competition from alternative cooking technologies. AI-powered cooking assistants, IoT-connected ovens, and precision temperature control systems are some of the innovations improving convenience and efficiency.

Newer energy-efficient heating elements, sustainable induction technology, and low-energy use appliances also conform to sustainability targets. Overseas demand, particularly in urban and luxury residential segments, is also bolstered by the worldwide move toward modular kitchens and lavish home renovations.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency standards, safety certifications, and eco-labeling mandates. |

| Consumer Trends | Demand for sleek, space-saving, and high-performance built-in appliances. |

| Industry Adoption | Growth in luxury home renovations and smart kitchen installations. |

| Supply Chain and Sourcing | Dependence on stainless steel, tempered glass, and electronic components from Asia-Pacific suppliers. |

| Market Competition | Dominated by premium appliance brands and modular kitchen manufacturers. |

| Market Growth Drivers | Growth fueled by urbanization, smart home integration, and demand for high-end kitchen solutions. |

| Sustainability and Environmental Impact | Moderate focus on energy-efficient designs and minimal heat loss in appliances. |

| Integration of Smart Technologies | Early-stage use of Wi-Fi-enabled ovens, digital timers, and temperature control panels. |

| Advancements in Cooking Efficiency | Development of multi-functional built-in ovens and hybrid cooking technologies. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter low-emission appliance regulations, recyclable material requirements, and carbon-neutral production policies. |

| Consumer Trends | Increased adoption of AI-powered cooking appliances, voice-activated kitchen controls, and automated meal preparation. |

| Industry Adoption | Expansion into self-cleaning appliances, AI-driven recipe customization, and precision cooking systems. |

| Supply Chain and Sourcing | Shift toward sustainable, recycled materials, and localized production for reducing supply chain disruptions. |

| Market Competition | Entry of AI-driven smart home startups, energy-efficient appliance makers, and home automation innovators. |

| Market Growth Drivers | Accelerated by green building initiatives, AI-driven kitchen automation, and next-gen energy-efficient appliances. |

| Sustainability and Environmental Impact | Large-scale adoption of zero-waste appliances, sustainable materials, and AI-driven energy optimization. |

| Integration of Smart Technologies | Expansion into AI-powered recipe guidance, real-time cooking diagnostics, and IoT-integrated appliance monitoring. |

| Advancements in Cooking Efficiency | Evolution toward wireless power transfer cooking, intelligent heat distribution, and fully autonomous cooking solutions. |

Comprehensive industry analysis and trends data with built-in ovens, microwaves and cooktops, consumers are opting for modular kitchens to ensure a seamless look and an efficient use of space. The market growth is also driven by the adoption of energy-efficient and IoT-enabled appliances.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

More and more households in the UK are investing in premium kitchen renovations, which is fuelling the growth of the built-in large cooking appliances market. Demand is increasing because of the trend towards open-plan living spaces and integrated kitchen appliances. Moreover, the growing demand for energy-efficient cooking solutions, including induction cooktop and built-in convection ovens, is propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

Growth in built-in large cooking appliances market, as consumers prefer sleek, high-performing kitchen appliances across the region. The push for energy efficiency, renewable energy, and sustainable cooking technologies is boosting the demand for built-in ovens, steam-ovens, and smart cooking appliances in the region. Due to the growing demand for special features, electronics manufacturers are placing great emphasis on battery life, voice controls, AI-assisted cooking, and remote connectivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Japan built-in large cooking appliances is growing moderately, driven by increasing demand for space-saving and multifunctional kitchen appliances. Consumers are choosing compact but feature-rich built-in ovens and cooktops boasting sophisticated cooking modes. The growth of the market is attributed to the rise in premium home appliances in urban households.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Growing urbanization, increasing disposable incomes, and a strong demand for modern kitchen solutions are driving the built-in large cooking appliances market in South Korea. Major trends affecting the market trends & opportunities. The increasing adoption of smart homes coupled with the integration of AI-driven cooking appliances. Government policies to promote energy-efficient household appliances are also driving growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The built-in large cooking appliances industry has been growing steadily, as consumers continues to look for modern and compact kitchen appliances to save space and offer high levels of performance. Increasing popularity of modular kitchens, smart home integration and energy-efficient appliances is boosting the demand for built-in cooking appliances in both residential and commercial sectors. The market is divided in Commercial, Residential, by product type (Built-in Cooktops, Built-in Ovens, Others).

The largest region in the Built-In Large Cooking Appliances Market segment is the Built-in ovens segment owing to their multi-functional use, latest cooking technology infusion and their seamless integration with modern kitchens. With convection baking, multi-rack cooking and self-cleaning technologies, built-in ovens have become a mainstay in high-end residential and professional cooking environments thanks to their contribution to cooking at a higher level.

As smart kitchen appliances become more common, Wi-Fi-enabled ovens you can operate remotely, A.I assisted cooking programs and precise temperature controls are proliferating. In this regard, steam ovens and combination ovens are also on the rise among consumers who prefer health and nutrition focusing on efficient methods of cooking.

Built-in cooktops still represent a substantial share of the market, including gas, electric and induction versions catering to different consumer technologic preferences. Induction cooktops, in particular, are seeing fast growth as they are energy efficient, boast safety features, and enable precision cooking.

The other category, which includes built-in microwaves, warming drawers and combination cooking systems, is also broadening as home and commercial kitchen designers seek multi-functional appliances that bring more efficiency and productivity to cooking processes.

The residential segment accounts for the largest market share in the built-in large cooking appliances market as there is a growing investment in smart kitchens and space-saving designs in new homes or renovations. The heightened appeal of open-concept kitchens, integrated cabinetry and high-end cooking experiences has created demand for built-in appliances that seamlessly integrate with modern interiors.

As cooking trends move toward health-conscious and time-efficient meals, consumers are investing in high-end built-in ovens, convection microwaves and induction cooktops, which cook meals more quickly and use less energy, and boast better safety features. Additionally, the growth of luxury real estate, smart home automation, and urban kitchen remodeling projects is driving the residential demand further.

The commercial segment, which includes all restaurants, hotels, catering businesses, and institutional kitchens, continues to grow steadily, especially in the area of high-capacity built-in ovens and cooktops. Commercial kitchen appliances need to be high-performance, durable, easy to maintain cooking appliances as they are used continuously and efficient food-preparation is taken to a the next level to cater large scale customers. Strong commercial demand for advanced built-in cooking appliances is being driven by the rising proliferation of quick-service restaurants (QSRs), cloud kitchens, and fine dining establishments.

The large cooking appliances segment of the built-in kitchen products market is experiencing growth, attributed to the rising interest in smart kitchen solutions, energy-efficient appliances, and contemporary designs that save space. Consumer demand for AI-driven cooking technology, IoT-enabled smart ovens, multi-functional kitchen devices, and user convenience, along with cooking efficiency and premium kitchen integration provide massive opportunities for companies to invest in these avenues.

The kitchen appliances supplier market comprises home appliance manufacturers, luxury kitchen brands, and smart home technology providers influencing technological developments across built-in ovens, cooktops, range hoods, steam ovens, and combination appliances.

Market Share Analysis by Key Players & Built-In Large Cooking Appliance Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | 18-22% |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | 12-16% |

| Electrolux AB (AEG, Electrolux, Zanussi) | 10-14% |

| Miele & Cie. KG | 8-12% |

| Samsung Electronics Co., Ltd. | 5-9% |

| Other Kitchen Appliance Brands (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | Develops AI-powered smart ovens, steam cooking systems, and multi-functional built-in appliances. |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | Specializes in energy-efficient built-in cooking ranges, IoT-enabled ovens, and air-fry cooking technology. |

| Electrolux AB (AEG, Electrolux, Zanussi) | Provides premium built-in ovens, hybrid cooktops, and AI-driven cooking assistance systems. |

| Miele & Cie. KG | Focuses on high-end built-in steam ovens, AI-integrated baking precision, and gourmet kitchen solutions. |

| Samsung Electronics Co., Ltd. | Offers smart kitchen connectivity, AI-powered recipe optimization, and voice-controlled built-in cooking appliances. |

Key Market Insights

BSH Hausgeräte GmbH (18-22%)

BSH offers market-leading products with integrated AI for cooking intelligence, high performance, steam ovens, and luxury kitchen integration in large built-in cooking appliances.

Whirlpool Corporation (12-16%)

Whirlpool builds multi-functional built-in cooking appliances that combine energy-efficient designs with IoT connectivity and smart pre-programmed cooking functions.

Electrolux AB (10-14%)

One of the key players in this realm is Electrolux, known for its upscale built-in oven and cooktop solutions that leverage AI-driven cooking modes and precision temperature control.

Miele & Cie. KG (8-12%)

Miele specializes in high-end steam and convection ovens that connect to bake automation powered by AI and smart touch controls.

Samsung Electronics Co., Ltd. (5-9%)

Widespread availability of Samsung built-in Wi-Fi enabled appliances with smart home connections, AI cooking assistance, and the ability to connect seamlessly to digital environments.

Other Key Players (30-40% Combined)

Several kitchen technology brands, smart home appliance companies, and built-in cooking appliance specialists contribute to next-generation smart kitchen innovations, AI-powered cooking precision, and multi-functional cooking solutions. These include:

The overall market size for built-in large cooking appliances market was USD 13.6 Billion in 2025.

Built-in large cooking appliances market is expected to reach USD 23.3 Billion in 2035.

The demand for Built-in Large Cooking Appliances is expected to rise due to increasing adoption of modular kitchens, growing urbanization, and rising consumer preference for space-efficient and premium kitchen solutions.

The top 5 countries which drives the development of built-in large cooking appliances market are USA, UK, Europe Union, Japan and South Korea.

Built-In Ovens and Residential Applications to command significant share over the assessment period.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.