Changing lifestyle of consumers towards urbanization coupled with rising demand for modern-based kitchen appliances are expected to propel the growth of global built-in hobs market. Designed to blend in seamlessly with cabinetry, built-in hobs are a popular choice among households looking for a combination of convenience and aesthetics, as they take up minimal space and usually come as a combined with integrated features.

And with the increased number of residential and commercial construction projects and the emergence of the middle class in developing markets, the demand for built-in kitchen solutions is sky-high. Built-in hobs also bring together additional technological advancements such as smart connectivity, energy efficiency, and touch controls.

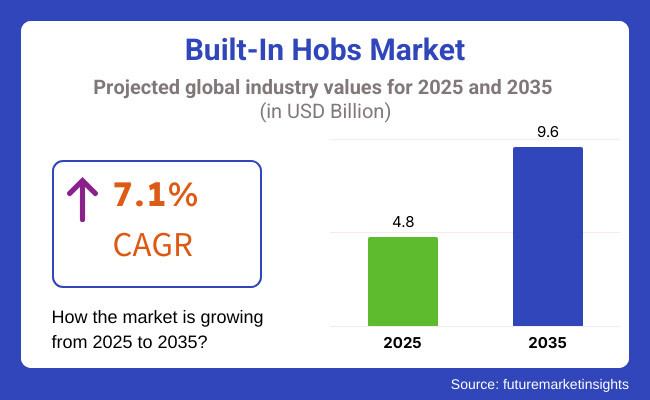

As homeowners seek both function and style, built-in hobs are becoming a default option for contemporary kitchens, contributing to market growth through 2035. The built hobs market in 2025 is expected to register around USD 4.8 Billion, primarily due to the growing consumer inclination towards new kitchen appliances and increased interest in pleasing, integrated design kitchen functionality. The market is projected to grow USD 9.6 Billion by 2035, at a compound annual growth rate (CAGR) of 7.1% during the forecast period.

Explore FMI!

Book a free demo

The prime market for built-in hobs is North America, attributed to an established home appliance market and the increasing adoption of open-plan kitchens. In the Americas, consumers are turning to built-in kitchen options to optimize the space and aesthetic appeal of their homes. The growing disposable income and a strong renovation culture have also spurred the acceptance of advanced built-in hobs with features including touch controls, induction heating, and enhanced connectivity.

Built-in hobs have also found a significant market in Europe, where there is a high demand for premium kitchen appliances with energy-efficient solutions. Countries such as Germany, Italy and France have been at the forefront of the shift, given their mature appliance manufacturing industries and consumers’ tendency to favor sleek, minimalist kitchen layouts. With sustainability rapidly centering in Europe, the manufacturers are launching energy-efficient models to comply with innovative energy standards, thus driving the growth of the market.

The Asia-Pacific region is poised to be the fastest-growing market for built-in hobs, driven by rapid urbanization, increasing disposable income levels, and growing housing construction. The consumer awareness of built-in kitchen solutions is increasing due to rising number of consumers preferring appliances that combines convenience and style in countries China, India, and Japan.

Moreover, the increasing penetration of smart home systems and the expansion of modular kitchen trends in the region are positively influencing the demand for smart built-in hobs. With the continuous expansion of Asia-Pacific’s middle class and a growing leisure-time construction project, the built-in hob market will usher in vigorous growth.

Challenges

High Installation Costs, Limited Consumer Awareness, and Regional Regulatory Standards

Challenges in the built-in hobs market include high installation costs and customized kitchen countertops. In contrast to standalone gas or electric stoves that can be standalone, built-in hobs require professional installation, increasing upfront costs and making adoption less viable in cost-sensitive markets. And in some areas where traditional stoves are more commonly used, consumer awareness is also still low.

Another obstacle is different regional regulatory requirements for gas safety, electrical wiring, and energy efficiency, making it difficult for manufacturers to standardize their product offerings across multiple markets.

Opportunities

Growth in Smart Kitchen Appliances, Energy-Efficient Induction Technology, and Premium Home Upgrades

However, there are challenges that the built-in hobs market will have to overcome, which includes, but is not limited to, changing consumer preferences and increased competition from alternative cooking solutions. Smart kitchen appliances with touch controls, AI-based temperature control, and IoT connectivity are boosting the functionality and effectiveness of built-in hobs.

The demand for induction is also being driven by new technology and induction hobs are much faster, consume less power and are safer. Additionally, the increasing focus on culinary leisure, along with the rising demand for premium home improvements, is standards for market expansion in luxury kitchen reconstruction and high-income homes, particularly in metropolitan areas.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with gas safety, electrical efficiency, and environmental impact regulations. |

| Consumer Trends | Rising preference for sleek, space-saving, and high-tech cooking solutions. |

| Industry Adoption | Adoption of induction, gas, and hybrid built-in hobs in urban kitchens. |

| Supply Chain and Sourcing | Dependence on traditional stainless steel and tempered glass materials. |

| Market Competition | Dominated by premium home appliance brands and kitchenware manufacturers. |

| Market Growth Drivers | Growth fueled by modern kitchen aesthetics, growing urbanization, and demand for energy efficiency. |

| Sustainability and Environmental Impact | Moderate focus on energy-efficient induction hobs and gas safety measures. |

| Integration of Smart Technologies | Early-stage use of touchscreen panels, app connectivity, and temperature sensors. |

| Advancements in Cooking Efficiency | Development of multi-burner induction hobs and hybrid cooking surfaces. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of eco-friendly kitchen standards, stricter energy efficiency mandates, and smart appliance regulations. |

| Consumer Trends | Increased demand for AI-integrated smart hobs, voice-controlled cooking, and self-cleaning surfaces. |

| Industry Adoption | Widespread use of IoT-enabled, touchless operation, and AI-powered heat control systems. |

| Supply Chain and Sourcing | Shift toward nanocoated, anti-scratch surfaces, and recyclable eco-friendly hob materials. |

| Market Competition | Entry of AI-driven smart kitchen startups, eco-friendly appliance firms, and energy-efficient product developers. |

| Market Growth Drivers | Accelerated by sustainable cooking technology, automated kitchen systems, and luxury home kitchen remodeling. |

| Sustainability and Environmental Impact | Large-scale shift to zero-emission kitchen appliances, fully recyclable materials, and minimal energy wastage designs. |

| Integration of Smart Technologies | Expansion into AI-driven recipe recommendations, automatic cooking adjustments, and real-time performance analytics. |

| Advancements in Cooking Efficiency | Evolution toward wireless energy transfer cooking, intelligent flame control, and fully automated meal preparation. |

The Built-In Hobs market in USA is witnessing a steady growth owing to increasing adoption of modern kitchen appliances and integration with smart home systems. Consumers are drawing keen toward aesthetic space-saving cooking solutions that enhance overall kitchen aesthetics and functionality. Further growth of the market is attributed to increasing acceptance of energy-saving and induction-based built-in hobs, as well as advancements in technology such as touch controls and IoT-enabled capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The built-in hobs industry in the United Kingdom is growing at a time when urban households are increasingly adopting modular kitchens and advanced kitchen appliances. The increasing trend of open kitchen designs and high-end home renovation is also helping the built-in hob demand. Moreover, growing awareness among consumers regarding energy efficient as well as eco-friendly cooking solutions is expected to further fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The growth of the built-in hobs market in Europe can be attributed to the increasing adoption of smart kitchen appliances among consumers in the region. However, to meet the demand for high-end hobs, manufacturers are putting emphasis on advanced features such as precise temperature control, improved safety features, and integration with home automation systems, as consumers prefer induction and ceramic hobs. Further, a rising demand for sustainable and high-performance appliances is expected to act as another factor providing a thrust to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

Japan's built-in hobs market is experiencing steady growth, driven by the country's adoption of modern kitchen appliances and smart home technologies. Trends in the market are being defined by compact, multipurpose built-in hobs, especially in urban apartments. The market is also expanding due to developments in energy-saving gas and induction hobs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Urbanization, increasing disposable income, and a high-end kitchen design preference are all contributing to the growth of the built-in hobs market over South Korea. The latest trend of the integrated induction hob with touch control function, device connected to each other and high safety system are all the rage. Market expand is bolstered due to government campaigns promoting energy-efficient equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The trend towards sleek, space-saving hobs is driving much of this growth in kitchen hobs market. Growing demand for premium built-in hobs is driven by the rising adoption of modular kitchens, smart home integration, and energy-efficient cooking technologies. It covers Market Segments by Product Type (Electric Hob, Permanent, Others-Induction, Gas) and Burner Type (2 Burner, 3 Burner, 5 Burner, Others).

Ceramic hobs account for the majority in the Built-In Hobs Market, because of its aesthetic appeal, easy to maintain, and energy efficient heating. Ceramic hobs are different in that they utilize infrared heating elements positioned under a smooth glass-ceramic surface for even heat distribution and cooking times. These kinds of hobs are left as the most well-known decision at the present time in high and cutting-edge kitchens where they can add a touch of style for your kitchen.

Moreover, the consumer preference for smart kitchen appliances is positively influencing the uptake of advanced ceramic hobs featuring touch control, automated temperature control and child lock. As energy efficiency standards become more stringent and consumers become more interested in eco-friendly kitchen appliances, ceramic built-in hobs are becoming increasingly popular.

Other than that, induction and gas hobs is housed under the others category which attracts a wider consumer base. Induction hobs are carving out market share particularly because of their fast heating, precise temperature control, and energy efficiency. While smart touch-controlled induction hobs have been favored by practitioners, it is expected to grow steadily as other homeowners capture their potential. Though gas hobs are conventional, they are still prevalent, especially in regions where gas is a part of the cultural cooking experience or where the electric tariff is high.

Largest market share of 4-burner built-in hobs as they offer flexibility, effectiveness, and steadiness for contemporary households and commercial kitchens. These hobs enable users to prepare multiple meals at the same time, perfect for big families, home cooks, and commercial kitchens. Moreover, manufacturers are adding smart features like flame control, auto-ignition, and heat sensors to improve user experience and maintain safety.

3-burner built-in hobs becoming increasingly widespread, especially in urban apartments and smaller kitchens. Giving context here, these hobs are perfect for small to mid-sized families that are looking for modern looking cooking appliances that are energy-efficient as well as functional but space-efficient. As real estate trends are evolving towards compact housing, smart kitchens, spaces between built-in hobs, the demand for multi-functional, space-optimized hobs is booming.

The global built-in hobs market is witnessing growth owing to the increasing preference for modern kitchen appliances that also save space and are energy efficient. As a result, firms are targeting AI-driven smart cooking tech, automation with gooder and safer features, and elaborate appearance designs to lead more convenient user’s ways of restricting carbon emissions as well as more incorporated with home kitchens.

In this space, the market consists of three different types of manufacturers: home appliance manufacturers, luxury kitchen brands, and smart home technology providers all playing their part in building increasingly sophisticated technology for built-in gas, induction and hybrid hobs, AI-driven temperature control, and IoT-enabled smart cooking.

Market Share Analysis by Key Players & Built-In Hob Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | 18-22% |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | 12-16% |

| Electrolux AB (AEG, Electrolux, Zanussi) | 10-14% |

| Elica S.p.A. | 8-12% |

| Miele & Cie. KG | 5-9% |

| Other Kitchen Appliance Brands (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | Develops AI-driven smart hobs, flex-induction cooking zones, and sensor-controlled flame regulation. |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | Specializes in energy-efficient built-in hobs, smart IoT connectivity, and automatic safety shutoff technology. |

| Electrolux AB (AEG, Electrolux, Zanussi) | Provides premium built-in induction and hybrid hobs, AI-powered heat distribution, and automatic cookware detection. |

| Elica S.p.A. | Focuses on luxury kitchen integration, built-in gas and induction hobs with downdraft ventilation, and smart touch controls. |

| Miele & Cie. KG | Offers high-end built-in hobs with precise temperature control, AI-assisted cooking modes, and premium glass-ceramic finishes. |

Key Market Insights

BSH Hausgeräte GmbH (18-22%)

BSH dominates the market for built-in hobs, with high-efficiency induction and gas hobs, AI powered flame and heat regulation and premium smart home integration.

Whirlpool Corporation (12-16%)

Whirlpool is focused on hob technologies that embrace energy efficiency, with smart temperature control, AI-assisted cooking presets, and safety-based design.

Electrolux AB (10-14%)

Provides top-of-the-line induction hobs that have the latest in AI-assisted automatic heating adjustment and seamless kitchen built designs.

Elica S.p.A. (8-12%)

Elica specializes in high-end kitchen appliance integration, incorporating downdraft ventilation tech, smart touch controls, and luxury aesthetic finishes.

Miele & Cie. KG (5-9%)

AI-controlled cooking aids have developed precision-focused built-in hobs with luxurious ceramic and glass finishes, and smart temperature sensors from Miele.

Other Key Players (30-40% Combined)

Several home appliance manufacturers, kitchen technology brands, and built-in hob specialists contribute to next-generation built-in hob innovations, AI-powered temperature control, and smart kitchen connectivity solutions. These include:

The overall market size for built-in hobs market was USD 4.8 Billion in 2025.

Built-in hobs market is expected to reach USD 9.6 Billion in 2035.

The demand for Built-in Hobs is expected to rise due to increasing urbanization, growing adoption of modular kitchens, and rising consumer preference for space-saving and aesthetically appealing kitchen appliances.

The top 5 countries which drives the development of built-in hobs market are USA, UK, Europe Union, Japan and South Korea.

Ceramic Hobs and 4-Burner Configurations to command significant share over the assessment period.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.