The global market for building automation systems (BAS) is rapidly growing, driven by the increasing demand for energy efficiency, sustainability, and automation in residential, commercial, and industrial buildings. As the world becomes more focused on smart cities and smart buildings, the BAS market is poised for significant expansion. The projected compound annual growth rate (CAGR) of the BAS market is expected to be around 10.5%, with sales expected to reach USD 107.5 billion by 2035.

Key players in the building automation system market, including Honeywell International Inc., Siemens AG, and Johnson Controls International, dominate by offering comprehensive and integrated solutions. These companies lead with innovations in technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and cloud computing, offering enhanced control and monitoring of building systems such as HVAC, lighting, security, and energy management. These technological advancements are expected to continue shaping the market dynamics in the coming years.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 107.5 billion |

| CAGR (2025 to 2035) | 10.5% |

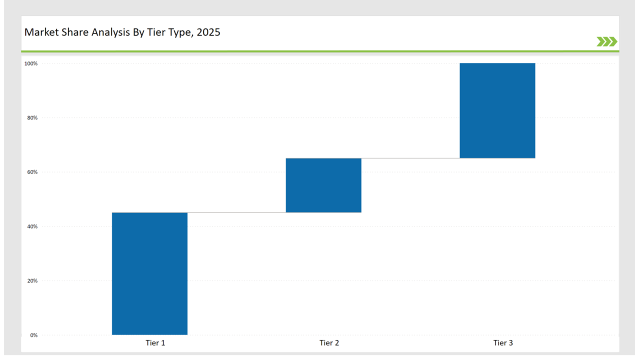

In the BAS market, the top companies have effectively captured market share through constant innovation, strategic partnerships, and expanding product portfolios. The leading players Honeywell International Inc., Siemens AG, and Johnson Controls International together hold approximately 40% of the market, capitalizing on their robust product offerings and strong presence across key regions. These companies also focus on providing integrated smart solutions that encompass building management, energy efficiency, and user comfort.

The next tier of players, such as Schneider Electric and ABB, hold about 30% of the market share, providing specialized automation systems with a focus on energy management and sustainability. Other players in the top 10, including Legrand, Trane Technologies, and Lutron Electronics, make up the remaining 30%, contributing with a range of products aimed at specific building needs such as lighting control, temperature regulation, and fire safety systems.

While North America and Europe remain dominant markets, the Asia-Pacific region is gaining significant traction due to rapid urbanization, increasing construction activities, and government initiatives supporting smart cities.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Honeywell International Inc., Siemens AG, Johnson Controls International) | 42% |

| Rest of Top 5 (Schneider Electric, ABB) | 20% |

| Rest of Top 10 | 38% |

The market is moderately consolidated with a few Tier-I players dominating the global BAS market. These Tier-I companies focus on offering highly integrated, flexible, and scalable solutions for large-scale projects. Tier-II and Tier-III companies primarily compete by offering specialized solutions catering to specific applications such as lighting, HVAC, and energy management.

The hardware segment remains a cornerstone of the building automation system (BAS) market, incorporating controllers, sensors, actuators, and other physical components that enable integration and automation across a building. With growing demands for energy efficiency and sustainability, the use of advanced and durable hardware solutions is increasing.

The software segment plays a pivotal role in enabling data management, predictive analytics, and remote monitoring. It enhances operational performance and energy optimization. Services, which include installation, integration, and maintenance, are essential for ensuring the smooth and continuous operation of BAS, particularly in complex building setups that require regular updates and technical support.

The security and surveillance system is crucial for maintaining building safety and monitoring activities. Integration with BAS allows for advanced features like motion detection, facial recognition, and real-time alerts, boosting security levels across commercial and residential properties. HVAC systems are central to maintaining indoor comfort and air quality, helping to optimize energy consumption in commercial and residential spaces.

Lighting solutions integrated with BAS utilize sensors for automatic adjustment based on occupancy and ambient light, improving energy efficiency. Building Energy Management Systems (BEMS) monitor and control energy use, contributing to sustainability. Other systems, including fire safety and air quality management, complete the BAS ecosystem.

In the commercial sector, BAS is extensively used in office buildings, retail spaces, and hospitality environments to optimize energy use, enhance occupant comfort, and streamline operations. Residential applications of BAS are rising, especially in high-end homes and smart buildings, where automation of lighting, HVAC, and security systems enhances convenience and energy savings.

The government sector also significantly contributes to the BAS market, where public buildings such as schools, offices, and healthcare facilities adopt BAS for energy efficiency and sustainability. The others segment includes industrial and retail applications, where BAS is used to improve operational efficiency, energy management, and safety in factories and warehouses.

Honeywell International Inc.

Honeywell continued to solidify its position as a market leader in 2024 by focusing on the development of AI-powered building automation systems. The company introduced a range of solutions for both residential and commercial buildings, including smart thermostats, integrated lighting systems, and advanced security technologies. Honeywell’s ongoing commitment to sustainability and energy efficiency further helped the company strengthen its market presence.

Siemens AG

Siemens made significant strides in 2024 by expanding its offerings in the energy management and HVAC sectors. The company introduced smart building solutions that integrate IoT and AI, allowing building owners to optimize energy use, reduce costs, and enhance overall comfort. Siemens also focused on cloud-based services that enable remote monitoring and control of building systems, further expanding its footprint in the smart building market.

Johnson Controls International

Johnson Controls remained a dominant player in 2024, thanks to its ongoing innovation in building control systems. The company launched several new products in the HVAC and energy management segments, focused on improving energy efficiency and sustainability in both commercial and residential buildings. Johnson Controls also enhanced its portfolio with intelligent building systems that leverage AI and predictive analytics.

Schneider Electric

Schneider Electric made notable advancements in 2024 by launching energy-efficient building automation systems designed to reduce carbon emissions. The company focused on providing end-to-end solutions for buildings, including integrated energy management, lighting control, and HVAC automation. Schneider Electric’s commitment to sustainability positioned it as a key player in the green building movement.

ABB

ABB’s focus on industrial automation helped the company become a leading player in the BAS market. The company introduced IoT-enabled solutions for industrial applications, allowing manufacturers to monitor energy consumption, optimize production processes, and reduce operational costs. ABB also made strategic investments in smart grid technologies, further strengthening its position in the energy management sector.

| Tier | Examples |

|---|---|

| Tier 1 | Honeywell International Inc., Siemens AG, Johnson Controls International |

| Tier 2 | Schneider Electric, ABB |

| Tier 3 | Legrand, Trane Technologies, Lutron Electronics |

| Company | Key Focus |

|---|---|

| Honeywell International Inc. | Launched smart thermostats and AI-powered HVAC systems to improve building efficiency. |

| Siemens AG | Focused on energy management and smart building solutions for sustainable infrastructure. |

| Johnson Controls International | Introduced integrated automation systems for both commercial and residential buildings. |

| Schneider Electric | Launched energy-efficient building automation solutions with a focus on sustainability. |

| ABB | Provided IoT-enabled automation systems for industrial buildings to optimize energy usage. |

The BAS market is set for continued growth, driven by technological innovations and increasing demand for energy-efficient solutions. Companies will need to focus on expanding their market reach, particularly in emerging economies, and continue investing in sustainable technologies. As the adoption of smart buildings continues to rise, the market will witness even greater integration of AI, IoT, and cloud computing into building automation systems.

Honeywell International Inc., Siemens AG, and Johnson Controls International hold around 40% of the market share.

HVAC systems and lighting control systems are the leading product segments, accounting for significant market shares.

Regional and domestic companies hold around 30% of the BAS market share.

The market is moderately consolidated with the top players accounting for significant market share.

Energy management and commercial building automation offer significant growth potential.

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.