The Japan building automation system market is anticipated to be valued at USD 2.7 billion in 2025. It is expected to grow at a CAGR of 8.1% during the forecast period and reach a value of USD 5.88 billion in 2035.

The Japan building automation system market in 2024 saw a surge in smart infrastructure deployment, driven by stricter energy regulations as well as incentives directed toward net-zero buildings. Commercial buildings, especially office spaces and shopping malls, were the early adopters of BAS due to rising energy costs and the push toward sustainability.

Major companies focused on integrating AI-based energy management solutions, improving HVAC efficiency, and automating lighting controls. Besides, cybersecurity concerns led to investments in advanced data security.

In 2025, a further increase will be supported by government policies and the promotion of smart city initiatives. On the residential side, growth potential exists as more consumers become interested in home automation and IoT-enabled energy monitoring. The rollout of 5G and edge computing will augment real-time capabilities found in BAS.

The areas beyond 2025 will be where AI, ML, and cloud-based automation come on the scene: The focus will remain on retrofitting older buildings, applying smart systems, while targets on carbon reduction will spur demand for energy-efficient BAS solutions. Thus, following this trajectory, Japan remains consistent in sustainability as well as digital transformation, ensuring steady long-term growth.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 2.7 Billion |

| Projected Industry Size in 2035 | USD 5.88 Billion |

| CAGR (2025 to 2035) | 8.1% |

Explore FMI!

Book a free demo

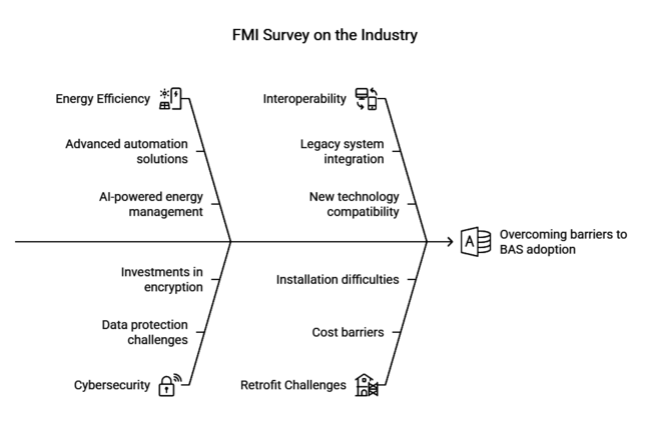

FMI conducted a comprehensive survey with key stakeholders in the Japanese building automation system market, including manufacturers, facility managers, technology providers, and regulatory authorities. The results further show the significance of energy efficiency, with 72% of respondents saying they require advanced automation solutions to cut operational costs. Stakeholders also noted that many were interested in AI-powered energy management systems, which help optimize power consumption while improving the sustainability of buildings.

Cybersecurity has become a prominent issue, and data protection in connected BAS infrastructure has been a major challenge for 65% of participants. Investments are being made in strong encryption and real-time threat detection as automation systems become heavily reliant on IoT and cloud platforms.

Interoperability between different BAS components was also called out as a challenge for the industry marketplace, with management of facilities finding it hard to bring together legacy systems with new automation technologies.

Retrofitting older buildings with smart automation is also highlighted in the survey results as a priority for 60% of the industry professionals. Other restrictions, such as cost and difficult installation, impose serious barriers to the widespread adoption of BAS technology. Stakeholders expect the government to provide incentives and policy directives to promote the technology's acceptability, particularly in the commercial and industrial sectors. Net-zero building initiatives advocate energy metering and HVAC automation innovations.

Want to stay ahead in Japan’s BAS industry? Contact FMI for customized insights and strategic recommendations.

Government policy and legislation have ensured the introduction of building automation systems in Japan. Stringent energy efficiency regulations and mandatory certifications take their toll on building structure and lead to significant mandatory adoption requirements for advanced automation solutions to comply with future environmental and energy management standards.

| Country | Government Policies & Regulations Impacting the BAS Industry |

|---|---|

| Japan |

|

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Future Outlook) |

|---|---|

| The sector experienced continuous growth, led by urbanization, increasing energy prices, and sustainability efforts. | The sector is likely to grow aggressively, driven by smart city initiatives, tighter energy laws, and AI-based automation. |

| HVAC equipment and commercial automation were the prevalent segments, gaining more and more use in offices, shopping malls, and industrial estates. | BEMS and AI-based automation will pick up pace, with predictive maintenance and IoT-based energy optimization becoming the norm. |

| Government policies and incentives, such as the Energy Conservation Act, compelled companies toward energy-efficient alternatives. | Stricter regulatory regimes will impose net-zero building requirements, speeding up smart infrastructure investments. |

| Cybersecurity issues arose with the growing use of IoT and cloud-based automation. | Strong encryption, real-time threat protection, and secure data handling will become top priorities for BAS providers. |

| COVID-19 expedited demand for touchless automation, remote monitoring, and indoor air quality management in commercial buildings. | Artificial intelligence-based, fully autonomous building systems will transform the management of facilities, decreasing energy loss and operational expenditure. |

| Attributes | Details |

|---|---|

| Top System | HVAC |

| Industry Share in 2025 | 32.1% |

In 2025, the HVAC systems segment is expected to dominate the industry, holding a 32.1% revenue share. The integration of smart technology in HVAC automation, including remote control, predictive maintenance, and AI-driven diagnostics, is fueling demand. Intelligent HVAC controls optimize energy consumption based on occupancy, temperature, and pressure, reducing operational costs while enhancing efficiency.

The adoption of web-based applications and mobile solutions enables seamless monitoring and automation, minimizing manual intervention. Increasing government regulations on energy efficiency and carbon emissions are further driving the demand for automated HVAC systems. Businesses are prioritizing smart climate control solutions to improve indoor air quality, occupant comfort, and sustainability, making HVAC automation a key industry growth driver.

| Attributes | Details |

|---|---|

| Top Application | Commercial |

| Industry Share in 2025 | 66.5% |

The commercial sector leads the industry with a 66.5% share in 2025, driven by growing demand for smart offices, retail spaces, and industrial complexes. Japan’s expanding IT industry and startup ecosystem are fueling the need for energy-efficient, technology-driven workspaces. The adoption of centralized automation, cloud-based control systems, and real-time monitoring is transforming commercial buildings, improving security and operational efficiency.

Increased emphasis on sustainability, cost optimization, and safety is prompting businesses to invest in intelligent building solutions. With the rise of smart city initiatives and government-backed energy regulations, commercial automation is set to witness substantial long-term growth, solidifying its dominance in the industry.

The Japanese building automation system market has seen significant advancements in 2024, driven by the increasing adoption of smart building technologies, energy efficiency mandates, and the integration of IoT and AI in building management systems. Key players such as Siemens AG, Honeywell International Inc., Schneider Electric, Mitsubishi Electric Corporation, and Johnson Controls International have been actively implementing strategies to strengthen their presence and cater to the growing demand for advanced BAS solutions.

In 2024, Siemens AG is still leading in Japan with an estimated share of 25% and USD 500 million revenue, on an overall industry basket of USD 2 billion. Over 90% of the entire industry is held by the top five players collectively. The company has set its sights on extending its IoT-enabled building automation platforms that integrate energy management, HVAC, and security systems within them.

In addition, companies such as Siemens have joined forces with several Japanese real estate developers in establishing smart building solutions for commercial and residential projects. On 25 March 2024, Siemens announced the launch of its new AI-driven predictive maintenance system for BAS, as stated by Building Technologies. This innovation has further strengthened Siemens's top position.

Honeywell International Inc. has a 22% stake in Japan, and its revenues amount to USD 440 million. Honeywell's primary focus for 2024 has been energy-efficient solutions for BAS applications in the industrial and healthcare segments. A new range of cloud-based systems, enabling remote monitoring and control of a building's operating facilities, has also been launched.

The company has also expanded its service network throughout Japan with ad hoc BAS applications for existing offices. The February 2024 acquisition of a Japanese software company that specializes in energy optimization confirms that Honeywell is equipped with the know-how to offer integrated BAS solutions.

Schneider Electric emerged as a contender with huge business in Japan; it controlled 20% of the business and USD 400 million revenue, having launched EcoStruxure Building in 2024, which integrated AI and machine learning to achieve the best performance in energy saving while improving occupant comfort.

Active participation in promoting the adoption of smart grid-compatible BAS solutions was also done in collaboration with local utilities. In April 2024, Schneider Electric announced a tie-up with a major Japanese construction sector player on the net-zero energy buildings project, according to Energy Efficiency News. This collaboration has fortified the presence of Schneider in the sustainable building segment.

Mitsubishi Electric Corporation is one of the top companies in Japan, having an 18% share and revenue of USD 360 million. In 2024, the company was focused on integrating its BAS solutions into renewable energy systems such as solar panels and energy storage. It launched a new range of IoT-enabled HVAC controllers that are designed to minimize energy use for very large buildings.

This company has its distribution network spread all over Japan to ensure its BAS products reach the consumers on time for installation. In January, it announced that it had developed a blockchain-based energy trading platform for smart buildings, as confirmed by Tech Japan. This feature puts it ahead of others as it comes to next-generation BAS technologies.

Johnson Controls International held 15% of the industry in Japan, with a revenue of USD 300 million. For 2024, its focus is to expand the OpenBlue digital cloud ecosystem that combines BAS with advanced analytics and cybersecurity features. The company has launched a new line of uncomplicated-to-fit wireless actuators and sensors to the existing buildings.

Along with many other Japanese municipalities, it has initiated smart city projects, for which it puts to use its core competence in BAS. In March 2024, Johnson Controls announced it has partnered with a Japanese technology firm in an effort to develop AI-based building management system solutions for energy optimization and efficiency improvements in smart buildings, as reported by Smart Cities World.

The Japanese building automation system market falls under the smart infrastructure and energy management industry, integrating IoT, AI, and automation technologies to optimize building operations. Broader macroeconomic trends, including urbanization, energy efficiency policies, and digital transformation, influence this industry.

Japan's aging population and labor shortages are accelerating the adoption of automated systems in commercial and residential buildings. The real estate sector is also shifting toward smart buildings as businesses seek cost-effective solutions to reduce energy consumption and enhance operational efficiency. Additionally, Japan's Net Zero Energy Building (ZEB) initiative is driving investments in energy-efficient automation solutions, particularly in commercial spaces.

Rising energy prices and sustainability goals are prompting businesses to integrate Building Energy Management Systems (BEMS) to cut operational costs. Government policies, including carbon neutrality targets and green building incentives, are further strengthening the demand for automated HVAC, lighting, and security systems. The post-pandemic work environment has also increased the need for contactless automation, remote monitoring, and air quality control.

With continued technological advancements, AI-driven automation, and smart city developments, Japan's building automation system industry is poised for steady growth. It is a key segment in the country's sustainable infrastructure evolution.

Growth Opportunities

Expansion of AI-Driven Energy Management

Companies should invest in AI-powered BEMS that enable real-time energy optimization, predictive maintenance, and automated control. As Japan advances its Net Zero Energy Building (ZEB) initiatives, AI-driven solutions will help commercial facilities lower energy costs and ensure regulatory compliance.

Integration of Smart HVAC with IoT Sensors

The HVAC segment presents an opportunity for growth by integrating IoT sensors that adjust temperature and airflow based on occupancy patterns. Businesses investing in sensor-based automation can enhance energy efficiency and differentiate their offerings in an increasingly competitive sector.

Targeting Commercial Real Estate & IT Hubs

The surge in smart offices, data centers, and co-working spaces provides a lucrative industry. Automation providers should develop customized solutions for energy-efficient IT hubs, incorporating advanced security, remote access, and climate control features to meet the evolving needs of technology-driven workplaces.

Strategic Recommendations

Enhance Cybersecurity in BAS Systems

As automation shifts toward cloud-based and IoT-integrated platforms, cybersecurity risks increase. Stakeholders should invest in blockchain-based access control, real-time threat detection, and encrypted communication protocols to mitigate cyber threats and improve system resilience.

Partnerships with Real Estate Developers & Facility Managers

Forming strategic alliances with commercial real estate firms will accelerate BAS adoption. Stakeholders should offer early-stage automation consulting for large-scale projects, ensuring their systems are embedded during initial construction or renovation phases.

Develop Subscription-Based Automation Models

Offering BAS-as-a-Service (BaaS) through subscription-based models can help companies tap into small and mid-sized enterprises (SMEs) that lack upfront capital for automation investments. This approach will ensure scalable adoption while creating long-term revenue streams.

Rising energy costs, government sustainability initiatives, and advancements in smart technology are accelerating the adoption of automated systems in commercial and residential buildings.

Commercial buildings, including offices, retail spaces, and industrial complexes, are leading adopters due to the need for energy efficiency, security enhancements, and centralized control systems.

AI-driven solutions enable predictive maintenance, real-time energy optimization, and automated security protocols, reducing operational costs while improving system efficiency and reliability.

Policies such as Japan’s Net Zero Energy Building (ZEB) initiative and energy efficiency mandates are encouraging businesses to implement advanced automation solutions for sustainability compliance.

The integration of IoT sensors, cloud-based management systems, and AI-powered analytics is shaping next-generation automation, enabling smarter, more responsive, and energy-efficient infrastructures.

By system, the industry is segmented into security & surveillance, HVAC, lighting solutions, and BEMS (building energy management systems).

In terms of application, the sector is segmented into commercial, residential, and government.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.