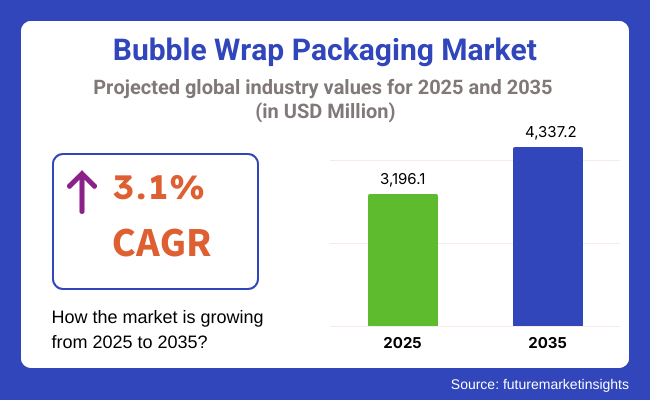

The market for bubble wrap packaging is estimated to generate a market size of USD 3196.1 million in 2025 and would increase to USD 4337.2 million by 2035. It is expected to increase its sales at a CAGR of 3.1% over the forecast period 2025 to 2035. Revenue generated from bubble wrap packaging in 2024 was USD 3100 million.

E-commerce will continue to hold over 32% of the bubble wrap packaging market share in 2035. In online selling, massive quantities of protective packaging are needed due to the fact that it is the biggest user of bubble wrap packaging. Since more and more online shopping is being done worldwide, packaging is beginning to meet the needs of safety and utility route to the consumers' doorstep for products as delicate as electronics, glassware, and cosmetics.

The international shipping boom along with the need for light yet strongly protective packaging material has helped support the application of bubble wrap in online business. Furthermore, eco-friendly and biodegradable alternatives are coming up for environmentally friendly online consumers.

Bubble Wrap Packaging Industry Forecast

In bubble wrap packaging, low-density polyethylene (LDPE) holds the largest market, about 68.4% of the total market share, due to its many benefits: flexibility and cushioning; and shock resistance that makes it ideal for protection of fragile products from damages during transport and storage.

The bubble wrap packaging market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 1237.2 million and will increase 1.4 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global bubble wrap packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 2.9% (2024 to 2034) |

| H2 | 3.3% (2024 to 2034) |

| H1 | 2.1% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.9%, followed by a slightly higher growth rate of 3.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.1% in the first half and remain relatively moderate at 4.1% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed an increase of 80 BPS.

Pharmaceutical and Medical Device Packaging Growth

Medical and pharmaceutical companies need sterile and protective packaging to preserve medicine, vaccines, and healthcare equipment to maintain safety in transport. Bubble packing packaging protects items from breakage, contamination, and temperature exposure for fragile medicines. With increased world health requirements, biotech industry advancements, and the more global exporting of pharmaceuticals, there is a need for protection packaging for safety.

In addition, as cold chain logistics for vaccines and biologics get bigger, bubble wrap, specifically insulated and thermal forms of bubble wrap, is used to maintain temperature consistency in transit. With the manufacturing of pharmaceuticals and medical devices growing all around the world, the demand for specialty protective packaging like bubble wrap will also grow equally.

Growing Demand for Protective Packaging in the Home Furniture and Decor Industry

The home and furniture sector is seeing robust global expansion. They are vases of ceramic, glass tables, paintings in frames, and wooden furniture, and they are fragile in nature with the need for shock-absorbing materials such as bubble wrap to package them during transportation.

As rising need for direct-to-consumer furniture brands and e-commerce shopping of furniture, producers and sellers are spending in superior protective packaging in order to keep damage rates down, eradicate returns, and ensure customer satisfaction.

Flat-pack and module furniture stores also use air-cushioned packing and bubble wrap to cushion delicate areas such as laminated wood, glass panels, and finishes. As demand for high-quality and custom home decoration products rises around the world, the demand for effective and affordable protective packaging solutions such as bubble wrap goes up.

Environmental Problems and Regulation of Plastic Waste May Restrict the Market

One of the biggest challenges the bubble wrap packing business faces today is mounting regulation of the usage of plastics in the interest of the environment. Germany, Canada, and all the nations belonging to the EU have implemented hard plastic waste minimizing regulations, leaving companies no option but to phase out traditional plastic-based bubble packing. Consumers are also going greener and selecting biodegradable and paper-made products.

As a result, most companies are reducing the application of bubble wrap or developing alternatives for protective packaging, e.g., molded pulp, corrugated inserts, and air cushioning made from recyclable material. Such consumer and governmental measures are challenging traditional manufacturers of bubble wrap, leading them to make investments in recoverable and sustainable solutions as a way to compete.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Strength & Durability | Sustainability & Eco-Friendly Materials Investing in biodegradable, recyclable, and reusable bubble wrap substitutes will minimize plastic waste and achieve sustainability objectives as environmental issues escalate. |

| Lightweight & Cost-Effective Solutions | Lightweight & Economical Solutions thinner but highly protective bubble wrap will reduce material consumption and shipping expenses while keeping packing efficiency unchanged. |

| Advanced Cushioning & Impact Protection | Breakthroughs in air retention and multi-layered technology will further advance shock absorption to provide unparalleled protection for delicate contents. |

| Customization & Branding | Opportunities Providing branded, color-tinted, or custom-sized bubble wrap will enable companies to add packaging beauty and enhance customer experience. |

| Automation & High-Speed Production | Investing in cost-saving manufacturing processes and automated production lines will lower costs and address the increasing demand for protective packaging. |

The global bubble wrap packaging market achieved a CAGR of 1.9% in the historical period of 2020 to 2024. Overall, the bubble wrap packaging market performed well since it grew positively and reached USD 3100 million in 2024 from USD 2875.2 million in 2020.

The market for bubble wrap packaging grew steadily between 2020 and 2024 due to growing demand for protective packaging in e-commerce, rising exports of fragile items, and developments in lightweight and eco-friendly cushioning materials.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Steady growth driven by increasing e-commerce, electronics, and fragile goods shipping. |

| Material Trends | Largely polyethylene (PE)-based bubble wrap for lightweight and economical protection. |

| Regulatory Environment | Compliance with packaging waste legislation and increasing bans on single-use plastics. |

| Consumer Demand | Strong demand from logistics, electronics, and retail industries for protective packaging solutions.. |

| Technological Innovations | Innovation of anti-static and performance bubble wrap to protect sensitive electronics and industrial items. |

| Sustainability Efforts | Rising adoption of recycled plastic and bio-based materials to minimize environmental impact. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Robust growth driven by growing international trade, online shopping boom, and increasing demand for eco-friendly protective packaging. |

| Material Trends | Trend towards biodegradable, recycled, and compostable bubble wrap substitutes to minimize plastic waste. |

| Regulatory Environment | Stricter global policies promoting recyclable and reusable packaging materials, reducing reliance on virgin plastic. |

| Consumer Demand | Growing preference for sustainable, reusable, and paper-based cushioning materials for improved sustainability |

| Technological Innovations | Innovations in biodegradable air cushion films, water-soluble alternatives, and smart packaging with shock sensors for damage prevention. |

| Sustainability Efforts | Strong push for carbon-neutral, fully compostable, and reusable protective packaging solutions to support circular economy initiatives. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Durability, Strength, Moisture Resistance) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Smart Features & Technology |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Durability, Strength, Moisture Resistance) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Smart Features & Technology |

|

During 2025 to 2035, demand for bubble wrap packaging will increase owing to increasing applications in electronics and medical device shipping, increasing use of biodegradable and recycled bubble wrap products, and rising innovations in reusable and custom-designed protective packaging for better product safety and sustainability.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Veritiv Corporation, Sealed Air Corporation, Jiffy Packaging Co., Pregis Corporation

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Barton Jones Packaging Ltd., IVEX Protective Packaging Inc, Automated Packaging System, Storopack Hans Reichenecker GmbH, Flexi-Hex, Atlantic Packaging Products Ltd., Signode Industrial Group, Kaneka Corporation

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach.

Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | Presence of major packaging manufacturers driving R&D in lightweight materials. |

| Latin America | Growing use in industrial and consumer packaging sectors. |

| Europe | Leading market due to strict environmental regulations promoting eco-friendly materials. |

| Middle East & Africa | Emerging market with increasing demand from logistics and retail sectors. |

| Asia Pacific | Increasing investment in recyclable and sustainable plastic packaging. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Expansion of smart bubble wrap with anti-static and temperature-control features. |

| Latin America | Increased government regulations promoting recyclable and eco-friendly alternatives. |

| Europe | Shift toward fully recyclable, paper-based, and biodegradable bubble wrap. |

| Middle East & Africa | Emerging market with increasing demand from logistics and retail sectors. |

| Asia Pacific | Growth in biodegradable bubble wrap solutions amid stricter government policies on plastic. |

The section below covers the future forecast for the bubble wrap packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 2% through 2035. In Europe, Spain is projected to witness a CAGR of 2.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.0% |

| Germany | 1.6% |

| China | 4.0% |

| UK | 1.5% |

| Spain | 2.7% |

| India | 4.2% |

| Canada | 1.8% |

With the USA seeing tremendous e-commerce growth, demand for protective and secure packaging to minimize damage in transit is on the rise. Online shopping giants such as Amazon, Walmart, and Shopify-based companies use bubble wrap packaging to a large extent to protect delicate products such as electronics, glassware, and cosmetics.

With online buying even more prevalent following the COVID-19 pandemic, the need for light and affordable protective material has also risen. The USA also follows strict customer return policies, i.e., firms must make undamaged deliveries in order to avoid losses.

Germany has one of the most rigid environmental legislations in the world, forcing industry to adopt ecologically friendly packaging materials and processes. With legal requirements, companies are forced to reduce plastic consumption and adopt recyclable materials. All this has led to growing demand for recyclable and biodegradable bubble wrap materials such as paper-based bubble wrap, air pillows, and biodegradable protection films.

A number of German companies are guaranteeing environmentally friendly package solutions with the same level of protection as traditional bubble wrap but with eco-friendly solutions. Focus on sustainability in manufacturing, retail, and logistics is creating innovation in reusable and recyclable protective packaging, which is making Germany a trendsetter in sustainable package solutions.

The section contains information about the leading segments in the industry. In terms of product type, bubble sheets are being estimated to account for a share of 57% by 2025. By material segment, LDPE are projected to dominate by holding a share above 68.4% by the end 2025.

| Product Type | Market Share (2025) |

|---|---|

| Bubble sheets | 57% |

Bubble sheets reign supreme in the market because they provide flexible and affordable protective packaging. They find extensive use across industries such as electronics, e-commerce, and shipping of delicate products because they possess better cushioning properties compared to other options.

They are available in different sizes and thicknesses of bubbles, hence a customer as well as business favorite. They can be easily cut, layered, or customized according to diverse packaging requirements, further boosting demand. Additionally, bubble sheets can be recycled and reused, which is in line with increasing trends towards sustainability in packaging.

| Material Segment | Market Share (2025) |

|---|---|

| LDPE | 68.4% |

LDPE is a lightweight material, it also saves the cost of transportation - another critical factor to be considered by industries like e-commerce, pharma, and electronics. Also, LDPE gives a fair amount of moisture and chemical protection, which are also protective in nature for materials like food items, medicines, and electronic components.

It is another attraction for manufacturers that the material itself is economical and is available in large quantities. With environmental-friendly and sustainable issues hitting the waves, companies are now introducing biodegradable and recyclable LDPE substitutes in an effort to even reduce carbon impact. Its flexibility seems to transcend industries such as logistics, cars, or shopping, which on its own has become the best-selling bubble wrapping packaging internationally.

Key players of global bubble wrap packaging industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Bubble Wrap Packaging Market

| Manufacturer | Vendor Insights |

|---|---|

| Sealed Air Corporation | Bubble wrap inventor providing broad solutions in protective packaging that look to the future and the environment. |

| Pregis Corporation | Offers cutting-edge protective packaging materials, such as bubble wraps for different industries, with a commitment to going green. |

| Smurfit Kappa Group | Paper-based protective packaging solutions, such as environmentally friendly bubble wrap alternatives, available to suit a wide range of market requirements. |

| Automated Packaging Systems | Excels in air cushioning systems and bubble wrap packaging, offering affordable and custom protective packaging solutions. |

| Veritiv Corporation | Provides extensive ranges of packaging products, such as reusable bubble wrap, focusing on efficient supply chains and sustainability. |

The global bubble wrap packaging industry is projected to witness CAGR of 3.1% between 2025 and 2035.

The global bubble wrap packaging industry stood at 3100 million in 2024.

Global bubble wrap packaging industry is anticipated to reach USD 4337.2 million by 2035 end.

East Asia is set to record a CAGR of 4.2% in assessment period.

The key players operating in the global bubble wrap packaging industry include Veritiv Corporation, Sealed Air Corporation, Jiffy Packaging Co., Pregis Corporation.

The bubble wrap packaging market is categorized based on product type into bubble sheets and bubble bags & mailers.

The market is segmented by material into LDPE, HDPE, and LLDPE.

The end-use market includes manufacturing & warehousing, e-commerce, logistics & transportation. Manufacturing & warehousing further divided into pharmaceuticals, electronics & electrical, automotive & allied industries, food & beverages, cosmetics & personal care and others.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Ultra High Bond (UHB) Tape Market Analysis by Type, Thickness and End Use Through 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.