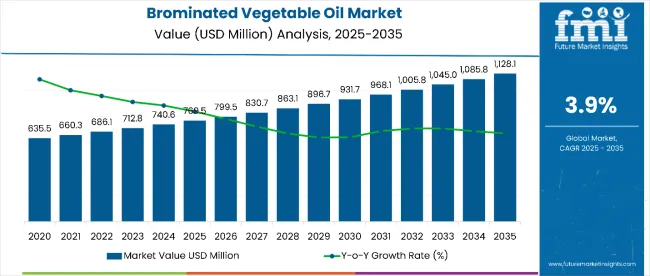

The brominated vegetable oil market is estimated to be valued at USD 769.5 million in 2025. It is projected to reach USD 1,128.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. The brominated vegetable oil market is projected to add an absolute dollar opportunity of USD 358.6 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 769.5 million |

| Forecast Value in (2035F) | USD 1,128.1 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

This reflects a 1.39 times growth at a compound annual growth rate of 3.9%. The market’s evolution is expected to be shaped by regional regulatory divergence, with declining usage in Western markets offset by continued demand in permissible jurisdictions and growing adoption of alternative emulsifiers in reformulated beverage products.

By 2030, the market is likely to reach approximately USD 931.7 million, accounting for USD 162.2 million in incremental value over the first half of the decade. The remaining USD 102.7 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product reformulation initiatives across major beverage manufacturers are gaining traction due to regulatory restrictions in key markets, with companies transitioning to sucrose acetate isobutyrate (SAIB) and glycerol ester of wood rosin as preferred alternatives.

Companies such as Spectrum Chemical Manufacturing Corp. and Parchem Fine & Specialty Chemicals are advancing their competitive positions through regulatory compliance expertise and alternative ingredient portfolios. Market performance is expected to remain anchored in regional regulatory landscapes, supply chain adaptability, and technological innovation in emulsifier alternatives. The industry faces structural transformation as major markets impose restrictions while emerging economies maintain permissible usage frameworks.

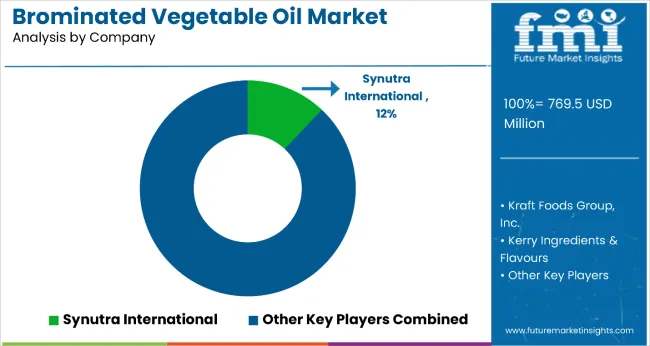

The brominated vegetable oil market holds approximately 12% of the global beverage emulsifier market, driven by its specific density-matching properties for citrus-flavored beverages and cost-effective stabilization capabilities. It accounts for around 8% of the food additive market in permissible jurisdictions, supported by established manufacturing processes and supply chain infrastructure.

The market contributes nearly 15% to the specialty chemical additives market, particularly for applications requiring precise density control and emulsion stability. It holds close to 6% of the beverage stabilizer ingredients market, where regulatory compliance and formulation expertise determine market access. The share in the functional food ingredients market reaches about 4%, reflecting its niche application profile and regulatory constraints.

The market is undergoing a structural transformation driven by regulatory restrictions in major economies and the accelerating adoption of alternative emulsifiers. The FDA’s revocation of BVO authorization in the United States, effective August 2024, has catalyzed reformulation initiatives across global beverage manufacturers.

Companies are investing in sucrose acetate isobutyrate (SAIB), glycerol ester of wood rosin, and natural emulsifier alternatives to maintain product consistency while meeting evolving regulatory requirements. Strategic partnerships between beverage companies and specialty chemical suppliers have accelerated the development and commercialization of BVO alternatives.

Regional market dynamics now favor jurisdictions with permissible regulatory frameworks, reshaping global supply chains and creating opportunities for compliant alternative ingredients.

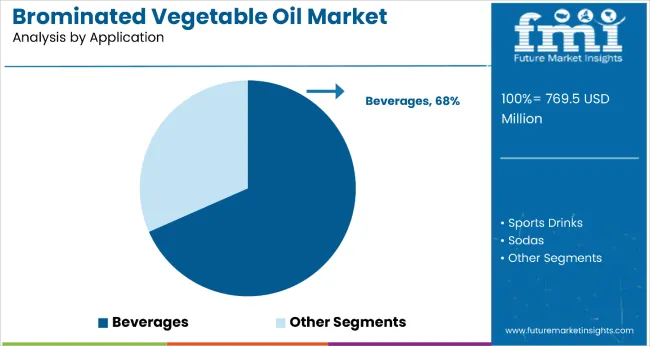

The market is segmented by application, source, distribution channel, and region. By application, it includes beverages, sports drinks, sodas, bakery products, pesticides, and flame retardants. Based on the source, the market is bifurcated into soy and corn. By distribution channel, it is segmented into online and offline. Regionally, the market is analyzed across North America, Latin America, Asia Pacific, Eastern Europe, Western Europe and Japan.

The beverages segment holds a commanding 68% share in the application category, reflecting BVO’s primary function as a citrus beverage emulsifier and the ingredient’s historical association with soft drink formulations. Beverage applications are increasingly concentrated in markets where BVO remains regulatory compliant, particularly in Asia-Pacific and Latin American jurisdictions.

The segment benefits from continued demand for citrus-flavored carbonated beverages, sports drinks, and fruit-flavored products where density matching and emulsion stability are critical performance requirements. Regional variations in regulatory acceptance create distinct market dynamics, with compliant markets experiencing sustained demand while restricted jurisdictions accelerate reformulation initiatives.

Manufacturers are focusing on optimizing BVO formulations for specific beverage applications while simultaneously developing alternative emulsifier portfolios to serve both compliant and restricted markets. As regulatory landscapes continue evolving and consumer preferences shift toward natural ingredients, the beverages segment’s growth will depend increasingly on regional compliance strategies and alternative ingredient adoption rates.

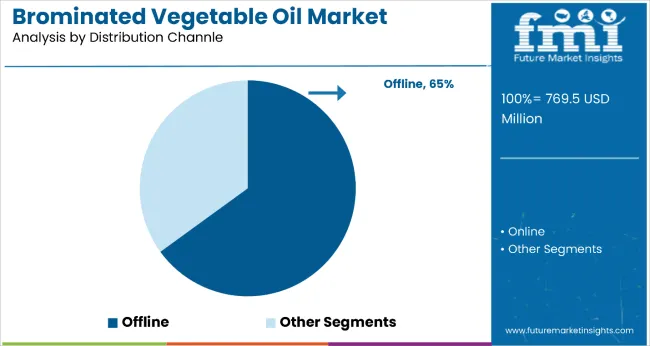

The offline segment dominates the distribution channel category with a 65.0% share in the global brominated vegetable oil (BVO) market, reflecting the ingredient’s predominant usage in industrial and institutional supply chains. Major beverage manufacturers and food processors continue to rely heavily on established offline procurement networks, including direct supplier relationships, bulk ingredient distributors, and specialized chemical agents.

Offline distribution offers logistical advantages such as streamlined inventory management, quality assurance protocols, and regulatory documentation handling, particularly important for an ingredient like BVO that faces varied regional compliance frameworks.

This segment benefits from longstanding supplier-buyer contracts and the preference among industrial users for in-person quality checks, controlled storage environments, and reliable delivery timelines. Furthermore, regulatory scrutiny and documentation requirements often make offline channels more favorable for transactions involving food-grade emulsifiers like BVO. While online distribution is expanding, particularly for small-scale R&D labs and regional food manufacturers, the bulk of BVO sales remains concentrated in offline networks.

As global supply chains stabilize post-pandemic and major food and beverage producers prioritize traceability and compliance, offline distribution is expected to retain its dominant role. Growth in this channel will be reinforced by investments in cold-chain logistics and partnerships between chemical suppliers and multinational beverage companies.

The brominated vegetable oil market's growth trajectory reflects complex regulatory dynamics and regional market variations, with declining usage in restricted jurisdictions offset by continued demand in permissible markets and emerging economies where cost-effective emulsification solutions remain valued.

Regional regulatory divergence is driving market segmentation, with Asia-Pacific, Latin America, and select Middle Eastern markets maintaining permissible usage frameworks while Western economies impose restrictions. Growing beverage consumption in emerging markets, particularly citrus-flavored soft drinks and sports beverages, continues to support demand in compliant jurisdictions.

Market evolution is also supported by the transition period for reformulation initiatives, where manufacturers in restricted markets are investing in alternative emulsifier technologies while maintaining existing operations in permissible regions. As global beverage companies adapt their formulation strategies and regulatory landscapes continue evolving, the market is positioned for measured growth concentrated in compliant jurisdictions and alternative ingredient segments.

From 2025 to 2035, regulatory compliance and alternative ingredient development are expected to remain central to market evolution, with companies investing in reformulation technologies and regional market strategies. The FDA’s BVO prohibition in the United States has catalyzed global reassessment of ingredient portfolios, while emerging markets maintain demand for cost-effective emulsification solutions.

Regional Regulatory Divergence Creates Market Segmentation

The fragmented global regulatory landscape for brominated vegetable oil has been identified as the primary factor shaping market dynamics. Following the FDA’s August 2024 prohibition in the United States and existing restrictions in Europe, Japan, and India, market demand has concentrated in Asia-Pacific, Latin America, and select Middle Eastern jurisdictions where BVO remains permissible.

This regulatory divergence has created distinct market segments, with compliant regions experiencing sustained demand while restricted markets accelerate reformulation initiatives. Companies operating globally are adopting dual-strategy approaches, maintaining BVO operations in permissible markets while investing in alternative ingredient technologies for restricted jurisdictions.

Alternative Emulsifier Innovation Drives Market Transformation

In 2024, beverage manufacturers began large-scale adoption of sucrose acetate isobutyrate (SAIB) and glycerol ester of wood rosin as BVO alternatives, supported by improved formulation technologies and supply chain development. By 2025, advanced emulsifier systems are being deployed to replicate BVO’s density-matching properties while meeting clean-label consumer preferences.

These developments demonstrate that alternative ingredient innovation can maintain product performance while addressing regulatory and consumer requirements. Manufacturers offering comprehensive emulsifier portfolios, including both traditional BVO and advanced alternatives, are positioned to serve diverse regional requirements and support global brand consistency across varying regulatory environments.

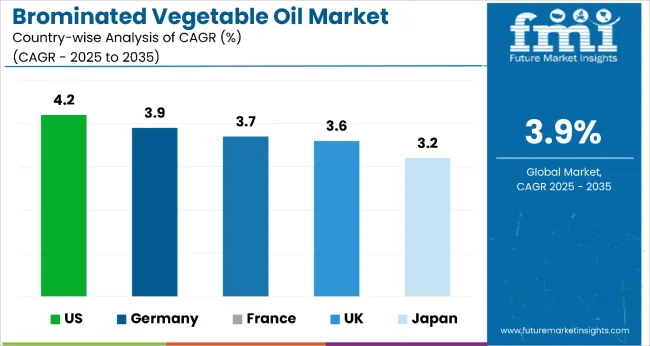

| Country | CAGR |

|---|---|

| USA | 4.2% |

| Germany | 3.9% |

| France | 3.7% |

| UK | 3.6% |

| Japan | 3.2% |

Among the key countries analyzed in the brominated vegetable oil (BVO) market, the USA leads with a projected CAGR of 4.2% from 2025 to 2035, driven by transitional regulatory allowances and robust innovation in alternative ingredients. Germany and France follow with growth rates of 3.9% and 3.7%, respectively, constrained by EU clean-label preferences and limited synthetic emulsifier tolerance.

The UK is expected to grow at a 3.6% CAGR, reflecting minimal BVO use amid regulatory caution and reformulation trends. In contrast, Japan remains at zero BVO market growth due to a complete ban, contributing solely to the alternative emulsifier segment.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The demand for brominated vegetable oil in the UK is projected to strengthen at a 3.6% CAGR from 2025 to 2035, reflecting cautious adoption amid increasing regulatory and consumer scrutiny. BVO usage remains legal but minimal, as food manufacturers preemptively reformulate beverages to align with clean-label trends and broader EU food safety expectations.

Major retailers discourage the use of BVO in their private-label products, accelerating the switch to alternatives like SAIB and glycerol esters. Beverage reformulation efforts, coupled with public health advocacy campaigns, continue to suppress demand. Most BVO applications are limited to legacy or imported products with declining shelf presence.

The brominated vegetable oil market in the USA is projected to grow at a 4.2% CAGR from 2025 to 2035, supported by strong demand in legacy products and ongoing use in specific beverage categories where BVO remains permitted during regulatory transitions. While the FDA issued a proposed ban in 2024, certain product lines continue to utilize BVO under transitional compliance timelines.

Beverage manufacturers are actively reformulating citrus sodas, sports drinks, and fruit punches, balancing short-term market continuity with long-term adoption of alternatives like SAIB and glycerol ester of wood rosin. Parallel investments in R&D and alternative emulsifier innovation bolster market adaptability.

Revenue from BVO in Germany is anticipated to expand at a 3.9% CAGR between 2025 and 2035, in line with broader EU regulatory constraints and low consumer tolerance for synthetic emulsifiers. Although BVO is not outright banned under EU regulations, its use remains rare due to precautionary food safety measures and a strong clean-label movement.

German beverage manufacturers predominantly use alternative emulsifiers in citrus and energy drink formulations, reducing reliance on BVO. Market growth is mainly limited to niche or imported products that still use BVO. Public health awareness, transparency laws, and green packaging initiatives further restrict BVO’s commercial viability in Germany.

The sales of brominated vegetable oil in France are projected to flourish at a 3.7% CAGR from 2025 to 2035, reflecting a restrained regulatory stance and strong consumer preference for natural ingredients. While BVO remains technically permitted in limited applications, most beverage brands avoid its use to align with market expectations and avoid reputational risk.

French food processors increasingly favor glycerol ester systems or SAIB in citrus-flavored drinks and bakery emulsions. Clean-label and organic product trends further limit synthetic emulsifier demand. The BVO market in France is primarily concentrated in older product lines, with limited new product development featuring the additive.

Japan has maintained a complete ban on BVO since 2010, positioning it firmly within the global alternative emulsifier segment. In 2025, Japan is expected to contribute approximately USD 8.2 million to the BVO alternative market, primarily in beverages, which account for 71.3% of this total. Japanese beverage manufacturers widely employ SAIB and glycerol ester technologies to replace BVO in citrus-based drinks.

Regulatory stringency and a strong innovation ecosystem have facilitated the shift to safer, functionally equivalent emulsifiers. Bakery and other food applications also leverage natural alternatives, reflecting Japan’s comprehensive ingredient safety culture and consumer preference for additive-free foods.

The market is moderately consolidated, with Spectrum Chemical Manufacturing Corp. leading at an estimated 18.5% market share. The company holds a dominant position through its diversified specialty chemical portfolio, regulatory compliance expertise, and established relationships with beverage manufacturers requiring emulsifier solutions.

Key players include Parchem Fine & Specialty Chemicals, Penta Manufacturing Company, Synutra International, Kerry Ingredients & Flavours, Abitec Corporation, Watson Inc., Advanced Food Systems Inc., Aarhuskarlshamn AB, and BASF Company, each providing specialized emulsifier solutions, including both traditional BVO for compliant markets and alternative ingredients for restricted jurisdictions, supported by regulatory expertise and formulation support services.

Market demand is driven by regional regulatory variations, beverage industry reformulation requirements, and the growing need for comprehensive emulsifier portfolios that serve both compliant and restricted markets while maintaining product performance standards across diverse applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 769.5 Million |

| Application | Beverages, Sports Drinks, Sodas, Bakery Products, Pesticides, Flame Retardant |

| Distribution Channel | Online and Offline |

| Source | Soy-based and Corn-based |

| Regions Covered | North America, Latin America, Asia Pacific, Eastern Europe, Western Europe and Japan |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Synutra International, Kraft Foods Group, Inc., Kerry Ingredients & Flavours, Abitec Corporation, Watson Inc., Advanced Food Systems Inc., Aarhuskarlshamn AB, Firmenich SA, BASF Company, Eurobio Lab, The Good Scents Company, DeWolf Chemical, COSME ITALY |

| Additional Attributes | Dollar sales by application and end-use sector, regional regulatory compliance analysis, alternative ingredient adoption trends, reformulation technology developments, market transition dynamics from traditional BVO to approved alternatives, innovation in emulsifier systems and supply chain adaptation strategies |

The global brominated vegetable oil market is estimated to be valued at USD 769.5 million in 2025.

The market size for the brominated vegetable oil market is projected to reach USD 1,128.1 million by 2035.

The brominated vegetable oil market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in brominated vegetable oil market are soy and corn.

In terms of application, beverages segment to command 47.2% share in the brominated vegetable oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reactive Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Seed Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Sugar Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Parchment Paper Market Size, Share & Forecast 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Vegetable Dicing Machines Market Growth – Food Processing Efficiency 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Vegetable Powders Market Insights - Growth & Functional Benefits 2025 to 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Vegetable Waste Products Market

IQF Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Savory Vegetable Flavours Market Insights - Applications & Industry Growth 2025 to 2035

Canned Vegetable Market Growth – Preservation & Industry Demand 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA