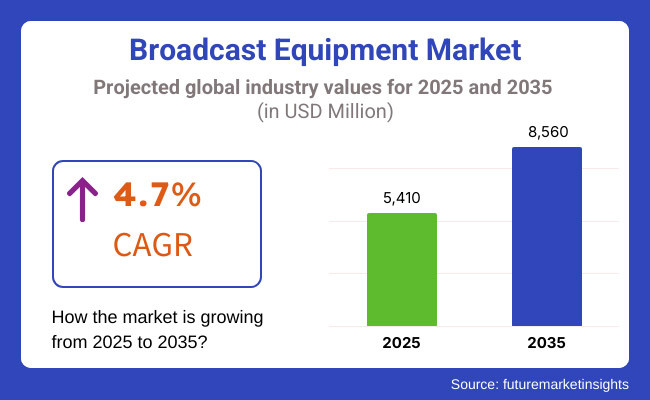

The Broadcast Equipment Market shows substantial growth potential from 2025 until 2035 according to forecasts due to expanding needs for broadcast content quality transmission and digital broadcasting technology progress as well as over-the-top (OTT) streaming services growth. The market experts estimate total broadcast equipment sales will reach USD 5,410 million at 2025 with a projected USD 8,560 million in 2035 at a compound annual growth rate (CAGR) of 4.7%.

The broadcasting industry transforms because traditional broadcasters are moving towards IP-based content distribution systems yet this transformation requires modern transmission systems. The combined effects of fast-growing 4K and 8K television broadcasting and 5G wireless network implementation for smooth streaming require state-of-the-art broadcast systems.

The market's leading companies face two main challenges: excessive initial costs and the complex process of moving from outdated systems to modern digital platforms. This drives companies to focus on creating affordable and scalable broadcasting frameworks.

The global broadcast equipment market is segmented on the basis of product types and applications. The key product segments comprise transmitters, encoders, antennas, cameras, and servers. Transmitters and encoders play a crucial role in content distribution, as digital transmission technologies have become industry standards for modern broadcasting solutions. Demand for stock-up cameras and video processing equipment is also growing, resulting from the increasing production of ultra-high-definition (UHD) content.

Applying to it, broadcast equipment are widely used in the television, radio, and internet video streaming services. Moving towards digital and cloud-based broadcasting solutions is especially noticeable in the OTT space where the streaming platforms are investing in high-end equipment for effective high-resolution content distribution. Additionally, live event broadcasting as well as sports media is adopting advanced video production tools that deliver rich content to the viewers in real-time.

Explore FMI!

Book a free demo

North America represents a key market for broadcast equipment, with healthy demand for high-resolution content, increasing investments in digital transformation, and growing adoption of IP-based broadcasting solutions. High-quality broadcasting infrastructure, especially in terms of 4K and 8K content delivery, is being led by the United States and Canada.

Moreover, the growing market of the region is propelled by the presence of major industry participants and the rising acceptance of customized content due to the use of streaming platforms. This is further improving operational efficiency with the use of AI assessments of the automated process in such production.

The market in Europe accounts for a significant share in the demand for needed broadcast equipment with regulatory policies to support digital broadcasting and appropriate investments in high definition content creation, cloud-based broadcasting, etc.

Germany, France, UK - Countries are leaders in the field of next-generation broadcasting technology, including remote production workflows, AI-enhanced video processing, etc. The EU overregulation on spectrum allocation and digital security is forcing the broadcast systems to upgrade their equipment to comply with the members’ requirements.

Broadcast equipment market in the Asia-Pacific region is projected to grow at the highest CAGR, owing to growing demand for digital content, increasing internet penetration, and government initiatives for modernization of broadcasting infrastructure.

5gBased broadcasting, UHD content production, and live-streaming platforms, Korea, India, and China are receiving up to billions of dollars. The growth of esports, online gaming, and mobile video streaming also drives demand for innovative broadcasting solutions. In addition, trade policies related to the transition to digital broadcasting and the promotion of domestic content are solidifying the local market.

Challenge

Rapid Technological Advancements and High Upgrade Costs

Broadcast technology is evolving at a pace that drives broadcasters to frequently upgrade their technology to stay competitive. Adopting these contemporary technologies requires a significant investment in infrastructure and training, as the transition from traditional broadcasting to digital, IP-based, and cloud-integrated solutions is anything but linear.

While the costs of the new upgraded equipment, as well as maintaining backwards compatibility with current systems, presented a hefty financial burden for broadcasters. Moreover, 4K, 8K, and other immersive media formats require additional processing power and storage, which must be factored as growing operational expenses. In order to compete, they need to adopt scalable solutions made-for-it, invest in software-defined broadcasting tool and partnerships to curb costs around the upgrade.

Opportunity

Growing Demand for IP-Based and Cloud Broadcasting Solutions

Indeed, the shift to IP-based broadcasting and cloud production workflows represents a huge area of growth. Remote production, live streaming, and cloud adoption for distributing content are increasingly being adopted by media companies as this brings them flexibility and cost efficiency. When bundled with virtualized workflows and software-driven production tools, AI-powered content automation allows broadcasters to cut costly infrastructure stuffing and optimize their operations.

Various factors such as proliferation of publishers on OTT platforms, esports broadcasting, and immersive media formats drive demand for advanced equipment capable of providing seamless, high-quality content. Manufacturers that create interoperable, software-driven, and cloud-native solutions will likely come out on top.

Amidst this rapid adoption of digital production technologies and cloud based workflows, the broadcast equipment market grew between 2020 and 2024. Streaming platforms, remote broadcasting and 5G connectivity changed the way media was produced and disseminated. The industry struggled to reconcile legacy infrastructure with new modular IP-based systems.

From 2025 to 2035, we will see new industry standards established with the AI-driven production of content in edge computing and immersive broadcasting formats. Media transcoding - Broadcasters increase their content loyalty and get rid of latency in the video stream using real-time data analytics, automated production tools, and next-generation compression technologies. The focus on sustainability will also create demand for energy-efficient broadcasting equipment and cloud-based delivery models for content.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Evolution | Transition from traditional to digital broadcasting with increasing adoption of IP-based workflows. |

| Streaming & OTT Growth | Expansion of OTT platforms and direct-to-consumer content models. |

| Remote & Cloud Production | Early adoption of cloud-based editing and remote collaboration. |

| Content Formats & Resolution | Gradual transition to 4K UHD content with limited 8K adoption. |

| Broadcast Infrastructure | Limited interoperability between legacy and IP-based systems. |

| Sustainability & Energy Efficiency | Initial steps toward reducing carbon footprint in broadcasting. |

| Regulatory & Compliance Standards | Compliance focused on spectrum management and digital broadcasting transitions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Evolution | AI-driven production, real-time data analytics, and software-defined broadcasting become industry standards. |

| Streaming & OTT Growth | Personalized, AI-curated content streaming and ultra-low-latency live broadcasting dominate. |

| Remote & Cloud Production | Fully virtualized, AI-enhanced production workflows with 5G and edge computing integration. |

| Content Formats & Resolution | Widespread 8K, VR, AR, and interactive media broadcasting. |

| Broadcast Infrastructure | Fully software-defined infrastructure with seamless cross-platform integration. |

| Sustainability & Energy Efficiency | Widespread adoption of energy-efficient equipment, cloud optimization, and sustainable production practices. |

| Regulatory & Compliance Standards | Global regulations enforce AI-driven content moderation and data privacy protections. |

The USA broadcast equipment market is growing gradually, fuelled by the demand for HD (high-definition) and UHD (ultra-high-definition) content, advancements in digital broadcasting, and the popularisation of OTT (over-the-top) streaming services. Market growth is also influenced by the transition from traditional broadcasting to solutions based on IP and the cloud.

With the rapid adoption of 4K and 8K broadcasting technology in television networks and sports broadcasting, there is an increasing investment in next-generation transmission and production equipment. Digital broadcasting sector has been one of the major factors driving the high demand for the high performance broadcast equipment from the broadcasting industry.

Moreover, regulatory policies aimed at moving away from satellite and replacing it with a backup fiber and ultimately IP infrastructure are driving upgrades across much of the major broadcasters. The rise of 5G technology is driving demand for mobile and remote broadcasting solutions, which improve live content delivery capabilities.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The growing investments in digital content creation, live streaming, and OTT platforms are driving growth in the UK broadcast equipment market. Broader interest is growing in remote production and other IP-based solutions in cloud-integrated workflows as broadcasters move toward a more efficient and scalable infrastructure.

The presence of leading production houses and major television networks is facilitating persistent investments in HD and UHD broadcasting technologies. Moreover, government inclination towards the digital switchover & the introduction of AI-driven automation in broadcasting is propelling the growth of the industry. Demand for state-of-the-art broadcast transmission equipment is coming from the media and entertainment industry.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Broadcast equipment in the European Union is showing strong demand, with Germany, France and Italy being the leading adopting markets. The booming digital broadcasting services along with government initiatives promoting the 5G based content delivery are acting as forces behind the market growth.

Investments in advanced production and transmission equipment are driven by the transition from terrestrial to digital broadcasting as well as increasing penetration of OTT platforms and; Streaming services. The EU's emphasis on sustainability is also stimulating broadcasters to move to greener, more energy-efficient broadcasting technology. Market demand for remote production solutions, which has gained great momentum since this pandemic started, especially for sports and large media events, is also driving the industry.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan’s broadcasting equipment industry shows steady growth, with the nation leading the world in UHD broadcasting, 8K television, and AI-based content production. The shift to 5G-enabled mobile broadcasting and the growth of interactive media platforms are fuelling demand for equipment.

Hold on tight as we ride the tsunami wave from the Tokyo Olympics which supercharged investments in high-resolution video production and broadcasting infrastructure, further strengthening that industry. The market expansion is further being guided by government initiatives aiding the implementation of next-generation broadcasting standards, including Advanced ISDB-T. The media & broadcasting industry is a major end user for high-end transmission and production equipment.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The domestic broadcast equipment market is growing at a fast pace to keep up with the technological advancements in smart broadcasting technologies, next-generation media delivery systems simplified by 5G networks, and ultra-HD streaming services. Growing need for real-time broadcasting solutions in sports and entertainment is contributing to the investments in next-generation equipment’s.

However, the adoption of IP-based content transmission and AI-driven broadcasting workflows is propelled up by the presence of global technology giants and high-speed internet penetration. Moreover, the growth of the industry is further driven by government support for smart city projects, as well as digital transformation in media. The OTT and digital content business is a primary catalyst for broadcast and media technology innovation across the region.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Until (2008) all television in Analog. After that year the transition to the digital signal with high definition began with the aim of offering clearer and more efficient signal transmission. This situation affected the players of the Broadcast equipment market where digital broadcasting and encoders segments holds the highest market share.

Digital broadcasting and encoders segments record the highest market share among all segments owing to the need for media companies, television networks, and also streaming platforms to transmit high-definition content and provide solutions for efficient data compression and real-time broadcasting.

Signal processing and optimization technologies, such as signal modulation and encoding devices, work to improve signal quality, optimize transmission latency, and enable multi-platform delivery, ensuring these systems get the most from their hardware investments while providing world-class services for digital television networks, satellite operators, and OTT content providers.

With the drift of viewers towards digital and internet media consumption, broadcasters and equipment manufacturers pay close attention to the development of digital and internet transmission specifications, as well as the incorporation of next generation encoding solutions to enhance signal reliability for 4K/8K content delivery and reduce bandwidth consumption - thereby satisfying the need to optimize network infrastructure for seamless broadcasting.

Increased Channel Clarity, Bandwidth Efficiency, and Multi-Platform Compatibility of Digital Broadcasting

Digital broadcasting represents the most commonly used transmission technology in the broadcast equipment market, allowing for better signal processing, reduced interference, and increased spectrum efficiency relative to analog transmission.

As opposed to finite broadcast delivery models, digital broadcasting allows for greater resolution video, expanded audio channel delivery, and overlap of content systems across television, radio, and online distribution, all which can lead to better experience and more viewable content.

Adoption has been driven by demand for next-generation digital broadcasting solutions with HEVC video encoding, low-latency transmission of deep-learning-based encoding solutions and error correction mechanisms. More than 75% of television broadcasters globally have already switched to digital broadcasting capable of providing better quality content and lower transmission costs, which will actively support this segment of the market, based on studies.

The booming DTT, satellite broadcasting and OTT streaming services with the use of high bandwidth 4K/8K broadcasting, opportunity to live stream sports, interactive content distribution, has further fuelled demand for the market contributing significantly to adoption of digital broadcasting infrastructure in traditional and new media platforms.

Additional supporting technologies, such as AI-driven signal processing with real-time noise removal, automatic bitrate adjustment, and AI-assisted audio-visual synchronization, have also been high contributors to the uptake, allowing for increased transmission stability and improved use of bandwidth.

The introduction of tailored digital broadcasting solutions featuring software-defined radio technology, next-generation multiplexing methods, and cloud-based content distribution networks (CDNs), have added value to the market, improving flexibility to accommodate changing audience preferences and regulatory standards.

The digital broadcasting segment, while benefiting from improved broadcast quality, interactive content support, and effective frequency utilization, is hindered by high infrastructure implementation costs, increased complexity for digital signal absorption, and regulatory disparities among various broadcasting markets.

Meanwhile, a slew of potential innovations in transmission technologies, such as 5G-based broadcast transmission, AI-driven frequency spectrum optimization, and cloud-integrated digital broadcasting networks are enhancing cost efficiency, content distribution flexibility, and market scalability, thereby ensuring sustainable market growth for digital broadcasting worldwide.

Areas such as digital broadcasting witnessed significant group buying where national broadcasting corporations, satellite TV service providers, and media access over the internet have strongly adopted and integrated into high-end digital broadcasting infrastructures, all while killing off the boundaries of losing analog transmission.

By contrast, in contrast with analog broadcast, the production of photos with high definition, the supply of audio data with high definition and the support of personalized material for different observing instruments are enhanced through digital transfer, allowing much higher user contacts and marketplace variety.

Growing adoption brings demand for integrated digital broadcasting networks, such as cloud-based signal management, AI-driven content recommendation engines, and multi-device streaming compatibility. According to studies, 80% of newly launched television channels and OTT platforms adopt digital broadcasting infrastructure from day one to serve their content from the cloud for a global audience, leading to sustained demand for this segment.

This facilitates next-generation interactive broadcasting, including ability to monitor audience analytics in real-time, automated content tagging as well as alignment of AI-generated subtitles, which has further solidified the adoption of the market as it led to better viewer retention along with enriched media personalization.

The adoption has further accelerated with the 5G-enabled broadcast transmission that comes with low-latency mobile video streaming, ultra-HD video support, and smart bandwidth allocation capabilities that contribute to better network resilience and faster content delivery speeds.

The digital broadcasting segment brings benefits in terms of increased transmission reliability and decreased broadcast interference, as well as allowing integration of content across platforms, making it the most favourable segment for the broadcasting landscape.

Up-and-coming technologies, from AI-driven content curation to cloud-based digital information control to block chain-based media distribution, will undermine market monopolies and enable more secure content solutions and better broadcasting efficiencies, pressing digital broadcasting growth across the globe.

Encoders Help Optimize for Bandwidth, Optimize for Quality, and Optimize for Cross-Platform Distribution

Encoders segment is emerging as one of the most significant product categories in the broadcast equipment market, as they allow television networks, OTT platforms, and digital radio stations to compress, format, and stream high-quality audio-visual content with the least possible cost of data transmission.

While traditional content delivery network focused on storing and distributing content, encoders paved the way for real-time video compression, adaptive bitrate streaming, and multi-device playback support, providing improved network efficiency and enhanced user experience.

The need for high-performance encoding solutions with real-time transcoding, AI-driven adapted bitrate and hardware-accelerated video processing has accelerated adoption. Advanced encoding technology has been responsible for pushing content quality to its limits while dramatically reducing transmission costs, ensuring strong demand from the segment with studies suggesting that the world’s largest broadcasters account for more than 70% of their utilization of this segment.

The rapid growth of live streaming libraries, coupled with high volumes of sports telecasts, as well as digital news and real-time events, has necessitated market demand and investment in high-efficiency video encoding solutions.

And individual next-generation video encoding standards, embracing AV1, H.265/HEVC and VP9 high-quality video can be directly integrated, allowing compression with no loss of resolution quality, adoption was further elevated.

Customized encoding solutions catering to specific needs, including cloud-integrated transcoding, AI-powered error correction, and latency-optimized live broadcast encoders have therefore strengthened the market growth by ensuring improved compliance to dynamic trends in media consumption and changing transmission standards.

Although it offers considerable advantages in terms of reducing costs related to bandwidth as well as providing greater stability for video streaming and the benefits of HD and UHD (ultra-HD) broadcasting, the encoders segment also has challenges like compatibility issues with older-generation, existing systems of broadcasting, and increasing cyber-related threats to the processing of digital content and regulatory hurdles towards the standardization of video compression to overcome.

But emerging technologies such as AI video codec or quantum codec and real-time optimization in the cloud for video compression are advancing cost-effectiveness and content security as well as streaming quality, so that the global market for broadcast encoders continues to grow.

The growing need for on-the-fly encoding solutions with such capabilities, including AI-based adaptive bitrate modulation, ultra-low-latency video processing, as well as content-aware compression algorithms, has fuelled adoption as well. Over 75% of streaming platforms and news broadcasts use AI powered encoders to help enhance video playback quality and reduce buffering, which drives strong demand for this segment, according to studies.

However, despite its numerous benefits in improving the efficiency of video transmission, lowering network congestion, and enabling high-definition streaming, the encoders segment is facing challenges, which include growing competition from open-source encoding solutions, the increasing demand for real-time video analytics, and changing consumer expectations for interactive streaming experiences.

ut innovative solutions are helping to build a more resilient encoding marketplace, with block chain-based content verification, AI-enhanced video capabilities, and 5G-enabled live-encoding technology all helping to secure transmission and improve audience engagement, ensuring that encoding solutions continue to charge ahead in the global broadcast equipment market.

The broadcast equipment market is benefiting from the growth of digital broadcasting, the emergence of OTT (Over-the-Top) streaming services, and technological advancements in 4K and 8K video. Demand for high-quality transmission, production, and storage equipment is also spurred by the shift from traditional broadcast to IP-based and cloud-based broadcast solutions.

Furthermore, market growth is aided by the need for live content streaming, remote production, and AI-powered content management. The industry is embracing a move towards software-defined, cloud-enabled and machine learning-powered broadcast solutions to help increase efficiency, scalability and viewer engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Corporation | 18-22% |

| Grass Valley (Black Dragon Capital) | 15-19% |

| Harmonic Inc. | 12-16% |

| Everts Microsystems Ltd. | 9-13% |

| Imagine Communications Corp. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Corporation | Provides high-end broadcast cameras, video production systems, and IP-based live broadcasting solutions. |

| Grass Valley (Black Dragon Capital) | Specializes in cloud-based production tools, video switchers, and automated content management solutions. |

| Harmonic Inc. | Develops video delivery solutions, software-defined encoders, and cloud-based media processing technologies. |

| Everts Microsystems Ltd. | Offers IP-based broadcasting infrastructure, routing systems, and real-time content distribution solutions. |

| Imagine Communications Corp. | Focuses on IP-enabled, AI-driven broadcasting solutions, automation tools, and OTT streaming infrastructure. |

Key Company Insights

Sony Corporation (18-22%)

Sony has established itself as a dominant player in the broadcast equipment market, providing professional video production tools, high-resolution cameras, and cloud-based broadcasting solutions designed for live events and studios.

Grass Valley (Black Dragon Capital) (15%-19%)

Grass Valley ensures cloud video production as well as workflow automation, offering flexible, scaled solutions for live production and broadcasters to stream.

Harmonic Inc. (12-16%)

Harmonic is a leader in delivering unrivalled video compression and cloud-based media delivery, with innovations in software-defined broadcasting and TV and video quality.

Everts Microsystems Ltd (9% - 13%)

Everts Designs and manufactures high-performance broadband infrastructure that combines the natively integrated IP-based routing systems with real-time content delivery networks for broadcasts to any global destination.

Imagine Communications Corp. (7-11%)

[Video] Imagine Communications is a leading provider of software and software-defined solutions catering to broadcasters' needs, with particular emphasis on AI-based automation capabilities and scalable OTT streaming infrastructure, enabling customers to embrace digital transformation in media.

Includes All Other Important Players (30-40% Combined)

Other players in this market include organizations that enable innovative and economical solutions for live broadcasting, content management, and digital transformation. Notable players include:

The overall market size for Broadcast Equipment Market was USD 5,410 Million in 2025.

The Broadcast Equipment Market is expected to reach USD 8,560 Million in 2035.

The demand for the broadcast equipment market will grow due to increasing adoption of digital broadcasting, rising demand for high-definition and 4K content, advancements in IP-based transmission technology, and the expanding reach of OTT platforms and live streaming services.

The top 5 countries which drives the development of Broadcast Equipment Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Digital Broadcasting and Encoders to command significant share over the forecast period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.