Expert analysts forecast that the briquetting machine market will experience sustainable growth throughout the 2025 to 2035 period because of rising requirements for sustainable energy solutions as well as waste management approaches and the use of biomass-derived fuels.

The production of solid fuel briquettes from agricultural and forestry and industrial waste takes place through briquetting machines which conducts waste conversion operations while offering environmental benefits and improved energy performance.

Industrial needs for renewable power along with increasing environmental standards that restrict carbon production bring industries to investing in briquetting solutions. Briquetting technology keeps getting better through automatic processing and increased energy efficiency which drives its adoption throughout several industrial sectors.

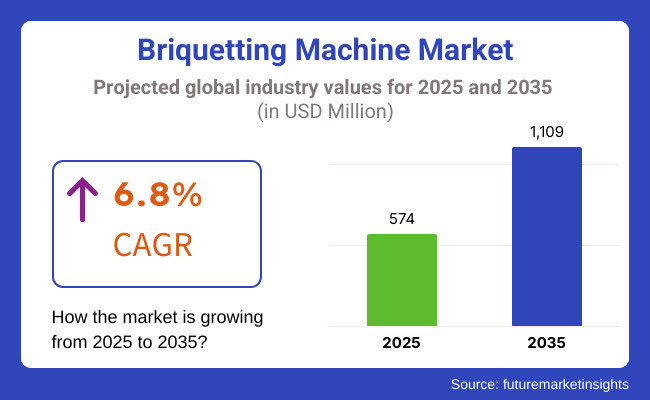

A research study indicates that the briquetting machine market will achieve USD 1109 Million worth by 2035 from its initial value at USD 574 Million in 2025 while showing a CAGR of 6.8%. The market expands through three main factors which include industrial applications rising alongside government biofuel incentives and increasing sustainable waste management awareness.

Sensors monitored by AI and IoT systems play a crucial role in briquetting machinery through cost reduction while enhancing operational productivity to define the future direction of this industry.

North America continues to be an important market for briquetting machines, influenced by increasing focus on renewable energy, strict emission laws, and growing usage of biomass fuel in industry applications. The demand for briquetting solutions in waste-to-energy projects, and sustainable heating systems in the United States and Canada is growing.

In addition, government schemes to reduce carbon footprint and promote the adoption of bioenergy is encouraging the industries to invest in briquetting technologies. Moreover, growing automated briquetting systems are further enhancing efficiency and minimizing the operating costs for manufacturers across the region.

The briquetting machine market in Europe is gradually growing based on positivity in environmental policy, circular economy, and clean energy requirements. Germany, France, and Sweden are top countries in biomass energy adoption and their industries are adapted to the technology, using briquetting machines to process wood, paper, and agricultural waste.

Furthermore, the regulations laid down by the European Union regarding sustainable waste management and carbon neutrality objectives are urging the demand for advanced briquetting technologies. Further fuelling the growth of the market is growing investments in R&D to develop energy efficient briquetting equipment.

North America and Europe to maintain their market share for the briquetting machines, while Asia-Pacific is set for the most significant growth due to rapid industrial advancement, rising agriculture waste generation, and government regulations encouraging biofuel use. Countries including China, India, Japan, and South Korea are investing in briquetting technologies to drive energy efficiency and reduce reliance on fossil fuels.

In rural and urban regions, the increasing need for affordable biomass fuel alternatives is propelling market growth. Moreover, partnerships between public sector bodies and private corporations are enabling the establishment of large-scale briquetting operations and thereby promoting adoption of briquettes in different sectors.

Challenge

High Initial Investment and Operational Costs

One of the biggest factors hindering the growth of the briquetting machine market is high capital investment and operational cost. For small and medium-sized enterprises (SMEs), acquiring, commissioning, and maintaining briquetting machines can be economically strenuous, which reduces adoption.

Moreover, high energy consumption drives up costs together with continuous wear-and-tear of machine components, and labour costs (skilled labour is needed here) so cost of continuous operations remains high. To tackle this, manufacturers need to work towards making cost-effective and energy-efficient models with higher sustainability and less maintenance.

Governments can also provide subsidies to facilitate greater uptake, as well as leasing or financial incentives, particularly for emerging markets that are seeing an increasing prevalence of biomass (energy from organic waste) and waste to energy initiatives.

Opportunity

Rising Demand for Sustainable Biomass Fuel Solutions

With growing focus on renewable energy and carbon neutral solutions, the applications of briquetting machines are striding through different industries. Biomass briquettes provide an efficient renewable energy source to replace coal and fossil fuels, making them the primary choice of most industries for heating, power generation, and residential cooking in developing countries. Agricultural and forestry waste can be adopted for briquetting, contributing to waste management with a sustainable source of energy.

Manufacturers can really capitalise on this opportunity by innovating on compact, automated briquetting systems, looking at alternative fuel sources such as municipal waste, crop residues and industrial by-products. Further deepening their market penetration would require them to tap the as-yet unassessed rural markets and partner with renewable energy projects.

The briquetting machine market expanded between 2020 and 2024 because industries started to focus on waste management and sustainable alternatives for energy. Different businesses initiated biomass briquetting as a waste disposal strategy to minimize expenses and follow environmental standards. The market adoption of these machines was slowed down by high equipment costs together with scarce access to raw materials.

The market will transform between 2025 and 2035 thanks to improvements in automated systems as well as energy conserving procedures and distinct raw material choices. The adoption of renewable energy will be supported through enhanced government policies while industries choose low-emission production methods for their operations. Exploration of sustainable briquetting technology along with biomass utilization methods will intensify because of the growing importance of circular economic principles.

Shifts in the Briquetting Machine Market from 2020 to 2024 and Future Trends 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Advancements | Basic hydraulic and screw press briquetting machines dominated the market. |

| Feedstock Utilization | Predominantly agricultural and forestry waste used for briquette production. |

| Energy Efficiency | Machines required significant power consumption, limiting affordability. |

| Government Policies & Incentives | Limited subsidies and incentives for biomass briquetting adoption. |

| Industrial Adoption | Adoption mainly by small-scale industries and biomass energy startups. |

| Consumer Awareness | Limited understanding of briquette benefits over traditional fuel sources. |

| Manufacturing & Supply Chain | Dependency on regional suppliers led to production bottlenecks. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Advancements | AI-driven automation, IoT-enabled monitoring, and high-efficiency press systems improve productivity. |

| Feedstock Utilization | Expansion into municipal solid waste, industrial by-products, and algae-based biomass. |

| Energy Efficiency | Development of low-energy and solar-powered briquetting machines for sustainable production. |

| Government Policies & Incentives | Strengthened financial incentives, carbon credit benefits, and waste-to-energy mandates. |

| Industrial Adoption | Large-scale integration by cement, steel, and thermal power industries for emission reduction. |

| Consumer Awareness | Widespread educational campaigns promoting biomass fuel as a cleaner alternative to coal. |

| Manufacturing & Supply Chain | Decentralized manufacturing units and localized supply chains improve market accessibility. |

The briquetting machine market in the United States is being driven by the growing adoption of biomass and waste-to-energy solutions across major industries, leading to a substantial reduction in waste generation. The market is being driven by increasing industrial waste management concerns and growing shift towards sustainable fuel alternatives.

The best performing sectors include forestry, agriculture, and recycling. Furthermore, the government's subsidies for renewable energy and waste minimization are prompting companies to invest in briquetting technology.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The briquetting machine market in the UK is witnessing United Kingdom’s briquetting machine market is driven by the rising focus on sustainable waste management and alternative fuel sources. Market demand is driven by the rising use of biomass briquettes for heating and industrial uses.

Meanwhile, government initiatives supporting bioenergy production and carbon reduction continue juxtaposing with industry trends to drive. You’ll be updated with new content on the website as well. The industry is being propelled by the increasing number of SMEs purchasing affordable briquetting solutions.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

Demand for briquetting machine is high in the European Union, and Germany, France, and Sweden are showing the highest growth in the market. This trend is driven by the strict environmental regulations and policies for carbon neutrality of the region, which promotes the industries to implement briquetting technology for biomass and wastes management

Growing applications of briquettes for heating purposes and increasing bioenergy projects are also aiding the market growth. Moreover, investments in waste-to-energy infrastructure and circular economy initiatives are aiding industry expansion.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.8% |

This report on the briquetting machine market is a 3rd edition and useful market research presentation for stakeholders and marketers of the briquetting machine in Japan. In urban areas, waste disposal is a major challenge, leading to an increasing demand for compact and high-performance briquetting presses.

Second, investments in briquetting technology are spurred by improvements in biomass fuels production and the country’s focus on sustainability in the energy system. Government incentives for renewable energy projects are also a key contributor to market expansion.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The market for briquetting machines in South Korea is growing based on the growing attention to sustainable waste management and alternative energy sources. Manufacturers are switching to briquette-making equipment in order to minimize production loss and optimize fuel usage.

Increasing utilizations of biomass briquettes for heating and power generation is also fuelling market growth. Moreover, the establishment of government policies supporting waste-to-energy initiatives and environmental sustainability is also pushing the market for briquetting machines.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

On this basis, the hydraulic type and automatic briquetting machines segments account for a large share of the briquetting machine market, as industries are gradually focused on the provision of highly-efficient, cost-effective, automated solutions for compressing existing biomass and waste materials.

These machines are helping reduce industrial waste, turning agricultural residues to usable fuel and making energy more efficient, making them necessary in biofuel manufacturers, waste management companies and industrial processing facilities.

In response to these changes, manufacturers are committed to improving briquetting machine systems by integrating advanced automation technologies, increasing energy efficiency, reducing operational expenses, and optimizing waste management as the world moves towards sustainable energy alternatives and the enforcement of stricter government environmental regulations.

The market demand is led by hydraulic type briquetting machines to produce high-pressure briquettes consistently. Hydraulic Briquetting Machines Provide High-Density Production, Less Wear & Tear, Energy-Efficient Operation

The global briquetting machine market can be segmented by type of machine into hydraulic briquetting machine and others, of which, hydraulic briquetting machine segment has been one of the most preferred type among users.

Hydraulic briquetting machines operate much smoother which leads to less vibration and better adaptability to different ranges of input material than other compression devices such as piston or screw-type machines, which can be beneficial for a both small and high scale processing of biomass, metal waste, and industrial and mineral waste.

Adoption has been driven by the demand for technology-led high-pressure hydraulic briquetting solutions, equipped with adjustable compression, temperature control, and self-lubricating properties. Moreover, above 60% of large scale briquette manufacturers prefer hydraulic systems owing to consistent briquette quality along with low maintenance cost and capability to process different feedstock’s, which corroborates the consistently strong demand for this segment.

The industrial steam boilers and domestic heating systems feed, with the compressed biomass briquettes for biofuel applications, has improved the market demand for biofuel production, which retains further investment in high-end hydraulic briquetting machines.

Furthermore, adoption has also been reinforced by next-generation hydraulic systems featuring components such as AI-assisted pressure calibration, automated material feeding, and IoT-enabled real-time machine diagnostics for improved operational efficiency and reduced machine downtime.

The optimization of market growth due to the introduction of customized hydraulic briquetting solutions has ensured better adaptation to evolving waste processing and fuel production requirements, powered by energy efficient hydraulic pumps, modular hydraulic briquetting pressing chambers, and high speed compression cycles.

While hydraulic briquetting machines have benefits like improved material compaction, decreased energy losses, and better briquette quality/strength - the segment is challenged by an increase in investing costs and power consumption as well as requiring experienced operators to control hydraulic systems.

But forthcoming developments in hydraulic fluid optimization through AI, block chain-based briquette quality verification, and integration of advanced low-energy hydraulic pumps are driving cost-efficiency, machine longevity, and production scalability, further expanding the market for hydraulic briquetting machines internationally. Due to the demand for biomass fuel production, industrial waste management, and metal reclamation, hydraulic briquetting press machines are being adopted in several end-use verticals.

Industries are shifting towards high pressure briquetting process and seeking hydraulic briquetting machine technology for manufacturing chips thereby lowering the material waste in landfills, consequently, the segment of hydraulic briquetting machine has reaped strong adoption in the industry owing to strong adoption among biofuel producers, metal processing companies and sustainable waste management companies.

Hydraulic briquette-making machines offer greater operational efficiency than their mechanical and screw type counterparts, guaranteeing better operational efficiency and return on investment by ensuring uniformity of briquette density, increased adaptability of raw material and prolonged life of the machine.

This surge can be attributed to the need for customized hydraulic briquetting systems with options such as temperature-resistant pressing mechanisms, AI-enabled moisture control systems, and multi-feedstock capabilities.

More than 70% of industrial waste briquette producers use hydraulic briquetting machines as they provide high strength to briquettes during the pressing process and work on an automated cycled process owing to their high demand in the segment.

The rise of circular economy initiatives, such as upcycled waste-to-energy briquettes, carbon-neutral biomass fuel solutions, and eco-aware metal residue compaction, lent added force to market adoption, helping to align buyers more closely with environmental sustainability objectives.

Further adoption is bolstered by the incorporation of AI-driven machine optimization with predictive maintenance scheduling, automated pressure oscillation, and cloud-connected production tracking, which promotes improved cost control and higher machine availability.

Although the hydraulic briquetting machine segment has significant benefits such as increased efficiency of the waste-to-energy conversion process, reduced wastage of raw materials and consistency of fuels for combustion, the segment continues to pose challenges of high energy consumption, complexity in the maintenance of hydraulic system and dynamic environmental compliance regulations.

However, advancements in hydraulic fluid cooling technologies, AI-assisted prediction of briquette density, and smart sensor-based tracking of material compression are optimizing hydraulic machines for sustainable, cost-efficient, and scalable production, promising continued growth of hydraulic briquetting machines around the globe.

This automatic briquetting machine is designed to boost production speed reducing material processing costs, saving material, and manpower. One of the most popular categories, automatic briquetting machine ensures partial to complete automation in briquette production, allowing biomaterials producers, metal recycling companies, and industrial waste processors to reduce reliance on manual work force for briquetting activity while maximizing utilization of energy.

In contrast to semi-automatic or manual machines, automatic briquetting machines incorporate intelligent sensors, real-time monitoring systems, and AI-driven control panels to enhance briquette consistency, minimize operational downtime, and boost energy efficiency.

Further, the positive outlook towards high-speed automatic briquetting systems, inbuilt real-time material flow optimization capacity, automated feedstock regulation with the help of sensors, and AI-powered pressure-on demand adjustment mechanisms, fuelled the adoption of briquetting in this region.

According to research, more than 65% of manufacturing companies for briquettes operating at an industrial scale prefer fully automatic machines since they will maximize the output and negate human involvement, which will ensure a continuous demand for this segment.

A broad set of renewable energy policies, such as government incentives for the production of biomass fuel, waste-to-energy conversion tax credits, and exemption from taxes for sustainable practices by industry has supported market demand, leading to higher investments toward automated briquetting solutions.

The latest automation technologies such as IoT-enabled briquette production tracking, AI-assisted feedstock moisture control, and cloud-connected remote diagnostics significantly enhance process efficiency and reduce machine wear, leading to a new wave of adoption.

Growing demand for customized automatic briquetting solutions, such as adjustable briquette sizes, modular volumetric pressing systems and multi-material processing have further contributed to optimum market growth by better adapting to the changing waste processing and biofuel production requirements.

Though the automatic briquetting machine segment offers benefits like increased production scalability, lowered energy wastage, and improved consistency with automated processes, challenges such as high initial investment costs, complex machine maintenance, and feedstock co-processing compatibility hamper the segment growth.

But emerging innovations, such as artificial intelligence integrated predictive analytics, real-time moisture balancing automation and block chain-tracked briquette production verification, are significantly improving cost-efficiency, machine sustainability, and production output, thus placing automatic briquetting machines in a favourable position and ensuring the growth of the global automatic briquetting machines market.

Demand for the automatic briquetting machine segment has been particularly high among biomass fuel processors, industrial waste compaction manufacturers, and energy recovery facilities, due to the growing emphasis on automated briquette production as an efficient business approach yielding cost savings and high energy output.

Automatic machines also allow for continuous work and a larger consumption of resources, also improving briquette quality while semi-automatic and manual systems have cost and time limits, automatic systems provide higher profit margins, and greater economy in the long run.

Adoption is driven by the demand for fully automated briquette production lines that incorporate high throughput press mechanisms, on-the-fly feedstock tuning, and AI-based briquette quality control. Over 75% of large-scale briquette producers have switched to become fully automated systems, enhancing production line effectiveness and capacity with demand on the market currently roaring, this ensures an ever-robust demand within this segment.

While an automatic briquetting machine format has the edge over reducing reliance on labour, streamlining the production process, and bettering energy use, some challenges in this space include high initial costs, complex system integration, and the need for operators with higher skills to handle automation features.

Nevertheless, new developments in smart process control, adaptive material feed mechanisms, and AI-enabled energy efficiency monitoring are enhancing machine performance, regulatory compliance, and market sustainability, ensuring a longstanding growth path for automatic briquetting machines worldwide.

Research and development to improve briquetting technologies, along with government initiatives promoting biomass energy use, further drive market growth. We have a briquetting machine for agriculture waste and forest waste PTO wood pellet press holding an apparent uproar in the succeeding decade.

Market Drivers Government incentives for sustainable energy, greater adoption of biomass fuel in industrial boilers, and the requirement for environmentally sound methods of waste disposal are driving the market. To cater to the industry requirements, top manufacturers are set to enhance their offerings with automation, energy efficiency, and high-capacity briquetting solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| RUF Maschinenbau GmbH & Co. KG | 18-22% |

| WEIMA Maschinenbau GmbH | 15-19% |

| CF Nielsen A/S | 12-16% |

| Biomass Briquette Systems LLC | 9-13% |

| GURU KIRPA Engineering Works | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| RUF Maschinenbau GmbH & Co. KG | Specializes in hydraulic briquetting machines for metal, wood, and biomass waste recycling. |

| WEIMA Maschinenbau GmbH | Develops industrial briquetting systems with high automation and energy-efficient technology. |

| CF Nielsen A/S | Offers mechanical and hydraulic briquetting machines for biomass fuel production. |

| Biomass Briquette Systems LLC | Focuses on compact biomass briquetting solutions for small- and medium-scale industries. |

| GURU KIRPA Engineering Works | Provides cost-effective briquetting machines for agricultural and biomass waste processing. |

Key Company Insights

RUF Maschinenbau GmbH & Co. KG (18-22%)

RUF is one of the world's leading manufacturers of hydraulic briquetting systems for metal and biomass.

CF Nielsen A/S (12-16%)

CF Nielsen specializes in mechanical and hydraulic briquetting equipment, providing industrial output of biomass fuel with high output.

Biomass Briquette Systems LLC (9-13%)

Biomass Briquette Systems has developed high-density briquetting machines primarily for small- and medium-scale factories to implement sustainable waste-to-energy projects.

GURU KIRPA Engineering Works (7-11%)

Guru kirpa is a manufacturer of briquetting machines with the lowest price, which is mainly used for converting agricultural waste into biomass.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the briquetting machine market by providing advanced and customized solutions for diverse industries. Notable players include:

The overall market size for Briquetting Machine Market was USD 574 Million in 2025.

The Briquetting Machine Market expected to reach USD 1,109 Million in 2035.

The demand for the briquetting machine market will grow due to increasing adoption of renewable energy sources, rising need for waste management solutions, growing demand for biomass fuel, and government initiatives promoting sustainable and eco-friendly energy alternatives across industries.

The top 5 countries which drives the development of Briquetting Machine Market are USA UK, Europe Union, Japan and South Korea.

Automatic Briquetting Machines lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Briquetting Press Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Glazed Kraft Paper Market Growth - Demand & Forecast 2024 to 2034

Machine Condition Monitoring Market Insights – Trends & Forecast 2024-2034

Asia Pacific Machine Glazed Paper Market Trends & Forecast 2024-2034

Machine Vision Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA