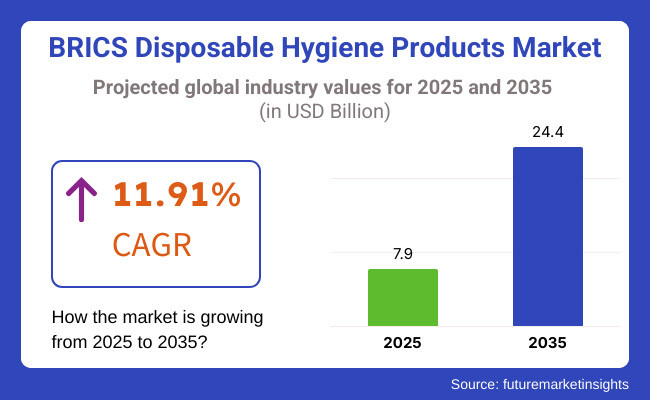

The BRICS disposable hygiene products market is projected to experience a massive growth from USD 7.9 billion in 2025 to USD 24.4 billion by 2035, representing a significant CAGR of 11.91%. The industry is expected to develop significantly between 2025 and 2035, covering Brazil, Russia, India, China, and South Africa. The main factors include the growing personal hygiene awareness, the increase in disposable income, and new product technology.

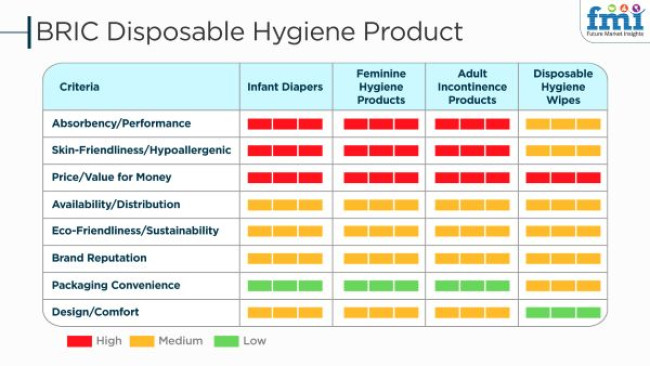

Disposables like baby diapers, sanitary napkins, adult incontinence products, and wet wipes will be among the major products, which will be in demand the most due to factors such as rapid urbanization, enhanced healthcare infrastructure, and the growing participation of women in the workforce. Besides, sustainability is regarded as a core of the sector, with material technologies that are biodegradable and friendly to the environment being at the center of product development and consumer preference.

Considering the massive populations and per capita income growth in China and India, they dominate the market while Brazil and Russia will cautiously recover because of a demographic shift and customer spending on hygiene products. South Africa, besides, is to see a hail of demand, which will be mainly based on governmental actions advocating hygiene education and enhancing the distribution of hygiene products.

Despite this, the territory has some challenges with respect to environmental sustainability and waste management. The greater consumption of disposable hygiene products has pulled up the plastic waste and landfill pollution issues, which has led to governments and environmental activists seeking the introduction of rules and eco-friendly methods of production.

The enterprises take part in-memory hygiene market in BRICS that require the implementation of practical solutions which include but are not limited to recyclable packaging, the application of water-saving production techniques, and the use of biodegradable materials to cope with the sustainability guidelines and the consumer expectations.

There are substantive business possibilities embedded in the creation of smart and environment-friendly hygiene solutions. The requirement for intelligent hygiene products like sensor-enabled diapers, antibacterial sanitary pads, and ultra-absorbent incontinence products is spiralling to the roof. Moreover, the use of organic and plant-based materials has raised the prominence of bamboo fiber diapers and chemical-free sanitary napkins among consumers who are environmentally conscious.

The development of online retail and direct-to-consumer sales models is an additional factor reshaping the BRICS disposable hygiene market, where brands can come to the market with more personal hygiene solutions. Subscription-based services and digital marketing operationalizing mainly on customers have become mainstays of consumer engagements and brand loyalty.

As the market keeps on transforming, those manufacturers who emphasize innovation, sustainability, and access will reap the benefits from a rapidly growing demand for disposable hygiene products across the BRICS nations. The trajectory of this market will further be identified by technological advancements, environmental responsibility, and consumer-led product development thus ensuring constant growth and success for the industry in the long run.

Explore FMI!

Book a free demo

From 2020 to 2024, the industry for disposable hygiene products grew as people became more aware of their health, their disposable incomes increased, and enhanced demand for easy-to-use, single-use solutions. The COVID-19 pandemic spurred the use of personal hygiene products, such as baby diapers, feminine hygiene products, and adult incontinence products.

Because of environmental concerns, people were preferring biodegradable materials, plant-based fibers, and looked for products having lower plastic content in disposable products. Consumers were also preferring subscription services for sanitary products and diapers. Price sensitivity and regulatory pressure were some challenges.

Between 2025 and 2035, the industry will witness innovations in biodegradable and compostable hygiene products due to more stringent environmental regulations and consumer pressure for sustainability. Intelligent hygiene products, including sensor-enabled diapers and sanitary pads with period-tracking features, will become popular.

Antimicrobial and skin-friendly material developments will improve comfort and safety. Refillable and reusable hybrid solutions will also appear, finding a balance between convenience and eco-friendliness, defining the next stage of disposable hygiene product innovation.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Companies introduced biodegradable and organic hygiene products, including plant-based diapers and sanitary napkins. Hypoallergenic and dermatologically tested materials gained traction. | AI-driven customization allows consumers to select personalized hygiene products based on skin sensitivity and lifestyle. Biodegradable superabsorbent materials become industry standard. |

| Brands reduced plastic use in packaging and introduced compostable wraps. Reusable and hybrid hygiene solutions gained presence. | Zero-waste hygiene products dominate the industry. Smart packaging solutions with usage tracking and refillable options become widespread. |

| Smart diapers and sanitary products with wetness alarms and real-time monitoring were launched. Digital health monitoring combined with hygiene solutions. | Hygiene products with AI adapt absorption levels to user requirements. IoT-based tracking offers health information through linked apps. |

| Urban demand increased with an increasing inclination towards premium and eco-friendly offerings. E-commerce and DTC sales channels expanded significantly. | Rural markets witness significant penetration with affordable sustainable options. AI-driven consumer education platforms enhance awareness and adoption. |

| Stricter regulations on disposable hygiene waste management influenced product development. Increased focus on ethical sourcing and manufacturing transparency. | Government policies mandate fully biodegradable hygiene products. Blockchain-enabled supply chain transparency ensures ethical sourcing. |

| Brands partnered with healthcare professionals and sustainability advocates to promote eco-friendly hygiene products. Social media campaigns drove awareness. | Virtual influencers and metaverse-based product trials enhance consumer engagement. Gamified sustainability initiatives drive brand loyalty and adoption. |

| Consumers prioritized safety, sustainability, and comfort. Demand increased for fragrance-free, chemical-free, and hypoallergenic products. | Biohacking-inspired hygiene solutions emerge, integrating with wearable health devices. Consumers embrace holistic well-being through multifunctional hygiene products. |

The BRICS disposable hygiene industry (Brazil, Russia, India, and China) is comparatively more ambiguous, growing rapidly, yet producing set problems within the respective region. Awareness of hygiene is low, while taboos are prevalent, especially in rural India, and this poses a significant risk to the acceptance of disposable sanitary napkins and diapers, which would otherwise be convenient.

In places where disposables are uncommon, for example, cloth diapers dominate simply because it’s how things have always been done and education about disposables isn’t widely available. Economic barriers also serve to inhibit market penetration, as high prices lend themselves to making these products a luxury good for many rural consumers.

Lack of infrastructure, such as stable supply chains and waste disposal, makes the environmental situation worse. Rivalry from behemoths such as Procter Gamble and nimble domestic players like Unicharm drive price wars and low margins, while fake goods undermine consumer trust. Regulatory changes too--India’s has gone from high GST all the way down to 0%, currency volatility (Brazil and Russia, for example) adds complexity. Demographic trends, with an aging population in China and a youthful base in India, need management.

Disposable hygiene products are priced to leverage affordability contra value. A common strategy is the ‘sachet’ approach, where small packs-often containing 5, or 10 units-are sold at low prices to appeal to cost-sensitive consumers. For example, in India, selling 5 or 10 diaper packs enables families to try disposable options without a large upfront expense, even though the per-unit cost is higher.

As incomes rise, brands encourage consumers to trade up to larger, more economical packs. Urban segments also access premium tiers; in China, basic domestic brands coexist with imported Japanese and premium Pampers options. Promotional tactics such as “Buy 2, get 1 free” in Brazil and bonus units in packs help lock in new customers.

E-commerce sales during events like Singles’ Day in China or Diwali in India, along with subscription models and geographic pricing adjustments, reinforce a balanced, tiered strategy, thus ensuring sustained growth across diverse segments.

The baby care segment is slated to capture largest share in 2025. Disposable hygiene items are commonly employed in infant care because of their convenience, sanitary advantage, and capacity to give baby superior comfort. Parents prefer disposable diapers, wipes, and changing pads since they present instant and convenient ways of keeping clean, especially in hectic lifestyles.

In contrast to reusable options, disposable items take away the need for constant washing, making them a convenient option for working parents and individuals always on the move. Their heavy absorbency and moisture-locking capability keep a baby's skin dry, thus lowering the occurrence of rashes and infections.

The diapers segment accounts for the largest share, supported by rising birth rates and mounting disposable incomes. Biodegradable alternatives drive innovation, and parents seek high-absorptivity and skin-friendliness along with eco-friendliness. The industry is also dominated by global brands like Pampers, Huggies, and Mamy Poko, which are capitalizing on their reputation as quality manufacturers to expand across BRICS countries.

Local brands deliver localized and cost-competitive options that deeply resonate with consumers. Urban demand is shifting toward premium baby care products that offer wetness indicators, breathable layers, and overnight protection. This trend mirrors a global shift toward convenience in baby care solutions in response to rapidly urbanizing populations looking for greater performance in value-added products.

Soft and flexible disposable baby care products are commonly bought because they are more comfortable, adaptable, and convenient. They come in the form of stretchy diapers, pull-up pants, and ultra-soft wipes and are made to fit snugly but comfortably to enable babies to move around freely without any discomfort.

The structural flexibility and material versatility ensure that the product conforms to a baby's body shape to avoid leaks without compromising on minimizing the risk of skin irritation. Parents find such products more attractive since they have improved performance over the conventional rigid ones, maximizing both the baby's comfort as well as hygiene in general.

Brazil disposable hygiene market is driven by rising middle-class income and increasing awareness of hygiene products. Demand for baby diapers, feminine hygiene, and adult incontinence products is growing. Sustainability concerns are pushing brands toward biodegradable and eco-friendly options, while online retail and convenience stores are boosting accessibility.

Russian market benefits from high demand for premium hygiene products and consumer preference for quality and comfort. Economic fluctuations and affordability concerns affect product choices, leading to growth in private-label brands. E-commerce expansion and retail chains are major distribution channels, with biodegradable hygiene solutions gaining traction.

Indian industry is experiencing rapid growth due to population size, urbanization, and increasing hygiene awareness. Government initiatives promoting sanitary pads and infant care are boosting demand. Affordability and accessibility are key factors, with low-cost and eco-friendly products gaining momentum in both urban and rural markets.

Chinese disposable hygiene market thrives on strong consumer spending, premiumization, and digital retail expansion. Increasing preference for organic and skin-friendly materials is driving demand. Advanced manufacturing and innovation in biodegradable products are shaping the industry, with brands leveraging smart retail and AI-driven recommendations.

South Africa’s USD 752.50 million market is supported by growing awareness of hygiene and improving distribution networks. While affordability remains a concern, government programs and international brand investments are increasing accessibility. The demand for biodegradable and budget-friendly hygiene products is rising, particularly in feminine and infant care segments.

Per Capita Spending on Disposable Hygiene Products - BRICS Countries

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| Brazil | 12.5 |

| Russia | 15.7 |

| India | 8.2 |

| China | 10.4 |

| South Africa | 11.3 |

The disposable hygiene product industry in BRICS is growing rapidly, driven by rising hygiene awareness, increasing urbanization, and demand for cost-effective yet high-quality personal care solutions. A survey of 250 respondents across Brazil, Russia, India, China, and South Africa highlights key consumer trends shaping purchasing behavior.

70% of respondents prioritize skin-friendly and chemical-free disposable hygiene products, with 65% in China and India preferring hypoallergenic and dermatologically tested options. 50% of consumers in Brazil and Russia seek affordable, high-absorbency products, particularly sanitary pads and baby diapers. 45% of respondents in South Africa favor eco-friendly and biodegradable alternatives, aligning with sustainability concerns.

Pricing sensitivity varies across markets, with 55% of Chinese and Indian respondents willing to pay premium prices (USD 10+) for high-quality hygiene products, while only 35% in Brazil and South Africa opt for high-end options. 40% of BRICS consumers expect hygiene products to be priced within 10-15% of regular alternatives, indicating demand for cost-effective yet high-performance solutions.

E-commerce is emerging as a dominant sales channel, with 60% of respondents in China and India purchasing disposable hygiene products online via Tmall, Flipkart, and Amazon. 50% of Russian and Brazilian consumers still prefer supermarkets and pharmacies, valuing convenience and accessibility. 35% of South African respondents rely on social media reviews and influencer recommendations for product selection.

Sustainability is influencing purchasing decisions, with 50% of respondents in Brazil and South Africa preferring biodegradable diapers, pads, and wipes. 40% of Indian and Chinese consumers favor recyclable packaging and refillable hygiene products, while 45% of Russian respondents consider fragrance-free and toxin-free formulations a key factor in their choices.

Premium hygiene products (USD 10+) are in high demand in China and India, while affordable options dominate in Brazil, Russia, and South Africa. E-commerce is expanding across BRICS, making online distribution and digital marketing crucial for brands. Local and global players must focus on affordability, eco-conscious innovations, and skin-friendly formulations to stay competitive. The BRICS disposable hygiene product market is evolving rapidly, with opportunities to capitalize on sustainability, digital engagement, and value-driven innovation.

| Countries | CAGR |

|---|---|

| Brazil | 5.9% |

| Russia | 4.7% |

| India | 7.2% |

| China | 6.8% |

| South Africa | 5.5% |

The industry in Brazil is accelerating with the rising awareness of hygiene, urbanization, and higher disposable incomes. Needs of baby diaper, female hygiene, and adult incontinence are emerging at a strongly high rate. Major Retailers/Multi-Brand Outlets: Carrefour, Walmart Brazil, and internet retailers like Mercado Livre make the market reach plausible. FMI is of the opinion that the Brazil disposable hygiene products market is set to register 5.9% CAGR during the study period.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Government Increased Adoption | Government initiatives toward hygiene are met with rising adoption of the product. |

| More Retail and E-commerce Channels | Web channels are giving convenient access to products. |

| Expansion of Demand for Eco-Friendly and Biodegradable | Consumers are calling for biodegradable and environmentally friendly disposable hygienic products. |

The industry is growing in Russia owing to growth in consumer expenditures on personal care, growth in older population, and growth in demand for high-quality hygienic products. Magnit, Auchan, and others, are big supermarket retail chain stores, and e-tailers such as Ozon and Wildberries are monopolistic retailers. FMI is of the opinion that the Russian industry is expected to observe 4.7% CAGR during the forecast period.

Growth Drivers in Russia

| Key Drivers | Details |

|---|---|

| Growth in Middle-Class Consumption of Personal Hygiene | Convenience and accessibility of hygienic products. |

| Growing demand for premium and organic hygiene products | Driven by green consumers. |

| Growing population of age Group Boosts demand for Adult Incontinence Products | Related elderly care segment is growing well too. |

India's disposable hygiene products industry is expanding healthily with an increasing population, increased awareness of menstrual health, and government programs in the form of Swachh Bharat Abhiyan. Increasing availability from online platforms such as Flipkart and Amazon India and retailing through Big Bazaar, and others are few of the key drivers. FMI is of the opinion that the Indian industry is set to witness 7.2% CAGR during the forecast period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Policies in favor of Sanitation and Hygiene | Policies in favor of menstrual health education propel demand. |

| Urbanization and Lifestyle Shift | Growing disposable incomes render the product more penetrable. |

| E-commerce Revolution Increased Product Reach | E-commerce channel is the strongest product dissemination channel. |

China's disposable hygiene industry is expanding on the strength of rising middle-class numbers, higher spending on personal cleanliness, and technology advancements in environmental products. The industry for selling products is controlled by online leaders JD.com and Tmall, and products are readily available in rural and urban areas. FMI is of the opinion that the industry in China is set to occupy 6.8% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Rising Trend towards Eco-Friendly, Biodegradable Products | Clean green hygiene products gaining popularity across the board. |

| Channel and Internet Extensions | Extended distribution of products as online shopping malls. |

| Baby and Women's Hygiene Product Awareness Increase | Positive demand for quality and organic products. |

South African disposable hygiene business is growing with urbanization, rising disposable incomes, and aging population and incontinence requirements. Multi-outlet mass merchandising chains like Pick n Pay and Checkers, and internet channels, provide industry reach. FMI is of the opinion that the South African industry is set to obtain 5.5% CAGR during the study period.

Growth Drivers in South Africa

| Key Drivers | Details |

|---|---|

| Hygiene and Sanitation Awareness | Personal hygiene awareness is driven by marketing through campaigns. |

| Affordable Hygiene Solutions | Economically priced disposable hygiene solutions are needed. |

| Demand for Baby and Female Hygiene Products | Rise in working women leads to sales. |

Highly competitive in nature, the industry features both international and local players. Some of the important companies involved include Procter &Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Essity AB, and Hengan International Group Co.

These major players have considerable presence in the BRICS nations with their various product ranges and their respective well-known brands that have gained huge industry shares. Their modus operandi often contemplates continuous product development, increased reach of their distribution network, and strategic partnerships, thereby gaining a competitive advantage in its position.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Procter & gamble co. | 15-20% |

| Kimberly-clark corporation | 12-16% |

| Unicharm corporation | 10-14% |

| Hengan international group co., ltd. | 8-12% |

| Essity AB | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble Co. | Offers a wide range of disposable hygiene products under brands like Pampers and Always. Focuses on product innovation and sustainability initiatives to cater to diverse consumer needs across BRICS nations. |

| Kimberly-Clark Corporation | Sells products such as Huggies diapers and Kotex feminine hygiene products. Invests in research and development to introduce high-quality, comfortable, and eco-friendly products tailored for emerging industries. |

| Unicharm Corporation | Provides disposable hygiene products under brands like mamypoko and Sofy. Emphasizes affordability and accessibility, expanding its presence in rural and urban areas within BRICS countries. |

| Hengan International Group Co., Ltd. | A leading Chinese manufacturer offering products like Anerle diapers and Space 7 sanitary napkins. Focuses on leveraging local market knowledge to cater to consumer preferences in BRICS nations. |

| Essity AB | Offers products under brands such as Libero and Libresse. Prioritizes sustainability by developing biodegradable products and reducing environmental impact, appealing to environmentally conscious consumers. |

Key Company Insights

Procter & Gamble Corp. (15-20%)

Procter & Gamble dominates BRICS with its extensive product portfolio in disposable hygiene products such as Pampers and Always. Along with investments in product innovation focusing on comfort and skin health, the company focuses on sustainable eco-friendly products and reduces carbon footprints. P&G develops its distribution both in urban and rural areas to reach the fullest capacity.

Kimberly-Clark Corporation (12-16%)

Kimberly-Clark has almost a niche market capture with products like Huggies and Kotex. The company invests in constant research and development for its innovative and quality comfortable, and ecofriendly products. The localized marketing strategies and joint partnerships emphasized developing its presence in the BRICS countries.

Unicharm Corporation (10-14%)

Unicharm is recognized for the affordability and accessibility of brands like MamyPoko and Sofy. The company increases presence in both rural and urban areas in BRICS countries. Investment in local manufacturing and distribution networks taking its systemi "a business" beyond their markets for improving its position.

Hengan International Group Co., Ltd. (8-12%)

Hengan uses its local knowledge for customizing products according to consumer preferences in the BRICS. The firm offers Anerle diapers and Space 7 sanitary napkins. It focuses on product diversification and improvement of quality to meet different consumer needs.

Essity AB (6-10%)

Essity takes product sustainability first and backs it with names like Libero and Libresse. The company works on making biodegradable products and runs various initiatives to reduce the negative impact on the environment. Awareness of hygiene and sustainability will build brand loyalty among consumers from the BRICS.

Other Key Players (30-40% Combined)

Several new entrants and local players are catalyzing this industry by emphasizing affordability and accessibility, with consideration for regional preference differences.

The industry is projected to witness USD 24.4 billion by 2035 end.

The industry is estimated to be USD 7.9 billion in 2025.

Diapers are widely purchased in BRICS.

India, poised to grow at 7.2% CAGR during the forecast period, is slated to witness fastest growth.

The key players include Dispowear Sterite Company, Kimberley Clark Corporation, Disposable Hygiene Products Ltd, BOSTIK SA, BAHP, UNICHARM Corporation, Kao Corporation, Procter & Gamble Company, and Svenska Cellulosa Aktiebolaget SCA.

Based on the age group, the industry is segmented into adult care, feminine care, and baby care.

By product, the industry is divided into nappies, diapers, toilet paper, wipes, sanitary protection, kitchen towels, paper tableware, and cotton pads and buds.

Under packaging, the industry is divided into rigid and flexible.

Geographically, the industry is segmented into Brazil, Russia, India, China, and South Africa.

Mini Refrigerator Market - Product Type, Price Range, Capacity, End-user, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Medical Loupes Market Analysis by Product Type, Lens Type, Application, Sales Channel and Region 2025 to 2035

Driving Protection Gear Market Analysis by Product, Material, Vehicle, Consumer Group, Distribution Channel and Region 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

Residential Hobs Market Analysis - Trends, Growth & Forecast 2025 to 2035

Portable Air Conditioner Market Analysis by Capacity, End Use, Sales Channel and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.