The performance coatings market for BRIC: Brazil, Russia, India and China shows very strong growth in megatrends from 2025 to 2035, based on very strong demand of durable and high performance protective coatings for automotive, construction, marine and electronics industries together with ongoing industrialization and infrastructure development across BRIC.

They offer better resistance against corrosion, chemicals, UV rays, and extreme weather, and are essential in extending the lifespan and appearance of structures and industrial equipment in tough environments.

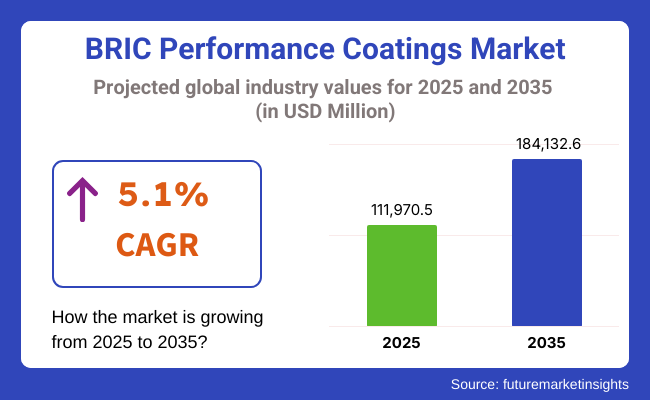

Demand is being driven by increasing investments in the energy, manufacturing and transport sectors across BRIC nations, and rising consumer expectations for quality finishes in the residential and commercial segments. Among the trending technologies are powder coatings, water based formulas and coatings that are aided for such innovations through nanotechnology and this is generating a lot of waves in product innovation throughout the region. The BRIC performance coatings market would increase from USD 111,970.5 Million in 2025 at a CAGR of 5.1% to USD 184,132.6 Million at the end of the forecast period.

The penetration of epoxy resins and water-based formulations generates demand in this market via enhanced durability, sustainability and regulatory compliance, amid battling investments injected into infrastructure emerging economies.The BRIC (Brazil, Russia, India, China) performance coatings market is experiencing high growth due to the increasing amount of industrialization in these regions and urban infrastructure developments leading to high demand for high-performance surface protection of structures in harsh environmental conditions.

Such coatings improve durability, corrosion resistance, and aesthetic appeal for automotive, construction, marine and manufacturing applications.

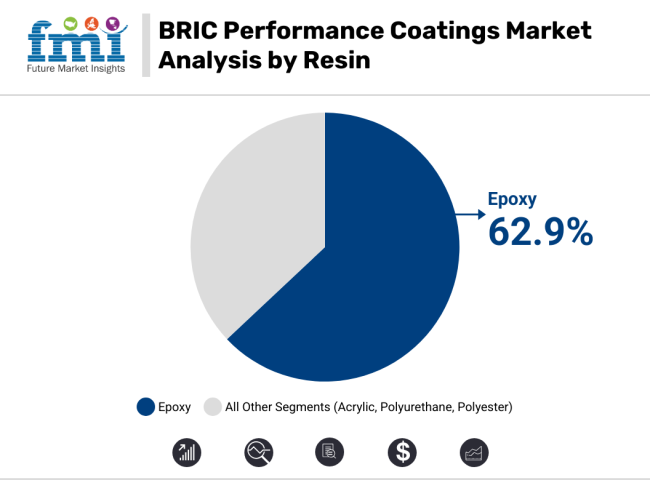

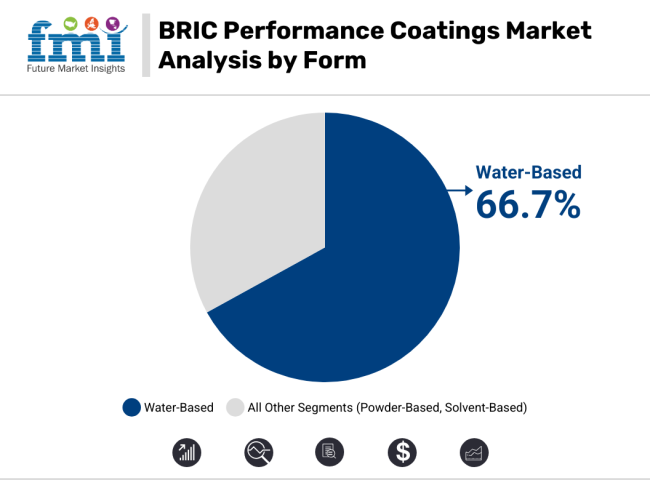

Epoxy resins and water-based coatings are the majority in terms of market share of resin types and formulation bases owing to their excellent mechanical properties, low VOC emission, and regulation co-compatibility across BRIC countries. Talk Engineered for these segments provides scalable solutions for protective finishes while helping to meet sustainability goals and strong environmental standards.

The performance coatings in these regions are aided by increasing construction activity, automotive production, and marine fleet expansion. In an industry pivoting towards long-life and high-efficiency coating systems, innovation and adoption remain predominately with epoxy and water-based technologies.

Epoxy resins gain traction due to chemical resistance, adhesion strength, and heavy-duty protection

In the BRIC performance coatings market, epoxy resins account for the highest share owing to their high-performance profile, which makes them suitable for industrial applications requiring chemical, mechanical, and thermal resistance. Epoxies, commonly used in metal protective coatings, floor finishes and marine infrastructure, are known for long-lasting durability even under heavy wear and corrosive conditions.

They are the preferred resin for coating applications in oil & gas pipelines, power plants, and industrial floors due to their excellent substrate adhesion, solvent resistance, and load-bearing capacity. Epoxies are also the core of many high build and anti-corrosive formulations applied to bridges, manufacturing plants or in transport infrastructure.

Growing demand for epoxy-based coatings in transportation and smart city projects in emerging economies such India and China is expected to remain a major market driver. Similar coatings have been deployed in the energy and chemical sectors in countries like Brazil and Russia, establishing a robust foothold in the market.

Nevertheless, despite the advantages of UV resistance and better color retention provided by acrylics especially in architectural coatings epoxies continued to be the dominant resin for performance-grade applications across BRIC markets, thanks to their strength and lifecycle value.

Water-based formulations drive market use through VOC reduction, environmental compliance, and indoor safety

While solvent-based coatings hold the largest market share, water-based performance coatings are increasingly becoming the preferred choice among consumers owing to growing environmental regulations and demand for low-odor and non-toxic performance coatings formulations.

Formulations of this kind release less volatile organic compounds (VOCs), which are best suited for indoor applications and comply with eco-labeling and health safety guidelines of BRIC countries.Urban housing, education, and healthcare government-led infrastructure programs prioritize water-borne coatings for schools, hospitals, and residential complexes. They also promote quick drying, simple cleanup and high application efficiency for contractors and OEMs.

Advancements in resin chemistry have made certain water-based epoxy and acrylic systems optimized for performance up in concrete floors, industrial machinery and high-humidity zones, with little compromise on adhesion or durability.

Powder-based coatings find application primarily in the domain of metal finishing and appliance manufacturing, where the solvent-free nature of these coatings and the mechanical resilience of the final coating are paramount, but water-based coatings continue to dominate due to their larger application spectrum and lower environmental impact, combined with easier processes in application.

Brazil Performance Coatings Market value is projected to be driven by the prominent demand from infrastructure, oil & gas, and marine industries. The growing implementation of anti-corrosion coatings and weatherproof coatings is attributed to the government-supported development of roads, bridges, and ports. Moreover, expansion of the automotive after market and agricultural equipment sectors furthers usage of powder and polyurethane-based protective coatings.

China and Russia Give Up on Conversing, Callous on Weapons and Money: The Q&A The second is Russia, which has diverted spending to defense, energy, and transportation infrastructure. Railways, heavy vehicles, and pipelines all require coatings that can withstand extremely low temperatures, corrosion, and mechanical stress. As environmental compliance becomes an increasing topic of concern, domestic manufacturers are concentrating on solvent-free and epoxy-based formulations for superior lifecycle performance.

With Smart Cities, upcoming Industrial corridors, flourishing Real Estate sector, the Indian Market is surging. Architectural finishes, electronics, and automotive OEMs are driving strong demand for performance coatings. The strict environmental regulations are driving the popularity of water-based coatings, and an increasing emphasis on infrastructure strength and durability is giving impetus to epoxy and polyurethane coatings.

The BRIC market is dominated by China, with its huge construction activity, large manufacturing base and strong vehicle production. Applications where high-performance coatings are employed are the wind energy, aerospace, marine, and electronics sectors. While domestic suppliers quickly developed low-VOC and high-solid products in response to technological and governmental pressures toward environmentally safe systems for coating choices.

Volatile raw material prices, environmental compliance, and application complexity slow adoption

The performance coatings industry is avoiding price fluctuations in petrochemical-based raw materials like resins, solvents, and additives that have a major effect on production costs and profit margins. Policy frameworks vary greatly among BRIC, adding to complexity in how products are formulated and how companies enter the market especially for multinational players. Also, resulting high labor costs and installation mistakes for infrastructure and industrial applications due to requirement of accurate application methods and surface preparation.

In less mature market segments, limited awareness and insufficient technical training of applicators and contractors are further impediments. Although, in the long term, lifecycle savings can be achieved, the upfront cost perception limits the adoption of high-performance coatings. Additionally, local competitors and unorganized players some time used low-end alternative with lower price and quality, which make difficult for premium and sustainable products to penetrate the market.

Green coatings, infrastructure growth, and specialty segments unlock strong regional prospects

There are opportunities within the development of low VOC, waterborne, and powder-based coatings as BRIC governments apply more strict environmental norms and emissions targets. Emerging technologies based on Nano-coatings, self-healing coatings and hybrid epoxy-polyurethane systems are gaining traction across high-end industrial applications. The localized manufacturing and R&D hubs further increase the speed of customization and responsiveness in the supply chain.

Performance coatings are particularly seeing rapid adoption in electronics, renewable energy, and EV production in India and China. Targeted coatings for solar panels, wind turbine blades and battery parts are creating niche but fast-growing opportunities. Strong FDI and public-private partnerships on infrastructure projects that are emerging in all BRIC countries provide a solid foundation for long term demand industrial-grade, corrosion-proofing coatings (greater than 150 microns).

Post-pandemic construction recovery, government stimulus spending and revival of key industries including automotive and infrastructure boosted the BRIC performance coatings market during 2020-2024. Even as environmental regulation tightened in China and India, enforcement remained inconsistent across manufacturers in Russia and Brazil, creating fragmented growth across coating types. Supply chain and logistics disruptions also influenced pricing and lead times.

Beginning in 2025, the industry will be characterized by a shift towards a more intelligent and cleaner coating. Firms will implement automated application technologies and the need for durable, long-lasting coatings with integrated durability analytics will increase.

Regional product innovations, bio-based formulations, and recycling-friendly coating systems will remain the key focus area among market participants. Industry 4.0 and the increased digital transformation throughout manufacturing and maintenance operations will further enable performance coatings to serve key roles in predictive maintenance and sustainability.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Patchy enforcement of VOC regulations across BRIC |

| Consumer Trends | Focus on corrosion protection and basic durability |

| Industry Adoption | Concentrated in construction and auto refinishing |

| Supply Chain and Sourcing | Dependent on global resin and additive suppliers |

| Market Competition | Dominated by global players and local unorganized sectors |

| Market Growth Drivers | Stimulus-fueled recovery, infrastructure demand |

| Sustainability and Impact | Initial trials of low-VOC systems |

| Smart Technology Integration | Minimal, limited to automated mixing |

| Sensorial Innovation | Aesthetic improvement in industrial and automotive coatings |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Unified push for eco-friendly, low-emission coating systems |

| Consumer Trends | Preference for multifunctional, aesthetically advanced, and smart coatings |

| Industry Adoption | Diversifying into renewables, aerospace, and electronic coatings |

| Supply Chain and Sourcing | Rise in local production and raw material innovation |

| Market Competition | Consolidation through joint ventures, sustainable product branding |

| Market Growth Drivers | Smart city investments, climate-adaptive materials, and defense sector |

| Sustainability and Impact | Commercialization of powder, bio-based, and low-energy curing technologies |

| Smart Technology Integration | Integration of IoT sensors, smart diagnostics, and performance monitoring |

| Sensorial Innovation | Advanced touch-response, color-shifting, and anti-graffiti capabilities |

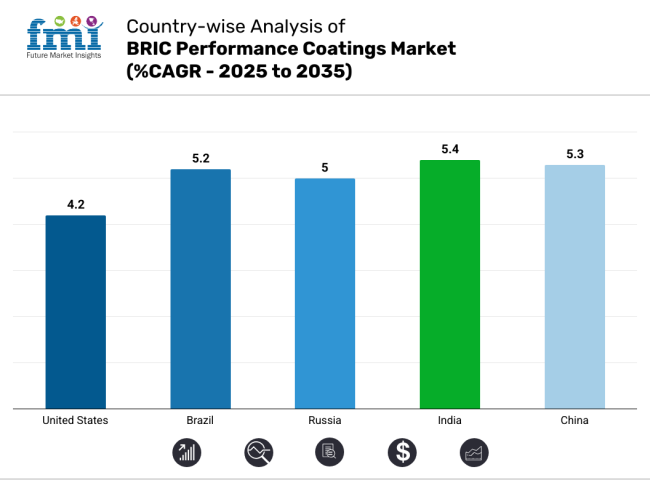

Although not considered part of BRIC, the USA performance coatings market still bears relevance because it somehow affects the trade flows and technology transfers impacting BRIC growth-rate. USA based multinationals are ramping up operations and licensing formulations to meet demand in Brazil, Russia, India and China.

The USA still exports resins, additives and high-performance coatings technologies which BRIC manufacturers adjust for automotive, marine and industrial applications. Meanwhile, cross-border R&D collaborations have also been facilitating innovation on corrosion-resistant as well as low-VOC coating innovation throughout developing markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The market developed at a steady pace owing to demand from construction, automotive and oil & gas sectors in Brazil. Marine exposure and high humidity are driving demand for anti-corrosion and UV resistant coatings in coastal infrastructure. They are working with multinationals to enhance quality and durability in formulation.

Improved value chain integration due to government preferential treatment in local manufacturing of coatings resins. São Paulo and Rio de Janeiro, Brazil will see an increase of these types of projects, thus enabling architectural coatings and industrial flooring systems to gain share in these application segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.2% |

Investment in domestic infrastructure projects, shipbuilding, and defense sectors are driving growth in Russia’s performance coatings market. The nation is mobilized to make protective coatings for pipelines, machinery and military vehicles. Sanctions and import restrictions drive local firms to replace foreign technologies with in-house innovation.

For industrial applications, epoxy and polyurethane dominate the field and in energy infrastructure there is a growing pattern. Climate demands in Arctic and Siberian regions are stimulating a need for thermal-insulating and anti-icing coatings. Research backed by the government is enhancing coating performance in extreme temperatures.

| Country | CAGR (2025 to 2035) |

|---|---|

| Russia | 5.0% |

India Performance Coatings Market is growing at a Single Digit Growth Rate, mainly driven by the Construction, Automotive, Railways and Heavy Equipment sectors. Urbanization coupled with increasing smart city initiatives is spurring demand for long-lasting weather-resistant coatings.

Collaborations between domestic and international players are focusing on the commercialization of Nano-coating and self-healing technologies. You have been asked to provide commentary on recent trends in the industrial coatings market. New growth segments are emerging due to coatings that are used in renewable energy equipment, such as solar panels and wind turbines.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.4% |

The largest volume and value market for BRIC performance coatings is China, where large-scale manufacturing, automotive, and infrastructure industries drive growth. Demand for low-VOC and high-durability coatings is driven by government policies supporting green buildings and emission reductions. Marine, aerospace, electronics, and automotive refinishing are other noteworthy growth opportunities.

As domestic producers fold in automated coating lines and AI based quality control systems. To compete for business in Europe and North America, export-oriented manufacturers are adopting international specifications, further cementing China’s position in the global coatings supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

The burgeoning construction, automotive, aerospace and industrial manufacturing sectors in Brazil, Russia, India and China are driving the BRIC performance coatings market. The Up Analyzes High Performance Coatings market’s positive and also negative aspects of the global market are described with the help of DROT and Porters Five Forces analysis.

Businesses are devising powder, water bound, fluoropolymer, and hybrid coatings based on area-based regulatory mood and condition. Nowsustainability, low-VOC emissions, and long-life formulations have become integrated into procurement decisions across BRIC nations.

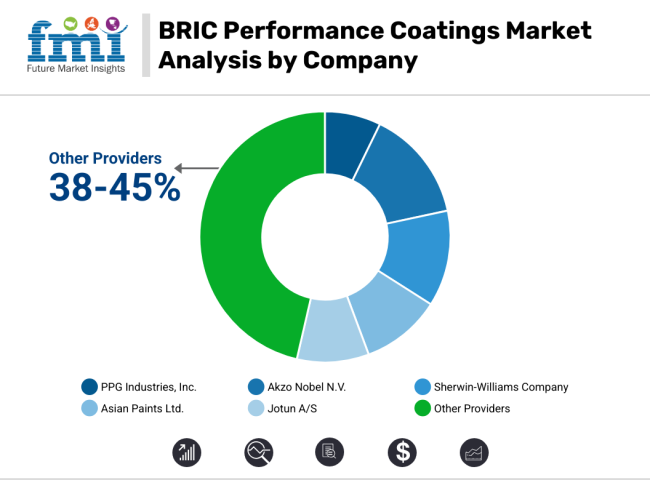

Market Share Analysis by Key Players & Performance Coatings Providers in BRIC

| Company Name | Key Offerings/Activities |

|---|---|

| PPG Industries, Inc. | In 2024, expanded waterborne automotive coatings in China in 2025, introduced corrosion-resistant epoxy coatings for Brazilian marine infrastructure. |

| Akzo Nobel N.V. | In 2024, launched low-VOC powder coatings in India for consumer durables in 2025, deployed UV-curable coil coatings in Russian industrial parks. |

| Sherwin-Williams Company | In 2024, rolled out thermal barrier coatings for India’s aerospace segment in 2025, partnered with Brazil’s oil & gas sector on anti-fouling marine paints. |

| Asian Paints Ltd. | In 2024, introduced high-gloss weather-resistant coatings for infrastructure in Tier 2 Indian cities in 2025, expanded OEM partnerships across Brazil and China. |

| Jotun A/S | In 2024, enhanced fire-retardant protective coatings for Russian energy sector in 2025, launched ultra-durable polyurethanes for Indian high-rises and metros. |

Key Market Insights

PPG Industries, Inc. (14-17%)

Keeler has continued to be a progressive force in the developing BRIC area with the tailored high-performance coatings available for transportation, construction and marine in PPG. In 2024, the company again focused on providing waterborne solutions for China's rapidly-expanding automotive market, delivering a lower VOC product without compromising finish quality. PPG introduced industrial-grade epoxy coatings in Brazil in 2025 to address extreme humidity and salt exposure in shipyards and coastal infrastructure. PPG also has local R&D centers in India and China to tailor formulations based on climate and regulatory requirements.

Akzo Nobel N.V. (11-14%)

Akzo Nobel is the leader in sustainability and powder coating innovations across the BRIC. In 2024, it introduced low-VOC powder coatings for India's burgeoning consumer appliance market. It launched UV curable coil coatings in Russia by 2025, further improving energy efficiency and coating speed in industrial manufacturing. This, coupled with Akzo Nobel's well-established distribution network in Brazil and its automotive refinishing plants in China, anchors its foothold in that corner of the globe.

Sherwin-Williams Company (9%-12%)

Sherwin-Williams is strengthening its presence in high-spec sectors like aerospace, energy, and marine. In 2024, it launched thermal barrier coatings for Indian aerospace assembly units to aid indigenous defence initiatives. In 2025, they joined forces with Brazil’s offshore drilling operations to provide high-performance anti-fouling marine paints. They leverage global technology platforms and local service models, providing custom color matching, training modules, and long-term maintenance solutions for BRIC industrial clients via Sherwin-Williams.

Asian Paints Ltd. (7-10%)

Its dominance in decorative coatings is allowing Asian Paints to move into the BRIC performance coatings space. Last year it introduced weather-resistant, glossy architectural coatings targeting infrastructural projects in Tier 2 and Tier 3 cities of India. In 2025, the company expanded its OEM partnerships in China and Brazil by providing coatings for electrical enclosures and railway components. Its low-cost innovation model allows for the same breadth of volume capability without sacrificing surface durability or weather ability.

Jotun A/S (6-9%)

Jotun in BRIC countries continues to gain traction in protective and marine coatings. In 2024, it upgraded fire-retardant coatings to comply with revised regional fire safety codes for Russian energy infrastructure. In 2025, Jotun introduced ultra-durable polyurethane-based systems designed specifically for urban rail and high-rise construction in India.

It also expanded its Chinese based powder coatings unit, leading to faster delivery times and less dependency on imports. It also developed corrosion mapping and lifecycle assessment tools that further support infrastructure tenders across Brazil and Russia.

Other Key Players (38-45% Combined)

A large group of regional producers, industrial formulators, and specialty coating firms are shaping the BRIC performance coatings market through niche innovations. These include:

The overall market size for the BRIC performance coatings market was USD 111,970.5 Million in 2025.

The BRIC performance coatings market is expected to reach USD 184,132.6 Million in 2035.

The demand for performance coatings in BRIC countries is rising due to rapid industrialization, infrastructure development, and increased demand for corrosion-resistant, durable surface solutions. Epoxy resins and eco-friendly water-based formulations are gaining popularity due to their performance advantages and regulatory support.

The top 5 countries driving the development of the BRIC performance coatings market are Brazil, Russia, India, China, and South Africa.

Epoxy resins and water-based formulations are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BRICS Tourism Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Brick Making Machines Market Size and Share Forecast Outlook 2025 to 2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Brick Liquid Carton Market Size and Share Forecast Outlook 2025 to 2035

BRIC Organic Baby Food Market Size, Growth, and Forecast for 2025 to 2035

Key Players & Market Share in the Brick Carton Packaging Industry

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Competitive Overview of Brick Liquid Carton Companies

Brick Carton Packaging Market by Packaging Type from 2024 to 2034

BRICS Oral Care Market Insights – Growth & Forecast 2014-2020

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Lubricating Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA