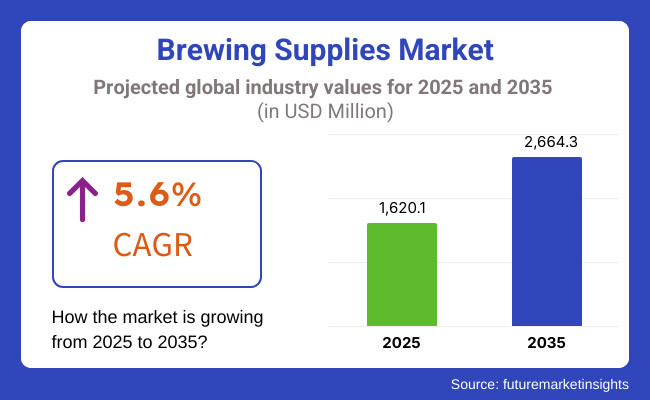

The brewing supplies market is anticipated to be valued at USD 1,620.1 million in 2025. It is expected to grow at a CAGR of 5.6% during the forecast period and reach a value of USD 2,664.3 million in 2035.

As a result of increasing craft beer production, expanding microbreweries, and demand for premium beer varieties, the global brewing supplies market had a good run in 2024. Supply chain disruptions continued into the new year with many disturbances. However, manufacturers adapted themselves to strengthen local sources and optimize logistics.

Constantly changing raw material prices with hops and malt at the center of them forced breweries to readjust their pricing and procurement strategies, thus triggering the use of alternative ingredients and novel techniques of brewing for profitability.

Craft lagers are at the forefront of brewing trends, driving demand for specialized fermentation and maturation units. Many breweries began to diversify their offerings, including hybrid beer styles and limited releases, to reel in consumer interest. Sustainability was given a much larger focus in capital investments into energy-efficient brewing systems, waste reduction technologies, and carbon footprint reduction strategies.

On the other hand, the booming direct-to-consumer, particularly e-commerce, channel was a boon for homebrew activity, with Asia and the Pacific being the hotbed. Homebrew kits and small-scale equipment were in much demand as more and more consumers began experimenting with craft beer production at home.

In 2025, premiumization, sustainability, and automation are likely to be the primary focuses for breweries. There will be continued high demand for India Pale Ales (IPAs) and innovative beer styles, while hybrid beer categories are also expected to grow.

Larger breweries will invest in AI-based brewing techniques and data analytics to optimize production efficiency. Joint projects by the breweries with the local communities will include purpose-driven beer releases and are expected to shape consumer preferences and market dynamics further.

Future Market Insights (FMI) recently conducted a comprehensive survey with key stakeholders in the market, including brewing equipment manufacturers, raw material suppliers, microbrewery owners, and industry regulators. The study aimed to assess market trends, challenges, and future opportunities in the sector. A significant finding was the growing emphasis on automation and AI-driven brewing techniques, with over 60% of respondents indicating plans to integrate smart brewing systems to optimize production efficiency and reduce operational costs.

Another key insight from the survey was the increasing shift toward sustainable brewing solutions. More than 70% of brewers highlighted their focus on water conservation, energy-efficient brewing equipment, and waste reduction strategies. Many breweries are investing in solar-powered brewing units and CO₂ recovery systems to meet regulatory requirements and align with consumer demand for environmentally responsible brewing practices.

The survey also revealed that fluctuating raw material costs remains a major challenge for brewers. Over 50% of respondents reported difficulties in sourcing high-quality malt and hops due to supply chain disruptions and climate-related agricultural issues. To counteract this, breweries are exploring alternative ingredients, local sourcing, and contract farming agreements to stabilize supply chains and maintain product consistency.

Looking ahead, industry stakeholders expressed optimism about market growth, with 85% predicting an increase in consumer demand for craft and premium beers over the next decade. The survey highlighted the potential of e-commerce and direct-to-consumer sales channels, with small and medium breweries actively expanding their digital presence to tap into new customer segments.

Brewing Supplies Market Evaluation: 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth, impacted by pandemic-related disruptions in 2020 to 2021, followed by recovery and expansion due to rising craft beer consumption. | Steady expansion with a strong CAGR, driven by increased investments in automation, sustainability, and premium beer categories. |

| Increased demand for craft beer, premiumization, and homebrewing, especially in North America and Europe. | Greater focus on sustainability, AI-driven brewing, health-conscious beer varieties, and hybrid beer styles. |

| Supply chain disruptions due to COVID-19, raw material shortages, and rising logistics costs. | Improved supply chain resilience with localized ingredient sourcing, advanced logistics management, and digital tracking. |

| Gradual adoption of brewing automation, filtration advancements, and smart monitoring systems. | Widespread adoption of AI, IoT-enabled brewing, CO₂ recovery systems, and sustainable brewing technologies. |

| There is a growing emphasis on sustainability, but adoption remains limited due to high costs. | Stringent environmental regulations driving breweries to implement energy-efficient systems and waste reduction strategies. |

| Dominated by established players, craft breweries are gaining traction. Mergers and acquisitions occurred but at a moderate pace. | Increased consolidation, with large companies acquiring niche players. Partnerships in AI and biotech to enhance brewing processes. |

| North America and Europe led in craft brewing, while Asia-Pacific saw rising homebrewing trends. | Asia-Pacific and Latin America will witness the highest growth due to a growing middle class and increased urbanization. |

| There is a surge in homebrewing during pandemic lockdowns, with direct-to-consumer models gaining importance. | Continued growth in homebrewing, fueled by e-commerce, DIY brewing kits, and personalized brewing experiences. |

Fermentation units are the most critical part of the brewing process, where yeast converts sugars into alcohol and carbon dioxide. With the growing demand for craft beers and experimental brews, breweries are investing in advanced fermentation tanks with precise temperature and pressure control to ensure flavor consistency and efficiency.

The rising trend of small-batch brewing and premiumization is driving the adoption of customized fermentation units. Breweries are opting for stainless steel fermenters with improved oxygen control to maintain beer quality. Additionally, automated monitoring systems are gaining traction, helping brewers optimize yeast performance and prevent contamination during fermentation.

The commercial brewing sector dominates the market, driven by the rising demand for craft and premium beer varieties. Large-scale breweries are adopting advanced brewing automation systems to increase production efficiency. AI-driven analytics are being used to monitor fermentation and filtration processes, ensuring optimal output with minimal resource wastage.

Sustainability is a key focus area for commercial brewers, with initiatives such as CO₂ recapture systems and solar-powered brewing facilities gaining momentum. The adoption of high-efficiency brewing equipment is helping breweries lower operational costs while meeting stringent environmental regulations. Innovations in hop dosing and yeast propagation are further refining beer quality.

The nano and microbrewery segment is thriving, fueled by the craft beer revolution and local consumer demand for unique, small-batch brews. These breweries are increasingly investing in compact, multi-functional brewing systems to maximize efficiency in limited spaces while maintaining high-quality output.

Direct-to-consumer sales via taprooms and e-commerce platforms are driving market expansion. Many microbreweries are adopting sustainable brewing practices, such as on-site wastewater treatment and energy-efficient equipment. Experimentation with alternative grains and unconventional fermentation techniques is helping microbreweries carve a niche in the competitive beer landscape.

The USA remains one of the most lucrative, driven by a strong craft beer culture and a growing homebrewing community. The country houses some of the largest brewing equipment manufacturers and ingredient suppliers. Additionally, sustainability initiatives, such as carbon footprint reduction and energy-efficient brewing, are influencing equipment purchases and brewing techniques. The rise of AI-driven brewing automation is also gaining traction among large-scale breweries.

The UK market is witnessing a resurgence in craft breweries despite economic uncertainties. Consumers are increasingly opting for premium and experimental beer styles, driving demand for advanced brewing equipment and specialty ingredients. Government policies supporting small breweries, coupled with the growth of e-commerce beer sales, have encouraged new investments in brewing technology and homebrewing kits.

France’s craft beer market is expanding as artisanal beer consumption rises alongside the country’s traditional wine industry. A shift toward organic and locally sourced ingredients is boosting demand for sustainable brewing equipment. Microbreweries are focusing on unique flavors, such as farmhouse ales and bières de garde, requiring specialized fermentation and maturation solutions. The country is also seeing growing investments in eco-friendly brewing technologies.

Germany remains a dominant force in the brewing industry, with a strong emphasis on traditional brewing methods adhering to the Reinheitsgebot (Beer Purity Law). The market is driven by high demand for precision brewing equipment, including fermentation tanks and filtration systems. The rise of craft lagers and hybrid beer styles is pushing manufacturers to develop innovative brewing solutions while maintaining adherence to traditional quality standards.

Italy's craft beer movement is gaining momentum, with increased investments in small-scale and artisanal brewing operations. Breweries are exploring hybrid beer styles, often incorporating regional ingredients such as chestnuts, grapes, and local herbs. Demand for automated brewing systems is growing as breweries scale operations. Sustainable brewing practices, including water recycling and CO₂ recovery, are also becoming key investment areas.

South Korea is expanding rapidly, fueled by the rising popularity of craft beer among younger consumers. An increasing number of independent breweries and brewpubs characterize the market. South Korean breweries are adopting high-efficiency brewing equipment and experimenting with fusion beer styles that incorporate traditional Korean ingredients like rice, ginseng, and persimmons.

Japan’s brewing industry continues to balance its strong traditional beer market with the rising craft beer movement. Precision brewing equipment is in high demand as brewers focus on quality and consistency. Japanese breweries are also leading in sustainable brewing practices, with a focus on energy-efficient brewing and waste reduction. The growth of low-alcohol and non-alcoholic craft beer is influencing brewing equipment trends.

China is one of the fastest-growing markets for brewing supplies, driven by a booming craft beer sector and increasing disposable income. Local breweries are investing heavily in advanced brewing technologies, fermentation tanks, and automated systems to meet rising demand. Government regulations on alcohol production and quality control are shaping market dynamics, while premiumization trends drive demand for high-end brewing equipment.

Government policies play a crucial role in shaping the market, affecting everything from production standards and ingredient sourcing to sustainability requirements and taxation. Several countries have introduced strict regulations related to alcohol production, environmental sustainability, and health safety, influencing how breweries operate and procure supplies.

| Countries | Regulation & Impact on the Market |

|---|---|

| United States | The Alcohol and Tobacco Tax and Trade Bureau (TTB) enforces regulations on beer labeling, taxation, and ingredient disclosures. Strict environmental laws promote water conservation and waste management in brewing. |

| Canada | The Excise Act of 2001 governs beer production, imposing taxes based on alcohol content. Stringent sustainability mandates encourage breweries to adopt energy-efficient brewing systems. |

| Germany | The Beer Purity Law (Reinheitsgebot) limits beer ingredients to water, barley, hops, and yeast, restricting ingredient innovation but ensuring quality. The country also enforces carbon footprint reduction policies for breweries. |

| United Kingdom | The Alcohol Duty Reform (2023) changed taxation based on alcohol strength, impacting pricing. The government also promotes circular economy practices, requiring breweries to use recyclable packaging. |

| Australia | The Excise Tariff Act of 1921 imposed a tiered taxation system based on a production scale, favoring small breweries. Water efficiency laws impact brewing processes, leading to increased investment in wastewater recycling. |

| China | The Food Safety Law mandates strict quality controls for brewing ingredients. Recent regulations promote domestic sourcing of hops and malt, affecting global supply chains. |

| India | Alcohol is regulated at the state level, with varying excise duties. Some states impose production quotas and distribution restrictions, creating significant barriers for new breweries to scale operations. |

| Brazil | The National Environment Council (CONAMA) enforces waste disposal regulations, compelling breweries to adopt eco-friendly production methods. |

Growth Opportunities

Expansion of Smart Brewing Technology

The brewing industry is rapidly adopting automation and AI-driven systems for enhanced efficiency and consistency. Smart brewing solutions, such as IoT-enabled monitoring systems and automated fermentation control, present a lucrative opportunity for manufacturers to cater to breweries looking to optimize production and maintain quality.

Growth in the Home Brewing Segment

The rising popularity of homebrewing, particularly in North America and Europe, is driving demand for compact brewing equipment and DIY kits. Companies that introduce user-friendly, affordable, and high-tech brewing systems will be well-positioned to capture this expanding consumer base.

Emerging Markets in Asia-Pacific

Countries like China, India, and Japan are witnessing a surge in microbreweries and craft beer consumption, fueling demand for high-quality brewing supplies. Companies must strengthen their supply chains, establish local partnerships, and tailor marketing strategies to gain traction in these fast-growing regions.

Strategic Recommendations

Focus on Digital Transformation

Manufacturers should prioritize R&D in digital brewing equipment, incorporating AI-driven analytics, cloud connectivity, and automated brewing systems to enhance process efficiency and attract tech-savvy brewers.

Enhance Product Affordability and Accessibility

Balancing affordability with quality will be crucial for expanding in both premium and budget segments. Introducing cost-effective brewing solutions for small-scale breweries and homebrewers can unlock new revenue streams.

Expand Distribution via E-Commerce & Direct-to-Consumer Sales

Investing in online sales platforms and direct-to-consumer strategies can improve accessibility, particularly in emerging markets where e-commerce adoption is on the rise.

The brewing supplies market is part of the food and beverage processing equipment industry, which falls under the manufacturing and consumer goods sector. Its growth is influenced by factors such as disposable income, consumer spending on alcoholic beverages, and advancements in brewing technology. Trade policies, agricultural commodity prices, and sustainability regulations also play a key role in shaping the market.

In recent years, the market has expanded due to the rising popularity of craft beer and premium alcoholic beverages, especially in North America and Europe. Emerging markets like China, India, and Brazil are also contributing to growth as urbanization and middle-class expansion drive demand for high-quality brewing supplies. However, challenges such as raw material price fluctuations, supply chain disruptions, and inflation have impacted manufacturers.

Looking ahead, economic growth in developing nations will create new opportunities for brewing equipment makers. Breweries are expected to prioritize energy efficiency and eco-friendly production methods due to tightening environmental regulations. AI-driven automation and IoT-enabled brewing systems will improve efficiency and cost-effectiveness. As global beer consumption shifts and consumer preferences evolve, taxation policies, trade agreements, and labor market conditions will continue to shape the long-term trajectory of the brewing supplies industry.

The brewing supplies market remains competitive, with leading companies leveraging advanced brewing technology, sustainability initiatives, and automation to strengthen their market positions. The industry is driven by demand from craft breweries, large-scale commercial brewers, and homebrewing enthusiasts worldwide.

GEA Group (~12.5%)

GEA Group dominates the market with its cutting-edge brewing systems and automation solutions. Its expertise in large-scale brewing operations, energy-efficient systems, and filtration technologies secures its market leadership in global markets.

Paul Mueller (~9.8%)

Paul Mueller specializes in stainless steel brewing tanks, fermentation vessels, and cooling solutions. Its strong reputation for high-quality equipment and durability makes it a key supplier for breweries of all sizes.

Alfa Laval (~8.3%)

Alfa Laval is a major player in brewing filtration and separation technologies. Its expertise in improving brewing efficiency, reducing energy consumption, and optimizing yield helps commercial brewers achieve cost-effective operations.

Della Toffola (~7.6%)

Della Toffola is known for its advanced filtration systems and turnkey brewing solutions. The company is expanding into automated brewing technology, catering to growing demand from mid-sized breweries.

Kaspar Schulz (~6.9%)

Kaspar Schulz is a leader in traditional German brewing equipment, supplying premium systems to craft and heritage breweries. Its reputation for craftsmanship and high-quality brewing vessels strengthens its position in the European market.

Criveller Group (~5.8%)

Criveller Group provides custom brewery setups and fermentation tanks tailored to craft brewers. Its ability to offer modular brewing solutions makes it a preferred choice for small and medium-sized breweries.

Hypro Group (~5.2%)

Hypro Group focuses on sustainability-driven brewing solutions, including CO₂ recovery systems and energy-efficient brewing equipment. Its eco-friendly approach is gaining traction among environmentally conscious brewers.

Micet Group (~4.6%)

Micet Group has a strong presence in the craft brewing segment, providing small-scale brewers with high-quality brewing systems. Its growing footprint in North America and Asia-Pacific makes it a key emerging player.

Brewtech Tiantai (~4.1%)

Brewtech Tiantai specializes in homebrewing kits and microbrewery solutions. Its affordability and ability to customize equipment make it a popular choice among aspiring brewers.

Others (~35.2%)

A diverse range of small-scale manufacturers and regional suppliers make up the remaining market share. Many startups are introducing AI-driven brewing solutions and IoT-enabled equipment, particularly in North America and Asia-Pacific, to meet evolving industry needs.

Key Developments

The market is segmented by product type into fermentation unit, brew house unit, filtration system, maturation unit, and others.

Based on application, the market is segmented into commercial purpose and industrial purpose.

The market is segmented based on category, including nano/microbrewery and macro/industrial brewery.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The demand for brewing supplies is driven by the rise in craft beer popularity, growing homebrewing interest, and advancements in brewing technology.

Fermentation units, brewhouse equipment, and filtration systems are the most adopted.

Regulations on food safety, alcohol production, and environmental sustainability are influencing the standards and practices in brewing equipment manufacturing.

Asia-Pacific, particularly China, Japan, and South Korea is seeing rapid growth in brewing equipment adoption due to the rise in microbreweries.

Key innovations include the integration of automation, IoT-enabled systems, and sustainable brewing practices like CO₂ recovery and energy efficiency.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Category, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Category, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Category, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Category, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Category, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Category, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Category, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Category, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Category, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018-2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018-2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018-2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 18: Global Market Volume (MT) Analysis by Category, 2018-2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Category, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Category, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018-2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018-2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 42: North America Market Volume (MT) Analysis by Category, 2018-2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Category, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Category, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018-2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018-2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 66: Latin America Market Volume (MT) Analysis by Category, 2018-2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Category, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Category, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018-2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018-2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 90: Europe Market Volume (MT) Analysis by Category, 2018-2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Category, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Category, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018-2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2018-2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 114: East Asia Market Volume (MT) Analysis by Category, 2018-2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Category, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Category, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018-2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2018-2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 138: South Asia Market Volume (MT) Analysis by Category, 2018-2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Category, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Category, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018-2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2018-2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 162: Oceania Market Volume (MT) Analysis by Category, 2018-2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Category, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Category, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018-2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2018-2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018-2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 182: MEA Market Volume (MT) Analysis by Application, 2018-2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Category, 2018-2033

Figure 186: MEA Market Volume (MT) Analysis by Category, 2018-2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by Category, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brewing Thermometer Market Size, Growth, and Forecast 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Brewing Chiller Market Trend Analysis Based on Type, Application, End-User, and Region 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Beer Brewing Machine Market

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Brewing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Moving Supplies Market Analysis - Growth & Demand 2025 to 2035

Key Players & Market Share in the Dental Supplies Industry

Medical Supplies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA