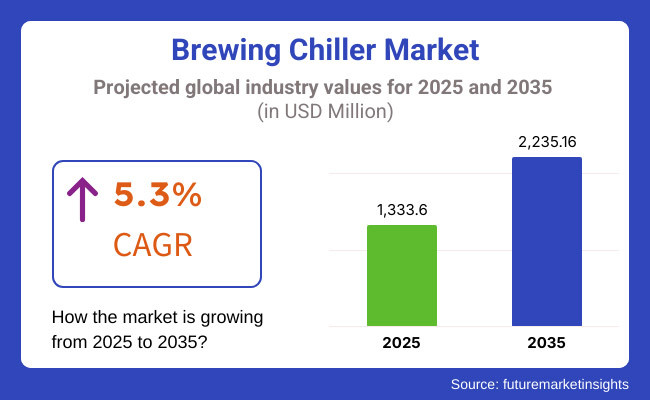

The brewing chiller industry globally is forecast to expand with a consistent CAGR of 5.3% during 2025 to 2035. The market is anticipated to grow from USD 1,333.6 million in 2025 to USD 2,235.16 million by 2035. The mounting demand for craft beer, in addition to growth in microbreweries and nano-breweries globally, is driving high-performance brewing chiller demand.

Effective temperature regulation is essential in ensuring beer quality, prompting producers to create efficient cooling systems. Glimpsing back to 2024, the brewing chiller industry witnessed a notable growth led by the rising number of investments in the craft brewing sector and the propagation of brewery activities globally.

Advancements in brewing methods, including special beer flavors and environmentally friendly brewing processes also shaped the industry landscape. As industry is heading into 2025 and beyond, industry growth will be penetrated with the firms’ prime target on energy-saving and eco-friendly refrigeration solutions to execute seamless activities.

The rising demand for high-quality, flavored, and specialty beers will encourage breweries to invest in state-of-the-art brewing chillers to maintain product consistency. Technological developments like automated cooling systems and intelligent monitoring solutions will are the most anticipated contributors to improving the efficiency of the brewing process. Increased focus on limiting energy consumption and carbon emissions will also prompt manufacturers to adopt eco-friendly chiller solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for craft beer, growth of microbreweries, and temperature control necessitated industry expansion. | Expanding craft breweries, growing demand for new flavors, and green brewing technologies will be the drivers for growth. |

| Breweries used conventional cooling systems that were moderately energy efficient. | Take-up of energy-efficient chillers, automated coolers, and intelligent monitoring devices will rise. |

| North America and Europe experienced the most robust growth due to the craft beer phenomenon. | Asia-Pacific and Latin America are likely to be the emerging regions for growth. |

| Premium craft beer and small batches were in favor among consumers. | Low-alcohol, flavored, and specialty varieties of beer will see increased demand. |

| Hospitality companies and beverage brands partnered with big breweries to roll out specialty beers. | Higher investments in R&D, mergers, and acquisitions will propel consolidation in the industry. |

| Sustainability was minimal, with few breweries using environmentally friendly cooling systems. | Breweries will emphasize green power, carbon emissions reduction, and recyclable cooling systems. |

The brewing chiller industry comes under the food and beverage processing equipment market's industrial refrigeration and brewery equipment segment. The industry is propelled by the macroeconomic factors including trends in global beer manufacturing, fluctuating levels of disposable income, energy efficiency standards, and advancements in industrial cooling technology.

From the perspective of global economic, the surging need for specialty drinks and craft beer has escalated investments in nanobreweries and microbreweries, particularly in emerging sectors of North America, Europe, and Asia-Pacific. The beer culture is gaining traction rapidly in countries like United States, Germany, and China making them the dominant players of the sector.

Additionally, the increasing rate of disposable incomes of consumers is propelling the shift towards premium and craft beer brands, encouraging the breweries to invest more in cost-effective cooling systems to preserve the product quality.

Furthermore, factors like energy efficiency standards and sustainability objectives impact the industry. Governments globally are enforcing stringent framework for energy usage, compelling manufacturers and breweries to incorporate greener and budget-friendly chiller solutions.

Increasing electricity expensed and carbon emissions concerns are prompting producers to engage in power-saving and highly efficient cooling items. Moving forward in the future, economic factors like inflation, trade policies, and supply chain stability will most likely impact industry landscape. Nonetheless, the continuous innovation in brewing technology and automation will accelerate steady industry expansion over the next decade.

The industry for brewing chillers comprises different cooling systems that are created to address the unique requirements of breweries. Air-cooled chillers are increasingly popular because they are easy to install, have low maintenance requirements, and are not dependent on water sources.

They are most preferred by breweries in areas experiencing water shortages. With increasing sustainability issues, air-cooled systems are likely to become more efficient and popular. Scroll chillers will continue to be in demand because they are compact, quiet, and offer constant performance.

Mid-sized and small breweries opt for them because they are economical and use minimal energy. Screw chillers, on the other hand, will become popular among large breweries because they are efficient while cooling high loads. The chiller is suited for businesses that need to increase production without sacrificing cooling capacity.

Reciprocating chillers will continue to find application in breweries that need flexibility under changing load conditions. Water-cooled chillers will continue to have a stronghold in large breweries where stable, heavy cooling is needed. Shell and tube, plate and frame, and glycol-cooled systems will be vital for achieving strict temperature control in craft and specialty beer making. Manufacturers will turn to innovations in energy-efficient refrigerant and environmentally friendly cooling technologies as breweries move toward sustainability.

Brew chillers are utilized mainly in brewing beer, for which temperature is the key in fermentation and aging. With an increase in consumption of beer all over the world, breweries will be investing in sophisticated chillers to provide uniform flavor and taste. Increased popularity of craft and specialty beers will also lead to demand for custom and highly effective cooling systems.

Breweries will look more and more towards precise chilling to achieve production efficiency as well as consumers' expectations. Wine making is another major application sector where brewing chillers are increasingly becoming relevant. Winemakers depend on accurate temperature management during fermentation and aging to keep the aroma and flavor of wines intact.

With the increasing demand for premium wines, wineries will invest in high-end chillers that ensure the best conditions for red as well as white wines. The trend towards automated cooling systems in wineries will also increase the demand for advanced chillers. The "others" segment comprises drinks like cider, kombucha, and specialty alcohol beverages.

With more and more beverage companies exploring innovative flavors, the demand for efficient cooling systems is on the rise. Several new-generation beverage brands are shifting towards sustainable brewing methods, and this will spur the demand for energy-efficient chillers. Since consumers are on the lookout for innovative drinks, brewing chillers will continue to play a pivotal role in product quality and stability.

Bars will remain an important end user for brewing chillers, especially as the consumption of fresh craft beer increases. Bars are using microbreweries or partnering with neighborhood craft breweries, generating a need for compact and efficient chillers. With higher consumer demand for freshly brewed beers and specialty brews, bars will make purchases of high-capacity chillers to preserve the quality of their products.

Restaurants are increasing their drinks portfolios, with others now offering premium craft beers and wines. Upscale restaurants and theme restaurants are adding small-batch brewing facilities, which demand sophisticated cooling solutions. Restaurant owners wishing to stand out with out-of-the-ordinary drink menus will lean on brewing chillers more than ever to better store and serve drinks.

Increased focus on drink pairings in upscale dining will also drive demand for consistent cooling systems. Breweries will continue to be the largest consumers of brewing chillers. Large-scale brewery operations are also emphasizing automation and sustainability, increasing demand for efficient chillers in terms of energy.

Microbreweries and craft breweries are growing as well, which will put more pressure on compact and precise cooling systems. As breweries need to ensure that they have high-quality production processes, they will keep investing in sophisticated chilling technology to maximize brewing efficiency and achieve consistency.

The United States is anticipated to maintain its dominance in the brewing chiller industry over the forecast period. The country is projected to contribute almost 35% of the global industry revenue, due to its established brewery sector and the expanding craft beer culture.

The rise in microbreweries and brewpubs is one of the most important drivers for industry growth. Consumers’ high preference for locally brewed craft beers, further compel brew makers to invest in refined chilling systems to ensure consistency and flavor in the product.

Another major rising concern in the USA, brewing sector is the rising focus towards sustainability. Breweries are integrating energy-efficient and eco-friendly chiller systems to cut down the operating costs and cater to rigid environmental regulations. With the increasing cost of electricity and water, the demand for air-cooled and glycol-cooled chillers is also booming.

The USA industry is also witnessing significant technological advancements. Brewers and manufacturers are adopting smart temperature balancing systems and automation to improve efficiency and reduce energy utilization.

The brewing chiller industry in the United Kingdom is set to grow by a CAGR of 6.4% during the forecast period of 2025 to 2035. The need for premium and craft beers has been driving growth in microbreweries and special brewing facilities around the country.

People are going for distinctive flavor and locally manufactured beverages, inspiring small and medium breweries to opt for quality brew chillers that help in the control and standardization of temperatures. Sustainability is now a top priority for breweries in the UK Government campaigns encouraging energy efficiency are prompting breweries to implement green chiller systems.

Glycol-cooled and water-cooled chillers are in increasing demand because of their ability to save water usage without compromising on precise cooling temperatures. The industry is experiencing a transition toward low-alcohol and non-alcoholic craft beers, which need sophisticated chilling solutions for exacting fermentation control.

Germany, which boasts an illustrious culture of beer brewing and stringent brewery customs, continues to be at the forefront in the brewing chiller industry. Germany's tradition of upholding the Reinheitsgebot (German Beer Purity Law) dictates the requirement for sophisticated cooling solutions to provide the best of brewery standards.

While large brewery manufacturers and small brewpub owners are increasing in size, purchases in effective brew chillers are poised to augment. Germany's brewing sector is also impacted by the increasing popularity of specialty beers and craft beers.

Germany's energy efficiency policies are forcing breweries to embrace eco-friendly refrigeration technologies. With increasing awareness of carbon emissions, breweries are turning towards low-energy chillers and CO₂-based refrigeration systems. High-tech automation and digital monitoring systems are also gaining ground, enabling breweries to maximize cooling operations and minimize waste.

South Korea's chiller industry for brewing is growing as the craft beer trend picks up pace. The South Korean beer industry, which has been historically controlled by big commercial breweries, is being led by a surge of independent craft breweries and brewpubs.

Consumers are increasingly preferring unique and locally brewed beer varieties, creating the need for highly specialized brewing equipment, including sophisticated chilling systems. South Korea's tropical climate requires extremely efficient cooling systems for brewing processes. Water-cooled and glycol-cooled chillers are popular because they can control exact temperatures under changing environmental conditions.

The nation is also witnessing growth in smart and automated brewing chillers, allowing brewers to remotely monitor and control cooling parameters. Government policies encouraging energy-efficient industrial machinery are also fueling the use of environmentally friendly brewing chillers.

Japan's beer chiller industry is gaining from the growing popularity of craft beer and premium lagers. Although traditional big commercial breweries still lead, the craft beer category is growing fast, especially in urban areas such as Tokyo, Osaka, and Kyoto.

Consumers are acquiring taste for specialty and small-batch beers, offering breweries the incentive to invest in high-quality chilling equipment to maintain precise fermentation and storage. Japanese breweries also place high value on precision brewing and quality, so sophisticated temperature control systems are a requirement.

Plate and frame chillers as well as glycol chillers are extensively employed for achieving precise cooling conditions. The other major force driving the demand for brewing chillers that are efficient and space-saving is joint ventures by breweries and restaurants for promoting limited-release craft beers. As the Japanese craft brewing industry develops, it will remain crucial to invest in efficient, high-performance cooling systems.

China's emerging chiller industry for brewing is forecast to register a CAGR of 5.8% between 2025 and 2035, spurred by the high growth of the craft beer sector and increasing disposable incomes. Though large-scale commercial breweries control the industry, craft beer is getting recognized among urban consumers who want premium and specialty beer flavors.

Glycol-cooled and water-cooled chillers are used in large-scale brewing plants, while small craft breweries are spending on small, green cooling systems. International craft beer brands are also entering the Chinese industry, driving competition and prompting local breweries to enhance their production processes.

The expanding e-commerce industry is also affecting beer sales, with breweries investing in top-quality chilling systems to ensure freshness during storage and distribution. As China's brewing industry further modernizes, the need for technologically enhanced and energy-saving brewing chillers will further increase.

India's brewing chiller industry is expected to grow at a CAGR of 6.0% between 2025 and 2035, fueled by the quick growth of microbreweries and an emerging craft beer culture. With urban consumers demanding premium and flavored beers, breweries are putting money into effective cooling systems to ensure quality and consistency.

Growth in brewpubs and specialty beer brands in cities such as Bangalore, Mumbai, and Delhi is driving demand for sophisticated brewing chillers. The Indian government's emphasis on sustainability and energy conservation is influencing breweries to embrace environmentally friendly and energy-efficient cooling systems.

The growing number of partnerships between Indian breweries and global brands is also fueling the need for high-performance brewing chillers. With the growth of the beer industry, breweries will continue to invest in automated and intelligent temperature control systems to increase production efficiency. The industry will experience continued growth as craft beer consumption increases and breweries adopt sophisticated cooling technologies.

Future Market Insights (FMI) carried out a recent survey of stakeholders in the brewing chiller industry, and it provided a meaningful insight into future growth opportunities, challenges, and trends within the industry. It received responses from suppliers, brewery owners, manufacturers of equipment, and industry specialists, and gave a balanced outlook on changing industry dynamics.

The vast majority of the respondents highlighted increasing energy-efficient and environmentally friendly brewing chiller demand fueled by escalating operational expenses and tightened environmental policies. Breweries, particularly in Europe and North America, are increasingly making investments in environmentally friendly cooling technologies to complement their carbon reduction initiatives.

The rapid growth of the craft brewing sector was also emphasized by stakeholders as a key impetus for chiller adoption in brewing. The survey founded that microbreweries and nanobreweries indicated the necessity of high-performance glycol and water-cooled chillers for accurate temperature control during brewing and fermentation.

The survey also suggested that breweries are moving towards intelligent and automated cooling systems that provide remote monitoring and data-driven process optimization of brewing. Another key finding from FMI’s survey showed that cost continues to be a major challenge for small and mid-sized breweries when it comes to upgrading their chilling systems.

Though big breweries are able to splurge on expensive and bespoke chillers, small players face constraints of budgets and hence witness the demand for cheaper, space-efficient, and modular cooling systems rising.

| Countries | Government Regulations Impacting the Brewing Chiller Industry |

|---|---|

| USA | The Environmental Protection Agency (EPA) regulates refrigerants under the Clean Air Act to phase down toxic substances such as hydrofluorocarbons (HFCs). The Department of Energy (DOE) has energy efficiency requirements for commercial refrigeration equipment, which affects brewing chillers. The Food and Drug Administration (FDA) also requires proper temperature management in beverage manufacture. |

| UK | The UK adheres to stringent energy efficiency and environmental sustainability standards under the Climate Change Act. The F-Gas Regulation limits the use of high global warming potential refrigerants in cooling systems. The British Beer and Pub Association (BBPA) dictates industry standards for brewing and storage temperatures. |

| Germany | Industrial cooling systems, such as brewing chillers, are regulated under the Federal Immission Control Act for emissions. EU F-Gas regulations also limit the application of specific refrigerants in the country. The German Renewable Energy Act offers energy efficiency incentives for eco-friendly cooling systems. |

| South Korea | Industrial cooling efficiency is mandated by the government through the Energy Use Rationalization Act. Use of HFC-based refrigerants is restricted by global climate policies. Incentives are given to breweries with the use of environmentally friendly chillers. |

| Japan | The Fluorocarbon Control Law controls commercial refrigerants. Industrial cooling systems' efficiency standards are set by the Top Runner Program. Japan's Food Sanitation Act maintains good temperature control for beer manufacturing and storage. |

| China | The government adopts strict environmental regulations under the Dual Control System, which restricts energy-intensive industrial machinery. The China National Energy Administration (NEA) encourages energy-saving chillers. China's Emission Standards for Air Pollutants must be complied with by brewery cooling operations. |

| India | Energy efficiency standards are defined by the Bureau of Energy Efficiency (BEE) for industrial cooling machines. The Refrigeration and Air Conditioning Sector within the Ozone Cell oversees the phase-out of the dangerous refrigerants. Regulations of Food Safety and Standards Authority of India (FSSAI) mandate optimal storage temperatures at breweries. |

The industry for brewing chillers is expected to witness high growth from 2025 to 2035, fueled by the growth of craft breweries, technological innovation, and growing demand for energy-efficient cooling systems. The development of environmentally friendly and energy-efficient chillers is one of the major growth opportunities.

As governments worldwide impose stricter environmental laws, manufacturers can spend money on low-GWP refrigerants, hybrid cooling systems, and solar-powered chillers to achieve sustainability targets. Breweries, particularly in Europe and North America, are keenly looking for solutions that minimize their carbon footprint, which makes green cooling technology a profitable venture.

The growth in automation and smart technology offers another significant growth opportunity. The convergence of IoT and AI-driven temperature control systems is on the agenda of breweries seeking to streamline their brewing process.

Data-driven, remote-operated, and predictive maintenance capabilities will improve operational efficiency and lower downtime. Technology companies can engage with manufacturers to create smart brewing chiller solutions that fit the requirements of contemporary breweries.

In order to take advantage of sector growth, strategic partnerships with breweries, bars, and restaurants will be critical. Providing tailored solutions for various brewing sizes, including small chillers for microbreweries and large systems for mass production, will provide a wider customer base. Moreover, after-sales support, maintenance agreements, and financing can improve customer retention and increase sector penetration.

The industry for brewing chillers is moderately fragmented, with several global and regional players in competition for industry share. Although a couple of top manufacturers control the industry through superior technology and widespread distribution networks, new companies and small firms are making headway by providing customized and economical cooling solutions.

Several strategic acquisitions, mergers, and partnerships took place in the market during 2024, with the intent to build product portfolios and consolidate global market presence. Glycol Chilling Solutions, an American company, was acquired by a European chiller maker to leverage its production capacities and benefit from the increasing demand for energy-saving brewing chillers in North America and Europe.

A top Japanese brewing chiller producer collaborated with a South Korean technology company to incorporate AI-driven cooling optimization systems into their chillers, enhancing efficiency and lowering brewery operating costs.

An Indian brewing equipment maker acquired a local cooling system supplier to localize production and provide cost-competitive offerings in the fast-growing Indian industry. One of the renowned Chinese brewing chiller producers closed a distribution deal with a German brewing equipment supplier, allowing technology transfer and elevated distribution networks in Europe and Asia.

Emerging entrants in the brewing chiller industry focus on AI-driven smart technology, sustainability, and adaptive pricing strategies. They adopt leasing models, artificial intelligence-based cooling, and direct-to-consumer sales. Joint ventures with breweries and venture capital investments continue to fuel innovation and competition in the sector.

Growth in craft beer production, temperature control needs, and sustainability initiatives boost demand.

IoT, AI-based cooling, and energy-efficient refrigerants enhance performance and reduce costs.

The USA, UK, India, and China see rising adoption of brewing chillers due to craft brewery expansion and regulations.

Breweries adopt eco-friendly chillers with low-GWP refrigerants and solar power to meet regulations.

They offer affordable, smart, and customizable chillers with leasing options and AI-driven cooling.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End-user, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End-user, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End-user, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End-user, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End-user, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 189: MEA Market Attractiveness by Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brewing Thermometer Market Size, Growth, and Forecast 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Brewing Supplies Market Analysis by Product Type, Application, Category, and Region Forecast Through 2035

Understanding Market Share Trends in Brewing Additives

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Beer Brewing Machine Market

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Brewing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Blast Chillers Market Size and Share Forecast Outlook 2025 to 2035

Scroll Chiller Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Absorption Chiller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chiller Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Draught Beer Chiller Market Size and Share Forecast Outlook 2025 to 2035

Instant Wine Chillers & Refreshers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA