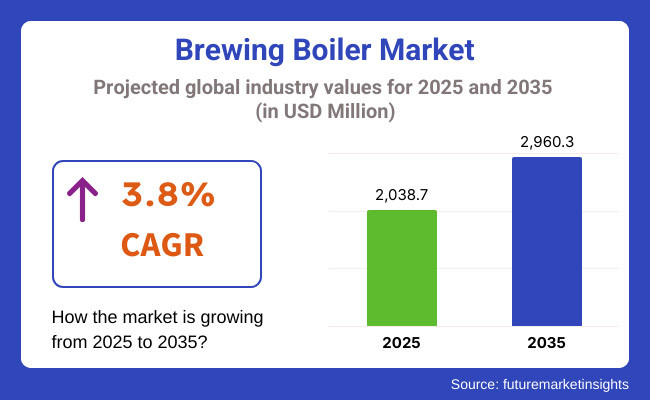

The global brewing boiler Market will continue to grow steadily, with increasing demand from wineries and breweries. The industry revenue is anticipated to grow from USD 2,038.7 million to USD 2,960.3 million during the period 2025 to 2035, projected to expand at a CAGR of 3.8%.

The growth is mainly attributed to increasing consumption of craft beer, innovation in energy-efficient brewing boilers, and growing microbreweries around the world. In 2024, the brewing boiler sector continued to grow as demand expanded from both craft breweries and large-scale beer producers.

The expansion of the market, increased the demand, microbreweries and home brewing trends have also contributed towards the segment expansion, especially in North America and Europe. In the end-user segment, companies are making strategic decisions regarding boiler designs to enhance efficiency and sustainability.

The advantage offered by energy-efficient and low-emission boilers, which have significantly influenced the adoption rate among boiler manufacturers investing in biomass and electric boilers. Moreover, specific environmental policies urge brewing companies to choose sustainable and fuel-efficient boilers, strengthening this industry demand.

Driven by well-established brewing industries, North America and Europe are projected to remain significant revenue drivers, while the Asia-Pacific region presents promising opportunities. The growing popularity of locally brewed beverages and increasing investments in the modernization of brewery infrastructure are also expected to contribute to industry expansion. However, with constant innovations and a high demand for premium beer types, the brewing boiler industry is expected to grow steadily in the coming decade.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

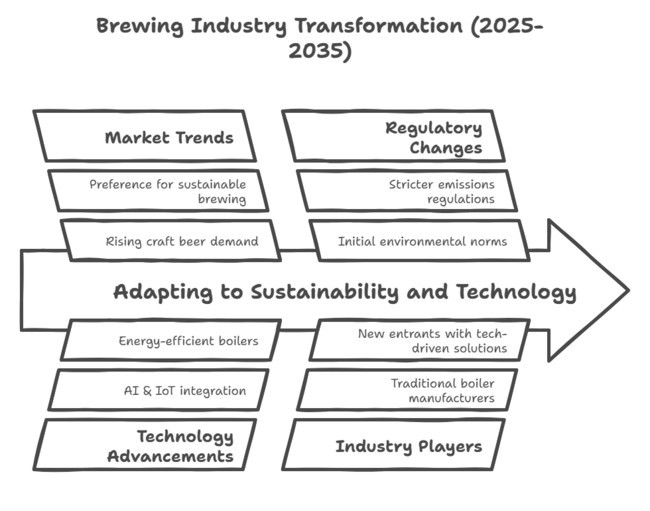

| Increasing craft beer demand, expansion of microbreweries | Strong focus on sustainability, energy-efficient brewing, and automation |

| Conventional steam boilers, basic automation | Smart brewing systems, AI & IoT integration for enhanced efficiency |

| Initial environmental norms, moderate compliance | Stricter emissions regulations, sustainability mandates driving adoption |

| Rising demand for craft and premium beers | Preference for low-carbon brewing and eco-friendly production |

| Growth primarily in North America and Europe | Strong expansion in Asia-Pacific and emerging markets |

| High installation costs, limited efficiency | Higher upfront costs but long-term savings through energy efficiency |

| Dominance of traditional boiler manufacturers | Diversification with new entrants focusing on green and smart brewing solutions |

| Continued reliance on fossil fuels | Increased adoption of renewable energy and biomass-based boilers |

| Established brands leading the market | Rising competition from innovative, tech-driven, and sustainability-focused startups |

FMI performed a comprehensive survey of brewing boiler production side stakeholders, manufacturers, brewery owners, industry experts, and policymakers. Survey data showed an increasing trend toward energy efficient and environmentally sustainable brewing solutions.

More than 65% of respondents emphasized the importance of advanced boilers that minimize fuel use and emissions, aligning with global sustainability goals. Others also said increasing prices for raw materials and energy are driving brewers to seek alternatives like biomass and solar heating.

Automation and smart brewing technologies are becoming imperative for operational efficiency, according to industry experts. More than 70% of large-scale breweries have expressed intentions of investing in boilers that have AI integrated into them within the next ten years to optimize their brewing cycles and lessen their energy waste.

Also, small and mid-sized breweries expressed significant interest in compact, high-efficiency boilers designed to accommodate varying production requirements while ensuring quality standards. The survey also found that regulatory pressures are the main driver of rapid technological development within the industry.

| Countries | Regulation & Impact |

|---|---|

| United States | EPA’s Clean Air Act enforces strict emissions limits on industrial boilers, encouraging breweries to adopt low-emission and energy-efficient systems. |

| Germany | The Renewable Energy Act (EEG) promotes the use of biomass and renewable energy in brewing operations, incentivizing sustainable boiler adoption. |

| United Kingdom | The Net Zero Strategy mandates breweries to reduce carbon footprints, pushing for energy-efficient boilers and green brewing processes. |

| China | The Air Pollution Prevention and Control Action Plan imposes stringent emission controls on industrial boilers, driving demand for cleaner technologies. |

| India | The National Bio-Energy Mission supports the transition to biomass-based boilers in breweries, reducing dependency on fossil fuels. |

| Australia | The Clean Energy Regulator provides grants for breweries investing in energy-efficient and low-carbon brewing solutions. |

Key players operating in the brewing boiler market are focusing on the pricing mechanisms, technological advancement, partnerships, collaborations, and global expansion. Price is a huge factor, with companies offering low- and high-efficiency boilers to accommodate various brewery types. There's also a strong innovation drive behind this, as companies pour resources into advancing technologies like automation and IoT-enabled smart boilers.

Emphasis on geographical growth, sustainability initiatives, and diversification. Major players are concentrating on new sectors in the Asia-Pacific region, particularly China and India, where modernization efforts and craft brewing are fueling demand. M&A (mergers and acquisitions) activity is also being utilized by firms to build their segment share and technical competence. Sustainability is presently a top priority among the companies, which better aligning themselves with international carbon cutting targets through the application of low-emission brewing boilers that aid fuel efficiency.

The brewing boiler industry is fragmented and underwent substantial growth across the previous years. Industry share data specific to brewing boiler manufacturers is scarce, but insights from related sectors offer surrounding context. Key players considered are ALFA LAVAL, GEA Group Aktiengesellschaft, Krones AG and Paul Mueller Company in the overall brewery equipment segment. These companies collectively own substantial shares of the sectors without citing specific percentages.

Some of the key players in the brewing boiler sector include General Electric Company, Babcock & Wilcox Enterprises, Inc. and Mitsubishi Heavy Industries, Ltd. They collectively own the largest industry share and set the industry standards. These segment share distributions are likely to change over the next few years as the market's predicted growth is substantially driven by the importance of innovation and sustainability far beyond today's levels, and companies that can respond to this can increase their market share.

In October 2024, the UK’s Hepworth Brewery became the first in the country to use an ultra-high-temperature heat pump that replaces conventional oil boilers. This approach substitutes old waste vapor from brewing with generating steam at 130°C. Developed by a London-based start-up called Futraheat, this system represents an industrial use of heat pumps and one that is reducing the UK's overall carbon emissions to achieve its net-zero goal by 2050.

AB InBev India plans to invest a USD 50 million investment in January 2024 to expand brewery operations in the state of Karnataka. This step highlights the company's dedication to expanding its footprint in the Indian market, which is becoming increasingly important in the global brewing landscape. The company also bought four craft breweries from Molson Coors in December 2024, including Hop Valley Brewing Co., Terrapin Beer Co., Revolver Brewing, and Atwater Brewery.

Market Share Analysis of Leading Companies

| Company | Estimated Share |

|---|---|

| Miura Co., Ltd. | 8-10% Known for energy-efficient and modular boiler systems; serves both large-scale and craft breweries. |

| Fulton Boiler Works, Inc. | 4-6% Specializes in industrial boilers with a strong presence in the brewing industry; provides reliable and efficient solutions. |

| Parker Boiler Co. | 3-5% Focuses on flexible and efficient boiler designs; caters to both small craft operations and large industrial breweries. |

| Cleaver-Brooks, Inc. | 6-8% A leading name in the boiler industry; offers integrated boiler solutions widely used in brewing applications. |

| Hurst Boiler & Welding Co., Inc. | 7-9% Provides a diverse range of boiler systems, including biomass and hybrid boilers, for breweries seeking sustainable solutions. |

Macroeconomic factors such as economic growth, per capita disposable income, energy prices, and regulatory policies have an impact on the global brewing boiler industry. Now, as the global economy emerges, an uptick in consumer spending on alcoholic beverages, particularly craft beer, is translating into growing orders for brewing equipment. Moreover, Rising disposable incomes, evolving consumer preferences, and favorable regulations are driving the growth of breweries, particularly in developing regions such as Asia-Pacific and Latin America.

However, breweries are facing challenges with inflation and changing costs associated with energy as they look for boilers that are both cost effective and energy efficient to help minimize operating costs. Government incentives to encourage renewable energy usage also drive breweries to use biomass and hybrid boilers.

On the other hand, stringent environmental regulations in regions such as Europe and North America are driving manufacturers to adopt sustainable, low-emission solutions. Despite the ongoing economic uncertainty, the brewing boiler industry is projected to grow steadily in the forecast period due to modernization and increasing demand for premium beer in established industries.

The brewing boiler industry covers stainless steel, cast-iron, and copper materials that work for specific industry requirements. Among these materials, stainless steel is the most popular due to its durability, corrosion resistance, and ease of maintenance. Stainless steel boilers are still being adopted by breweries to maintain product purity and hygiene, and for long-term cost effectiveness.

With sustainability becoming more mainstream, manufacturers are using recycled stainless steel to match the growing trend of eco-brewing. Cast-iron boilers, prized for heat retention and long life, still run in old-school breweries and wherever steady-state heat is needed. Though, those also have a more robust design and maintenance needs that may constrain their universal application.

On the basis of application, the industry is segmented into wine breweries, beer breweries, and cider production, where demand for specialized boiler solutions is driven in all segments. There is currently a focus on the needs of beer breweries in the brewery's boiler industry with most small scale and large scale commercial and craft brewers looking for advanced solutions to improve energy efficiency and brewing accuracy.

The growing popularity of craft beer and microbreweries worldwide drives demand for small, high-performance steam generators. For the short-term, fermentation has many wine breweries using modern boilers with an energy-efficient and automated focus. More and more, wineries are investing in sound sustainable boiler systems, that not only reduce carbon footprints but also preserve quality of production.

Brewing Boiler automation is automatic, electric, steam, semi-automatic, gas, oil, and other new technologies. For its part, fully automatic boilers are becoming more popular due to breweries recognizing the power and efficiency, consistency and decreased labor costs they provide. These systems seamlessly connect with brewing processes, maximizing energy efficiency and minimizing human intervention.

Although electric boilers are popular in small and green breweries, their popularity is growing further because of their own zero operation and easy installation. Semi-automatic boilers offer the best of both worlds and are often popular with mid-sized breweries that prefer different options.

The growth in craft & premium beer demand from 2025 to 2035 is urging breweries to opt for high performance energy-efficient brewing boilers. The rising middle class in Asia-Pacific and Latin America presents lucrative expansion opportunities. Moreover, they can also focus on adopting sustainable brewing practices to capture a considerable growth opportunity.

This in turn creates an opportunity for manufacturers to innovate and offer biomass, electric and hybrid boiler solutions, as breweries look to move to low-emission and renewable energy-powered boilers. Automation, such as Artificial Intelligence and IoT-powered brewing equipment, encourages manufacturers to innovate and brainstorm new ways to enhance efficiency and reduce costs.

The world is moving towards energy-efficient and low-carbon emission boilers to comply with strict environmental regulations, which create opportunities for the companies operating in the boilers industry. Manufacturers will look to include solutions to meet changing industry needs through strategic partnerships with breweries.

Identify opportunities for AI-driven boiler automation, invest in research and development efforts to build expertise, then showcase benefits around enhanced efficiency to entice breweries looking to streamline their operations. Industry participants must also increase their presence in high growth regions through collaborations with local brewers and distributors. Flexible financing options for smaller craft brewers will encourage adoption rates, particularly in emerging industries.

The USA accounted for 36.7% of the global brewing boiler industry in terms of sales value and the segment size is expected to reach approximately USD 747.7 million in 2025, making it a major contributor to the industry. The country’s mature beer industry, spurred on by both commercial beer companies and a burgeoning craft beer scene, drives demand for brewing boilers.

The growing consumer demand for craft and high-end beers has resulted in investments in modern and energy-saving brewing facilities. To meet the EPA emissions standards, breweries are gradually embracing sustainable practices: electric and biomass-driven boilers. Efficient brewing processes and cost savings are key focus areas for many breweries, which can be seen in the growing popularity of automation and smart brewing technologies.

FMI opines that the United States brewing boiler industry will grow at nearly 3.5% CAGR through 2025 to 2035.

In the UK, the number of craft breweries has skyrocketed, and consumers are opting for quality local beers. Breweries are therefore investing in modern brewing equipment, such as energy-efficient and automated boilers, to keep up the trend. There are other government initiatives to promote sustainability, which is also impacting the industry with the move from gas, oil, solid fuel to electric, biomass and hydrogen-ready boilers.

The increasing cost of energy has only been adding to the trend of searching for economical brewing alternatives. With breweries seeking to optimize production through eco-friendly technologies, the use of advanced boiler technologies is anticipated to reign in the future.

FMI opines that the United Kingdom brewing boiler industry will grow at nearly 3.2% CAGR through 2025 to 2035.

France is witnessing a transition in beer consumption, which is fuelling the growth of brewing boiler industry in the country. Now known more for its wine regions, France has seen a steady rise in craft and specialty beer interest in recent years; investment in more modern-brewing infrastructure has followed. Boilers are often energy inefficient, which offers a chance for breweries to cut their carbon footprint and production costs to meet standards set by the European Union.

France’s drive for carbon neutrality by 2050 has encouraged breweries to experiment with alternative energy solutions like biomass and electric boilers. Automated brewing processes are also gaining popularity as breweries look to improve efficiency and consistency of their products. The French brewing boiler industry between 2025 and 2035 is likely to grow at a steady pace due to the development of clean energy adoption supported by government incentives and growth in artisan beer culture.

FMI opines that the France brewing boiler industry will grow at nearly 3.5% CAGR through 2025 to 2035.

By 2025, it is expected that Germany should retain 21.6% of the total brewing boiler industry owing to its long-standing brewing tradition and stringent quality regulations. Germany, home to many of the world’s most popular beer brands, maintains a high demand for high-performance brewing systems. Excellence at brewing processes is mandated by a law known as Reinheitsgebot (Beer Purity Law) that breweries follow, driving investments in advanced boiler systems.

According to the World Biogas Association, as the industry works to lower carbon footprints but still produce excellent beers, demand for biomass and hybrid boilers is on the rise. Automation and digitalization will transform the industrial landscape in Germany and smart brewing technologies will lead to additional developments on the industry between 2025 and 2035.

FMI opines that the Germany brewing boiler industry will grow at nearly 3.8% CAGR through 2025 to 2035.

Italy’s growing boiler industry is inexplicably linked to the rise of craft beer in the nation, keeping pace with its historic winemaking roots. Italian breweries are spending money on modern, more energy-efficient brewing equipment, and to meet European Union’s environmental guidelines. Growing concern towards the sustainable brewing practices is escalating the demand for electric and biomass-powered boilers.

Furthermore, the growth of the craft beer industry in Italy and increasing offerings in restaurants and bars by the hospitality and tourism sector in Italy offers growth opportunities in the Italian beer industry to grow. Another driving factor contributing to the industry is automation, as breweries implement smart brewing technologies to enhance the production process. Industry growth is also underpinned by government incentives to adopt green energy.

FMI opines that the Italy brewing boiler industry will grow at nearly 3.6% CAGR through 2025 to 2035.

The brewing boiler market in South Korea is fueled by the booming craft beer and specialty brews industry. Once dominated by mass-produced lagers, the country’s beer industry is now moving to premium and artisanal beers, leading breweries to upgrade their brewing machinery. Breweries are pouring more money into automation and energy-efficient boilers to improve quality control and increasing supply to keep up with consumer demand.

The South Korean government’s drive for industrial energy efficiency is leading to the use of low-emission boilers, such as electric and hybrid units. Demand for small and modular brewing systems is also growing in urban settings with the rising number of brewpubs and microbreweries. The South Korean brewing boiler industry is poised to be shaped by sustainability and technological innovation over the next decade.

FMI opines that the South Korea brewing boiler industry will grow at nearly 4.2% CAGR through 2025 to 2035.

Japan's brewing boiler industry benefits from the expansion of the country's beer industry beyond traditional lagers. The demand of craft beer is rising, but energy-efficiency is high on the priorities for breweries to invest in advanced boiler systems. Japanese breweries are investing in automation to enhance brewing precision and reduce operational cost.

Government environmental policies promoting carbon reduction have driven wider adoption of biomass and electric boilers. The shift towards premium and non-alcoholic beers is also driving breweries to implement new brewing technologies. Given Japan’s focus on innovation and quality, we anticipate notable progress in automation and sustainability in the brewing boiler industry from 2025 to 2035.

FMI opines that the Japan brewing boiler industry will grow at nearly 3.4% CAGR through 2025 to 2035.

China Brewing Boiler Industry Overview By 2025 to 2035, the China brewing boiler industry will grow at a 6.3% CAGR. China, as the world's largest beer consumer, is experiencing vigorous modernization of brewing industry, stimulating strong demand for high-efficiency brewing boiler. The country’s evolution toward premium and craft beer rather than mass production has ramped up the demand for energy efficient and automated brewing solutions.

Breweries in China are installing IoT-enabled boilers that reduce energy consumption, thus lowering production costs. The transition to low-emission boiler technologies is also being driven by strict emissions regulations under China’s Air Pollution Prevention and Control Action Plan. The demand for biomass and electric boilers is increasing due to government support for renewable energy programs.

FMI opines that the China brewing boiler industry will grow at nearly 4.5% CAGR through 2025 to 2035.

The brewing boiler industry in Australia and New Zealand is experiencing steady growth as both countries experience a rising demand for craft beer. The investment in modern brewing infrastructure has been driven by Australia’s diverse beer culture and New Zealand’s reputation for high-quality hops.

The growing inclination of brewers towards energy-efficient alternative technology such as electric and biomass are driving the growth in this segment. Policies from government that favor the adoption of renewable energy and carbon reduction goals help to propel this transition even more. Also driving demand for small-footprint, high-performance boilers is the emergence of independent breweries and microbreweries.

FMI opines that the Australia & New Zealand brewing boiler industry will grow at nearly 3.9% CAGR through 2025 to 2035.

Government initiatives for Make in India and the adoption of renewable energy encourage breweries to invest in biomass and electric boilers to reduce operational expenses and achieve sustainability targets. Rising energy prices and environmental regulations have also led breweries to adopt low-emission and fuel-efficient boilers.

India’s expanding hospitality and tourism industry also fuels growth; restaurants, bars, and hotels have all increased their craft beer offerings. High demand for compact, modular, and automated brewing boilers is further driven by the increasing number of microbreweries and brewpubs in metropolitan cities such as Bangaluru, Mumbai, and Delhi.

FMI opines that the India brewing boiler industry will grow at nearly 4.8% CAGR through 2025 to 2035.

Stainless Steel, Cast-iron, Copper

Wine Breweries, Beer Breweries, Cider

Automatic, Electric, Steam, Others, Semi-automatic, Gas, and Oil

North America, Latin America, Europe, Asia Pacific, Oceania, Middle East and Africa (MEA)

The increasing popularity of craft and premium beers, along with a focus on energy efficiency and sustainability, is driving the need for advanced brewing boilers. Breweries are adopting automation, low-emission technologies, and alternative fuel options to optimize production.

Brewing boilers are widely used in beer, wine, and cider production. Both large-scale commercial breweries and small craft breweries rely on them to maintain precise temperature control and ensure efficient brewing processes.

Many countries have implemented stringent emission control policies, encouraging breweries to switch to energy-efficient and eco-friendly boilers. Incentives for sustainable energy solutions are also influencing equipment choices.

Smart automation, IoT-enabled monitoring, and alternative fuel integration, such as electric and biomass-powered boilers, are transforming brewing operations. These innovations help breweries reduce operational costs and improve efficiency.

Regions with a strong brewing tradition, such as North America, Europe, and Asia Pacific, are seeing increasing investments in modern brewing equipment. The rise of craft breweries and sustainability initiatives are further accelerating adoption.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Automation, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Automation, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Automation, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Automation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Automation, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Automation, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Automation, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Automation, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Automation, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Automation, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Automation, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Automation, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Automation, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Automation, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Automation, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Automation, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Material Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Automation, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Automation, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 189: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by Automation, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brewing Thermometer Market Size, Growth, and Forecast 2025 to 2035

Brewing Supplies Market Analysis by Product Type, Application, Category, and Region Forecast Through 2035

Brewing Chiller Market Trend Analysis Based on Type, Application, End-User, and Region 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Beer Brewing Machine Market

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Brewing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA