The market for brewer yeast powder will experience substantial growth from 2025 to 2035 because of rising food ingredient demand for functionality and animal feed expansion together with consumer interest in nutritional supplements. Brewer yeast powder serves as a fundamental natural ingredient that delivers protein and B vitamins while delivering essential amino acids to the market because of its widespread use in dietary supplements and baking and fermentation processes.

New product innovation in the market receives additional momentum from the rising demand for ingredients derived from plants and organic sources. New technologies developed to extract and process yeast results in improved product quality alongside better shelf-life stability and enhanced bioavailability.

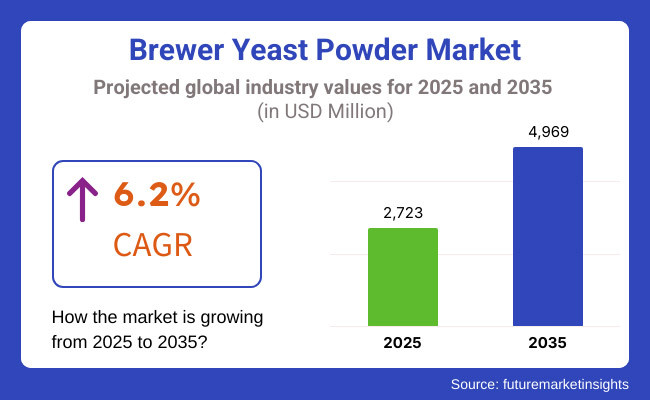

According to the projected figures the brewer yeast powder market will achieve a value of USD 4,969 Million by 2035 from its present value of USD 2,723 Million with an anticipated 6.2% CAGR Between 2025 to 2035. The market achieves growth due to increased livestock nutrition applications of brewer yeast powder combined with its expanding use for functional beverages and probiotics. In addition to higher research and development spending for yeast-derived bioactive compounds the health and wellness industries drive market trends by enhancing the role of yeast.

Explore FMI!

Book a free demo

Driven by factors such as the growing consumer preference for natural dietary supplements, the rise in fortified foods, and expansion in pet food applications, North America persists as a prominent market for brewer yeast powder.Yeast-based ingredients are becoming used more widely of late in plant-based proteins and functional beverages across the USA and Canada.

Furthermore, advancements in technology for yeast fermentation and extraction methods is increasing product efficiency and application versatility which is further aiding the regional market growth.

Europe holds stable growth in demand for brewer yeast powder due to stringent regulations for clean-label ingredients and increasing demand for organic food products as well as growing applications in beer brewing and animal nutrition.Euro-centric innovation in yeast is being spear-headed by Germany, France and the UK, where manufacturers are creating bio-active derivatives of yeast for immune-boosting and gut health uses.

Furthermore, the rapid expansion of yeast-based ingredients utilized in bakery, confectionery, and alternative protein sectors is also bolstering the market dynamics across the region.

The Asia-Pacific region is expected to be the largest market for brewer yeast powder, attributed to the rising health-conscious consumer trend, booming livestock and aquaculture sectors, and various initiatives taken towards functional foods.

Yeast-based Probiotics, Protein-Fortified Food Products, Fermentation-Enhancing Agents, etc., are very much in demand in countries such as China, Japan, South Korea, India, etc. Similarly, governmental programs supporting sustainable animal feed ingredients and clean-label dietary supplements have contributed to the regional market growth.

Challenge

Fluctuations in Raw Material Availability and Cost

The accessibility together with price of brewer’s yeast powder depends on beer manufacturing since it emerges from the brewing process. The supply chain of brewer’s yeast remains directly affected by all beer market fluctuations such as changes in beer stock demand and brewery plant closures and disruptions in delivery networks. The ability to standardize products becomes hard for producers because inconsistent quality arises from different fermentation methods.

To guarantee reliable supply and consistent quality companies should enter secure agreements with breweries and enhance their yeast cultivation technology and purification system development. Suppliers should establish multiple channels and enhance their storage methods to create stable market prices while decreasing dependence on beer market trends.

Opportunity

The expanding usage of brewer's yeast by nutrition sector as well as animal feed markets drives its growing demand

Consumer understanding of brewer's yeast powder nutritional assets creates expanding demand for both human and animal nutrition segments. Plants and functional foods gained popularity because vegan consumers along with health-oriented individuals demanded yeast-based protein supplements. Natural use of brewer’s yeast powder in animal feed serves two purposes: it stimulates animal digestive processes and strengthens their immune system.

Manufacturers should use this market opportunity to develop both fortified yeast-based supplements and enhance their bioavailability through fermentation techniques. Market growth of brewer's yeast powder as a sustainable nutrition ingredient will be accelerated through strategic alliances with health brands and animal nutrition companies.

| Market Shift | 2020 to 2024 |

|---|---|

| Raw Material Sourcing | Dependence on breweries for yeast supply created market inconsistencies. |

| Functional Food Applications | Brewer’s yeast gained popularity in nutritional supplements but remained niche. |

| Sustainability Practices | Limited repurposing of brewing by-products beyond yeast extraction. |

| Animal Feed Utilization | Yeast powder served as a protein and probiotic additive in livestock feed. |

| Processing & Standardization | Quality inconsistencies due to brewing variations and lack of uniform processing. |

| Consumer Awareness | Limited knowledge about the benefits of brewer’s yeast in human nutrition. |

| Regulatory Landscape | Early-stage labelling regulations for yeast-based nutritional products. |

| Market Shift | 2025 to 2035 |

|---|---|

| Raw Material Sourcing | Widespread adoption of controlled yeast cultivation for independent production stability. |

| Functional Food Applications | Mainstream integration into plant-based diets, functional foods, and energy-boosting formulations. |

| Sustainability Practices | Full circular economy adoption, utilizing waste streams for bioactive compound extraction. |

| Animal Feed Utilization | Enhanced formulations with specialized yeast strains to improve gut health and nutrient absorption. |

| Processing & Standardization | Advanced purification and precision fermentation ensure consistent, high-quality formulations. |

| Consumer Awareness | Broad consumer education campaigns position it as a superfood ingredient for wellness and fitness. |

| Regulatory Landscape | Stricter quality, purity, and nutritional compliance standards for human and animal applications. |

Overview growing demand from the food and beverage, animal feed, and dietary supplement industries is driving the USA brewer yeast powder market. Market growth is also being bolstered by the increasing demand for functional foods and plant-based protein alternatives.

Pet nutrition, livestock feed: increasing consumption of brewer yeast powder for these categories also propels the market growth. Moreover, the increasing demand for natural probiotics and immune-boosting ingredients is spurring yeast-based supplements innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

As increasingly health-conscious consumers look for more natural and nutrient-rich ingredients in their foods, the UK wheat yeast powder market is witnessing promising growth. The market growth is anticipated to be further supported by the yeast-based supplements demand in the vegan and plant-based nutrition segment. Brewer yeast powder is gaining prominence in brewing, baking, and animal nutrition as well. Moreover, increasing consumer inclination towards products that are beneficial for gut health is further fuelling the adoption of yeast-based formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

EU Brewer Yeast Powder Market: demand growth for imposes in Germany, France and Belgium the EU Brewer Yeast Powder Market is experiencing robust demand. Some of the key factors identified by the report, driving the growth of the yeast market are the growing craft brewing industry and increasing application of yeast based ingredients in dietary supplements. Brewer yeast powder a natural protein source is gaining acceptance in the animal feed industry. Further growing market demand is the rising production of fermented food products and functional beverages.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

Japan brewer yeast powder market at a glance The Japan brewer yeast powder market is expected grow steadily in the coming years, aided by rising demand for nutritional supplements and functional food products in the region. Consumer preference for fermented foods in the traditional Japanese diet is driving the use of brewer yeast powder in food & beverage formulations. Also, the increasing emphasis on gut health, and immunity boosters are driving the yeast-based dietary supplements are used. Increased pet ownership in Japan is also driving use of yeast-based feed ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Growing interest in functional foods, probiotics, and natural dietary supplements is spurring growth in South Korea’s yeast powder market. Demand is also rising due to the rising use of brewer yeast powder in sports nutrition and protein-based formulations. Fermented drinks, like kombucha and brown rice wine, are rising in popularity, promoting yeast-based ingredients. Highlighting, innovations in livestock feed formulations to promote health and well-being of animals is propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The beer dry yeast and brewing segments cover a significant portion of the market share in the brewer yeast powder space as breweries, craft beer producers, and even home brewers, are choosing high-quality, fermentation-optimized, and flavour enhancing yeast strains. These brewer’s yeast acclimation solutions help improve fermentation efficiency, beer consistency, and the sensory profile of alcoholic beverages-making them a necessity for commercial breweries, microbreweries, and specialty home brewing communities.

With consumers flocking to craft brewing, small-batch production, and novel beer flavours, yeast manufacturers concentrate on strain development, fermentation optimisation, and microbial stability to improve beer quality, fermentation control, and product differentiation.

A highly stable product that is packaged for maximum performance and convenience

Among the wide range of brewer yeast powder types, the beer dry yeast segment has mapped one of the most common use types for through put engineering owing to high fermentation efficiency, flavour development sustainability, and wider shelf-life duration. Whereas liquid yeast cultures have a shorter shelf life, less temperature stability, and greater risk of contamination, beer dry yeast is a more convenient and reliable option for commercial and home brewing needs.

Surge in the uptake of premium beer dry yeast strains such as lager-specific, ale-optimized, and hybrid fermentation properties have spurred adoption. More than 70% of commercial breweries use dry yeast because it is easier to handle, has a predictable fermentation performance, and can be stored for longer periods of time compared to liquid yeast which ensures a strong demand for this segment, states the study.

Craft brewing innovations such as specific yeast fermentation techniques and controlled ester production combined with flavour-enhancing yeast blends have contributed to market demand, guaranteeing increased diversity in beer styles and improved brewing efficiency.

Next-generation yeast formulations containing genetically optimized strains, AI-powered fermentation analytics and probiotic-enriched yeast cultures have propelled adoption even further, guaranteeing improved flavour control and superior quality in terms of stability.

We have optimized market growth by developing tailor-made beer dry yeast solutions with high-temperature tolerance, fast fermentation acceleration, and balanced attenuation characteristics, to better adapt to different brewing condition.

However, which, while increasing fermentation quality and reducing brewing variability, can also help brewers produce consistent beer, the beer dry yeast segment faces challenges, including fluctuating raw material availability and evolving fermentation regulation, as well as competition from the liquid yeast alternative.

Despite so, next-gen innovative in the field of AI-powered yeast strain creating, block chain-backed ingredient traceability systems and enzyme-mediated fermentation efficiency are showcasing a definite cost-effective solution with microbial stability as well as international market scalability in the beer dry yeast global marketplace preserving its reach throughout globalisation scenarios.

Brewing with Beer Dry Yeast Is Suitable for Plentiful Commercial Breweries, Microbreweries, and Home brewing Communities

Due to its high-performance yeast strains enabling flavour consistency and fermentation precision, beer dry yeast segment has seen strong adoption across large-scale brewing facilities to independent craft brewers and small-batch home brewing operations. Compared to wet yeast cultures, beer dry yeast supports greater stability, lower risks of contamination, and better handling convenience with improved quality and long-term storage.

The adoption has been driven by a need for specialty yeast strains, including high-attenuation, low-flocculation, and aromatic-ester-producing traits. The specialty beer segment generates over 75% of brew house production, with a strong dependence on dry yeast for production due to strong fermentation activity and distinguishing flavour profiles, indicating that such specialty beers have significantly increased in demand.

Prior increases in adoption of high-efficiency brewing processes, such as automated fermentation monitoring, advancements in yeast propagation, and AI-assisted strain selection have reinforced market penetration and improved fermentation consistency.

Adoption has also be aided by advances in biotechnology, such as genetic engineering for better stability in yeast, a shorter lag in lactic fermentation, and enhancing the yeast's power to handle stress so that brewing yields even higher alcohol and more precision in the brewing process.

While beer dry yeast offers several advantages, including improved beer quality, fermentation control, and extended yeast viability, the segment faces competition as wild yeast strains gain popularity; the cost of ingredient sourcing is subject to fluctuations, and consumer preferences are shifting towards new styles of beer. But the global beer dry yeast industry will not miss out on growing opportunities thanks to new advancements in enzyme-enhancing yeast, AI-enabled standardization of sensory profiles, and cloud-based control of fermentation processes that lead to a more consistent product, better positioned in the market, better optimized production, and plenty of room to grow.

Yeast is Key to Optimizing Fermentation, Aroma and Ethanol Levels in Brewing Applications

The brewing segment is expected to register high growth rate in the brewer yeast powder market, allowing major breweries, craft beer makers, and home brewers to insert advanced fermentation technology, improve alcohol yield, and increase the quality of consistency in beer. If you are us you immediately recognized in this style of tweet that there are no other brewing methods that offer control and sugar conversion, alcohol levels, and aroma production with better balance and brewing efficiencies than yeast driven fermentation with brewing processes.

The adoption of next-generation brewing yeast, such as those with high-performance fermentation kinetics, enhanced alcohol tolerance and low-oxygen fermentation compatibility, has driven demand. According to studies, more than 70% of brewing facilities utilize yeast powder manifestations to increase flavour complexity and simplify fermentation, making this segment a consistent consumer demand.

Market demand has been further reinforced through the rise of bespoke brewing solutions, highlighting precision yeast strain selection, hybrid fermentation techniques, and AI-influenced recipe optimization so that they better match with developing consumer profile inclination.

Advances in controlled batch brewing through biotechnology led to the emergence of yeast cell recycling, controlled ester production, and extended yeast cell longevity, which brought an additional infusion to adoption for improved beer consistency and productivity in brewing.

Breweries across the globe use different types of yeast except for a few that have also started producing tailored yeast formulations in the new age of craft brewing styles with lager yeast strains for crisp finish, ale yeast strains for fruity esters, and hybrid yeast strains for unique flavour fusion, thus optimizing the market growth owing to better adaption in accordance with the brewing industry demands.

While offering benefits like improved fermentation control, increased alcohol yield, and beer flavour standardization, the brewing segment is grappling with challenges, including higher energy consumption for fermentation management, regulatory scrutiny over yeast strain modifications, and competition from alternative brewing techniques. Nonetheless, disruptive technologies such as artificial intelligence driven fermentation models, enzyme-assisted yeast awakening, and block chain-enabled yeast strain identity authentication will boost brewing efficiency, meet compliance, and enable sustainable production to ensure the global yeast market for brewing process is poised for healthy growth in the years ahead.

The usage of optimized yeast formulations has gained a considerable traction from the brewing segment, especially from the craft beer producers, industries with large breweries, and at-home brewing; this has been a trend and is expected to receive a further boost as manufacturers strive to upgrade the quality and precision of fermentation, and develop new flavours. Brewer’s yeast powder outperforms yeast-free alcohol fermentation methods with higher fermentation efficiency, increased sugar conversion rates, and improved batch-to-batch consistency, providing brewery control and a high degree of consumer preference for yeast-based beer formulations.

Craft brewers and more prominent brewing companies are increasingly adopting brewing-specific yeast strains and high-attenuation characteristics, low-dactyl production and fragrance-enhancing metabolic pathways. According to various studies, more than 75% of craft breweries currently include specialized yeast blends to enhance mouthfeel, carbonation performance, and alcohol blending in beer, creating high demand for this market segment.

While it does optimize beer fermentation and ensure a predictable amount of alcohol is produced and improve the complexity of flavours, the brewing segment still faces obstacles like high fermentation monitoring costs, regulatory changes for the development of yeast strains, and changing consumer preferences towards low-alcohol or non-alcoholic beer alternatives.

But new developments in AI-assisted fermentation analytics, enzymatically-modified yeast stabilization, and automated brew process standardization are enhancing fermentation reliability, brewing efficiency, and product differentiation, ensuring ongoing growth for yeast-based brewing applications throughout the world.

Industry Overview

The market for brewer's yeast powder shows substantial progress because different industries such as food & beverage and animal feed along with pharmaceuticals and nutraceuticals depend on its applications. The nutritional contents within brewer’s yeast powder including protein alongside B vitamins and minerals and probiotics have made it celebrated as an important component in both dietary supplements and functional foods alongside livestock nutritional products.

Market expansion has grown due to natural and high-protein as well as probiotic-rich additive demands which led manufacturers to develop clean-label organic and fortified formulations. The craft brewing, pet nutrition along with plant-based protein sectors help boost the market demand for brewer’s yeast powder.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lesaffre Group | 18-22% |

| Angel Yeast Co., Ltd. | 15-19% |

| Lallemand Inc. | 12-16% |

| Archer Daniels Midland (ADM) | 9-13% |

| Alltech Inc. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Lesaffre Group | Produces high-quality brewer’s yeast powder for nutritional, feed, and brewing applications with probiotic-enriched formulations. |

| Angel Yeast Co., Ltd. | Specializes in organic and fortified brewer’s yeast powders for food, animal feed, and pharmaceutical uses. |

| Lallemand Inc. | Develops functional brewer’s yeast powders with enhanced protein and B-vitamin content for dietary supplements and fermentation industries. |

| Archer Daniels Midland (ADM) | Focuses on brewer’s yeast powder for food processing, pet food, and agricultural applications. |

| Alltech Inc. | Provides yeast-derived feed additives, focusing on gut health and immune support in animal nutrition. |

Key Company Insights

Lesaffre Group (18-22%)

It is a leading producer of brewer’s yeast powder, producing probiotic and functional yeast derivatives for human nutrition, fermentation and animal feed.

Angel Yeast Co., Ltd. (15-19%)

Angel Yeast focuses on the high-grade and organic brewer’s yeast powder to meet the needs of the increasing natural and pontificated nutritional raw materials.

Lallemand Inc. (12-16%)

Lallemand develops brewer’s yeast in a powdered form that can be fortified with protein and B-vitamins fit for application in dietary supplements and fermented foods.

Archer Daniels Midland (ADM) (9–13%)

ADM leverages brewer’s yeast powder for use in food processing, pet nutrition, and agricultural products, with a focus on sustainability and functional ingredient solutions.

Alltech Inc. (7-11%)

Alltech provides yeast-based feed additives, targeting animal health with probiotic-rich and immune-supportive formulations for livestock and poultry industries.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the brewer’s yeast powder market, offering diverse formulations and specialized applications. Notable players include:

The overall market size for Brewer Yeast Powder Market was USD 2,723 Million in 2025.

The Brewer Yeast Powder Market expected to reach USD 4,969 Million in 2035.

The demand for the brewer yeast powder market will grow due to increasing adoption in the food and beverage industry, rising demand for nutritional supplements, expanding applications in animal feed, and growing consumer awareness of its health benefits, including probiotics and protein content.

The top 5 countries which drives the development of Brewer Yeast Powder Market are USA, UK, Europe Union, Japan and South Korea.

Beer Dry Yeast and Brewing lead market growth to command significant share over the assessment period.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.