The demand for breathable films is rising as industries prioritize moisture control, durability, and sustainability in packaging and personal care products. Breathable films play a crucial role in hygiene products, medical applications, food packaging, and industrial membranes, ensuring comfort, protection, and extended shelf life.

Manufacturers are investing in innovative polymer blends, microporous structures, and eco-friendly materials to align with sustainability regulations and evolving consumer preferences. The industry is shifting toward bio-based breathable films, recyclable materials, and high-performance membranes to improve functionality and reduce environmental impact.

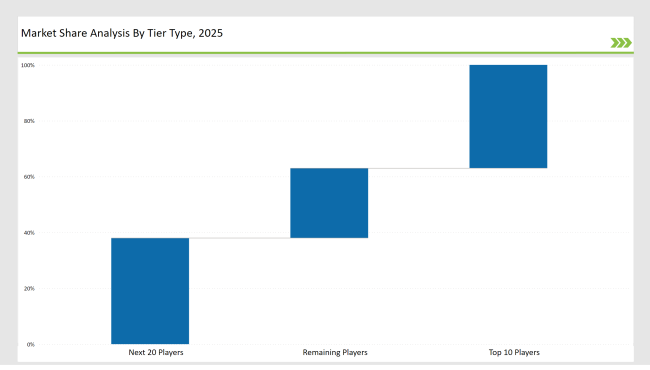

Tier 1 players, including Berry Global, RKW Group, and Toray Industries, dominate 37% of the market due to their extensive R&D, large-scale production, and strategic partnerships with global brands.

Tier 2 companies, such as Arkema, Clopay Plastics, and Trioplast, capture 38% of the market by offering customized, cost-efficient solutions tailored for hygiene, packaging, and medical applications.

Tier 3 consists of regional and niche players specializing in biodegradable breathable films, high-performance applications, and industry-specific solutions, holding 25% of the market. These companies focus on localized production, sustainable materials, and customized performance features.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Berry Global, RKW Group, Toray Industries) | 17% |

| Rest of Top 5 (Arkema, Clopay Plastics) | 11% |

| Next 5 of Top 10 (Trioplast, Mitsui Chemicals, Daika Kogyo, Fatra, Schweitzer-Mauduit) | 9% |

The breathable films industry serves multiple industries where moisture management, barrier performance, and sustainability are critical. Companies are investing in new formulations and production technologies to meet industry demands.

Manufacturers are developing breathable films with superior performance and sustainability in mind.

The industry is evolving as companies innovate breathable films with higher permeability, improved recyclability, and intelligent moisture regulation. Manufacturers are adopting AI-driven quality control systems and integrating bio-based materials to align with sustainability goals. They are also exploring nanotechnology to enhance film breathability and durability. Companies are investing in advanced extrusion techniques to improve film consistency and performance. Additionally, firms are working on incorporating antimicrobial properties to extend product shelf life and safety.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable materials, and advanced barrier control to meet growing industry requirements. Collaborating with hygiene, medical, and packaging companies will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Berry Global, RKW Group, Toray Industries |

| Tier 2 | Arkema, Clopay Plastics, Trioplast |

| Tier 3 | Mitsui Chemicals, Daika Kogyo, Fatra, Schweitzer-Mauduit |

Leading manufacturers are advancing breathable film technology with sustainable materials, enhanced barrier protection, and AI-driven quality improvements.

| Manufacturer | Latest Developments |

|---|---|

| Berry Global | Launched next-gen high-performance breathable films in March 2024. |

| RKW Group | Introduced biodegradable breathable films for hygiene applications in April 2024. |

| Toray Industries | Developed ultra-thin, moisture-resistant membranes in May 2024. |

| Arkema | Expanded bio-based breathable films in June 2024. |

| Clopay Plastics | Strengthened recyclable breathable film portfolio in July 2024. |

| Trioplast | Innovated highly durable protective breathable films in August 2024. |

| Mitsui Chemicals | Released new microporous film technology for medical use in September 2024. |

The breathable films market is evolving as companies enhance permeability, prioritize sustainability, and develop high-performance applications. Manufacturers are also leveraging advanced nanotechnology to improve breathability and durability.

The industry will continue refining AI-driven quality control, high-performance materials, and sustainable solutions. As environmental regulations tighten, manufacturers will transition toward fully recyclable and compostable breathable films. Companies will integrate smart packaging features, such as humidity sensors and enhanced barrier coatings, to extend product longevity and improve performance. They will also adopt energy-efficient manufacturing processes to reduce carbon footprints. Researchers are working on next-generation bio-based polymers to improve breathability and recyclability. Additionally, firms will strengthen partnerships with food and medical industries to develop specialized breathable film applications.

Leading players include Berry Global, RKW Group, Toray Industries, Arkema, Clopay Plastics, Trioplast, and Mitsui Chemicals.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, high-performance permeability, smart packaging, and regulatory compliance.

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Disposable Lids Market Analysis – Growth & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Cup Carriers Market Insights - Growth & Forecast 2025 to 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.