The Breast Fillers Market is valued at USD 468.8 million in 2025. As per FMI's analysis, the Breast Fillers Industry will grow at a CAGR of 6.2% and reach USD 874.5 million by 2035.

In 2024, the industry showed steady growth, driven by a rise in minimally invasive cosmetic procedures. There was a notable increase in demand from women aged 30-45 who preferred non-permanent fillers over traditional implants.

This shift was largely due to the growing preference for procedures with shorter recovery times and fewer long-term risks. Hyaluronic acid-based fillers gained significant popularity, as they provided a more natural look and feel, while new advancements in filler composition extended product longevity and minimized adverse reactions.

On a regional level, North America maintained its dominance due to widespread aesthetic awareness and strong presence of certified professionals. Meanwhile, countries like South Korea and Brazil saw a spike in demand due to cultural openness toward cosmetic enhancements and expanding medical tourism.

Looking ahead to 2025 and beyond, the industry is expected to continue its upward trajectory. Advancements such as AI-assisted treatment planning, customized filler options, and rising disposable income across emerging economies will likely support this growth. In addition, the influence of social media and celebrity endorsements is expected to remain a strong driver for industry expansion.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 468.8 million |

| Industry Value (2035F) | USD 874.5 million |

| CAGR (2025 to 2035) | 6.2% |

Explore FMI!

Book a free demo

The breast fillers industry is on a steady growth path, driven by rising demand for non-surgical cosmetic enhancements and safer, reversible alternatives to implants. The key driver is increasing aesthetic awareness among women aged 30-45, along with advancements in filler materials and techniques. Companies offering minimally invasive, long-lasting, and natural-looking solutions stand to benefit most, while traditional implant manufacturers may face declining demand.

Invest in Next-Gen Filler Formulations

Prioritize R&D in advanced, biocompatible filler materials such as hyaluronic acid blends and long-lasting synthetic compounds to meet growing demand for safety, durability, and natural aesthetics.

Align with Changing Consumer Preferences

Adapt marketing and product positioning to appeal to women aged 30-45 seeking non-invasive, reversible procedures, and leverage digital platforms and influencer partnerships to strengthen brand visibility.

Expand Global Reach through Strategic Partnerships

Form distribution and clinic partnerships in high-growth industries like South Korea, Brazil, and India, and explore M&A opportunities with regional aesthetic solution providers to scale rapidly and localize offerings.

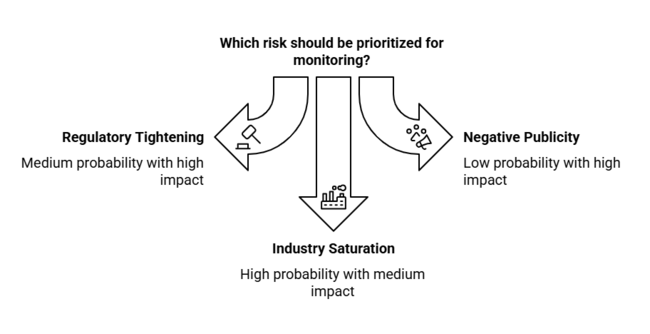

| Risk | Probability-Impact |

|---|---|

| Regulatory tightening on filler safety standards | Medium Probability-High Impact |

| Negative publicity or complications from procedures | Low Probability-High Impact |

| Industry saturation and pricing pressure | High Probability-Medium Impact |

1 year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Develop advanced filler products | Conduct feasibility study on next-gen biocompatible filler formulations |

| Strengthen industry positioning | Initiate consumer feedback loop on preferences for non-surgical options |

| Expand in high-growth regions | Launch distributor incentive program in South Korea and Brazil |

To stay ahead, companies must accelerate investment in next-generation; non-surgical breast fillers technologies that cater to safety-conscious and aesthetically driven consumers, particularly women aged 30-45.

This intelligence signals a clear shift in industry dynamics-away from permanent implants and toward minimally invasive, reversible solutions. Executives should pivot their roadmap to focus on rapid product innovation, strengthen digital consumer engagement strategies, and deepen their presence in high-opportunity industries like Asia-Pacific and Latin America. Differentiation will come from offering personalized, longer-lasting fillers and building trusted partnerships with aesthetic clinics to drive adoption at scale.

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, cosmetic surgeons, dermatologists, and medical distributors in the USA, Western Europe, Brazil, South Korea, and India

Regional Variance

High Variance

ROI Perception

Consensus

Hyaluronic Acid (HA): Chosen by 71% globally due to its safety, reversibility, and patient familiarity.

Regional Variance

Shared Challenges

81% cited rising R&D and regulatory approval costs as a challenge impacting pricing.

Regional Differences

Manufacturers

Clinics & Distributors

Alignment

77% of global respondents plan to invest in AI-guided injection systems and patient personalization software.

Divergence

USA

66% agreed that FDA’s shifting requirements for soft tissue injectable have led to slower innovation cycles.

Western Europe

79% considered MDR as both a challenge and a filter for quality differentiation.

Brazil/India/South Korea

Only 34% said regulatory bodies were a major factor in purchasing, pointing to weak enforcement and uneven application of standards.

High Consensus

Safety, affordability, and minimal downtime are global patient priorities. Material preference (HA) and demand for reversibility also hold across regions.

Key Variances

Strategic Insight

Companies must tailor offerings by geography-high-end, tech-integrated products for Western industries, value-engineered options for emerging regions, and localized R&D to meet regulatory and cultural expectations.

| Countries | Regulations and Mandatory Certifications |

|---|---|

| United States | The FDA regulates breast implants as Class III medical devices, requiring preindustrial approval (PMA) to ensure safety and effectiveness. Manufacturers must comply with stringent labeling requirements, including patient decision checklists and boxed warnings. |

| United Kingdom | The MHRA oversees medical devices, including breast implants. Post-Brexit, devices must have a UK Conformity Assessed (UKCA) mark to be industries in Great Britain, ensuring compliance with safety and performance standards. |

| France | Breast implants must carry the CE marking, indicating conformity with EU safety, health, and environmental requirements. French authorities actively monitor implant safety and have previously suspended specific products due to health concerns. |

| Germany | Germany mandates participation in a national breast implant registry to enhance patient safety and product traceability. This registry aims to monitor implant performance and facilitate swift action if safety issues arise. |

| Italy | Italian regulations require CE marking for breast implants, aligning with EU directives. Authorities emphasize adherence to safety standards and have taken action against non-compliant products to protect public health. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates breast implants, requiring rigorous safety evaluations and approvals before industry entry. Manufacturers must comply with local testing and certification processes to ensure product safety. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) oversees medical devices, including breast implants. Products must undergo thorough review and obtain Shonin approval, confirming compliance with Japan's safety and efficacy standards. |

| China | The National Medical Products Administration (NMPA) regulates breast implants, necessitating comprehensive clinical trials and approvals to ensure safety and quality. Imported devices must meet China's specific regulatory requirements and obtain NMPA certification. |

| Australia & New Zealand | The Therapeutic Goods Administration (TGA) in Australia enforces strict regulations for breast implants, including mandatory patient information leaflets and implant cards. In 2019, the TGA suspended certain textured implants due to safety concerns. New Zealand's Med safe aligns with similar standards, ensuring rigorous assessment and monitoring of breast implants. |

Sales in the USA are anticipated to grow at a CAGR of 5.4% between 2025 and 2035. Despite being a mature aesthetic industry, the USA continues to see consistent demand for breast fillers, primarily driven by innovation in minimally invasive procedures and growing consumer interest in non-surgical augmentation.

The FDA’s evolving stance on injectable fillers and advancements in cross-linked hyaluronic acid products are supporting safer and longer-lasting treatments. Urban centres like Los Angeles, New York, and Miami are leading in procedural volumes. However, regulatory scrutiny and high practitioner liability insurance costs remain key challenges, slightly moderating growth compared to emerging industries.

Sales in the UK are anticipated to grow at a CAGR of 6.0% between 2025 and 2035. The UK’s breast fillers industry is expanding, supported by increasing consumer preference for temporary, reversible procedures over traditional implants.

With an uptick in younger women opting for subtle aesthetic enhancements, demand for dermal fillers, including breast applications, is rising. London remains the hub, with private clinics seeing strong footfall.

Additionally, increasing awareness about less invasive augmentation options and improved filler safety profiles are boosting adoption. Regulatory clarity post-Brexit and high focus on practitioner training standards are further solidifying industry growth prospects.

Sales in France are anticipated to grow at a CAGR of 6.1% between 2025 and 2035. France’s aesthetics industry has historically emphasized natural beauty, aligning well with the minimally invasive profile of breast fillers. Demand is being driven by women aged 25-40 seeking contouring without committing to permanent implants.

Hyaluronic acid-based products dominate, with Paris leading in cosmetic procedure density. France is also home to several aesthetic medicine innovators, creating opportunities for local filler manufacturers.

Regulatory bodies continue to prioritize safety and transparency, which enhances consumer confidence and opens pathways for international players seeking expansion through local partnerships.

Sales in Germany are anticipated to grow at a CAGR of 5.8% between 2025 and 2035. Germany’s conservative approach to cosmetic enhancements is evolving, with increasing acceptance of non-surgical alternatives like breast fillers. Consumers appreciate procedures that offer natural-looking results with minimal downtime.

Urban areas such as Berlin and Munich report higher adoption, driven by a mix of younger professionals and middle-aged women. German consumers are quality-conscious, often preferring CE-marked products with strong safety profiles.

While growth is slightly below the global average, rising investments in clinic infrastructure and a shift toward outpatient services are expected to unlock new opportunities.

Sales in Italy are anticipated to grow at a CAGR of 6.3% between 2025 and 2035. Italy continues to demonstrate strong enthusiasm for aesthetic procedures, with a cultural emphasis on beauty and self-care. Breast fillers are increasingly viewed as a low-commitment enhancement option, especially among younger women in metropolitan areas like Milan, Rome, and Naples.

Clinics are offering customizable filler packages, combining affordability with visual results, which appeals to budget-conscious clients. Additionally, Italian dermatologists and cosmetic surgeons are known for early adoption of global filler innovations, and this openness to new techniques is supporting faster-than-average industry growth.

Sales in South Korea are anticipated to grow at a CAGR of 6.9% between 2025 and 2035. South Korea is a global leader in aesthetic procedures, and its breast fillers market is no exception. With a beauty-conscious population and tech-forward healthcare sector, the country embraces cutting-edge filler technologies, including long-lasting cross-linked formulations. Seoul is a hotbed for aesthetic clinics, and K-beauty standards continue to influence procedural trends across Asia.

Breast fillers are gaining popularity due to their temporary nature and customizable results. However, competition among clinics is intense, and regulatory scrutiny is tightening around filler advertising and performance claims.

Sales in Japan are anticipated to grow at a CAGR of 5.6% between 2025 and 2035. While Japan remains a conservative industry for breast enhancements, there is slow but steady acceptance of non-invasive solutions like fillers.

Breast fillers procedures are more popular in urban areas like Tokyo and Osaka, where younger women are gradually experimenting with volume enhancement for aesthetic balance. Patient safety and discretion are paramount in Japanese culture, which favours minimally visible or reversible procedures.

Although industry penetration is still modest compared to neighbouring South Korea, strong consumer trust in medical-grade products supports long-term potential for breast fillers in Japan.

Sales in China are anticipated to grow at a CAGR of 7.4% between 2025 and 2035. China is one of the fastest-growing industries for breast fillers, propelled by rising disposable income, growing acceptance of cosmetic procedures, and increasing influence of Western beauty standards. The popularity of “lunch time” aesthetics-quick, outpatient procedures with minimal downtime-is driving the demand for injectable fillers.

Cities like Shanghai, Beijing, and Guangzhou are witnessing high clinic expansion, often offering combo treatments with facial fillers and breast enhancements. Domestic brands are rapidly scaling up, though international players continue to dominate in premium product segments.

Sales in Australia and New Zealand are anticipated to grow at a CAGR of 6.5% between 2025 and 2035. The ANZ region exhibits robust demand for aesthetic treatments, with a particular interest in minimally invasive procedures. Breast fillers are gaining traction, especially among women seeking subtle volume enhancements without committing to surgery. Coastal cities like Sydney, Melbourne, and Auckland are leading in procedural volume.

A strong culture of body aesthetics, combined with social media influence and improved product availability, supports industry growth. Regulatory frameworks are transparent, and clinics are increasingly focusing on practitioner education and client safety to maintain high service standards.

Hyaluronic acid fillers are projected to be the most lucrative product segment in the breast fillers industry, growing at a CAGR of 6.5% from 2025 to 2035. This growth is primarily driven by their high safety profile, natural-looking results, and reversibility using hyaluronidase. Patients prefer them due to the minimally invasive nature of procedures and quicker recovery time.

Additionally, these fillers are widely adopted in both premium and mid-tier clinics due to their flexibility in application and strong patient satisfaction rates. Continued innovation in formulation-focusing on durability and skin integration-is further boosting demand. Their popularity among millennials and working women seeking subtle, non-permanent enhancements will continue to propel industry growth.

Medical spas are expected to be the fastest-growing end-user segment in the breast fillers industry, with a projected CAGR of 6.4% during the forecast period. This surge is attributed to increasing consumer preference for aesthetic procedures in more comfortable, non-hospital environments.

Medical spas combine clinical expertise with luxury service, making them ideal for time-sensitive, elective procedures like breast fillers. They are particularly appealing to urban, younger demographics who prioritize convenience and minimal downtime. Moreover, the rise of social media and influencer culture is driving more clients to med spas for appearance-enhancing treatments. Affordable pricing models and strong aftercare services further position medical spas as key growth drivers in this segment.

Top companies in the breast fillers industry are actively competing through product innovation, strategic pricing, global expansion, and partnerships. In 2024, GC Aesthetics partnered with Bimini Health Tech to expand breast reconstruction solutions, while also advancing regulatory achievements with CE-marked delivery devices.

Mentor Worldwide, a Johnson & Johnson company, secured FDA approval for its Memory Gel BOOST implants, strengthening its industry position. Coll Plant made significant progress in regenerative breast implants with promising large animal trial results. These players are focusing on enhancing product portfolios, gaining regulatory approvals, and leveraging partnerships to stay competitive and meet rising demand for safe and effective breast fillers solutions.

Market Share

Mentor Worldwide LLC (Johnson & Johnson Services, Inc.)

AbbVie Inc. (Allergan PLC)

Galderma SA

Merz Pharma GmbH & Co. KGaA.

Croma Pharma GmbH

Huons Global Co. Ltd. (Humedix)

Prollenium Medical Technologies

Cytophil Inc.

Bio Science GmbH

Hologic, Inc.

The breast fillers industry is expected to reach USD 874.5 million by 2035.

Women aged 30-45 are the key demographic driving growth in the industry.

Hyaluronic acid-based fillers are the most popular due to their natural look and safety.

South Korea and Brazil are seeing rapid growth due to medical tourism and aesthetic trends.

The breast fillers industry is projected to grow at a CAGR of 6.2% from 2025 to 2035.

The industry is segmented into hyaluronic acid, polylactic acid, platelet-rich plasma (PRP) injections

The industry is divided into hospitals, cosmetology clinics, ambulatory surgical centres, medical spas

The industry is studied across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.