Between 2025 and 2035 the breakfast cereal market will grow significantly because consumers want convenient nutritious breakfast choices and they know how to eat healthily and manufacturers keep developing new cereal products. Breakfast cereals present ready-to-eat and hot versions which many consumers from different age groups consume because they offer prompt preparation together with multiple nutritional benefits.

Manufacturers focus on delivering cereal products that combine high protein content with fiber and organic composition and gluten-sensitive ingredients. Manufacturers continue to develop new product options because of increasing demand for plant-derived ingredients and functional additives.

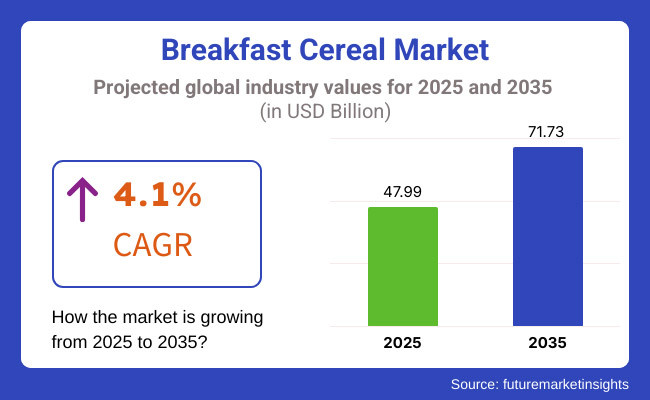

Breakfast cereals experienced a valuation of USD 47.99 Billion in 2025 before analysts estimated they will achieve USD 71.73 Billion by 2035 while demonstrating 4.1% annual growth throughout the 2035 timeframe. The breakfast cereal market keeps expanding because urban populations are rising and people change their daily routines and more customers move their grocery purchases to digital platforms. The advancement of industry developments is driven through consumer expectations which include sustainable packaging and cleaner ingredient lists.

Explore FMI!

Book a free demo

There exists a significant potential for growth in the breakfast cereals market, particularly in North America, where consumers are inclined towards convenient and fortified breakfast options. The demand is also increasing in United States and Canada for cereals with less sugar, high protein and probiotic fortification for gut health.

And, the emergence of private-label cereal brands and innovative flavour are further boosting product diversity. Mid-day requests for more on-the-go and single-serving cereal formats in the region are prompting pack innovations.

Owing to growing awareness regarding health among individuals in the region, used alongside increasing consumption of whole grain and organic cereals, the breakfast cereal market in Europe is growing steadily. Germany, France, and the UK will lead the way in product innovation in which manufacturers will include functional ingredients such as plant-based proteins, superfoods, and omega-3 fatty acids.

And regulatory support for initiatives to reduce sugar and promote cleaner ingredients for food continues to fuel the uptake of healthier alternatives in the world of cereal. Moreover, the consumer trend towards conventional and muesli-style cereals remains widespread throughout the area.

Coffee had gained immense popularity in Europe too, with a wide array of brands emerging. In addition to Japan, India, and Australia, Western-style breakfast options will increasingly be adopted in countries such as China, leading to a growing market for cereals. E-commerce and supermarket retail chain expansion is helping increase accessibility for premium and specialty cereals.

Moreover, the launch of local cereal flavour and healthier formulations that cater to regional taste preference are enhancing market presence in the region.

Challenge

Growing Concerns over Sugar Content and Artificial Ingredients

Consumers have begun to closely inspect the sweetness and artificial element amounts in breakfast cereals which results in manufacturer changes to their brand products. The increased sugar regulations from health organizations force brands to develop products with natural sweeteners and fiber-rich ingredients and clean ingredient statements. Businesses need to strike a proper balance between product flavour and texture alongside preservation qualities while preserving public belief and following changing wellness criteria.

Opportunity

The market shows increasing demand for cereals that offer high protein content as well as functionality.

The marketplace for breakfast foods prefers cereals with high protein content along with dietary fiber and functional elements as their main nutritional requirements. Manufacturers are adding plant-based proteins as well as probiotics and superfoods to their products in order to deliver better nutrition while retaining convenience for customers.

Brand manufacturers have introduced processed food innovations and ingredient selection methods for manufacturing fortified cereal products that address weight management needs and benefit gut health while providing increased energy performance.

| Market Shift | 2020 to 2024 |

|---|---|

| Nutritional Reformulation | Brands reduced sugar content and introduced whole grain variants, but artificial sweeteners remained common. |

| Functional Ingredients | Prompt use of probiotics, vitamins, and cereals with added minerals. |

| Sustainability Practices | More use of recyclable packaging and responsibly sourced ingredients. |

| Customization & Personalization | Brands experimented with limited-edition flavours and dietary-specific options. |

| Consumer Preferences | Demand for indulgent flavours remained high, with some interest in healthier alternatives. |

| Regulatory Landscape | Stricter labelling requirements emerged, but sugar reduction remained voluntary for many brands. |

| Market Shift | 2025 to 2035 |

|---|---|

| Nutritional Reformulation | Natural sweeteners, fiber fortification, and plant-based proteins become industry standards. |

| Functional Ingredients | Popular use of adaptogens, superfoods and gut-health-boosting ingredients. |

| Sustainability Practices | Ultimate use of materials that is biodegradable, regenerative agriculture and carbon neutrality in production. |

| Customization & Personalization | AI-driven personalization tailors cereal blends to individual health goals and taste preferences. |

| Consumer Preferences | Health-conscious consumers favour nutrient-packed cereals with short, transparent ingredient lists. |

| Regulatory Landscape | Global regulations mandate clear nutritional disclosures, sugar reduction targets, and functional health claims verification. |

The breakfast cereal market in the United States is experiencing steady growth due to rising consumer demand for convenient and nutritious breakfast products. Market growth is driven by the increasing popularity of high-fiber, protein-enriched, and low-sugar cereals.Organic and gluten-free alternatives are increasingly popular among consumers, which is changing the market. Developments in flavours and functional elements, including probiotics and plant-based proteins, also appeal to health-resistant customers.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

Breakfast cereals market in the UK economy continues to expand as consumers are adopting healthier and fortified cereal variants. Granola, muesli and whole-grain cereals are on the rise as consumers look for healthy choices at breakfast. Northern America is driving the market for this product due to the increasing trend of private-label brands and sustainable, eco-friendly packaging. And government initiatives to promote healthier eating habits are pushing manufacturers to cut sugar and artificial additives in cereals.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

Germany, France and Italy account for most demand in the EU breakfast cereal market, which is experiencing stable growth. This is further propelling the growth of the market through increased awareness among consumers about the nutritional attributes of fortified cereals. Organic and non-GMO cereals pervade the trend, with numbers also rising for sugar-free or high-protein versions. The rising investments towards on-the-go breakfast products and cereal bars are also driving the demand of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan’s breakfast cereal market is growing steadily due to a rising preference for Western-style breakfast options. Consumers are increasingly opting for fortified and functional cereals that offer added vitamins, minerals, and probiotics. The demand for portion-controlled, ready-to-eat cereal packs is increasing, driven by busy urban lifestyles. Additionally, the introduction of innovative flavours and premium cereal varieties is attracting a broader consumer base.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

Accompanied with this trend, South Korea’s breakfast cereal market is growing thanks to the increasing adoption of healthy eating habits and a rising inclination towards convenient breakfast items. High-protein, low-sugar, and high-in-fiber cereals are in demand. Factors such as Western food trends and the growing popularity of cereal-based snacks serve as fodder that helps drive growth in the market. Furthermore, the increasing need for functional cereals incorporating probiotics and superfoods is propelling the demand.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Health-conscious consumers are always on the lookout for nutrient-rich, clean-label, and time-saving breakfast options and this results in these segments being the most dominant share of the breakfast cereal market. These cereal goods are key for supplying very important fiber, vitamins, and minerals and make it easy for shoppers to take in meals on the go, making them critical for overall health-minded consumers, hectic pros, and family members striving for speedy but wholesome foods.

With the increasing consumer demand for organic ingredients and less processed food products, manufacturers are investing in natural sweeteners, non-genetically modified organism (non-GMO) ingredients, and gluten-free formulations to not only make products more appealing but also to guarantee that they fall within any dietary restrictions, such as celiac disease or gluten intolerance.

Health Benefits of Organic Cereals: Sustainable and Chemical-Free Nutrition

With clean-label, minimally processed, and free from chemicals formulations in the organic segment, breakfast cereal manufacturers have widely been adopting organic cereals, positioning them as one of the most coveted breakfast cereal categories in the food & beverage industry as they adhere to the consumers' inclination towards natural, sustainably sourced, and micronutrient-rich breakfast options. Unlike traditional cereals, organic cereals do not use synthetic pesticides, artificial additives, or GMOs and are able to provide higher consumer trust and values for health-conscious consumers.

Adoption has also been driven by the demand for certified organic breakfast cereals, which often include whole grains, plant proteins, and dried fruit sweeteners. Research shows that more than 65% of healthy eating consumers prefer organic breakfast cereals as compared to regular breakfast cereals, which ensures strong demand for this segment.

The growth of sustainable food production practices, including regenerative farming, fair-trade grain sourcing and carbon-neutral supplied chains, has increased market demand, providing stronger alignment with environmental and ethical food production standards.

Adoption further accelerated with next-gen organic cereal formulations focused on fortified vitamins, enhanced fiber content, and nutritional optimization support through AI allowing for better functional benefit and higher market penetration.

Tailor-made organic cereal blends, including high-protein, gluten-free, and probiotic-enriched products, have further driven market growth, providing more extensive coverage on the dietary preference spectrum.

While this segment also faces challenges with production costs, raw material availability, and price sensitivities in mass-market retail channels, its strengths lie in the need for clean-label nutrition, reducing exposure to synthetic additives, and improving gut health. Still, new alternatives from AI-based organic grain farming, block chain-integrated ingredient tracking and sustainable packaging technologies continue to optimize cost-efficiency, transparency and scalability, which drives continued annual growth of organic breakfast cereals in the global market.

The organic breakfast cereals market is segmented into Hypermarkets and supermarkets, Convenience stores, and Online grocery.

The most adopted segment among the organic breakfast cereals market is the organic breakfast cereals offered by health food brands, premium grocery chains, and specialty organic retailers, where industries are removing artificial ingredients from their products and converting to more whole food based cereals. Organic cereals, in contrast to conventional cereals, promote better gut health, facilitate healthier digestion, and echo dietary trends around clean foods-all of which knowledge reinforces consumer trust and long-term brand loyalty.

Adoption has been fuelled by the demand for organic whole-grain cereals with sprouted grains, naturally fermented ingredients and prebiotic fiber blends. Research shows that more than 70% of organic consumers specifically search breakfast cereals produced from non-GMO and minimally processed grains, indicating significant demand in this area.

The growth of natural sugar alternatives in organic cereals including coconut sugar, monk fruit extracts, and organic honey-sweetened varieties has reinforced market adoption ensuring stabilizing blood sugar and maximized on diabetic-friendly diets.

Additionally, the advancements in AI-driven food personalization that include personalized organic cereal recommendations, nutrient-rich ingredient formulations, and diet-based customization options have further fuelled adoption, guaranteeing increased consumer engagement and satisfaction.

While the organic breakfast cereal segment boasts benefits such as improving consumer health outcomes, bolstering sustainable farming practices, and lowering consumer risk to chemical exposure through food, it is also at risk due to higher retail price points, loftier supply chain inconsistencies for organic grain sourcing, and changing consumer preferences towards options beyond traditional breakfast offerings. But the unique surface topography of organic breakfast cereals can slow the migration of such structures, providing opportunities for emerging innovations, such as enzyme-assisted grain processing, AI-powered quality control in organic agriculture, and next-generation biodegradable packaging solutions to enhance product reach, make them more sustainable and more exciting with consumers, securing continued growth opportunities for organic breakfast cereals all over the world.

RTE Cereals: Quick, Nutrient-Dense and Versatile Breakfast Ideas

The ready-to-eat (RTE) cereal segment has become one of the most prominent categories in the breakfast cereal market as it gives individuals who are busy professionals, busy families, and health conscious consumers the opportunity to consume nutritional dense meals with minimal preparation time. In contrast to hot cereals, RTE cereals can be consumed easily without cooking, they can provide a better flavour and texture, resulting in higher consumer appeal and higher versatility in meal preparation.

The growing popularity of fortified RTE cereals, with their plant-based proteins, omega-3-enhanced grains and antioxidant-rich fruit mixes, is a trend that the demand has spurred. RTE cereals facilitate easy and quicker snacking and are an integral part of the busy life of an individual, as studies suggest over 65% of the working population and parents consider RTE cereals as a part of their lifestyle; thus, the demand for this segment is expected to remain high.

RTE (ready-to-eat) cereals are generally fortified with functional ingredients such as probiotics, adapt genic herbs and brain-boosting super foods, in order to strengthen their demand and ensure they align with changing consumer dietary preferences.

Cereal formulation in an AI-assisted approach along with sugar-reduction technologies, protein-enhanced varieties, and personalized nutrition blends have provided further impetus to adoption for better health benefits in a large variety of markets.

High-protein, low-carb, and keta-focused RTE cereals with nut-based ingredient formulations, fiber-enriched whole grains, as well as superfood additions have vaulted market growth by better meeting modern dietary patterns.

Although it may help increase convenience, nutrient absorption, and benefits for nature-friendly lifestyles, the RTE cereal segment may see challenges from vertical such as another growing threat from consumer concern about the journalists re-externality of sugar in the traditional formulations of cereal, regulatory scrutiny regarding artificial flavour injection agents, and harder to find pressures for fresh breakfast options. But advancements in areas such as AI-driven product reformulation, sugar-free flavour optimization and next-generation high-fiber processing technologies, are enhancing health benefits alongside taste retention and consumer satisfaction, while also ensuring global market growth for ready-to-eat cereals.

Supermarkets, Convenience Stores, and E-Commerce Grocery Platforms Start Carrying RTE Cereals

As the industry shifts toward shelf-stable, no-cook and nutrient-dense products to meet with post-COVID and food inflation diet trends, the RTE cereal sub-segment has seen a major penetration with mass market retailers, online grocery providers, and school nutrition programs. RTE cereals deliver better nutrition, shelf life, and convenience over conventional cooked breakfast options that lead to higher availability and industry-wide consumer adoption.

Adoption has been driven by growing consumer demand for RTE cereals with natural ingredient fortifications ranging from fiber-rich grains and heart-healthy seeds to gut-supporting probiotics. According to reports, more than 70% of consumers that purchase breakfast cereals do so Rio varieties that are prefabricated for their time-saving advantages and nutritional enhancements, allowing for strong requirement for demand during this segment.

This model, while beneficial in terms of enhancing breakfast accessibility, ensuring nutritional diversity, and adapting to contemporary eating preferences, is not without its challenges in the RTE cereal sector, where threats include everything from smoothie meal replacements to changing consumer views on highly-processed cereals and the policy on added sugar. But new plant-based innovations, shelf-life optimization software powered by artificial intelligence, and block chain-enabled transparency of ingredient sourcing will build trust among consumers while improving product quality and long-term sustainability, making certain that ready-to-eat cereals continue to grow around the world.

Industry Overview

Changing Dietary Habits, Increasing Health Awareness, and Growing Demand for Convenient, Ready-To-Eat (RTE)/Instant Foods are Driving Growth in the Breakfast Cereal Market. Though the most popular dry breakfast cereals include cornflakes, muesli, granola, and oatmeal and are consumed for their high fiber, protein, and fortified vitamins.

Market growth is being propelled mainly by innovation in organic, gluten-free and plant-based cereals and the launch of functional ingredients i.e. probiotics and high-protein blends. Top manufacturers are working towards clean-label products as well as sustainable packaging and digital marketing to boost consumer engagement and widen their market reach.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kellogg’s Company | 18-22% |

| General Mills Inc. | 15-19% |

| Nestlé S.A. (Cereal Partners Worldwide) | 12-16% |

| Post Holdings, Inc. | 9-13% |

| PepsiCo (Quaker Oats) | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kellogg’s Company | Produces a wide range of cereals, including Frosted Flakes, Special K, and Raisin Bran, with a focus on fortified and high-fiber options. |

| General Mills Inc. | Offers diverse breakfast cereals such as Cheerios and Lucky Charms, integrating whole grains and reduced sugar formulations. |

| Nestlé S.A. (Cereal Partners Worldwide) | Develops nutritious cereals under brands like Nesquik and Fitness, with an emphasis on fortified ingredients and global accessibility. |

| Post Holdings, Inc. | Manufactures leading cereal brands, including Honey Bunches of Oats and Grape-Nuts, catering to health-conscious consumers. |

| PepsiCo (Quaker Oats) | Specializes in oatmeal, granola, and ready-to-eat cereals, leveraging whole grains and functional nutrition. |

Key Company Insights

Kellogg’s Company (18-22%)

Kellogg’s holds a substantial market share in the breakfast cereal sector, offering a wide-ranging product portfolio and prioritizing fortified, high-fiber, and low-sugar cereal options to accommodate differing dietary needs.

General Mills Inc. (15-19%)

General Mills: With leading brands like Cheerios and Wheaties, General Mills dominates the RTE cereal space and has built health partnerships emphasizing whole grains and low-sugar options.

Nestlé S.A. (Cereal Partners Worldwide) (12-16%)

Nestlé was General Mills' partner in the manufacture of cereal brands that are distributed around the world, promising these are fortified, nutritious and inexpensive.

Post Holdings, Inc. (9-13%)

In response to changing consumer preference, Post Holdings is shifting its emphasis onto health-oriented cereal types, including high-protein, high-fiber, and specialty diets.

PepsiCo (Quaker Oats) (7-11%)

Quaker Oats brand from PepsiCo is a top player in oatmeal and granola-based cereals that offer whole grain nutrition a functional benefits, including heart health support.

Other Important Players (30-40% Combined)

Other manufacturers are joining the breakfast cereal field with stylish, organic and health-conscious products.Notable players include:

The overall market size for Breakfast Cereal Market was USD 47.99 Billion in 2025.

The Breakfast Cereal Market expected to reach USD 71.73 Billion in 2035.

The demand for the breakfast cereal market will grow due to increasing consumer preference for convenient and nutritious breakfast options, rising health awareness, expanding product innovation with organic and functional ingredients, and growing adoption of on-the-go meal solutions.

The top 5 countries which drives the development of Breakfast Cereal Market are USA, UK, Europe Union, Japan and South Korea.

Ready-to-Eat (RTE) Cereals lead market growth to command significant share over the assessment period.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Industry Analysis from 2025 to 2035

Comprehensive Analysis of Dehydrated Onions Market by Variety, Form, End Use, Distribution Channel, and Country through 2035

Comprehensive Analysis of Europe Dehydrated Onions Market by Product Variety, Product Form, Processing Technology, End Use and Country through 2035

Comprehensive Analysis of ASEAN Dehydrated Onions Market by Product Verity, by Product form, by processing technology, by end Use and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.