Between 2025 and 2035 the bread preservatives market will grow steadily because of rising needs for extended-shelf-life bakery products and increasing food waste awareness and new food preservation technologies. Bread preservatives function as essential additives to stop mold formation and retain freshness while enhancing the quality standards of baked goods.

Manufacturers now focus on developing clean-label natural preservative solutions because consumers prefer organic acids, enzymes and plant-based extracts. Manufacturers require better preservation technology solutions because consumer demand for packaged and frozen bread has recently increased.

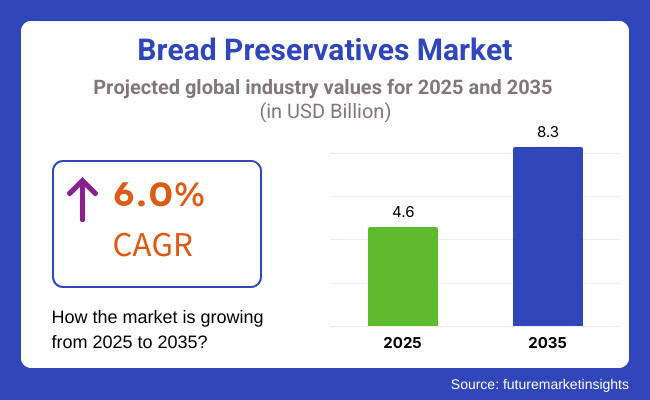

According to market estimates the bread preservative sector generated approximately USD 4.6 Billion in 2025 yet it is forecast to grow up to USD 8.3 Billion by 2035 at a projected annual growth rate of 6.0%. The industrial bakery sector growth combined with rising bread demand for gluten-free and fortified types along with antimicrobial research in developing innovative solutions drives market expansion. The development of alternative preservation methods receives encouragement from food safety regulatory policies and artificial additive reduction regulations that shape industry trends.

Explore FMI!

Book a free demo

The North American bread preservatives market is driven by the high consumption of packaged and ready-to-eat bakery products. Rising demand for preservative-free and clean-label bakery products across North America is bringing natural preservatives under the spotlight, with manufacturers looking for skilful formulations to preserve food quality and extend shelf life.

Organic bread sector expansion and increased consumer demand for transparency in food labelling are influencing product formulations. Moreover, as more sophisticated packaging technologies are introduced to reduce consumption of preservatives, products are benefiting from longer shelf-lives and improved quality.

The bread preservatives market in Europe is steadily growing driven by stringent food safety regulations and increased demand for quality baked goods. Germany, France, and the UK take the lead in the research and development of such natural preservatives, along with bakeries adopting enzyme or fermentation-derived solutions to achieve freshness.

Growing awareness of food waste reduction and sustainable and wilted groceries is working as a catalyst for bakery brands to join hands with food technology companies focusing on creating such shelf-life extended products. European Manufacturer of Preservative Blends Additionally, European manufacturers are developing preservative blends that provide a good balance between efficacy and health statements to the consumers.

Asia-Pacific region predicted to witness the fastest growth in the bread preservatives market due to increasing urbanization, evolving dietary habits, and growing preference for ready-to-eat meals. Regions such as China, Japan, South Korea, and India are experiencing increasing growth in commercial bakery production, propelling the adoption of advanced preservation methods.

The rising population of the middle-class segment as well as deeper penetration of Western-style baked items are creating demand for long-time shelf life products. Meanwhile, policies issued by the government with an aim to support food safety, as well as continuous developments related to the plant-extracted antimicrobial agents are also influencing the market developments in the region.

Challenge

Increasing Demand for Clean-Label Products from End Users

Consumers have increasingly turned against synthetic preservatives, making manufacturers reformulate bread products more often with natural options. Artificial preservatives such as calcium propionate and sorbic acid come under fire for health concerns, regulatory challenges and changing preferences for organic and minimally processed foods.

To stay competitive, companies need to innovate on natural preservation solutions (plant-based extracts, fermented ingredients and enzyme-based formulations) while maintaining extended shelf life and cost-efficiency.

Opportunity

New Technologies for Natural Preservation

Growing consumer demand for natural bread preservatives is leading to research and development of novel solutions that keep bread fresh without sacrificing quality. Manufacturers are creating bio-based antimicrobial agents, including cultured wheat and extracts from vinegar, to supplant synthetic chemicals.

Representatives from Arkema, a specialization chemical manufacturer, will then address techniques in encapsulation technology that improve stability of natural preservatives for industrial bakeries. This trend towards clean-label and functional preservatives suggests a significant opportunity for sustainable and consumer-friendly solutions for bread preservation.

| Market Shift | 2020 to 2024 |

|---|---|

| Preservation Methods | Artificial preservatives such as calcium propionate and sorbates continued to be the norm for prolonging the shelf life of bread. |

| Clean-Label Movement | As consumers rejected artificial additives, gradual uptake of clean-label solutions ensued. |

| Food Waste Reduction | Manufacturers looked for solutions to help extend freshness and cut down on waste, but chemical-based preservatives were still ubiquitous. |

| Technological Innovations | Initial adoption of enzyme-based bread preservation with limited scalability. |

| Consumer Preferences | Preference for long shelf-life products despite concerns over synthetic additives. |

| Regulatory Landscape | Governments introduced early restrictions on artificial preservatives but allowed their continued use. |

| Market Shift | 2025 to 2035 |

|---|---|

| Preservation Methods | The market is ruled by natural antimicrobials, enzyme-based solutions, and fermentation-driven preservation methods. |

| Clean-Label Movement | It is assisted with regulatory bodies tightening the noose around synthetic preservatives and fuelling the transition to completely natural substitutes. |

| Food Waste Reduction | Biodegradable and food-grade coatings enhance shelf life while aligning with sustainability goals. Such biodegradable and food-grade coatings can extend shelf life and optimise sustainability objectives. |

| Technological Innovations | Advanced encapsulation and bio-preservation techniques improve the efficiency and cost-effectiveness of natural preservatives. |

| Consumer Preferences | Growing demand for short ingredient lists, organic preservatives, and transparency in formulation. |

| Regulatory Landscape | Stricter global regulations phase out synthetic additives, requiring full compliance with natural preservation standards. |

Demand Units for Bakery Products Shelf Life in USA is Rising High, Hence Growth of USA Bread Preservatives Market The increase in convenience food consumption, as well as the bakery industry expansion; are some of the factors driving the market growth.

In response, manufacturers are prioritizing natural preservatives-vinegar-based and plant-derived antimicrobials that are in demand among clean-label products. Moreover, regulatory challenges associated with synthetic preservatives are driving innovation in organic and food-safe preservation options.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

The UK bread preservatives market is witnessing growth as consumers seek fresh and additive-free bakery products. Market trends are being influenced by increasing applications of natural preservative and declining use of artificial additives. This increases demand for alternate methods to maintain the freshness of these products. Furthermore, government interventions toward food safety and clean-label transparency are also driving the growth of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The demand for bread preservatives will grow at a high rate which can be attributed to the booming demand from European Union with Germany, France, and Italy being the key markets. As a result, the strict EU regulations on food preservatives are influencing manufacturers to create natural, innovative, and less processed preservation options.Changing trends towards frozen & packaged bakery products are optimally raising the demand for shelf-life solutions. Moreover, rising investments in antimicrobial packaging and bio-based preservatives are also aiding the market expansion.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

Growing consumption of packaged and convenience bakery products is driving growth of Japan’s bread preservatives market. Growing demand for safe and stable food products is driving innovation in enzyme-based and natural preservatives. Clean-label preservation solutions are gaining acceptance in Japan due to consumer preferences for minimal processing and no additives in bakery products.

The growing demand for preservative solutions in the bakery business is, furthermore, being complemented by advancements in modified atmosphere packaging (MAP) technology.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korean bread preservatives market is growing due to the rising demand for ready-to-eat and pre-packaged baked goods. Soaring inclination towards longer shelf life of bakery products will propel the growth of market.

Growing demand for functional or premium bakery products such as gluten-free and high-fiber bread is fuelling demand for specialty preservatives.

Moreover, the government initiatives for ensuring the food safety and reducing food waste are also aiding in the adoption of advanced preservative technologies.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The significant use of natural bread preservatives and bread preservatives in powder form segmented bread preservatives market is attributable to the benefit of the use of natural preservatives, which are clean-label, and provide a longer shelf life, supporting bakeries, food manufacturers, and commercial bread producers in preserving the freshness of bread, preventing mold growth, and improving overall stability.

Widely used preservatives, including gluten, carboxymethyl cellulose, and other compounds are critical for food safety, food waste, product consistency and thus essential for artisan bakeries, industrial bread baking, and packaged bread brands.

With the growing consumer demand for natural ingredients, and the growing and stricter regulation on synthetic additives, manufacturers control for whole-grain, plant-based, fermentation-derived and functional preservative solutions to improve bread quality, extend shelf-life and activate clean-label food production.

Growing Diet Consciousness Drives Demand for Natural Bread Preservatives Insights from FMI’s Report on Global Market for Natural Bread Preservatives.

Natural Preservatives Allow For Synthetic Additive-Free Long-Life Bread

Natural bread preservatives are one of the fastest-growing categories in the bread preservatives market, providing healthier, chemical-free, and naturally derived solutions to improve the shelf life of bread without compromising their nutritional integrity. Natural alternatives, on the other hand, use plant extracts, organic acids and enzyme-based preservation methods to prevent spoilage without the often unappealing association of artificial preservatives.

The growing adoption of plant-derived natural bread preservatives such as fermented vinegar, rosemary extracts, and cultured whey proteins has led to high demand. Over 60% of health-conscious consumers have a preference for baked goods prepared with natural preservatives, ensuring strong demand for this category, according to studies.

Market demand has been bolstered by an extension of clean-label bakery trends encompassing non-GMO contents, additive-free formulations of bakery products, and organic bread manufacturing, resulting in wider industry uptake of natural preservatives.

Implementation of next-generation natural preservative solutions (probiotic-based anti-moldinhibitors, enzymatic protection for bread and AI-driven microbial spoilage prediction) further increased adoption by providing better consistency and improved product quality.

Customized natural bread preservative blends such as gluten-free stabilization, anti-staling enhancer, and moisture retention have directed market growth for the product helping in better adaptation to changing dietary nature.

Natural bread preservatives are projected to be a relatively fast-growing segment in spite of their advantages in improving food safety, supporting clean eating, and preserving the quality of bread since they confront challenges with their relatively high manufacturing costs, short shelf stability than synthetic alternatives, and limited effectiveness in extreme humidity conditions.

But novel technologies in AI-driven fermentation optimization, advanced enzyme-based spoilage prevention solutions, and organic acid optimization techniques are addressing the cost-per-unit economics, shelf life performance, and the market scalability of the products developed using these technologies to drive market growth of natural bread preservatives globally.

Strong adoption of natural bread preservatives among organic bakeries, specialty bread manufacturers, and premium packaged bread brands, owing to increasing replacement of synthetic preservatives with natural preservatives in several industries, have further accelerated the sales growth of natural bread preservatives. Natural bread preservatives maintain higher acceptance among clean-label food consumers, encouraging heightened trust, better digestion, and suitability with changing dietary habits, when compared to synthetic preservation solutions.

The adoption has been driven by the demand for fermentation-based preservation solutions, which are used to achieve controlled sourdough fermentation, active probiotic cultures, and natural mold-inhibiting enzymes. Studies have suggested that over 70% of premium and organic bread brands are transitioning to natural preservatives to build consumer trust and comply with global food safety standards, assuring a positive outlook for this segment.

Market adoption of natural bakery preservatives is further strengthened with plant-extracted polyphenols, organic citric acid blends and clad in rosemary oil-derived antifungal agents, which advocates better product safety and regulatory conformity.

Adoption has also been boosted by the integration of biodegradable and eco-friendly packaging innovations, which include oxygen-absorbing inserts, moisture-balancing storage solutions and intelligent freshness monitoring labels.

However, the natural bread preservatives segment is significantly challenged in terms of production and effectiveness as it is relatively complex in formulation, involves higher processing time, and may or may not be as effective across various bread categories.

Nonetheless, advancements such as & polymerization for natural ingredient stabilization,block chain-enabled organic certification and enzyme-assisted mold prevention are enhancing product efficiency, enhancing manufacturing scalability and expanding consumer reach; enabling global expansion of natural bread preservatives.

The Benefits of using Powdered Bread Preservatives: Longer Shelf Life, Stability and Easy Mixing

In the form type segment, powder form has been one of the key sought-after bread preservatives in the market which provide better stability, ease of application and better formulation compatibility at commercial bakeries, packaged bread producers, and large scale food processing units. Dry preservatives offer extended shelf life with assorted options for dry powder dispersals in any dry mixes, improving cost effectiveness while enabling better production scalability and reduced wastages compared to liquid preservatives.

Adoption is driven by the demand for next-gen powdered preservatives, such as enzyme modified anti-staling agents, moisture-locking stabilizers, and slow release organic acid blends. Powdered preservatives are favoured in industrial bakeries because they are simpler to use, they have a low moisture reactivity, they provide better stability for supply chain storage, and they help ensure the strong demand scenario for powdered preservatives.

Market demand has been further driven by pre-mixed bakery ingredient formulations with diverse integrated powdered mold inhibitors, yeast-stabilizing compounds, and gluten-free preservation agents that are supporting accurate product consistency, and minimizing the production variability.

This paradigm has considerably increased bakery preservation as AI-assisted technologies for spoilage threat prediction enable the monitoring of interactions between ingredients in real time, while machine learning algorithms are used for the optimization of preservatives dosing.

The formulation of customized powdered preservative solutions with resistant formulations toward excess heat or temperature, antifungal materials without sugar content, and anti-staling content suitable in a vegan diet has paved an optimized path for market growth while promising a more suitable compatibility across varying bakery manufacturing infrastructures.

However, there are certain drawbacks inherent to this form, including dust-related health concerns during processing, slower activation times compared to liquid preservatives, and the need for hydration in some bread formulations. Nevertheless, the rise of novel technologies such as micronized powder dispersion, AI-based preservative interaction analysis, and moisture-resistant powder encapsulation are enhancing preservative efficiency, formulation safety, and market expansion, dome-shaping growth for powdered bread preservatives globally.

Commercial Bakeries, Large Scale Bread Production and Pre-mixed Baking Solutions Adopting Powdered Preservatives

Powdered bread preservatives are experiencing a higher level of adoption while food standards and preservation acts are also pushing the powdered bread preservatives market as industries are always on the lookout for solutions which are convenient to integrate in production processes, long-lasting, and effective.

Syrups are usually the final form of liquid-based preservatives, but they are cost-ineffective, require more storage space, and are less effective in preventing microbial damage to food than powdered preservatives, due to extended-based composition of powdered preservatives leading to extended shelf life.

Increasing adoption of the high-performance powdered preservation blends, comprising enzyme-based freshness stabilizers, low-sodium organic acid mold inhibitors, and starch retaining anti-staling agents are anticipated to drive adoption. More than 70% of commercial packaged bread brands of large scale use powdered preservatives for shelf stability extensions and dough stability improvements have made this segment in high demand, as shown in studies.

Although the powdered bread preservatives segment holds benefits like the ability to improve texture, a lower risk for spoilage, and increased processing flexibility, it faces challenges including exposure to dust in manufacturing areas, slower activation in liquid-based formulations, and regulatory challenges surrounding fine-particle preservative labelling.

Recent developments like AI-powered formulation mixing, biodegradable moisture-resilient powder coatings, and block chain tracked food safety verification are making preservative usage safer, more efficient, and compliant globally, strongly supporting the expansion of powdered bread preservatives across the world.

Industry Overview

The bread preservative industry demonstrates growth because consumers want longer-lasting bakery goods together with increasing packaged-food use and enhanced food retention methods. The utilization of bread preservatives protects the product from mold development while preventing bacterial infection along with spoilage for maintaining both freshness and safety features.

A market expansion in bread preservatives occurs because customers look for natural and clean-label preservatives while regulators support food safety standards and manufacturers develop antimicrobial and antifungal solutions. Top manufacturers adopt organic acids along with enzyme-based remedies and nature-derived substances as preservatives to accommodate the trend for chemical-free food products preferred by consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kerry Group | 18-22% |

| Corbion N.V. | 15-19% |

| DuPont (IFF) | 12-16% |

| Kemin Industries | 9-13% |

| Puratos Group | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kerry Group | Specializes in clean-label and natural preservative solutions, including vinegar-based antimicrobial agents. |

| Corbion N.V. | Develops lactic acid-based and enzyme-enhanced bread preservatives for extended shelf life. |

| DuPont (IFF) | Provides advanced antimicrobial and antifungal preservatives, focusing on natural solutions. |

| Kemin Industries | Offers plant-based and synthetic preservative solutions with moisture control properties. |

| Puratos Group | Innovates in natural fermentation-based bread preservatives for chemical-free freshness. |

Key Company Insights

Kerry Group (18-22%)

Kerry Group leads the bread preservatives market with its natural and clean-label preservative solutions, offering vinegar-based antimicrobial agents for extended shelf life.

Corbion N.V. (15-19%)

Corbion specializes in lactic acid-based and enzyme-enhanced preservation solutions, ensuring mold prevention and moisture retention in bread products.

DuPont (IFF) (12-16%)

DuPont (now part of IFF) provides a range of antimicrobial and antifungal preservatives, focusing on natural food protection solutions for bakery applications.

Kemin Industries (9-13%)

Kemin Industries is a key player in plant-based and synthetic preservatives, offering advanced moisture control and mold prevention technologies for the bread industry.

Puratos Group (7-11%)

Puratos focuses on fermentation-based preservation, delivering natural and chemical-free solutions to maintain bread freshness and safety.

Other Key Players (30-40% Combined)

Several other companies contribute to the bread preservatives market by developing innovative natural and synthetic solutions for shelf-life extension. Notable players include:

The overall market size for Bread Preservatives Market was USD 4.6 Billion in 2025.

The Bread Preservatives Market expected to reach USD 8.3 Billion in 2035.

The demand for the bread preservatives market will grow due to increasing consumption of packaged and processed bakery products, rising demand for extended shelf-life solutions, advancements in food preservation technology, and growing consumer preference for fresh and safe bakery items.

The top 5 countries which drives the development of Bread Preservatives Market are USA, UK, Europe Union, Japan and South Korea.

Natural Bread Preservatives and Powder Form lead market growth to command significant share over the assessment period.

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.