The Brandy Flavor Market is expected to witness steady growth between 2025 and 2035, driven by rising demand for premium alcoholic beverages, expanding applications in the food and beverage industry, and increasing consumer preference for artisanal and natural flavors.

Brandy flavors, derived from aged fruit-based spirits, natural extracts, and synthetic formulations, are widely used in alcoholic beverages, confectionery, bakery, and gourmet culinary applications. The growing trend of cocktail culture, flavored spirits, and clean-label flavoring agents is further fueling market expansion.

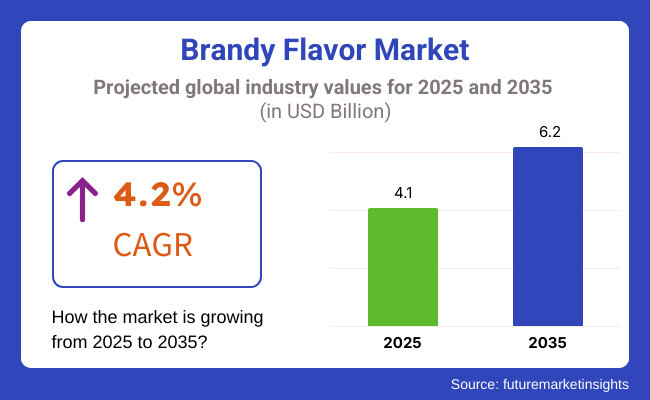

The market is projected to reach USD 4.1 Billion in 2025 and is expected to grow to USD 6.2 Billion by 2035, registering a CAGR of 4.2% over the forecast period.

Increasing adoption of organic brandy flavors, rising popularity of low- and no-alcohol beverages, and advancements in extraction and encapsulation technologies are expected to drive further market expansion. Additionally, the growing demand for aged and craft spirits, along with premiumization in food flavoring solutions, is shaping the future of the industry.

Explore FMI!

Book a free demo

The Brandy Flavor Market in North America is projected to be dominant due to the rising demand for flavored spirits, the growing cocktail culture, and the increasing use of brandy essence in gourmet food.

High consumer spending on premium beverages in the region, adoption of craft distilleries and rise in demand for natural flavoring agents in food is expected to open up new growth avenues for the United States and Canada market.

Market growth is being fueled by the expansion of flavored brandy categories, particularly fruit-infused and barrel-aged varieties. Increasing inclusion of non-alcoholic brandy flavors in desserts, sauces, and artisanal chocolates is also supporting the industry’s expansion.

The Brandy Flavor Market Share is significant in Europe, where France, Spain, Italy, and Germany dominate this spirit's production, consumption, and applications in the culinary world.

Unfortunately, such availability and successful brandy penetration did not occur at every turn, as the demand for true and aged brandy flavors is still largely driven by heritage brandy market leaders such as Cognac, Armagnac and the Spanish Brandy de Jerez.

European luxury and craft distilleries invest in flavor innovation, with organic extracts, natural aging layers etc, elevating the game for premium brandy flavors. Furthermore, artisanal and premium confectionery market growth, which includes brandy chocolates, pastries, and desserts, is opening market opportunities across the region.

The Asia-Pacific region is expected to register the highest CAGR in the Brandy Flavor Market during the forecast period, owing to increasing alcohol consumption, the increasing use of exotic flavors in regional cuisine, and a growing trend for flavored spirits in the growing economies.Premium brandy consumption and cocktail trends and culinary fusion innovations Countries like China, Japan, India, and South Korea have been leading the trend.

China’s blossoming premium spirits sector and increasing spending on fruity and herbal-infused brandy flavors are fueling market growth. India’s growing appetite for Western-style spirits, flavored liqueurs and infused culinary ingredients is also driving growth in the industry.

Japan and South Korea are at the forefront of the growing ready-to-drink (RTD) flavored brandy cocktails, infused gourmet sauces, and confectionery applications in innovative beverage markets.

Challenges

Regulatory Constraints and High Cost of Premium Flavors

Stringent regulations on alcohol-based flavoring agents are another obstacle in the Brandy Flavor Market, particularly in health-conscious and Islam-based nations, where the sale or consumption of alcohol is restricted.

Furthermore, the significant production cost associated with the aging process and premium brandy extracts may result in pricing implications and market accessibility challenges, particularly when it comes to sourcing naturally derived brandy flavors.

The availability of low-cost artificial and synthetic flavors that lack authenticity must be overcome in favor of premium and organic brandy flavor-based manufacturers. Moreover, supply chain interruptions and rising raw material prices (particularly grapes, oak barrels, and natural extracts) can impact the consistency of the product and market stability.

Opportunities

Expansion in Non-Alcoholic and Functional Flavor Segments

There are challenges but the scope for growth remains vast in Brandy Flavor Market. Rising demand for non-alcoholic brandy flavors used in mocktails, gourmet sauces, and functional beverages is unlocking new market segments. Innovations in de-alcoholized and low-alcohol spirits injected with natural brandy essences are booming due to the supersaturation of health-minded consumers who are seeking out alcohol-free but complex flavors.

The growth of premium chocolates, dairy-based desserts, and gourmet bakery products with brandy flavor profiles is providing other streams of revenue for flavor producers, distillers, and food-processing companies. Moreover, the emergence of encapsulation advancements, nanotechnology inspired taste retention, and artificial-intelligence-centric flavor profiling are facilitating improved shelf-life and elevated organoleptic experiences for brandy-based goods.

Barrel-aged extracts, botanically infused brandy flavors and adaptogenic ingredients are among many functional beverage and nutraceutical formulations contributing to market demand for both health-oriented and premium flavor solutions.

The period from 2020 to 2024 saw a steady growth in the brandy flavor market due to the rising consumer demand for premium spirits, craft cocktails, and flavored alcoholic beverages. Optimization in brandy-driven flavouring alternatives was triggered by the ascendency of mixology culture, premiumisation rays in the beverage location, and clients’ inclination toward feasible and all-natural tastes.

Non-alcoholic applications displayed trend in fruit distillates, specialty digestives, and fermentation vinegars; and alcoholic in natural extracts, barrel-aged essences, and fruit-infused brandy flavors in several culinary applications including alcoholic beverages, confectionery, bakery, and gourmet food.

The demand for RTD (ready-to-drink) cocktails, craft spirit companies, and premium culinary applications fostered the use of more oak-aged, caramelized, vanilla, and spiced forms of brandy. Regulatory bodies alongside or in addition to those included above (including bodies such as the USA Food and Drug Administration [FDA], European Food Safety Authority [EFSA] and Alcohol and Tobacco Tax and Trade Bureau [TTB] had identified approved clear regulations on labeling and certifications surrounding natural flavors, setting the stage for an emergence of clean-label, non-GMO and organic brandy extracts. Nonetheless, the market stability of the spirits market segment was hindered by high production costs, disruption of supply chains in aged spirits and availability of raw materials.

During the 2025 to 2035 period, transformational advancements-led by AI-driven flavor profiling, sustainable extraction techniques, and molecular gastronomy-inspired flavor engineering-will shake up the brandy flavor landscape. Sensory analytics supported by AI will allow for hyper-personalized flavor creation to craft distinctive products through dedicated aging profiles, fruit infusions, and caramelization tactics. Fermentation-based bioflavoring will add synthetic, yet natural-identical notes of brandy, opening up reduced dependency on traditional barrel aging, while adding complexity that can be recreated in the barrel.

There will be a focus on sustainability as manufacturers switch to carbon neutral distillations, AI driven raw material optimization, and blockchain based ingredient tracking for raw material tracing and quality assurance. Popularity of zero-alcohol brandy flavors will create opportunity in the market for non-alcoholic spirits market for health-conscious consumers looking for alcohol-free but premium flavors.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and TTB regulations on natural flavor labeling and alcohol content. |

| Technological Advancements | Growth in barrel-aged extracts, natural fruit infusions, and high-quality caramelized notes. |

| Industry Applications | Used in premium spirits, RTD cocktails, confectionery, bakery, and gourmet sauces. |

| Adoption of Smart Equipment | Traditional distillation and natural aging processes for flavor development. |

| Sustainability & Cost Efficiency | Limited focus on eco-friendly distillation, energy-efficient aging, and sustainable flavor sourcing. |

| Data Analytics & Predictive Modeling | Use of sensory analysis and consumer preference tracking for flavor trends. |

| Production & Supply Chain Dynamics | Challenges in aging timelines, seasonal ingredient availability, and raw material price volatility. |

| Market Growth Drivers | Growth fueled by premiumization trends, mixology culture, and rising demand for craft spirits. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-based ingredient authentication, AI-powered regulatory tracking, and sustainability certification for brandy extracts. |

| Technological Advancements | AI-driven flavor profiling, bioengineered fermentation-based brandy flavors, and real-time sensory analytics. |

| Industry Applications | Expansion into non-alcoholic spirits, AI-powered personalized flavoring, and molecular gastronomy-inspired beverage innovation. |

| Adoption of Smart Equipment | AI-enhanced molecular aging, smart barrel simulation, and AI-powered dynamic aroma enhancement. |

| Sustainability & Cost Efficiency | Carbon-neutral distillation, AI-optimized raw material utilization, and blockchain-based supply chain transparency. |

| Data Analytics & Predictive Modeling | AI-driven predictive consumer taste modeling, real-time flavor optimization, and adaptive beverage formulation. |

| Production & Supply Chain Dynamics | AI-powered demand forecasting, decentralized flavor production, and bioengineered sustainable brandy extracts. |

| Market Growth Drivers | Future expansion driven by AI-personalized flavor experiences, bioflavored alcohol innovations, and sustainable brandy essence production |

The Brandy Flavor Market in the United States is witnessing steady growth, owing to the rise in consumer demand for premium and craft spirits, increasing demand in flavored alcoholic beverages, and wider applications in confectionery and bakery. TTB Regulates Brandy-Based Flavors in Bottling and labeling of alcoholic and non-alcoholic beverage applications.

Booming cocktail culture and growing mixology trends have driven demand for brandy-flavored liqueurs, syrups and infused spirits. Moreover, the rising trend for gourmet food ingredients is boosting the use of brandy flavors in desserts, sauces, and marinades. Brands such as Hennessy, E&J Brandy and Courvoisier are making more flavored products in the category of brandy to match individual tastes of consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The United Kingdom Brandy Flavor Market is significantly expanding due to increasing demand for flavored spirits, rising consumer preference for artisanal & craft beverages, and growing applications in the bakery & confectionery industry. The UK Food Standards Agency who implements in-process control checks to guarantee the formulation of high-quality, all-natural brandy flavors for food and beverage use.

Higher end of brandy flavor is gaining traction in both booze and high-end dining. Moreover, the demand for ready-to-drink (RTD) cocktails and flavored spirits is providing an impetus to manufacturers to launch brandy-based liquors, dessert toppings, and flavored extracts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The EU region is seeing steady growth in the Brandy Flavor Market due to the tradition of brandy production, rising demand for natural and authentic flavoring agents and the use of these applications in gourmet cuisine. The use of a brandy flavor in food and beverages, including confectionery products is regulated by European Food Safety Authority (EFSA) and also source the raw materials to be natural.

France, Italy and Spain, major brandy producer and consumer countries (demand for both superior and aging brandy infusion in the spirit and fine dessert. Flavored liqueurs and fruit-infused brandy macerates are also growing in popularity as ingredients in RTD cocktails and craft beverages.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Increasing demand for premium confectionery in turn is leading to the growth of global brandy flavor market including Japan as premium confectionery are prepared by using premium quality ingredients including premium flavoring agents and brandy flavor in Japan used for high end culinary usages are also creating demand in the region. Japanese Ministry of Health, Labour and Welfare (MHLW) regulates the use of alcohol-based flavoring agents in food and its beverages for quality and safety purposes.

Japanese consumers gravitate toward well-rounded and well-aged flavors of brandy, whether in premium chocolates, cakes or cocktail infusions. The increasing usage of flavored syrups and flavored extracts on drinks, both alcoholic and non-alcoholic, such as barrel-aged and specialty spirit flavors is fuelling the demand for brandy-flavored syrups and extracts.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Brandy Flavor The market is growing in South Korea due to the growing preference for craft cocktails, increasing use of brandy-based flavoring in snacks and desserts, and growing demand for Western-style spirits in South Korea. South Korean MFDS is working toward regulatory standards for flavoring agents (both alcoholic and non-alcoholic), inspiring high-quality sourcing of ingredients.

However, the bakery and confectionery segment is driving the demand for fruit-based fillings, syrups, and glazes and the expansion of luxury bars and premium cocktail culture is boosting sales of brandy-based liqueurs and extracts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

The Brandy Flavor Market is expanding rapidly, fueled by an increasing consumer preference for premium, alcohol-infused flavors in food products, rising demand for gourmet culinary experiences, and innovation in flavor formulations. Bakery & confectionery and sauces & savory segments are among the most prominent applications holding a significant share in the food enzymes market for the deployment of rich, aromatic and sophisticated enhancement of taste across a number of food categories.

Bakery & Confectionery Dominates the Brandy Flavour Consumers Brandy in the beverage category is the largest consumer of the brandy flavours, owing to the flavour's rich, warm, and slightly smoky taste profile. Fruitcakes, truffles, pralines, and specialty baked goods all benefit greatly from the addition of brandy flavor, making it the premium ingredient in time-honored recipes.

As consumer demand for artisan and booze-inspired desserts rise, so do brandy-infused fillings, icings, and syrups in premium chocolates and artisanal breads. Moreover, the surge of natural flavors and clean label has forced manufacturers to use authentic brandy extracts in place of synthetic flavoring agents.

Such food has gained popularity, but regulatory concerns about alcohol-based flavors in mass-market confectionery and restrictions in some regions hinder widespread adoption. However, as improvements in flavoring and encapsulated flavor technologies are making alcohol-free brandies more accepted and stable for bakery use.

Brandy flavors are seeing a broader acceptance within the sauces & savory sector, specifically in French cuisine, gourmet sauces, and other hearty gravies. Brandy-inspired sauces-like a brandy cream sauce or cognac-spiked reductions-are popular in steaks, poultry preparations, pasta sauces, and fine dining recipes.

With the emergence of home gourmet cooking and gourmet sauces, there was an increase in demand for ready-to-use sauce blends, along with brandy-infused marinades and cooking bases. And pre-packaged savory meals and restaurant-quality frozen entrees are using brandy flavor to provide depth and complexity in flavor profiles.

But cost sensitivity in mass-market savory categories and potential loss of gentle brandy flavor notes during high-heat stovetop cooking represent hurdles to overcome. Heat-stable concentrated brandy flavor extracts and alcohol-free brandy essence for broader applications across cooking are anticipated to drive adoption of brandy in sauces and savory foods.

Among various brandy flavor types, grape brandy and cognac are the most widely used, offering rich, full-bodied, and authentic aged notes suitable for both sweet and savory applications.

The most typical sort is grape brandy, offering a well-rounded, mild, fruity, and oak-aged taste. Widely used in pastries, fruit preserves, chocolate-based confectionery, and gourmet culinary sauces, deepens and warms flavor evolution.

Due to its versatility, grape brandy is widely used for alcohol-flavored syrups, fillings, and beverage flavoring applications. Moreover, the rising trend of non-alcoholic spirits and alcohol flavored desserts is expected to fuel the demand for natural and concentrated grape brandy extracts across mocktail mixes, dairy desserts, and premium ice-creams.

Factors like variability in flavor intensity based on aging variations and the demand for alcohol-free alternatives are compelling the manufacturers to develop concentrate of brandy flavor that is consistent and of high quality and with controlled aging characteristics.

Cognac, a premium variety of brandy, is being incorporated into more and more high-end bakery products, artisanal chocolates and gourmet sauces, where its aged, complex and slightly spiced profile makes for richer flavor complexity. You do well for premium confectionery brands, seasonal cakes, and artisanal food businesses that highlight legacy and exclusivity.

Specialty flavors like cognac-infused creams are surging in popularity, as are dessert sauces and even premium liquor offerings. Cocktail-inspired desserts and boozy-flavored ice creams have helped cognac expand in dessert and frozen food categories, as well.

Cognac flavored formulations are still considered very much in the premium end of the product categories, despite the increased prices over standard brandy flavors. Improvements in cognac essence development, alcohol-free aged cognac flavors, and fine-tuned extraction processes are likely to increase its reach in off-the-shelf food products.

Increasing demand for premium alcoholic beverages, flavored spirits, and brandy-infused in food and beverage applications is contributing to the growth of the Brandy flavors market. The market is driven by the increasing consumer penchant for craft and artisanal flavors, innovations in natural and synthetic flavor compounds, and growing applications in the confectionery, bakery, and beverages industries.

To improve taste profiles, aroma retention, and product differentiation, companies emphasize natural extracts, alcohol-free brandy flavor substitutes, and tailored formulations. The market includes major flavor houses and specialty ingredient suppliers and beverage manufacturers, with the latest technologies in distillation-based flavor extraction, encapsulated flavors, and sustainability-oriented ingredient sourcing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan SA | 15-20% |

| Firmenich SA | 12-16% |

| International Flavors & Fragrances Inc. (IFF) | 10-14% |

| Symrise AG | 8-12% |

| Mane SA | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan SA | Develops natural and synthetic brandy flavor extracts for beverages, confectionery, and bakery applications. |

| Firmenich SA | Specializes in alcohol-free brandy flavors, encapsulated flavor systems, and premium spirit-based aromas. |

| International Flavors & Fragrances Inc. (IFF) | Provides distillation-based and fermentation-enhanced brandy flavors for food and beverage industries. |

| Symrise AG | Manufactures customized brandy-inspired flavor compounds for alcoholic beverages and non-alcoholic alternatives. |

| Mane SA | Focuses on botanical extracts and natural distillation techniques for high-quality brandy flavor formulations. |

Key Company Insights

Givaudan SA (15-20%)

Givaudan leads the brandy flavor market, offering premium natural extracts and synthetic alternatives for alcoholic beverages, desserts, and fine dining applications.

Firmenich SA (12-16%)

Firmenich specializes in alcohol-free brandy flavors and innovative encapsulation technologies,catering to low- and no-alcohol beverage markets.

International Flavors & Fragrances Inc. (IFF) (10-14%)

IFF provides distilled brandy-inspired flavors, integrating fermentation techniques to enhance aroma complexity and flavor depth.

Symrise AG (8-12%)

Symrise develops customized brandy flavor profiles, supporting flavored spirits, confectionery, and functional food innovations.

Mane SA (6-10%)

Mane focuses on botanical-infused and natural distillation processes, ensuring high-quality brandy flavor extractions for premium applications.

Other Key Players (35-45% Combined)

Several flavor and fragrance companies, beverage ingredient suppliers, and artisanal distillers contribute to advancements in brandy flavor enhancement, sustainable extraction methods, and novel food applications. These include:

The overall market size for the Brandy Flavor Market was USD 4.1 Billion in 2025.

The Brandy Flavor Market is expected to reach USD 6.2 Billion in 2035.

Growing demand for premium alcoholic beverages, increasing use in confectionery and bakery products, and rising consumer interest in flavored spirits will drive market growth.

The USA, France, China, Germany, and the UK are key contributors.

Natural brandy flavors are expected to dominate due to consumer preference for authentic and clean-label ingredients.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.