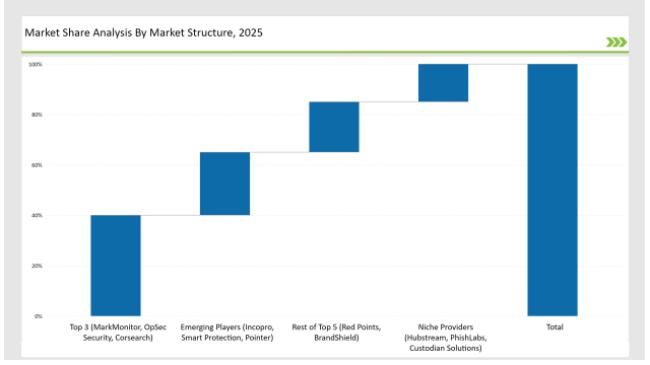

The Brand Protection Tools market is experiencing significant growth as organizations increasingly adopt digital solutions to safeguard intellectual property, trademarks, and online presence. The top 3 vendors MarkMonitor (Clarivate), OpSec Security, and Corsearch hold a 40% market share, offering AI-powered brand protection, anti-counterfeiting tools, and domain monitoring solutions. The rest of the top 5, including Red Points and BrandShield, control 20%, focusing on automated enforcement and real-time fraud detection. Emerging players such as Incopro, Smart Protection, and Pointer Brand Protection account for 25%, excelling in social media monitoring, AI-driven brand reputation management, and online infringement detection. Niche providers like Hubstream, PhishLabs, and Custodian Solutions capture 15%, addressing specialized needs in cybersecurity, intellectual property protection, and marketplace monitoring.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (MarkMonitor, OpSec Security, Corsearch) | 40% |

| Rest of Top 5 (Red Points, BrandShield) | 20% |

| Emerging Players (Incopro, Smart Protection, Pointer) | 25% |

| Niche Providers (Hubstream, PhishLabs, Custodian Solutions) | 15% |

The market is moderately consolidated, where top players control 40-60% of the market. Companies like MarkMonitor and OpSec Security dominate, but mid-sized vendors innovate in for SMEs end users.

The Trademark Monitoring & Enforcement Tools segment leads the market with a 30% share, driven by increasing concerns over counterfeit products and brand infringement. MarkMonitor and Corsearch dominate this segment, leveraging AI-driven brand monitoring and automated legal enforcement capabilities.

AI-powered brand protection is extended, using predictive analytics developed on AI for companies in the fight against online fraud. Large-scale datasets are used by AI algorithms to identify suspicious activities, detect fraudulent transactions, and find patterns of potential threats. This constant learning through current data enhances the fraud detection ability, thus offering proactive measures in trademark infringement, counterfeit product listings, and misleading advertising. Brand reputation, therefore, is entrusted to AI-run protection for the building of consumer trust in a brand in the face of growing e-commerce.

Companies apply blockchain to facilitate authentication of products through securing of supply chains. Here, blockchain forms an indelible record which clearly offers transparency on when the products would move from manufacturing stage to sales with the view to preventing counterfeiting. The industries of pharmaceuticals, luxury goods, and electronics use blockchain-based authentication for the betterment of consumer trust and regulatory requirements for traceability. With the need for fraud prevention, the integration of blockchain solutions protects company products and facilitates the verification process.

Organizations are rapidly deploying cloud-based brand monitoring solutions to assess threats in real time. These platforms provide the ability for businesses to detect unauthorized brand use, identify counterfeit products, and quickly respond to threats. By leveraging cloud computing, companies can tap into advanced analytics, automated alerts, and AI-driven insights that monitor their brand presence across e-commerce platforms, social media, and digital marketplaces. The scalability of cloud-based monitoring allows businesses to enhance brand protection and mitigate risks more efficiently.

Such automated AI-powered solutions identify and eliminate counterfeit sellers from social media and online marketplaces. Systems run through online listings searching for suspicious sellers and reach out against unauthorized use of brands. Besides, fraud detection technologies are being directly embedded into the digital channels of companies to block revenue loss and theft of intellectual property. This active monitoring of online platforms allows companies to preserve brand integrity while providing a safe shopping environment for consumers.

Organizations integrate brand protection systems with legal and compliance platforms for reinforcing enforcement efforts against counterfeiters and intellectual property violators. Enforcement automation helps manage takedown notices, intellectual property claims, and coordinated legal steps against infringers. In other words, this integration empowers businesses to react swiftly toward infringements, in addition to achieving compliance in response to rapidly evolving global laws that regulate the rights of intellectual property. The evolving regulations of this nature encourage brands to increasingly bolster their respective legal frameworks with enhanced asset security.

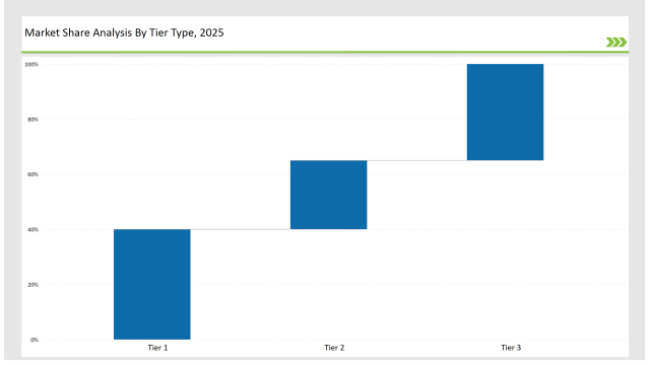

Tier-Wise Company Classification (2025)

| Tier | Tier 1 |

|---|---|

| Vendors | MarkMonitor, OpSec Security, Corsearch |

| Consolidated Market Share (%) | 40% |

| Tier | Tier 2 |

|---|---|

| Vendors | Red Points, BrandShield, Incopro |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Smart Protection, Pointer, Hubstream, PhishLabs, Custodian Solutions |

| Consolidated Market Share (%) | 35% |

Key Company Initiatives

| Vendor | Key Focus |

|---|---|

| MarkMonitor | AI-powered domain protection and automated trademark enforcement. |

| OpSec Security | Blockchain-based anti-counterfeiting and product authentication. |

| Corsearch | Global AI-driven brand enforcement network. |

| Red Points | Real-time social media and e-commerce fraud detection. |

| BrandShield | Automated online marketplace monitoring. |

| Incopro | AI-based brand risk assessment and legal enforcement. |

| Smart Protection | Cloud-based counterfeiting prevention tools. |

Vendors must refine AI-driven detection capabilities to proactively combat brand abuse. Machine learning models will improve accuracy in identifying counterfeit goods, trademark infringements, and domain squatting.

Automation of brand enforcement actions, such as AI-driven legal takedown notices and compliance reports, will streamline operations and reduce manual workload. Cloud-based brand protection platforms will continue to dominate, offering seamless integrations with ERP, CRM, and e-commerce platforms for real-time threat mitigation.

Expanding into emerging markets presents significant growth opportunities. Vendors must ensure regional compliance, multilingual monitoring, and jurisdiction-specific enforcement tools to enhance global adoption.

Leading vendors MarkMonitor, OpSec Security, and Corsearch hold 40% of the market.

Emerging players such as Incopro, Smart Protection, and Pointer account for 25%.

Market concentration is categorized as medium, with top 10 players controlling 60-70% of the market.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.