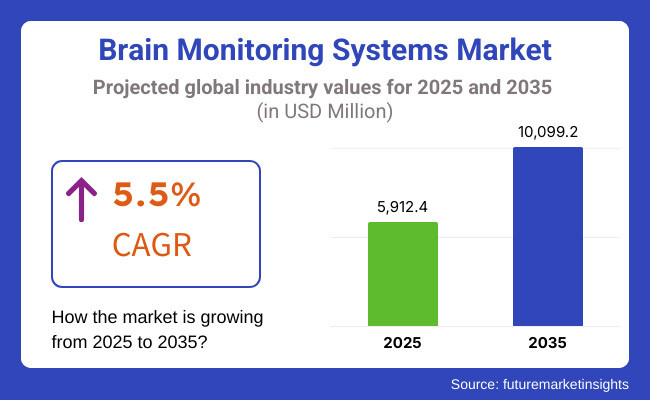

In the coming years the brain monitoring systems products market is expected to reach USD 5,912.4 million by 2025 and is expected to steadily grow at a CAGR of 5.5% to reach USD 10,099.2 million by 2035. In 2024, brain monitoring systems have generated roughly USD 5,604.2 million in revenues.

Brain monitoring systems uses technologies such as networks of electrodes, found in electroencephalography, magnetic resonance imaging, and magnetoencephalography. They are used to analyze neural signals of the brain patterns. The purpose of these systems is to assist with diagnostics in neurology, brain-computer interfacing, cognitive science, and the enhancement of brain functions.

A large motivation for these applications is that there are multiple reasons for the increasing use of brain monitoring systems. Neurotechnological developments have been ever-increasingly fine-tuning, and the instruments are thus being rendered more accurate and more widely available.

Pressure for health solutions is being increased, especially in the area of psychiatry and neurology. Awareness of improvement of brain health, mental well-being, and cognitive development has also become a driving factor for brain monitoring technologies.

Finally, the arrival of artificial intelligence and machine learning has made these complex neural data sets amenable for analysis and contributed to the capabilities and development of brain monitoring technology into different fields.

The ever-increasing number of historical factors that have made brain monitoring systems very popular for over 2020 to 2024 is the increasing incidence of neurological and mental disorders. It has become the focus of brain health. Growing awareness for stress and other related neurological disorder is significantly contributing to the growth of the market.

In addition, investments into neurotechnology have been ramped up in demand by personalized medicine and targeted diagnostics, with a further increase in availability and efficiency with breakthroughs.

The increased focus on mental health and cognition has been one of the fastest growing attractions toward the adoption. Real-time observation and tracing of the brain's function become indispensable in diagnosing such conditions as epilepsy, Alzheimer's, or even depression against this background of rapid aging of the population worldwide.

Furthermore, advancements in artificial intelligence and machine learning will enable more sophisticated neural network analysis of acquired brain data for the uncomplicated resolution of difficult neural patterns.

Given the large increase in global funding for health and the decreasing cost of neurotechnology, brain monitoring systems have become indispensable instruments in both clinical and research environments that improve diagnosis and treatment, as well as general brain health.

Explore FMI!

Book a free demo

Recent advancements in neurotechnology, monitoring devices for the brain have significantly improved in precision and accessibility of the brain monitoring systems. Among these technologies are EEG, fMRI, and NIRS, which are comparatively cheaper, more effective, and less invasive for the setup to be used in the hospital or laboratory.

This demand for good diagnosis and treatment has grown with a burgeoning list of neurological disorders and mental illnesses, among them Alzheimer's and Parkinson's and depression. Brain monitoring systems provide noninvasive means of monitoring brain activity in real time, hence allowing for early detection and personalized treatment options.

These advancements have further opened the horizons of brain monitoring systems, allowing the sick to avoid the physical trip to the clinic for an evaluation, thus improving the access to treatment, especially among disadvantaged communities.

Despite the rightful investment by several governmental grants, technologies from the private sector, and university collaborations have propelled this field. The merger of artificial intelligence and machine learning with brain monitoring systems makes them more empowered in the management of complex brain data and consequently aids the progression of their use into clinical, research, and even consumer wellness applications.

Europe has very heavy pushes of research and development on neuroscience. Brain research is highly sponsored by the government and institutions across Europe; hence, the possibility of innovation in the area of monitoring devices for the brain. These investments brought in advanced technology, which is being widely used in various health care settings for precise and advanced measurement of brain activity.

Another reason causing such evolution is Europe's response towards an increasing prevalence of neurological and psychiatric disorders. With old-age populations relatively increased and rising ailments, such as Alzheimer's and Parkinson's, the need for effective treatment and diagnostics looms large. These brain monitoring systems help in an early diagnosis with proper treatment, thus improving patient outcomes and lowering costs.

Data privacy and security have led to the establishment of ethical, secure, and reliable brain monitoring systems in Europe. Greater consumer awareness regarding monitoring their brain health, combined with increasing consciousness about mental health, has added to the fast-growing market across the continent.

The growing incidence of neurological and mental disorders such as Alzheimer's, Parkinson's, epilepsy, and depression has stimulated a demand for cutting-edge diagnostic equipment. A successful solution for these maladies is a matter of life and death among the rapidly ageing populace in countries like Japan and China.

Brain monitoring systems provide a non-invasive solution for early diagnosis, thereby improving patient care and cutting long-term healthcare costs.

Investment in neuroscience research - by both public and private sectors - has equally propelled the development of more advanced brain monitoring systems. The onset of digital health and telemedicine in Asia Pacific has provided an avenue for remote monitoring of brain activity, thus ensuring that even patients in remote or underserved areas can access essential health care services while avoiding long-distance travel.

Mental health and well-being are now being emphasized more than before in the region, especially in urban areas. Changes in culture towards preventive health care and mental well-being have in turn triggered an increase in interest in the brain monitoring systems for both clinical and private uses.

Accuracy and Sensitivity Issues Related to the Brain Monitoring Systems Hinders its Adoption in the Market

A continuing constraint that is faced by brain monitoring systems is that of data security and privacy. Brain monitoring devices deal with private personal neural information that generates concern about the issues regarding the storage, sending, or guarding of this data.

For the organizations that are framing such overall technologies, it becomes difficult to comply with even the General Data Protection Regulation (GDPR) in countries such as Europe because of strong data protection laws. The same huge volume of real-time data generated by brain monitoring systems also needs substantial cybersecurity measures to prevent unauthorized access or misuse.

These systems now interface most often with personal gadgets and telemedicine platforms; hence, the danger of data breaches has drawn companies' attention to ensuring that security measures remain up to date. Thus, resolving these issues becomes imperative to maintaining consumer confidence and creating an environment for the massive adoption of brain monitoring technologies.

Emphasis of Manufacturers on Introducing Advancements in Neurotechnology which allows for Tailored Therapeutic Interventions can create New Business Opportunities for the Market Players

One of the most promising opportunities created for brain monitoring gathering systems is in the personalized medicine and treatment optimization fields. Because of the neurotechnology improvements, brain monitoring systems can provide real-time, accurate data about a person's neural activity that can be used in very specific therapeutic interventions as behavioral treatments and medication strategies.

Continuous brain-wave pattern monitoring may optimize drug therapies and behavioral treatments on patients suffering from epilepsy, depression, or anxiety through real-time feedback. Personalization will highly boost treatment efficacy and will minimize side effects and, thus, improve patient outcomes.

Besides, the introduction of wearable technologies that are able to measure brain activity offers such systems an opportunity for large-scale applications beyond medical settings. Such systems can help users control or monitor their cognitive well-being, thus leading to preventative treatment and early intervention in most cases where standard access to specialized medical care is not readily available.

Growing incorporation of artificial intelligence (AI) and machine learning (ML) with neurotechnology is one major highlight in brain monitoring systems. In addition, personalized treatments are supported with this technology. For example, AI-enabled platforms could quickly find patterns within the brain that are difficult to detect by human clinicians, thereby prompting earlier intervention.

Such intelligent and automated systems are guiding healthcare into a new era through the innovation of diagnosis and the speeding up of decision-making processes. In addition, AI-derived insights help discover new biomarkers, create targets for novel therapies, and broaden the clinical applications of brain monitoring systems.

The other emerging trend related to brain monitoring systems is the development of low-power portable and wearable devices designed for the continuous monitoring of brain activity. The upsurge is basically aimed at the development of light, portable, and non-invasive technologies such as EEG headbands, brainwave monitors, or even smart helmets that people can wear in everyday life.

Because of this, with these devices, cognitive function, stress, and sleep can be monitored in real time, with very useful information for consumers and healthcare providers alike. The more notable avenues are aligned to mental wellbeing and sports performance, as people are using these devices to sharpen their minds to improve their concentration and mitigate stress.

As technology keeps on improving and going further to become more readily accessible, such wearable brain monitoring gadgets will for sure pass from the clinical to the mass consumer spectrum and herald a new area of brain health monitoring and intervention.

The increasing number of neurological and psychiatric disorders, such as Alzheimer's, Parkinson's diseases, epilepsy, and depression, have created a growing market for brain-monitoring systems. These systems are becoming really popular as they are accurate and non-invasive for diagnosing brain activity and monitoring it happen.

Increased demand for customized healthcare solutions along with the advent of neurotechnologies, which incorporate AI-based integration for real-time analysis of the data, is also affecting the market.

With the wearable technology husk and the growing backdrop of telemedicine, brain-monitoring systems are now open to everyone. Its cost-effectiveness over time, especially in the long term, especially in combat against chronic neurologic disorders, can serve as a further incentive for market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory bodies are increasingly emphasizing safety and efficacy for brain monitoring systems, especially concerning data privacy and compliance with global standards like GDPR. |

| Technological Advancements | The integration of AI and machine learning with brain monitoring tools has improved real-time data analysis, enabling early detection of brain disorders. |

| Consumer Demand | Increasing awareness of brain health, cognitive wellness, and mental health conditions has led to higher demand for brain monitoring systems, especially in urban populations. |

| Market Growth Drivers | Rising prevalence of neurological and mental health conditions, such as Alzheimer’s and epilepsy, is driving demand for brain monitoring systems. |

| Sustainability | Manufacturers are developing energy-efficient and non-invasive brain monitoring systems that require less infrastructure, making them more affordable and accessible. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | The year 2035 more holistic regulations with stricter standards for data protection, accuracy of diagnostics, and ethical applications of A.I. in the monitoring tools of brains |

| Technological Advancements | The future progresses with real-time individualized treatment strategies using diagnostics that rely on A.I., thus improving precision in brain health management further than the wearable devices that monitor 24/7. |

| Consumer Demand | Increased global demand by 2035, stimulated by the need from clinical practice and patient demands for mental well-being, is expected to spread even more into home-based care and telemedicine. |

| Market Growth Drivers | Will spur immense growth in the market, driven by personalized preventive treatment for diseases related to the nervous system, with much wider incorporation of brain monitoring in both clinical and home enviroments |

| Sustainability | The sector will primarily gear itself towards sustainable methodologies, especially those focused on minimizing environmental footprint through recyclable materials and energy-efficient devices, making brain monitoring a greener product. |

Market Outlook

well-established healthcare infrastructure and a robust focus on innovation, the USA occupies a considerable part of the market for brain monitoring systems. With a growing number of neurological as well as mental diseases, the potential for growth is fantastic.

Rising demand for personalized medicine and early diagnosis products opened up doors toward application of brain monitoring systems such as EEG, fMRI, and wearables into both clinical and consumer health products.

Fast-tracking development and adoption of these for brain monitoring is achieved through government grants and private investments in AI-based technologies. Expanding telemedicine and remote monitoring increases further, rapid growth in these systems to much more citizens.

Market Growth Factors

Market Forecast Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

Market Outlook

With the magnificent healthcare infrastructure of Germany coupled with an emphasis and investment in research and development activities, the brain monitoring systems market is hardly ever out of bounds in the country. Increasing neurasthenic degenerative diseases and growing age groups in the population are driving increased demand for much improved devices for diagnosis, such as EEG and fMRI.

A well-developed healthcare system provides assurance for the integration of current technologies. While government support and funding of neuroscience research enhance the momentum of growth in the market, precision medicine and AI-based brain health diagnostics are likely to drive personalized therapy in Germany, and this will make the market sustainable for growth in coming years.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.3% |

Market Outlook

The demand for brain monitoring systems in India is sky-high ganes, which relate directly to the increased awareness about mental and neurological diseases rather than booming health care industries or other factors in the country. New emerging technologies like mobile-based health care are improving and increasing demand for the economical brain monitoring devices with rising incidence of diseases such as epilepsy, stroke, or Alzheimer's.

The major drivers for the market growth are the increased adoption of wearable technology and investment by the government in telemedicine and digital health. Impact of increased penetration of healthcare technology will have its best effect as far as cost-effective and efficient solutions for brain monitoring are concerned in tier-2 and tier-3 cities.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

Market Outlook

The largest driver of brain monitoring system market in China is its tremendous population, fast urbanization, and, most recently, the most rising aged population over the years. Moreover, there has been a rise in cases of neurologic illnesses like stroke and even mental illnesses like depression and anxiety calling for such products even louder.

Moreover, the Chinese government is also heavily investing in healthcare infrastructure and cutting-edge technologies such as AI and big data analytics for enhanced management of brain wellness. Consumer demand for health and brain enhancement products will also drive the market, along with it. Owing to increased accessibility to healthcare facilities in rural areas, brain monitoring systems will experience a broader adoption reach.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

Market Outlook

Growth drivers for brain monitoring system market include the increasing aged population of Japan and rising number of neurological disorders such as Parkinson's and dementia. Next to Japan itself has a well-established healthcare infrastructure and highly relies on the introduction of new technologies to bring more innovation in the brain monitoring technology.

Besides, a good share of research activities in that country has been concentrated on the prevention of neurodegenerative disorders and personalized medicine.

Continued growth will be witnessed by this market, and Japan has successfully pioneered the introduction of wearable devices-based solutions for brain monitoring due to increased consumer interest in brain and mental health. Increased further by convergence of AI and big data, accuracy in diagnostics further facilitates expansion in the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The Cost Effective Nature of EEG Systems aid it to hold Dominant Position in the Market

EEG systems are dominating in the market because of being cheaper, non-invasive, and real-time acquisition of data. EEG is a long-tested and reliably used instrument to diagnose and monitor neurological disorders such as epilepsy, sleep disorders, and brain injuries. Mobility and relative affordableness strengthened its use both in its clinic and outpatient environments, thus widening its reach.

Furthermore, EEG systems can monitor continuously, providing common data on brain activity, critical data that can assist patients with chronic diseases. Easy use and simplicity add public popularity to EEG systems, more in clinical settings, to make these be the most struck-at segment in the market.

The Growing Clinical Application of fNIRS Segment aid them to Grow at Higher Rate

The fNIRS market is growing at the highest CAGR. The major reason is its application in functional brain imaging because, unlike conventional MRI and EEG, fNIRS is a portable, low-cost, non-invasive technique for quantifying brain activity in real-time.

The method has increased research and clinical applicability, especially in cognitive neuroscience, neurorehabilitation, and pediatrics, which allows continuous observations in a non-specialized spectral equipment set-up.

Furthermore, fNIRS is becoming more prevalent in hospitals and rehab centers because it can record brain function while patients interact with their environment during speech or movement, lending its technique to observing everyday brain functions.

The Growing Demand for advanced diagnostic tools in Hospitals aid it to Hold Highest Market Share

Increasing demand for advanced diagnostic instruments for various neurological ailments in hospitals aid it to dominate the market. These systems are integrated into the intensive care units (ICUs), neurology wards, and emergency departments to be applied widely.

Moreover, hospitals are the prime location for the longitudinal resident monitoring of patients with chronic neurological diseases, and thus, they add need to the technologies regarding brain monitoring. So, due to the availability of trained healthcare professionals and modern equipment, hospitals continue to be the leading end-user market.

Growing Adoption of Brain Monitoring Systems to provide Quick, Cost-Effective Diagnostics in Ambulatory Surgical Centers aid it to gain Traction in the Market

Due to the growing trend towards outpatient treatment, the ambulatory surgical centers (ASCs) segment is expanding at the highest CAGR. ASCs have been taking brain monitoring systems on board in order to provide timely, cost-effective diagnostics and therapeutics for a wide array of neurological diseases.

Patient convenience and lack of hospital stays are increasingly the target of healthcare systems, and ASCs have been now recognized as a convenient alternative for patients for minimally invasive procedures.

Post-procedure care is also now more often being done using brain monitoring technologies in ASCs, and elective neuro surgeries are continuing to play a role in the intensifying focus on outpatient alternatives thus driving the rapid uptake of brain monitoring systems in ASCs and resulting in the highest growth rate within the market.

The brain monitoring systems sector is swiftly becoming congested with new players coming into the markets and making innovative solutions to meet the growing demands for advanced diagnostic solutions. Companies are investing in the development of EEG, fNIRS, and other monitoring technologies to give solutions that are accurate, non-invasive, and cost-effective.

Great focus is on the acceptance of artificial intelligence and machine learning in the solution to render it intelligent with real-time monitoring. Other factors gaining rather special focus are portability, ease of use, telemedicine compatibility, and thereby mass-level access to brain health diagnostics in both clinical and home-care situations.

In an attempt to appeal to the mass markets, manufacturers have increasingly focused on low-cost and accessible solutions, primarily in developing markets. Whereas the increasing need for customization by research institutions, ambulatory surgical centers, and hospitals, has made the brain monitoring technology more inclusive and diverse in its turn causing competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Neurosoft | 36.5% |

| Natus Medical Incorporated | 20.6% |

| Medtronic PLC | 17.0% |

| Integra Lifesciences | 6.8% |

| Other Companies (combined) | 19.0% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Neurosoft | The release of a new model of EEG systems by Neurosoft with improved sensitivity and portability for real-time monitoring of brain activity in a homecare or clinical setting. The company has integrated an AI algorithm for an improved diagnosis of neurological diseases such as epilepsy and sleep apnea |

| Natus Medical Incorporated | Natus Medical has pointed out that the product line is growing with the introduction of a new portable EEG product in 2024. This new gadget is intended for ambulatory care, owing to increased demand for remote monitoring of the brain. The company strengthened its position in emerging markets with low-cost and easy-to-use brain monitoring solutions. |

| Medtronic PLC | Medtronic launched their latest-generation brain monitoring system in 2024 with an emphasis on real-time data analysis and remote monitoring. It will interface seamlessly with Medtronic's current neurological treatment platforms, offering better-tailored care for stroke and epilepsy patients |

| Integra Lifesciences | Integra Lifesciences diversified their business in brain monitoring systems with the development of a new intraoperative monitoring system, providing real-time information to neurosurgeons during critical brain surgeries to increase outcomes and reduce complications. Integra Lifesciences also extended research into AI-based monitoring devices for neurological disorders |

Key Company Insights

Neurosoft

Neurosoft is developing brain monitoring technologies to increase diagnostic accuracy and develop mobility. EEG systems by Neurosoft enhance diagnosis and treatment of neurological disorders such as epilepsy and sleep disorders. With AI algorithms, Neurosoft is now moving toward providing accurate real-time monitoring options for clinic and home requirements.

Natus Medical Incorporated

Natus is focused on high-quality diagnostic devices for brain health and increasing accessible and efficient EEG systems. Their mobile EEGs accommodate the growing demand for remote brain monitoring solutions with cost-effective and reliable diagnostics for all healthcare professionals and patients. Natus also has a focus on offering solutions for ambulatory environments, giving patients consistent monitoring and care.

Medtronic

Medtronic focusses on integrated brain monitoring systems that will directly affect patient outcomes. By combining their neurological therapy platforms with new brain monitoring technologies, Medtronic helps create smooth solutions for epilepsy management, stroke, and neurodegenerative disorders. Their research into real-time monitoring and data analysis is geared toward individualized treatment and care.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. They include:

These companies focus on expanding the reach of brain monitoring systems, offering competitive pricing and cutting-edge innovations to meet diverse needs.

The overall market size for brain monitoring systems market was USD 5,912.4 million in 2025.

The brain monitoring systems market is expected to reach USD 10,099.2 million in 2035.

Increase in number of people suffering from neurological diseases anticipates the growth of the market.

The top key players that drives the development of brain monitoring systems market are Neurosoft, Natus Medical Incorporated, Medtronic PLC, Integra Lifesciences and Compumedics Neuroscan

EEG Systems segment by product is expected to dominate the market during the forecast period.

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Hutchinson-Gilford Progeria Syndrome Market Growth – Innovations & Therapies 2025 to 2035

Home Infusion Therapy Devices Market - Growth & Forecast 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market - Trends & Forecast 2025 to 2035

Home Healthcare Market Growth - Trends, Innovations & Forecast 2025 to 2035

Dental 3D Printing Material Market Trends, Growth & Forecast by Material, Product, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.