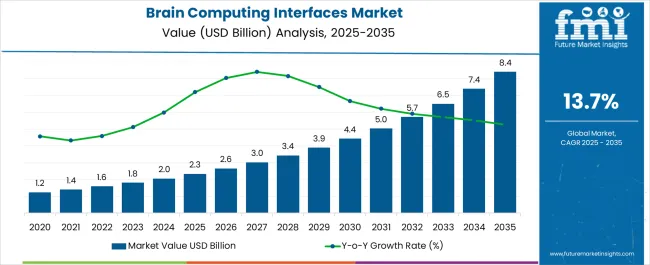

The Brain Computing Interfaces Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 13.7% over the forecast period.

| Metric | Value |

|---|---|

| Brain Computing Interfaces Market Estimated Value in (2025 E) | USD 2.3 billion |

| Brain Computing Interfaces Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 13.7% |

The brain computing interfaces market is expanding rapidly due to advancements in neurotechnology, increased investment in brain research, and the growing demand for assistive communication and control systems. Rising prevalence of neurological disorders and the need for innovative therapeutic solutions are accelerating adoption in both clinical and research settings.

The integration of artificial intelligence, machine learning, and wireless connectivity has significantly enhanced the performance and usability of brain computer interface systems. Regulatory support for medical device innovation and expanding clinical trials are strengthening market confidence.

Furthermore, the shift toward personalized healthcare and rehabilitation solutions is increasing reliance on these technologies for patient care. The future outlook remains positive, with opportunities in neuroprosthetics, cognitive monitoring, and human machine interaction paving the way for broader adoption across multiple industries.

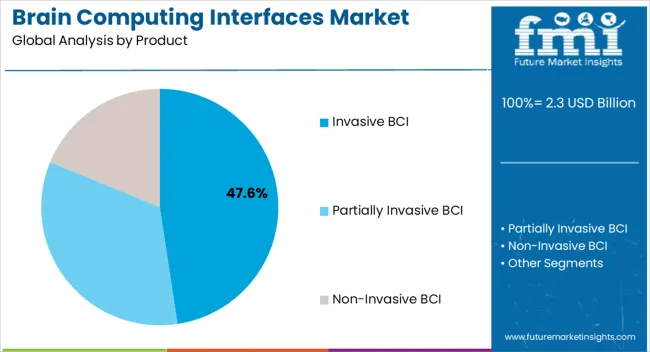

The invasive BCI segment is projected to account for 47.60% of total revenue by 2025 within the product category, making it the leading segment. Its dominance is driven by the high precision of signal acquisition, enabling direct communication with the brain for advanced medical applications.

The ability to deliver accurate and reliable data has reinforced its use in treating severe neurological conditions, restoring sensory functions, and enabling complex motor control through neuroprosthetics. Continued innovation in minimally invasive surgical techniques and biocompatible electrode materials has improved patient outcomes and adoption.

As healthcare systems emphasize precision medicine and advanced neurorehabilitation, invasive BCI maintains a strong position in the product landscape.

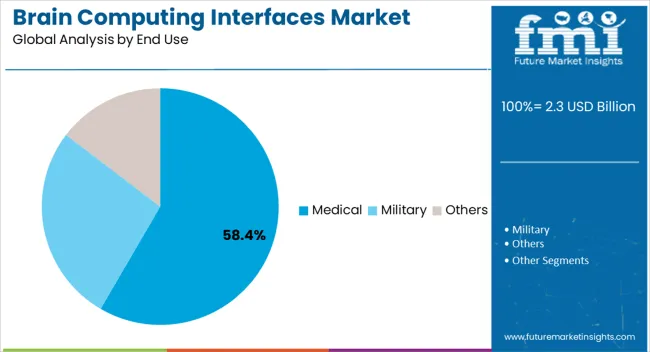

The medical segment is anticipated to hold 58.40% of overall market revenue by 2025 under the end use category, establishing itself as the largest end use sector. Growth in this segment is being propelled by the increasing need for advanced treatment of neurological conditions such as paralysis, stroke, and spinal cord injuries.

The deployment of BCI systems in surgical planning, brain mapping, and motor function restoration has reinforced their value in clinical practice. Hospitals and research institutions are increasingly adopting BCI solutions for patient centric care, while collaborations between technology developers and medical device companies are accelerating innovation.

This alignment with medical priorities and clinical outcomes has ensured the dominance of the medical segment in the brain computing interfaces market.

FMI states that the global brain computing interfaces market is expected to grow at a CAGR of 15.6% from 2020 to 2025. BCIs are capable of combining with artificial intelligence (AI) and robotics in order to create powerful systems.

For instance, brain activity decoding is done to improve precision when BCIs are used alongside AI algorithms, or advanced prosthetics that can be controlled by the brain. In both human-machine interactions and medical breakthroughs, collaborations like these can be beneficial.

Mental health conditions can be monitored and managed using BCIs. Neurofeedback can improve mental well-being and self-regulation skills by providing real-time information about brain activity. Post-traumatic stress disorder (PTSD) and anxiety are some of the conditions that BCIs may help with.

As BCIs will increasingly develop ethical concerns related to privacy, confidentiality, and informed consent as they become more advanced and widespread. In order for BCIs to be used responsibly, data protection and responsibility for their use will be key.

To handle these challenges and protect user rights, guidelines and regulations should be established.

Technological Innovations in BCI Devices to gain Traction in Coming Years

Research is continually being conducted to develop higher precision and spatial resolution methods for recording neural activity. In the near future, new technologies will allow doctors to interpret the activity of the brain more accurately, including optogenetics, electrocorticography (ECoG), and nanotechnology-based sensors.

A growing trend has been observed toward the development of miniaturized and wearable devices for body-computer interfaces. In addition to being mobility-, comfort-, and user-friendly, these compact systems are suitable for long-term use in everyday life.

Consumer electronics, healthcare, and assistive technologies can all benefit from wearable BCIs.

The use of BCIs can enhance human capabilities in a number of different areas. For example, BCI is being explored for applications in neurorehabilitation to restore movement and control to people with motor impairments. Cognitive functions can also be enhanced by BCIs, such as improving memory and attention.

With BCIs, brain-to-cloud communication can be achieved directly through the internet. With this, human brains can exchange information with online platforms, databases, and artificial intelligence systems seamlessly. Educational institutions, entertainment, and data analysis could all benefit from this technology.

The Use of Military Sectors to Increase Demand for Brain Computer Interfaces

Brain computing interfaces are expected to become widely used in the United States market. By 2035, the brain computing interfaces market is expected to reach a valuation of USD 2.3 billion in the United States. US economic growth is projected to grow at a CAGR of 13.7% between 2025 and 2035.

The United States military has also explored BCIs for controlling drone swarms, monitoring a soldier's cognitive workload, and interconnecting weapons systems. The use of BCIs in healthcare extends to communicating with patients who are completely confined to prison.

There are a number of BCI projects and startups underway in the United States that are exploring this technology's potential applications.

Several clinical trials are being conducted on brain devices in the United States which helps explain the region's dominance.

Universities, hospitals, and research centers are increasingly adopting these devices and launching new initiatives such as the human brain project. With rising technologies in the country and dominance in healthcare, the brain computing interface demand is expected to grow.

China Implements High Levels of Advanced BCI, Paving the Way for the Growth Business

According to FMI, brain computing interfaces sales in China are expected to reach USD 8.4 billion by 2035. From 2025 to 2035, the Chinese market is predicted to grow by 13.5%. Modernization of healthcare will lead to better options for individuals and healthcare professionals.

The growing incidence of neurodegenerative conditions in these countries has contributed to the growth of the BCI market. The demand for BCIs in this region will be driven by unmet needs, a rise in healthcare expenditures, and increased awareness among patients.

Foreign investors have flocked to China due to low manufacturing costs and favorable taxation policies. Innovations had been developed through intensive research and development.

Chinese researchers also developed a brain-machine interface in 2024 using memristor arrays that can analyze neural signals, which achieved 93% accuracy in filtering epilepsy-related neural signals.

Developing Invasive Products That Improve Performance to Encourage the Use of Brain Computing Interfaces

Invasive BCIs are expected to dominate the brain computing interfaces market. According to forecasts, this segment of the market is expected to grow by 13.4% over the next few years. According to the government, the economy is expected to grow at a CAGR of 15.5% between 2020 and 2025.

A brain-controlled robotic leg & arm and a camera connected to the brain will be able to restore vision to paralyzed people over the forecast period, so the invasive segment is expected to grow the fastest over the forecast period.

A new development in invasive BCIs would be the development of minimally invasive techniques to decrease the invasiveness of the procedure, thereby increasing market demand.

While BCIs may offer potential benefits, they are also ethically problematic, including the risk of adverse effects on the brain and the need for informed consent. The development and use of brain-computer interfaces are expected to be fueled by future demand and growth, but they need to be evaluated for ethical and safety concerns.

Due to its ease of adaptation and various technological advancements, partially invasive BCI will also see significant growth during the forecast period. For instance, Synchron Inc. launched Stentrode in September 2020, a wireless neural interface that records brain activity partially invasively.

Healthcare Application is expected to Increase Demand for Brain Computing Interfaces

FMI predicts that the healthcare segment will grow at a CAGR of 13.1% by 2035. Cognitive or physical impairments are being treated with brain computer interface (BCI) technology. It promises to significantly improve the autonomy and mobility of these patients, which will greatly enhance their quality of life.

In addition to being an assistive, adaptive, and rehabilitation technology, BCI can be used to identify signals indicating the elderly's intent, which can then be incorporated into commands that can control almost any device.

Growing demand for training motor/cognitive abilities is expected to help prevent the effects of aging in the future. As home nursing becomes more prevalent, BCI devices are expected to become more widely used for interacting with others as well as controlling home appliances.

An exoskeleton is a device that controls the joints of the body in order to increase their strength. Besides enhancing the study of neuroscience, BCIs are used to convert the signals from the brain into commands that are then displayed on a device such as a keyboard and a light controller for specific tasks such as reading or typing.

Advanced healthcare systems have been developed using BCI technology integrated with the Internet of Things (IoT). Neuronal interfaces that enable people with disabilities to communicate are being developed by startups such as CereGate.

BCIs can be used in healthcare systems to benefit patients and researchers alike, offering numerous opportunities and benefits.

Technological advancements and changing market conditions constantly shape business trends. A growing startup ecosystem is resulting from the growing popularity of brain computing interfaces around the world. Some of the most important brain computing interfaces startups are listed below:

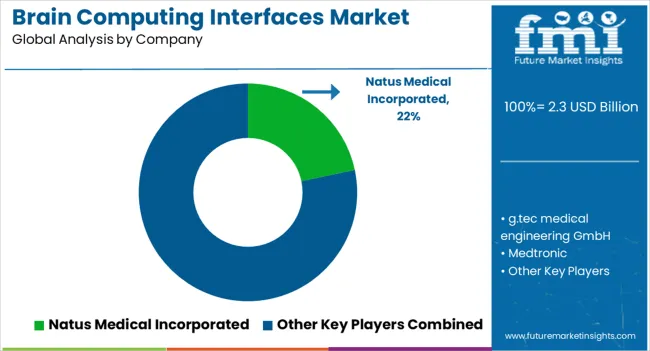

Many key players are active in the brain computing interfaces industry. Competitors compare the quality of their products, their innovation, their pricing, their distribution network, and their aftersales service.

The Internet of Things (IoT) is one of the key technologies being invested in by key players to improve valve operations and decision-making. New technologies such as IoT and brain implants are being introduced by key companies.

As a result, it enhances the efficiency of the valve, which in turn enhances the efficiency of the interfaces.

A number of approaches are being used by manufacturers to expand their business with aircraft OEMs, including alliances, mergers, and acquisitions.

Various strategies are being adopted by key players to maintain their dominance in the market. Product launches, partnerships, and collaborations are examples of mergers and acquisitions.

A strict regulatory environment presents several challenges to the brain computing interfaces industry. Moreover, the industry must continue to advance its technology in order to keep up with its evolving needs.

New entrants can invest in brain computing interfaces despite the challenges. A focus on developing distribution networks, researching and developing improved and cost-effective computing interfaces, and focusing on expanding markets.

In June 2025, CraniUS LLC, a company dedicated to improving brain health through the development of new diagnostics and treatments, announces the results of their preclinical study examining their patented NeuroPASS device, which demonstrated successful convection-enhanced delivery.

In June 2025, Wearable Devices Ltd., an innovative technology company focused on the development of wearable technology powered by artificial intelligence that provides touchless sensing to users, is delighted to announce the release of the Mudra Band application, which can now be found on the Apple App Store.

Additionally, Mudra Band users now have access to an exclusive Apple Watch Face.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Market Segments Covered | Product, Application, End-use, Region |

| Key Companies Profiled | Natus Medical Incorporated; g.tec medical engineering GmbH; Medtronic; Compumedics Neuroscan; Brain Products GmbH; Integra Lifesciences Corporation; Advanced Brain Monitoring, Inc.; EMOTIV; NeuroSky; Interaxon, Inc.; ANT Neuro; Neuroelectrics; Ripple Neuro; NIRx Medical Technologies, LLC; OpenBCI; CGX, A Cognionics Company |

| Customization & Pricing | Available upon Request |

The global brain computing interfaces market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the brain computing interfaces market is projected to reach USD 8.4 billion by 2035.

The brain computing interfaces market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types in brain computing interfaces market are invasive bci, partially invasive bci and non-invasive bci.

In terms of application, healthcare segment to command 52.3% share in the brain computing interfaces market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Brain Fingerprinting Technology Market

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Auditory Brainstem Response Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Wireless Brain Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA