The Box Sealing Machines Market is expected to experience steady growth between 2025 and 2035, driven by increasing automation in packaging, growing e-commerce and logistics industries, and rising demand for efficient and high-speed sealing solutions.

Box sealing machines are widely used in food & beverage, pharmaceuticals, consumer goods, and industrial packaging, ensuring faster, more precise, and tamper-proof sealing. The adoption of automated and semi-automated sealing technologies, integration of AI and IoT for predictive maintenance, and demand for sustainable packaging solutions are further fueling market expansion.

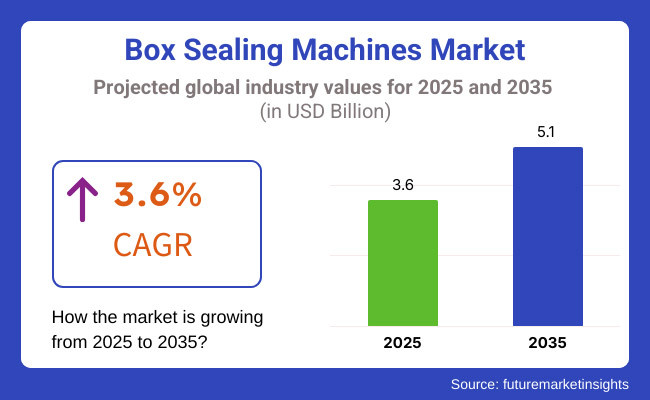

The market is projected to reach USD 3.6 Billion in 2025 and is expected to grow to USD 5.1 Billion by 2035, registering a CAGR of 3.6% over the forecast period. Increasing investments in smart packaging solutions, eco-friendly sealing tapes, and fully automated sealing systems are expected to drive innovation and efficiency in the industry. Additionally, the rising focus on reducing packaging waste and improving supply chain automation is boosting demand for energy-efficient and customizable box sealing machines.

Explore FMI!

Book a free demo

It is expected that North America would occupy a large share in the Box Sealing Machines Market due to growing demand for automated packaging and growth of e-commerce along with focus on sustainability in logistics. The demand for AI-enabled packaging systems and robotic automation in warehouses is high owing to government support for sustainable packaging Solutions, which leads North America to dominate the regional market.

Amazon, UPS, FedEx, and other major logistics companies are paying for the machines and trying to push warehouses to be more efficient with faster, AI-driven machine presses that seal boxes. Moreover, North America is witnessing the growing adoption of tamper-proof and food-safe sealing solutions in the food & beverage and pharmaceutical industries to satisfy the FDA & USDA packaging regulations.

With focus towards sustainable packaging innovation, high-precision sealing technologies and compliance with environmental regulations, countries such as Germany, the UK, France, and Italy in Europe possess a significant share of Box Sealing Machines Market. EU directives on packaging waste are driving manufacturers to invest in biodegradable sealing tapes, recyclable materials and energy-saving machinery.

Increasing demand for fully automated sealing machines, with tamper-proof and hygienic features in pharmaceutical and food packaging industries in Europe sector are expected to drive the growth of the market. Furthermore, the growth of Industry 4.0 technologies, such as IoT-enabled predictive maintenance and AI-enabled quality control, is revolutionizing the automation of smart packaging in the region.

The Asia-Pacific region is anticipated to record the highest CAGR in the Box Sealing Machines Market due to rapid industrialization, the rise of online retail, and substantial investment in automated packaging solutions. The market is growing in countries such as China, Japan, India, South Korea, and is primarily driven by booming e-commerce and, rising export activities and strong growth in the manufacturing sector.

As the largest e-commerce market in the world, China is investing heavily in high-speed sealing automation to meet the growing demands of logistics and warehouse stimulation. Another key factor playing a role in an expanding market are rising levels of automated packaging machinery being employed in the FMCG, pharmaceutical and food delivery services across India. Japan and South Korea are at the forefront of advanced robotics, AI-smart quality control and next-gen packaging automation technologies.

Challenges

High Initial Investment and Maintenance Costs

High capital expenditure for complete automatic sealing solutions reduces the feasibility of such systems for small and mid-size business (SME) is among the key challenges facing the Box Sealing Machines Market. Moreover, advanced sealing machines often come with operational costs associated with routine maintenance, calibration, and skilled personnel requirements.

In addition to that, integration challenges with existing production lines, especially in older manufacturing facilities, may slow the transition to automated sealing solutions. Market dynamics are also affected by the change in price of raw materials like adhesives and packaging tapes.

Opportunities

AI-Powered Sealing Machines and Sustainable Packaging Innovations

There are substantial growth prospects across the Box Sealing Machines Market despite being faced with multiple challenges. AI-driven integration with sealing machines, which consists of real-time defect detection, adaptive sealing mechanisms, and cloud-based predictive analytics is improving the operational efficiency and reducing downtime.

The emergence of sustainable and biodegradable packaging materials is promoting the demand for custom GMP sealing solutions compatible with compostable tapes as well as recycled cardboard packaging. Also, increasing warehouse automation, smart logistics and robotics-powered packaging systems are likely to aid to such devices' adoption in the next generation.

Increasing demand for high-speed, flexible, and precision-based sealing technologies is being driven further by mechanisms such as the expansion of subscription box services, direct-to-consumer (DTC) brands, and sustainable packaging initiatives. Future’s automated packaging industry would be driven by innovations addressing filling accuracy and precision like heat-free sealing, RFID-enabled track-and-trace solutions and robotic-assisted sealing arms.

The global box sealing machine market scenario has been growing due to some high-impact rendering factors such as growing e-commerce, trends towards automation in packaging, and growing efficiency demand through logistics and warehousing processes over the forecast period of 2020 to 2024. These factors were further accelerated by increasing online shopping, explosive growth of 3PL services, innovative packaging technologies, all of which translated into a high adoption rate of semi-automatic and fully automatic box sealing machines. Almost all end-users that include food & beverage, pharmaceuticals, electronics, and retail industries made substantial investments in automated case sealing solutions to augment packaging speed, lower labor costs, and ensure product safety.

From AI-powered tape dispensers to sensor-based sealing verification and automated flap-folding mechanisms, technology finessed operational efficiency. Concerns regarding sustainability were another major reason, causing manufacturers to move toward biodegradable adhesive tapes, energy-saving machines for sealing, and recyclable packaging solutions. But the widespread adoption of automatic box fillers in small and medium-sized enterprises (SMEs) was hindered by high initial investment costs, maintenance requirements, and box size compatibility.

The box sealing machines market will not be the same as it is now, right from 2025 to 2035 due to advancements in AI-driven predictive maintenance, robotic-assisted packaging solutions and IoT-enabled smart sealing systems. AI-enabled real-time quality control will improve sealing precision, tape optimization, and error detection, thereby decreasing waste and downtime. By using machine learning algorithms to automatically adapt the seal to each box type, weight, and shipping circumstance, efficiency and customization will be significantly enhanced.

One of the most prominent drivers will be sustainability, as manufacturers will increasingly develop more efficient water-activated biodegradable tapes, paper-based sealing adhesives, and low-energy box sealing technologies. Using blockchain technology to secure packaged goods, industries subject to stringent packaging guidelines like pharmaceuticals and food & beverage will be able to ensure supply chain transparency, prevent counterfeit products, and automate compliance tracking.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with packaging waste reduction laws, adhesive material safety, and automation safety standards. |

| Technological Advancements | Development of automatic case sealers, sensor-based flap detection, and variable tape dispensers. |

| Industry Applications | Used in e-commerce, food & beverage, pharmaceuticals, and industrial packaging. |

| Adoption of Smart Equipment | Integration of semi-automatic sealing machines in mid-sized warehouses. |

| Sustainability & Cost Efficiency | Transition to biodegradable packaging tapes, energy-efficient machines, and waste reduction initiatives. |

| Data Analytics & Predictive Modeling | Use of basic packaging analytics and sensor-based fault detection. |

| Production & Supply Chain Dynamics | Supply chain affected by high equipment costs, limited customization options, and maintenance downtime. |

| Market Growth Drivers | Growth fueled by e-commerce boom, rising labor costs, and demand for automation in packaging. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-based packaging traceability, AI-driven regulatory compliance tracking, and automated waste reduction systems. |

| Technological Advancements | AI-powered predictive maintenance, robotic-assisted box sealing, and IoT-enabled smart sealing verification. |

| Industry Applications | Expanded into autonomous logistics hubs, AI-powered supply chain management, and robotic packaging lines. |

| Adoption of Smart Equipment | Self-learning sealing machines, robotic case sealing arms, and smart packaging analytics for error reduction. |

| Sustainability & Cost Efficiency | Water-activated biodegradable tapes, AI-driven material optimization, and carbon-neutral packaging automation. |

| Data Analytics & Predictive Modeling | AI-driven sealing optimization, real-time defect analysis, and machine learning-assisted adaptive sealing technologies. |

| Production & Supply Chain Dynamics | Decentralized sealing system production, AI-optimized supply chain logistics, and on-demand smart box sealing customization. |

| Market Growth Drivers | Future expansion driven by autonomous fulfillment centers, AI-enhanced packaging flow, and sustainability-driven packaging solutions. |

Its need to expand and utilise newer products has also generated the growth factor in the market. Enforcement of packaging safety and quality standards by the USA Food and Drug Administration (FDA) and Occupational Safety and Health Administration (OSHA), has led the companies to invest in automated and high-precision sealing machines.

Box sealing machines are categorized into semi-automatic and fully automatic and are capable of sealing at least 30 boxes/min; this demand driven by warehouse automation and growth of the e-commerce sector. Top companies like 3M, Intertape Polymer Group (IPG), and Wexxar Bel are developing AI-driven and IoT-enabled sealing systems that are improving operational efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The Market for UK Box Sealing Machines is evolving due to increasing demand from e-commerce fulfilment centres, growing acceptance of sustainable packaging, and automation of sealing. Manufacturers must develop sustainable heat seal solutions for the efficient use of adhesive and recyclable materials as the UK government’s emphasis on minimizing packaging waste is motivating manufacturers to create sustainable solutions.

The increasing number of direct-to-consumer (DTC) brands and third-party logistics (3PL) services are also pushing the demand for small, high-speed box sealing machines. Moreover, increasing automation of industries and growing prevalence of smart factories and packaging systems integrated with AI is fuelling product innovation in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

EU's increasing packaging regulations combined with rising demand for automated solutions in food and beverage industry are driving the growth of EU box sealing machines market. The EU Directive on Packaging and Packaging Waste has made sustainable packaging and recyclable packaging practices a priority, which has pressured manufacturers to offer energy-efficient sealing machines with low adhesive waste.

Leading markets include Germany, France, and Italy where automated packaging lines are being adopted as a standard across various industries including food, pharmaceuticals, electronics, etc. Also, the adoption of robotic sealing systems and Industry 4.0 technologies are continuously driving efficiency in high-volume production environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.6% |

Japan is witnessing an increase in Box Sealing Machines Market due to high-precision packaging demand, rising automation in the logistics sector, and the country’s constant emphasis on efficient manufacturing. The Japanese Ministry of Economy, Trade, and Industry (METI) is promoting smart packaging technologies, such as IoT-enabled sealing machines, to monitor sealing and conduct predictive maintenance.

Fuji Machinery and Ishida Co., what Japan specializes in high speed, compact and AI-based box sealing machines in food, cosmetics, and consumer electronics enabled industries. The growth of automated convenience store fulfillment is also creating a high demand for these intelligent and compact sealing machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

Developments like thriving e-commerce logistics, increasing investment in smart packaging, and growing automation in warehouse operations have spurred the growth of Box Sealing Machines market in South Korea. To encourage the adoption of AI-based packaging solutions, the South Korean Ministry of Trade, Industry and Energy (MOTIE) is moving ahead with the deployment of sensor-based adaptive box sealing machines used in warehouses and production lines worldwide.

Leading South Korean corporations, like Samsung and LG, are employing 100% automated packaging and sealing solutions to optimize their supply chain. There is also an increasing need for sustainable and tamper-evident sealing solutions in food delivery, pharmaceuticals and electronics packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

The world market for Box Sealing Machines is highly competitive, with many local as well as international players working for high profile consumers, allowing them to move toward new markets and lessen competition from new entrants in Box Sealing Machines market. Automatic and Semi-automatic are the most widely used box sealing machines and are expected to continue leading the box sealing machine market in terms of automation level, as these technologies provide productivity, lower operational costs, quality sealing, and increased efficiency.

Automatic box sealing machines are the most dominant type of product segment, as they are valuable for improving throughput in higher volume packaging operations with less operator intervention. These machines are employed in high-throughput food and beverage processing plants, e-commerce distribution centers, and industrial packaging assembly lines, where speed, precision, and operating efficiency are crucial.

The surge in the adoption of Industry 4.0 as well as smart packaging technologies has also driven demand for intelligent automated box sealing machines integrated with sensors, AI-based fault detection systems, and robotic packaging systems. On top of that, brands are making the investment in high-speed automatic case sealers with adjustable settings to accommodate a range of box sizes as well as different adhesive types, providing flexibility and reliability in fast-paced manufacturing settings.

Though using these systems has many benefits, their high initial investment costs and complex maintenance needs present a challenge especially for small and medium-sized enterprises (SMEs). Nevertheless, the rise of compact, modular, and energy-efficient automatic sealing machines is making these solutions more affordable to businesses of all sizes.

Semi-automatic box sealing machines are preferred for small to medium scale businesses, small scale industries that need customized packaging solution. These are also semi-automated machines which cause a balance between automation and manual operation in a controlled manner where the operator can adjust the parameters for a box size or sealer settings up to achieve the normalized tape application and closure integrity.

Semi-automatic case sealers are expected to gain traction in consumer goods, pharmaceuticals, and specialty food packaging, owing to their low-cost, ease of use, and versatility with various packaging needs. Plus, a lot of manufacturers are enhancing their semi-auto models with pneumatic assistance, easy-to-use UI, and height-adjustable conveyors to maximize efficiency while keeping the price down.

In contrast, semi-automatic machines need to be decommissioned more than fully automatic systems, which may hinder their application function in high-rate development settings. Nevertheless, these competitors can now match normal-performance cam-components (up to 22,000) on human-operated machines for features via AI-based movement management, high-speed changeover systems, and hybrid phone technologies, presenting a feasible solution for companies not requiring extreme output.

Food & Beverages and General Industrial Sectors Drive Market Adoption as Businesses Prioritize Secure and Efficient Packaging

Rising food & beverages and general industrial sectors are driving the demand for box sealing machines market owing to need of closure by both industries for secure, effortless and scalable packaging solutions suited to meet rising production demand.

Among end-users, the food & beverage segment is expected to account for high adoption of box sealing machines, as automated and semi-automated box sealing machines are increasingly being used for hygiene, tamper-proof, and high-speed packaging. Need for effectively sealed cartons in perishables and frozen food, as well as, beverage shipment is anticipated to propel the growth of precision adhesive application and moisture-resistant sealing case sealers.

Moreover, strict food safety regulations coupled with growing preference for sustainable packaging materials among consumers has compelled manufacturers to invest on box sealing machines compatible with eco-friendly adhesives, biodegradable tapes and lightweight designs of cartons. AI powered monitoring systems and robotic case sealing solutions are being integrated further to improve production efficiency and reduce product damage in transit.

While it has grown, there are issues in the food & beverage segment, including equipment sanitation, compliance with food-grade standards, customizable solutions, and sizes of varied package sizes. Wash down friendly, stainless-steel box sealers and quick-changeover features are enabling companies to achieve these goals in a fast-moving environment.

Demand for these machines is being propelled in diverse segments including electronics, automotive, pharmaceuticals, and machinery components as the global trade rises along with supply chain optimization and the growing demand for protective transit packaging. Such solutions have become a mandatory part in such industries because they are exposed to a higher risk of being damaged, contaminated, or stolen in transit.

Manufacturers are now using semi-automatic and automatic case sealers in the assembly line to ensure that they can accommodate different carton sizes, increase packaging speed, and reduce dependency on manual labor. In addition, the use of water-activated tapes, reinforced sealing adhesives, and heat-sealing technologies is improving carton durability and enabling secure industrial shipments.

Cost pressures, high-volume packaging variability, and machine compatibility with different packaging formats are among the challenges that can affect adoption rates in this sector. Nonetheless, AI-based sealing automation, predictive maintenance, and modular case sealer designs are overcoming these challenges, leading to increased flexibility and cost efficiency for industrial applications.

As the need for mechanized packaging systems is rising, automated packaging solutions are growing as well, leading to the development of the Box Sealing Machines Market. Factors fuelling the growth of the market include increasing adoption of automated case sealers, demand for high-speed production lines, and transition towards sustainable packaging solutions.

Multiple growing studies continue to be focused on high-speed taping and gluing machines, adjustable case sealing technology, and AI-powered automation that increases the efficiency of packaging while lowering waste of the materials, while contributing to the overall flexibility of the operation.

Top package equipment manufacturers, industrial automation companies, and innovative sealing technology suppliers contribute to this market by providing cutting-edge technologies in the automated case sealing space and environmentally friendly adhesives, among other areas, as well as intelligent packaging systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 15-20% |

| Intertape Polymer Group (IPG) | 12-16% |

| Wexxar Bel (ProMach) | 10-14% |

| Lantech, Inc. | 8-12% |

| SIAT S.p.A. | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Develops high-speed case sealers with advanced adhesive solutions for industrial automation. |

| Intertape Polymer Group (IPG) | Specializes in automated taping and gluing systems, integrating energy-efficient sealing technologies. |

| Wexxar Bel (ProMach) | Manufactures semi-automatic and fully automatic case sealers, focusing on modularity and customization. |

| Lantech, Inc. | Provides smart case sealing systems with predictive maintenance and AI-driven packaging efficiency. |

| SIAT S.p.A. | Focuses on cost-effective case sealers with adjustable sealing mechanisms for diverse packaging needs. |

Key Company Insights

3M Company (15-20%)

3M is a leader in box sealing technologies, offering automated taping systems and industrial-grade adhesives for high-speed packaging lines.

Intertape Polymer Group (IPG) (12-16%)

IPG specializes in energy-efficient automated sealing solutions, integrating AI-driven case sealers and recyclable adhesive tapes.

Wexxar Bel (ProMach) (10-14%)

Wexxar Bel provides customizable, semi-automatic, and fully automated box sealing solutions, optimizing packaging speed and material usage.

Lantech, Inc. (8-12%)

Lantech focuses on intelligent packaging systems, developing high-speed case sealers with remote monitoring and predictive maintenance capabilities.

SIAT S.p.A. (6-10%)

SIAT is known for cost-effective and flexible box sealing machines, catering to small and mid-scale packaging operations.

Other Key Players (35-45% Combined)

Several packaging machinery manufacturers and automation firms contribute to advanced box sealing technologies, sustainable packaging solutions, and AI-driven efficiency improvements. These include:

The overall market size for the Box Sealing Machines Market was USD 3.6 Billion in 2025.

The Box Sealing Machines Market is expected to reach USD 5.1 Billion in 2035.

Rising e-commerce activities, increasing automation in packaging, and growing demand for efficient and high-speed sealing solutions will drive market growth.

The USA, China, Germany, India, and Japan are key contributors.

Fully automatic box sealing machines are expected to dominate due to their efficiency in large-scale packaging operations.

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Metal Aerosol Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.