The Bottles Market is expected to witness steady growth between 2025 and 2035, driven by increasing demand for sustainable packaging, growing consumption of bottled beverages, and rising awareness of plastic waste reduction initiatives. Bottles are widely used across industries including food & beverages, pharmaceuticals, personal care, and household products, with a strong shift toward eco-friendly materials such as biodegradable plastics, glass, and aluminum. The expansion of e-commerce, innovative packaging designs, and lightweight bottle manufacturing technologies is further propelling market growth.

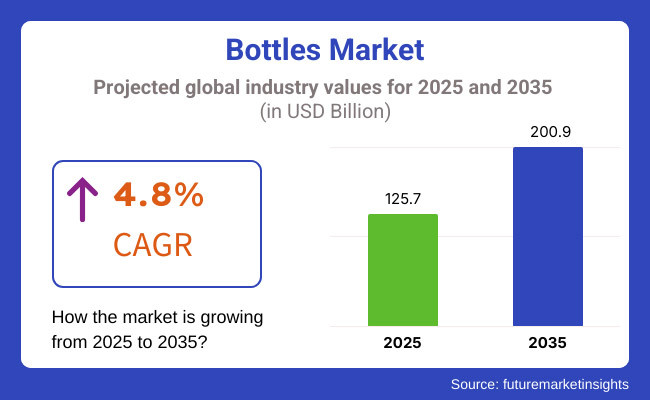

The market is projected to reach USD 125.7 Billion in 2025 and is expected to grow to USD 200.9 Billion by 2035, registering a CAGR of 4.8% over the forecast period. Increasing investments in recyclable materials, smart packaging solutions, and refillable bottle programs are reshaping industry trends. Additionally, the rising demand for premium bottled water, sustainable cosmetic packaging, and tamper-proof pharmaceutical bottles is expected to drive further market expansion.

Explore FMI!

Book a free demo

North America is anticipated to dominate the Bottles Market owing to a high preference of consumers towards recyclable packaging, increased demand for bottled functional beverages, and increasing government regulations on plastic waste. The region is predominantly led by the United States and Canada, owing to the growing consumer trends toward healthy food, organic drinks market expansion in these countries, along with the rising investments in the field of bio-based plastic and glass bottle production.

The bottled water segment remains in the lead, followed by rising demand for premium and alkaline water, poured plant-based milk options, and infused drinks. Moreover, stringent regulations put forward by FDA and EPA regarding food and pharmaceutical packaging is driving demand for quality-based, tamper-proof, and BPA-free bottle materials.

Germany, UK, France, Italy and other European countries are leading in sustainable packaging innovation, strict environmental regulations, and refillable bottle programs, giving Europe a major share of the Bottles Market. The European Union’s Single-Use Plastics Directive (SUPD), in particular, incentivizes manufacturers to switch to recyclable and biodegradable materials for bottles, increasing demand for glass, aluminum, and plant-based plastics.

Brands are now implementing zero-waste and closed-loop recycling initiatives to provide eco-friendly, refillable, and luxury glass packaging, as it becomes increasingly in-demand in the European cosmetics and personal care market. Moreover, growing investments in smart bottle technology, such as near-field communication (NFC)-enabled tracking and self-cleaning bottle coatings, are assisting the future of the market.

The Bottles Market in the Asia-Pacific region is projected to record the highest CAGR, dominated by growing disposable incomes, escalating urbanization, and increasing consumer inclination towards bottled beverages and pharmaceutical products. The market is being propelled by countries like China, India, Japan, and South Korea with factors like increasing production of food & beverages, rapid industrialization, and growing e-commerce penetration.

China, the world’s biggest consumer of bottled drinks, is embracing environmentally friendly packaging, stations to refill bottles and government-supported programs to reduce plastic waste. India’s booming pharmaceutical and personal care markets are driving demand for glass and PET bottles for medicines and skin- and haircare products. Japan and South Korea are also at the forefront of high-tech bottle innovations, including biodegradable plastics and much lighter bottle designs.

Challenges

Environmental Concerns and Regulatory Restrictions

The key challenge facing the Bottles Market is the growing environmental apprehensions involving plastic wastes and carbon emissions during the production of bottles. Tough restrictions on single-use plastics, recycling laws and goals for reducing carbon footprints are forcing manufacturers to embrace sustainable practices and invest in alternative materials.

The bottle manufacturing industry also faces the challenges of fluctuating raw material prices, supply chain disruptions, and high investments in the development of biodegradable and reusable bottle technologies. Transitioning to sustainable packaging materials also requires education of consumers and entry of infrastructure to recycle on a large scale and to have refillable bottle programs.

Opportunities

Smart Packaging and Circular Economy Solutions

The Bottles Market holds high growth horizons despite challenges. Integrating smart packaging technologies such as RFID tracking, active and passive label, and intelligent coating, which can assist in consumer engagement and offer supply chain visibility, are gaining momentum.

Demand for refillable and reusable bottle solutions including glass milk bottles, aluminum water bottles and bulk refill stations is creating opportunities for circular economy solutions in the packaging space. Emerging technologies like plant-based bioplastics and compostable materials, along with AI-driven sorting systems for bottle recycling, will help to further enhance sustainability and minimize waste.

Moreover, growing premium bottled beverage markets, wider adoption of eco-friendly cosmetic packaging, and increasing interest for minimalist and aesthetic bottle designs are fueling product differentiation and the change in consumer preference.

The market showed a steady growth from 2020 to 2024, driven by rising global demand for sustainable packaging solutions, increasing beverage consumption across many different sectors, and innovations in material science. The shift toward lighter, more reusable and biodegradable bottles was also driven by government policies for plastic reduction, extended producer responsibility (EPR) programs and recycling mandates. In addition, the beverage, pharmaceutical, and personal care industries began no longer using eco-unfriendly alternatives that were made of glass, aluminum, bioplastic, and recycled PET (rPET).

Food & beverage industry led the charge in the market mainly due to bottled water, soft drinks, and alcoholic beverages while the pharmaceutical & cosmetics industry fuelled the need for high barrier, UV resistant, and tamper-proof bottle designs. Innovations in smart labeling, digital printing, and RFID-enabled tracking led to enhanced product authentication and greater supply chain transparency. However, market stability was marred by hurdles like plastic pollution, changing raw material prices, and high investment in recycling infrastructure.

The bottles market in between 2025 to 2035 is off to major breakthrough shifts due to AI-driven smart packaging, decentralized recycling networks, and biodegradable nanomaterial innovations. Biodegradable PHA (polyhydroxyalkanoates) and (algae-based) bottles are an alternative to conventional plastics and reduce environmental impact. The incorporation of NFC technology in AI-integrated smart bottles will provide real-time freshness tracking, anti-counterfeiting verification, and interactive consumer engagement.

The hottest drivers in the market will be sustainability, carbon-neutral bottle production, closed-loop recycling systems, and bottle-to-bottle rPET upcycling. 3D-printed, on-demand packaging will also save on materials and transportation emissions. The use of blockchain for bottle traceability will also improve efficiency of waste collection with deposit return schemes or through global initiatives for recycling.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter bans on single-use plastics, rPET mandates, and circular economy policies. |

| Technological Advancements | Growth in rPET, aluminum, and lightweight glass bottles. |

| Industry Applications | Used in beverages, pharmaceuticals, personal care, and industrial packaging. |

| Adoption of Smart Equipment | Limited use of RFID tracking and digitalized recycling programs. |

| Sustainability & Cost Efficiency | Adoption of recyclable plastics, lightweighting strategies, and eco-labeling. |

| Data Analytics & Predictive Modeling | Use of basic material tracking and lifecycle assessments. |

| Production & Supply Chain Dynamics | Challenges in raw material price volatility, supply chain bottlenecks, and high recycling costs. |

| Market Growth Drivers | Growth fueled by sustainable packaging trends, beverage consumption rise, and recycling mandates. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-secured bottle traceability, AI-powered recycling compliance, and global EPR standardization. |

| Technological Advancements | Biodegradable nanomaterials, algae-based bottles, and AI-powered smart packaging. |

| Industry Applications | Expansion into smart bottle technologies, intelligent refill systems, and IoT-connected supply chains. |

| Adoption of Smart Equipment | AI-driven bottle sorting, real-time freshness tracking, and NFC-enabled anti-counterfeiting solutions. |

| Sustainability & Cost Efficiency | Zero-waste bottle manufacturing, carbon-neutral packaging, and decentralized bottle upcycling networks. |

| Data Analytics & Predictive Modeling | AI-powered waste flow analytics, predictive material optimization, and blockchain-backed recycling monitoring. |

| Production & Supply Chain Dynamics | On-demand 3D-printed bottle production, decentralized material sourcing, and AI-optimized packaging logistics. |

| Market Growth Drivers | Future expansion driven by AI-enhanced material science, real-time smart packaging innovations, and fully circular bottle economy models. |

The United States Bottles Market that is the most in demand, as it is growing at a steady rate being driven by increasing demand for sustainable packaging and vessel consumption along with technological advancements in bottle manufacturing. There is also growing awareness among people about the health hazards associated with the use of plastic bottles and the need for manufacturer change; the USA Food and Drug Administration (FDA) is regulating safety standards of plastic and glass bottles to phase manufacturers to utilize BPA-free and recyclable contents.

Demand for lightweight, durable, and eco-friendly bottles is being driven by the rise of bottled water, functional beverages, and personal care product packaging. Top companies like Coca-Cola, PepsiCo and Nestlé Waters are investing in bio-based plastics and recycled PET (rPET) bottles to achieve their sustainability targets.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

Factors such as rising demand for sustainable packaging solutions, stringent regulations imposed by the government on single-use plastics, and growing consumer awareness regarding glass and aluminum bottles are expected to contribute to the growth of the Bottles Market in the United Kingdom. UK ’s Plastic Packaging Tax is spurring investment in recycled and biodegradable bottle substitutes.

Major players are focusing on aesthetic and eco-friendly packaging, and the premium bottled water and craft beverage sector is aiding market growth. Moreover, the rising adoption rate of personalized and reusable bottles in lifestyle and sports sectors further drive the demand for stainless steel and BPA-free plastic bottles.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The Bottles Market is being propelled by stringent sustainability regulations, an increasing requirement for circular economy solutions, and an increase in the consumption of bottled beverages in the European Union. Manufacturers are encouraged to use recycled plastics, glass and aluminum in bottle production as part of the European Green Deal and Single-Use Plastics Directive.

Germany, France and Italy are pioneers in introducing reusable and returnable bottle systems, especially for beverages and personal care products. The increasing popularity of plant-based bioplastics and compostable bottles is also changing the game with many of the biggest beverage brands currently pledging to use 100% recycled or biodegradable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The Bottles Market in Japan is growing due to some factors such as the increasing demand from the development of innovative packaging, the rising adoption of environment-friendly materials, and increased consumption of ready-to-drink beverages. Initiatives to reduce plastic waste in Japan, including the use of lightweight and recyclable bottle designs, are promoted by through the Japanese Ministry of the Environment.

Suntory and Kirin, two of Japan's beverage giants, are pumping money into PET bottle recycling tech and alternatives to PET, which is a kind of a biodegradable plastic. Moreover, increasing demand for high-end glass and aluminum bottles from the cosmetic packaging segment as a result of the booming beauty and personal care industry is further contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

Government policies promoting the reduction of plastic waste, increasing trends for healthy and environmentally responsible consumer behavior, and growing demand for refillable and eco-friendly bottle options are driving growth of the Bottles Market in South Korea. Plastic reduction regulations from the South Korean Ministry of Environment have led companies to transition to rPET, as well as aluminum and biodegradable alternatives to bottles.

The growth of functional beverages, luxury skincare items and refillable household products is increasing demand for premium, reusable and recyclable bottles. Moreover, the burgeoning e-commerce market in South Korea is driving the adoption of bespoke and lighter bottle packaging for direct-to-consumer brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Glass and Plastic Bottles Lead Market Growth as Demand for Sustainability and Convenience Continue to Rise The Bottles Market is driven by the increasing demand for sustainable and eco-friendly packaging, rising bottled beverages consumption, and increasing end-use application sectors including pharmaceuticals, cosmetics, and personal care. Plastic and glass are the most common bottle materials that can be recycled and are also versatile.

The glass segment accounts for a considerable share of the market owing to the non-toxic characteristics, excellent recyclability, and premium cosmetic appearance. They are extensively utilized in alcoholic drinks, perfumes, drugs, and high-end food products, in which product integrity, long service life, and chemical leaching resistance are crucial.

Furthermore, the growing consumer demand for sustainable and reusable packaging solutions has also contributed to the demand for glass bottles in the industries inclined to minimize the usage of plastic waste. Also, favourable regulations for environmentally-friendly packaging and bans on single-use plastics is fuelling manufacturers to pour investment into lightweight glass bottle and strengthened glass bottle innovations.

But issues such as higher manufacturing costs, fragility and transportation weight have limited widespread adoption in some sectors. However, advancements in lightweight glass technology, impact-resistant formulations, and improved recycling processes are making these challenges less of a concern, and glass bottles increasingly represent a sustainable and desirable packaging option.

They have been transported in plastic for a long time because it is inexpensive, durable, and easy to transport plastic bottles are still prevalent in the beverage, personal care, household cleaning and pharmaceutical sectors. This is why PET (Polyethylene Terephthalate) HA PDPE (High-Density Polyethylene) contains a great amount of plastic, as these two types of bottles are lightweight, shatter-resistant, and strong enough to contain carbonated drinks without breaking.

For example, the rising popularity of functional drinks, ready-to-drink (RTD) products, and personal care innovations have increased the need for custom plastic bottle designs featuring ergonomic properties, smart dispensing mechanisms, and sustainable designs. Innovations around biodegradable plastics, rPET, or plant-based polymers are allowing manufacturers to create packaging in line with sustainability goals and these solutions are reducing the impact on the environment.

While their benefits are significant, damage done by plastic waste, challenges surrounding recycling, and government bans on single-use plastic products stifle their market opportunities. However, such demanding and evolving aspects of the market such as additional investments into circular economy models, refillable plastic packaging, and advanced waste management technologies are likely to uphold demand for plastic bottles in a more eco-friendly manner.

Adoption of different bottle capacities is in large part determined by product type, industry preferences and consumer convenience, introducing the two most widely used segments 201-500 ml and 501-1000 ml.

201-500 ml Bottles Lead Market Demand for On-the-Go Convenience and Single-Use Applications

The 201-500 mL bottle size category is the most common size category for ready to drink beverages, personal care products, and pharmaceutical packaging. These provide the best in portability, portion control, and access, making them great for on-the-go use, travel-friendly cosmetics, and single-dose medication packaging.

It also drives demand for compact, resealable, and ergonomic bottle designs in this size range due to the increasing number of health-conscious consumers opting for functional drinks, energy boosters, and vitamin-infused water. Brands in the personal care and cosmetics sector are also introducing travel-sized and mini products to accommodate modern consumer lifestyles and airline travel limitations.

Potent for a bottle that gets reported annually by 1,500 different brands, such a half dozen are urgent and utilized and top limit are driving brands to go after refillable, biodegradable and recycled-content packaging solutions in this segment, contrasting this with plastic waste concerns as with as the need for sustainability.

In household cleaning, personal care, and multi-serving beverage packaging, 501-1000 ml bottles can open new opportunities, with larger capacity enabling less frequent repurchase and much better cost-efficiency. This size segment is particularly prevalent across liquid detergents, shampoo bottles, cooking oils and larger family-sized beverage containers.

Sustainability through packaging has become a mainstream conversation, as brands are striving to find alternative solutions to plastic by moving towards bulk packaging formats, which support more refillable packaging systems. Moreover, recent break-through in bottle design, like as smart dispensers, anti-spill caps, and ergonomic handles, are making it easier to use bigger storage capacity bottles.

But limitations in storage space, increasing shipping costs and issues in handling weights may trump consumer preferences in this segment. New lightweight bottle designs, collapsible packaging, and concentrated product formulations are mitigating these concerns and allowing for continued market growth.

As more people tend to live an eco-aware lifestyle, they are inquiring about sustainable packaging which will drive the Bottles Market. Factors such as increasing beverage consumption, pharmaceutical packaging development, and new lightweight and biodegradable bottles drive the market. Manufacturers are also working towards glass alternatives and smart packaging solutions that improve durability, environmental end-of-life recyclability and branding opportunities. This market comprises frontrunners in packaging such as packaging manufacturers, beverage companies, and sustainable material innovators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor plc | 15-20% |

| Berry Global Inc. | 12-16% |

| Gerresheimer AG | 10-14% |

| O-I Glass, Inc. | 8-12% |

| Alpla Group | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor plc | Develops lightweight PET and sustainable plastic bottles for beverage, pharmaceutical, and personal care packaging. |

| Berry Global Inc. | Specializes in custom plastic bottle designs, recycled material usage, and lightweight packaging solutions. |

| Gerresheimer AG | Manufactures high-quality glass and plastic bottles for pharmaceutical and medical packaging. |

| O-I Glass, Inc. | Provides premium glass bottle solutions for food, beverage, and spirits industries with a focus on recyclability. |

| Alpla Group | Focuses on biodegradable and reusable plastic bottles with innovative barrier technology for extended shelf life. |

Key Company Insights

Amcor plc (15-20%)

Amcor is a global leader in PET bottle production, offering lightweight, recyclable, and high-barrier plastic packaging solutions for beverages, healthcare, and food industries.

Berry Global Inc. (12-16%)

Berry Global specializes in custom bottle designs with post-consumer recycled plastics, promoting sustainability and innovation in flexible packaging.

Gerresheimer AG (10-14%)

Gerresheimer focuses on pharmaceutical-grade bottles, producing glass and high-quality plastic packaging for medical and laboratory use.

O-I Glass, Inc. (8-12%)

O-I Glass is a major glass bottle manufacturer, offering premium and eco-friendly packaging for alcoholic beverages, juices, and carbonated drinks.

Alpla Group (6-10%)

Alpla develops biodegradable plastic bottles, refillable solutions, and sustainable bottle designs for food, beverage, and cosmetic industries.

Other Key Players (35-45% Combined)

Several packaging and bottle manufacturers contribute to advancements in sustainable packaging, lightweight materials, and smart bottle technology. These include:

The overall market size for the Bottles Market was USD 125.7 Billion in 2025.

The Bottles Market is expected to reach USD 200.9 Billion in 2035.

Rising demand for sustainable packaging, increasing consumption of bottled beverages, and growth in the pharmaceutical and personal care sectors will drive market growth.

The USA, China, India, Germany, and Brazil are key contributors.

Glass and Plastic bottles are expected to dominate due to their lightweight nature, durability, and cost-effectiveness in packaging solutions.

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.