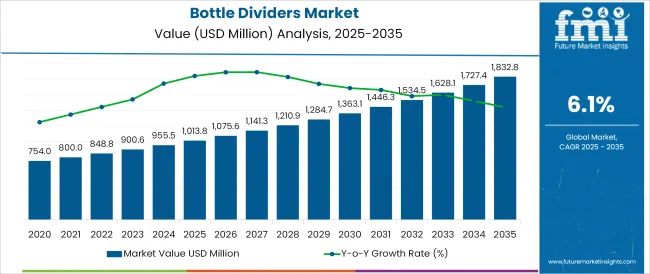

The Bottle Dividers Market is estimated to be valued at USD 1013.8 million in 2025 and is projected to reach USD 1832.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The bottle dividers market is exhibiting steady growth as sustainability imperatives, product protection requirements, and premiumization trends in beverages converge to drive demand. Increased emphasis on reducing breakage during transit, improving shelf appeal, and complying with eco friendly packaging regulations has elevated the relevance of bottle dividers across industries.

Companies are actively incorporating recyclable and renewable materials to align with environmental goals while delivering functional strength. Growth prospects are further strengthened by rising global consumption of bottled beverages, expansion of e-commerce channels, and growing expectations for branded, sustainable packaging solutions.

Future adoption is anticipated to benefit from innovations in material coatings, improved printability for branding, and designs optimized for automated packaging lines, ensuring both environmental compliance and operational efficiency.

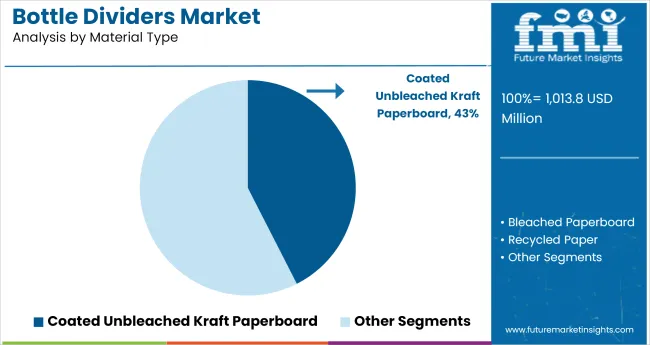

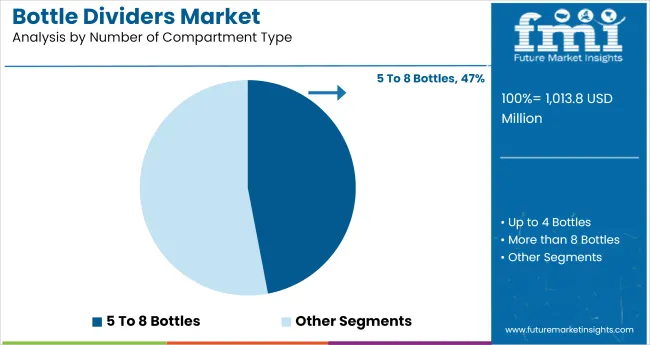

The market is segmented by Material Type, Number of Compartment Type, and End Use and region. By Material Type, the market is divided into Coated Unbleached Kraft Paperboard, Bleached Paperboard, and Recycled Paper. In terms of Number of Compartment Type, the market is classified into 5 To 8 Bottles, Up to 4 Bottles, and More than 8 Bottles.

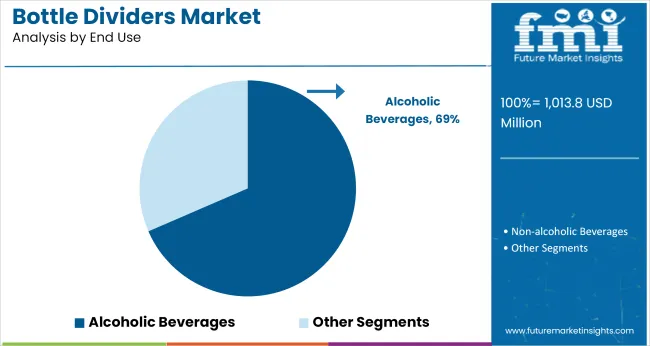

Based on End Use, the market is segmented into Alcoholic Beverages and Non-alcoholic Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material type, coated unbleached kraft paperboard is projected to hold 42.5% of the market revenue in 2025, making it the leading material segment. This dominance has been supported by the material’s superior strength to weight ratio, recyclability, and ability to withstand moisture and abrasion during handling and transport.

Its coated surface has allowed better printability and branding opportunities while maintaining the natural appeal of unbleached fibers, appealing to both premium and sustainable brand positioning. The cost efficiency and compatibility of this material with automated cutting and folding systems have also enhanced its adoption.

In addition, regulatory and consumer pressure for renewable, biodegradable solutions has further reinforced the leadership of coated unbleached kraft paperboard in the material mix for bottle dividers.

When segmented by number of compartments, dividers designed for 5 to 8 bottles are expected to account for 47.0% of the market revenue in 2025, establishing themselves as the most prominent compartment type. This preference has been driven by the optimal balance these configurations offer between packaging efficiency and structural integrity during transport.

Their widespread use in cases of wine, spirits, and specialty beverages, which are typically shipped in medium sized cartons, has solidified their position. The segment’s growth has also been supported by manufacturing flexibility and suitability for both retail-ready and bulk shipment formats.

Additionally, these dividers have proven effective in minimizing material waste while providing adequate protection, aligning with sustainability goals and cost containment strategies prevalent in the beverage supply chain.

When segmented by end use, alcoholic beverages are anticipated to command a dominant 68.5% share of the market revenue in 2025, affirming their leading role. This leadership has been attributed to the sector’s high packaging standards, strong branding needs, and regulatory requirements for safe and secure transit of glass bottles.

Rising global consumption of wine, beer, and spirits has directly influenced demand for durable and visually appealing dividers that protect products during distribution while enhancing presentation. The segment has also benefited from premiumization trends, where branded dividers contribute to the unboxing experience and reinforce product positioning.

Moreover, stringent quality expectations from both producers and retailers, combined with the sector’s willingness to invest in sustainable and innovative packaging, have ensured sustained growth and dominance of the alcoholic beverages end use segment in the bottle dividers market.

The demand for bottle dividers is mostly slanted by the beverage industry. The producers of wine provide premium and great wine in specially designed boxes. The demand for wine is directly proportional to the demand for bottle dividers which are more influenced by alcoholic beverages, which are costly and are supplied all over the world. The bottle dividers are available in a variety of colours and make them attractive while packing.

The rising disposable income and growing population in developing economies are creating new paths for packaged beverages. As per the Brewers Association, the overall sales of the beer was USD 955.5 Bn in 2024, which leads to transportation and packaging of those 2-3 bottles in one box had increased the demand for bottle dividers.

The growing urbanization, coupled with the fluctuating lifestyle, has steered the growth of total packaged alcohols in emerging countries like India.

Additionally, the rising health awareness among youngsters has increased the demand for health drinks, energy drinks and packaged juices providing vast opportunities which leads the companies to increase their sales.

Moreover, the easy availability of bottled water, increase in tourism and preference for a healthy lifestyle have also amplified the demand for packaged and flavoured bottled water infused with natural flavors like orange, mint and lemon leads to an increase in the market share for bottle dividers market.

The implementation of beverages has been increased from the historical period due to growth in disposable income and rise in preferences of consumers for beverages. Additionally, the consolidation of on-premises distribution channels further complements overall growth.

Moreover, changes in culture and implementation of western culture have prejudiced consumers toward distilled beverages. However, higher excise duties and taxations on local as well as imported drinks like wine or beer and the progress in health awareness among drinkers’ effects positively towards the growth in sales of bottle dividers. However, the beverage industry has already shown and offers several growth opportunities in the near future.

The young population are gradually opting to experiment with international premium and locally produced beers or any other soft drinks. The bottle dividers, in the beverage industry, is facing strong competition from paperboard suppliers. Though, it is likely to uphold its share during the forecast period, due to its usage to divide the premium bottle products.

The youngsters in the European region have greater consciousness related to the environmental and benefits of using glass bottles and are willing to pay more for such benefits. The key players in the region are also appreciating such trends and gradually addressing them in their packaging choice which will lead to increase the regional consumption.

The European bottle dividers business has the knowledge and expertise to be regionally competitive whereas, for exporting, the UK acts as the central hub for the European economy. According to the Department for Environment, Food, and Rural Affairs, the drink and food transfer exceeded more than USD 955.5 Billion in 2025.

Lightweight glass has been the major invention in recent times, offering the same resistance to transport globally. Such activities can lead to grow the market.

Asia-Pacific region has a wide range of beverages available with each one having its own characteristics like flavour and taste. These include different types of bottles, glasses which leads to grow the sales of bottle dividers. The market has been witnessing substantial growth due to the rise in demand from developing economies like China and India.

A significant rise in the consumption of alcohol has been witnessed in India due to a surge in beer fancying youngsters. Consumer preferences and changes in lifestyles substantially lift the adoption of bottle dividers in Asia-Pacific. Also, the momentous rise in the number of working professionals and increase in disposable incomes of the people in the region have favored adoption of high-quality and premium alcohols.

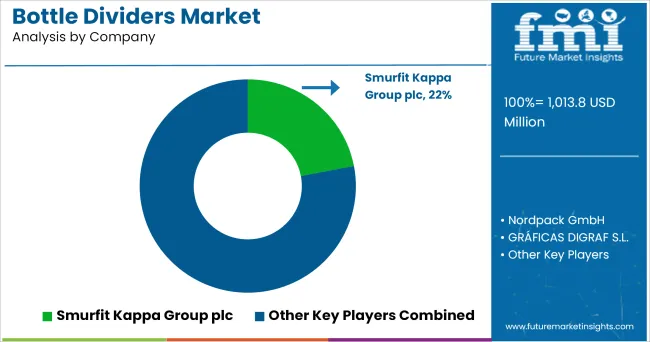

The market is fragmented in nature with the existence of several small, mid-sized companies that compete against each other in terms of quality and price. Some of the major manufacturers operating in the global market are

The focus of major manufacturers for bottle dividers is very less and contributes nearly one fifth of global making. Most of the necessities are accommodated by local players located in close proximity to the buyers.

It is essential for bottle divider manufacturers to invest more in technology so as to automate the process of production. As the industries are slowly moving towards intensive capital, there is a need to achieve scale economically. It can be achieved by the divergence in various forms of dividing.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments by material type, by number of compartment type, by application and by geographies.

The global bottle dividers market is estimated to be valued at USD 1,013.8 million in 2025.

The market size for the bottle dividers market is projected to reach USD 1,832.8 million by 2035.

The bottle dividers market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in bottle dividers market are coated unbleached kraft paperboard, bleached paperboard and recycled paper.

In terms of number of compartment type, 5 to 8 bottles segment to command 47.0% share in the bottle dividers market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA