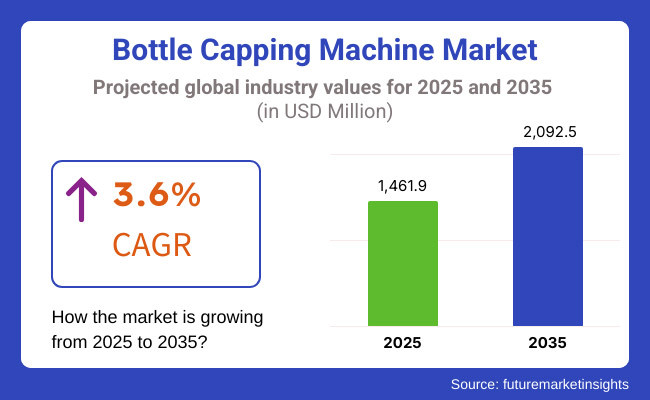

The bottle capping machine market is anticipated to be valued at USD 1,461.9 million in 2025. It is expected to grow at a CAGR of 3.6% during the forecast period and reach a value of USD 2,092.5 million in 2035.

A bottle capping machine is mostly used to seal the bottle tightly with chicken or a different cap to protect the product inside and to avoid regulatory interactions. It is applied extensively in food & beverage, pharmaceutical, cosmetic, and chemical industries to boost packaging efficiency, avoid contamination, and extend shelf life through high-speed, precise sealing.

The market for bottle-capping machines is increasing owing to an upsurge in demand for automation, efficiency, and safety packaging in the food & beverages, pharmaceutical, and cosmetics segments. The growth is driven by rising beverage consumption, e-commerce, regulatory norms, technology changes, and trends for sustainability, as industries switch towards automated, flexible, and sustainable capping options for improving productivity.

Explore FMI!

Book a free demo

| 2020 to 2024 Trends | 2025 to 2035 Trends |

|---|---|

| Steady growth due to rising packaging demands in food & beverage, pharmaceuticals, and cosmetics. | Automation, sustainability efforts, and increasing e-commerce fueled fast growth. |

| Increased adoption of semi-automatic and automatic machines. | Advanced robotics, AI-driven capping, and fully automated lines dominate. |

| Focus on reducing plastic waste and energy consumption. | Shift toward biodegradable materials and energy-efficient smart machines. |

| Strong demand in North America, Europe, and Asia-Pacific. | Strong growth in developing economies as a result of urbanization and industrialization. |

| Transition from manual to automatic capping machines. | Widespread use of AI-powered, high-speed automation with minimal human intervention. |

| Basic customization options for different cap sizes and materials. | Highly flexible and modular designs to accommodate varying packaging needs. |

| Stringent safety and hygiene regulations driving machine innovations. | Even stricter compliance with global sustainability and health safety regulations. |

| Strong influence from the pharmaceutical and food & beverage sectors. | Expanding applications in biotechnology, personal care, and smart packaging. |

| Initial investment continues to be a challenge for small businesses. | Lower costs as a result of economies of scale and technology. |

| High initial costs, maintenance concerns, and skill gaps. | Managing AI-integrated systems, supply chain disruptions, and environmental mandates. |

Rise of Automation and Smart Technologies

The market is witnessing a significant shift toward automation and smart technologies as manufacturers prioritize efficiency and precision. Organizations are actively adopting sophisticated robotics, IoT-based surveillance systems, and AI-enabled quality control systems to automate production processes and minimize physical labor. Food & beverage and pharmaceutical industries are increasingly favoring mechanical automation, as it improves speed, maintains consistent seals and reduces risks of contamination.

Growing Focus on Sustainability

Sustainability has emerged as a core driver of innovation in capping solutions for bottles. Businesses are creating environmentally friendly capping technologies that promote recyclable materials and energy-efficient processes to meet environmental regulations worldwide.

Consumers and businesses both desire solutions that reduce waste and lower the carbon footprint, which has led to manufacturers adopting sustainable methods while ensuring high performance standards of capping efficiency.

| Attributes | Details |

|---|---|

| Top Machine Type | Screw Capping Machine |

| Market Share in 2025 | 5.2% |

The segment of the screw capping machine dominated at a CAGR of 5.2%. These machines are most sought after as they ensure airtight caps, thus product safety, in various industries like food & beverages, pharmaceuticals, and cosmetics. They became an essential part of automated packaging line, screw capping machines demonstrated their worthiness in terms of reducing contamination and sustaining product integrity.

Available in automatic and semi-automatic models, screw capping machines are designed to address different production scales. Automatic screw cappers improve production speed and consistency while lowering labor costs and human error.

In contrast, this type of semi-automatic screw cappers requires operator action, giving more versatility to small scale productions while maintaining high precision and dependability. An increasing trend to automation and efficiency is further anticipated to drive market growth in this segment.

| Attributes | Details |

|---|---|

| Top End-use Industry | Food & Beverage |

| Market Share in 2025 | 4.2% |

As per FMI analysis, the market for bottle capping machines will be fueled by the food & beverage industry at a 4.2% CAGR. Increased consumption of packaged drinks and ready-to-drink foods and higher demand for extended shelf-life packaging solutions are among the driving factors that fuel the usage of automated capping machines. As manufacturers are concentrated on optimizing the efficiency of their production processes and reducing waste, the demand for advanced capping solutions keeps increasing.

Strict food safety guidelines and sustainability practices also influence technological developments in bottle capping solutions. Most manufacturers are incorporating intelligent automation and AI-based quality control systems to ensure uninterrupted operations and regulatory compliance.

The automated segment is expected to lead the bottle capping machine market, driven by increasing demand for high-speed production and efficiency. Some people emphasize the productivity targets that industrialization can achieve through automation, and in that context, automated capping machines indeed provide effective contributions to consistent, precise, and minimal wastage application.

Advancing smart manufacturing and AI-based quality control has paved the way for developing automated capping solutions that would have had to comply with stringent industry regulations. A major benefit of their application is the simplification of procedures towards enhanced product safety and compatibility with various cap types, hence making automated capping an ideal application in specific fields such as food and beverages, pharmaceutical, and cosmetics.

| Countries | CAGR |

|---|---|

| USA | 3.2% |

| Germany | 5.3% |

| UK | 2.6% |

| Japan | 3.4% |

| China | 5.8% |

| India | 6.3% |

The USA is projected to expand at a CAGR of approximately 3.2% during the period 2025 to 2035. Rising demand for packaged drinks, medicines, and cosmetics will propel the market. The growth in technology in automation and robotics will continue to enhance efficiency and minimize dependence on labor.

The use of intelligent bottle-capping technology will grow, enhancing production capacity and reducing mistakes. Sustainability trends will provoke manufacturers to create environmentally friendly capping machines. Increase in regulatory requirements and consumer awareness toward sustainable packaging will compel firms to adopt energy-saving and recyclable packaging materials, lending support to consistent market growth in the coming ten years.

Germany is expected to grow at a CAGR of 5.3% for the period 2025 to 2035. In the country, the increasing past of precision engineering and automation, bottling machines (largely and small) are in massive demand. The pharmaceutical in addition to food sectors continues to be the important contributors to the demand for very high-speed, sterile, as well as efficient capping solutions with regards to ideal quality standards.

Integration of Industry 4.0 technologies will change the industry by optimizing production processes. On the other hand, the green initiatives would compel manufacturers to make machines compatible with biodegradable and recyclable materials. With increasing government regulations towards sustainable manufacturing, the Germany market will continuously be the pioneer in Europe regarding the innovation and adoption of bottle-capping technologies.

The UK is anticipated to grow at a CAGR of 2.6% between 2025 and 2035. The growth in the beverage and pharmaceutical industries will drive demand for bottle capping machines. The move toward sustainable packaging will prompt companies to create capping machines that support green materials and low waste.

Automation and digitalization will gain traction in the UK market, increasing efficiency in manufacturing. Companies will invest in smart capping solutions integrating AI and IoT for real-time monitoring. The emphasis on reducing carbon footprints will push manufacturers toward energy-efficient machines, shaping the market’s direction over the forecast period.

Japan is anticipated to develop at a CAGR of 3.4% during 2025 to 2035. The demand for bottle-capping machines in the country will increase as a result of growing automation in the food and beverage sector. Demand for safe, high-speed, and contamination-free capping will propel manufacturers to invest in innovative sealing technologies.

Japan's technical know-how will facilitate the incorporation of robotics and artificial intelligence in capping solutions to increase productivity. Sustainability will be a prominent trend where companies create solutions that advocate for reusable and recyclable materials. Rising consumer preference for sustainable packaging will shape innovations in Japan’s bottle-capping machine market in the coming years.

China is projected to grow at a CAGR of 5.8% from 2025 to 2035. The booming growth in the food and beverage sectors, in addition to that of the pharmaceutical industry, could see bottle capping machines recording a very bright future in demand. Efficiency is evidently determined by high-end automation and intelligent features, which are meant to maximize production speed while minimizing human intervention during the manufacturing process.

In addition, sustainability initiatives will contribute to developing greener capping alternatives. A very vigorous manufacturing setup in China will allow it to be among the leading countries with the most promising bottle-capping technologies. The local manufacturers would adapt to the impacts of the government's regulations favoring recyclable packaging materials and promote further innovations and market growth in the next decade.

India is likely to register a CAGR of 6.3% during 2025 to 2035, making it the global leader in the market. The demand for sustainable packaging will fuel innovation in capping technology. Growing environmental consciousness and government initiatives promoting sustainable solutions will speed up the uptake of green capping machines.

The fast-expanding food and pharma industries will drive investment in automated capping technology. Firms will focus on productivity and savings by incorporating intelligent technology into manufacturing lines.

The leading commercial enterprises in the bottle-capping machine domain have remained predominant owing to high-end automation, precision engineering, and a significant presence in international markets. Furthermore, their dominance will be augmented with continuous innovation in smart manufacturing in all the industries, which will make processes much more efficient, reliable, and responsive. By making use of better technology and maximized manufacturing abilities, these companies provide benchmarks that even smaller players cannot match.

This enables them to lock long-term contracts with big pharmaceutical, food, and beverage companies, big spenders on research and development using AI-based diagnostics, real-time monitoring, and high-tech robotics to gain operational efficiency and minimize downtime. This technology edge is a significant hurdle to entry.

Developed relationships with significant customers further reinforce their leadership since industries that need precision and dependability always seek established suppliers. These companies offer tailored solutions suited to high-volume and specialty manufacturing requirements, integrating smoothly with established manufacturing lines.

By offering a comprehensive predictive maintenance program combined with remote monitoring, companies enhance customer retention while mitigating risks associated with operations. Their strategic acquisitions and partnerships with component manufacturers provide an avenue for technological advancement and enhancement of the faster capping, tamper-evident sealing, and multifunctional variants.

These leaders continue to enhance their know-how and introduce appropriate changes into their product portfolio to meet the growing demands and ensure competitiveness and perhaps scalability into production.

With strong intellectual property safeguards and high capital investment needs, industry entrants must overcome tremendous challenges in taking market share. Dominance of leaders is not substantially eroded as they set efficiency, sustainability, and innovation agendas. With foresight in perceiving upcoming trends, their continued leadership ensures there is limited opportunity for challengers to displace them from the competitive landscape.

The high-competitive bottle capping machine market involves a combination of international leaders and regional competitors competing for market leadership. Across food & beverages, pharmaceutical, cosmetics, and chemical industries, demand for automated, high-speed capping solutions is on the rise. Players emphasize technological innovation, customization, and sustainability to boost efficiency as well as comply with regulations.

Among the major players, Accutek Packaging Equipment, Closure Systems International (CSI), E-PAK Machinery, Acasi Machinery, and Liquid Packaging Solutions hold a significant share. These companies compete on innovation, service quality, and machine versatility. Other prominent makers, such as KWT Machine Systems, TORQ Packaging USA, Kinex Cappers, and ZALKIN AMERICAS LLC, add to the competitive landscape with customized solutions and widening product portfolios.

Accutek Packaging Equipment has established itself as a market leader through turnkey packaging solutions with automated and modular capping systems. Its strategy is based on scalability and efficiency, catering to high-speed manufacturing requirements of industries. Closure Systems International (CSI), however, focuses on precision and sustainability, using energy-efficient cap designs to reduce material loss and enhance sealing performance.

E-PAK Machinery provides capping machines that are built to customer specifications, with the ability to offer flexibility to small and mid-size manufacturers. Its machines accommodate a variety of bottle types and closure styles to provide flexibility in dynamic production conditions.

Acasi Machinery specializes in economical, high-speed capping solutions, thus making its equipment suitable for large-scale manufacturing operations. Liquid Packaging Solutions is differentiated by its changeover capabilities, which are beneficial to industries with constant changes to their packaging lines.

The innovation of products is thus going to be the promising factor for competition in the market. Accutek has brought an intelligent torque-based capping system, which has doubled the precision and reduced the cap waste for capping bottles.

The cap system designed and released by CSI is a lightweight, tamper-evident device that secures the content while using plastics minimally. Developed by E-PAK Machinery, this system is a servo-driven capper powered to allow real-time adjustment, ensuring perfect operation during capping. KWT Machine Systems has now integrated an AI-enabled cap sorting technology for full optimization of production flow, thus reducing down-time.

The market evolves focusing sharply on automation, regulatory compliance, and sustainability. More and more manufacturers are adopting AI-driven systems, smart sensors, and energy-efficient machines to remain competitive.

There is a growing demand for customizable and multifunctional capping solutions as industry strives for greater flexibility and efficiency. Obviously, this stark shift toward biodegradable and eco-friendly packaging materials will compel companies to keep modifying their capping technology.

The bottle capping machine market is expected to reach USD 2,092.5 million by 2035, growing at a CAGR of 3.6% from USD 1,461.9 million in 2025.

The future prospects for bottle capping machine sales are strong, driven by automation, sustainability initiatives, e-commerce growth, and increasing demand from food & beverage, pharmaceutical, and cosmetics industries.

Key manufacturers include Accutek Packaging Equipment, Closure Systems International, E-PAK Machinery, Acasi Machinery, Liquid Packaging Solutions, and KWT Machine Systems, among others.

India (CAGR 6.3%) and China (CAGR 5.8%) are expected to generate the most lucrative opportunities due to rapid industrialization, automation adoption, and growing demand for packaged goods.

The market is segmented by automation into automated, semi-automated, and manual.

Based on the operating speed, the market is segmented into 50 bottles/minute, 50-250 bottles/minute, 250-500 bottles/minute, and above 500 bottles/minute.

The market are categories based on machine type, including screw capping machine, snap-on capping machine, ROPP capping machine, and crown capping machine.

Based on end-use industry, the market is segmented into food & beverage, pharmaceuticals, cosmetics & personal care, chemicals, automotive, and household.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Metal Aerosol Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.