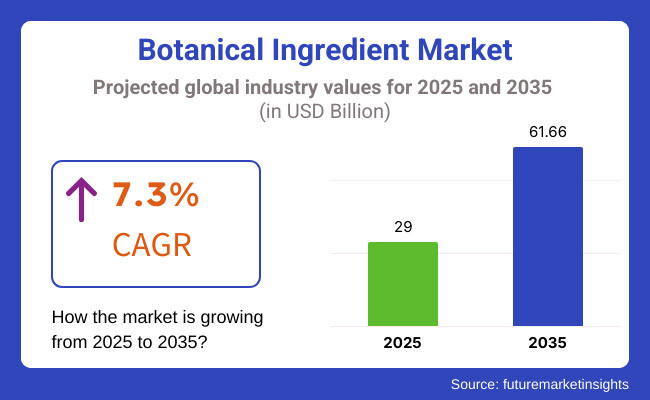

The demand for global Botanical Ingredient market is expected to be valued at USD 29.00 Billion in 2025, forecasted at a CAGR of 7.3% to have an estimated value of USD 61.66 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 6.9% was registered for the market.

The growing number of health-conscious consumers and clean-label developments in the food beverage and pharmaceutical sectors are the main drivers of the industry’s expansion. A growing number of consumers are choosing healthier options and embracing preventive care as an essential tool to support a healthier lifestyle. Because botanical ingredients are a rich source of bioactive compounds and have a variety of biological effects they are therefore being used more and more in the production of food and beverages.

The need for botanical ingredients is greatly impacted by the increasing number of vegans the growing emphasis on using natural and organic food ingredients and the existence of major manufacturers with extensive distribution networks. The market is anticipated to gain from the country’s growing need for sports nutrition which will increase demand for dietary supplements.

Clear labels help to separate the excessive amount of data. The use of botanical ingredients in the food dietary supplement and pharmaceutical industries is directly expanding due to the trend toward clean-label sources.

Globally the COVID-19 pandemic significantly altered consumer behaviour retail distribution and supply chains for a wide range of goods and services. However due to consumers growing desire for wellness and health products that promote general well-being demand for botanical ingredients increased during the pandemic. Botanical ingredients are used in the formulation of several dietary supplement sources related to vascular health obesity anxiety and joint health.

Explore FMI!

Book a free demo

Demand for Natural Products is Driving the Market Growth

Due to growing health consciousness and worries about synthetic ingredients consumers are increasingly looking for natural and organic products. Due to their perceived safety gentleness and effectiveness as substitutes for synthetic ingredients botanical ingredients are becoming more and more popular.

Due to consumer demand for natural and organic skincare haircare and cosmetics products the demand for botanical ingredients is especially high in the personal care and cosmetics sector. The demand for botanical ingredients is also being increased by the rising acceptance of herbal supplements and traditional medicine.

Technology Advancement Driving the Market Growth

New and creative botanical ingredients with greater purity potency and bioavailability emerged as a result of advancements in extraction and processing technologies that allowed for the more efficient and cost-effective extraction and processing of botanical ingredients. The availability of superior botanical ingredients is a more significant factor contributing to the industry’s growth.

Application in Food and Beverage Industry Driving the Market Growth

In the food and beverage industry botanical ingredients are being utilized more and more as natural preservatives flavors and colors. The increasing consumer desire for natural and healthful food and beverage products is fueling the demand for botanical ingredients in the food and beverage supply chain. Additionally, new and creative food and beverage products like functional foods and beverages are being developed using botanical ingredients.

During the period 2020-2024, the sales grew at a CAGR of 6.9%, and it is predicted to continue to grow at a CAGR of 7.3% during the forecast period of 2025 to 2035.

People all across the world are beginning to realize how important their own health and well-being are. There is now more demand for botanical ingredients as a result of this trend. They offer the very advantages that customers around the world are looking for which explains why.

Due to its anti-inflammatory antioxidant and immunity-boosting qualities it is in high demand worldwide. Nowadays a lot of manufacturers use botanical ingredients in beverages dietary supplements and functional foods. This is in response to consumers who are concerned about their health and want organic products.

The preferences of consumers have changed in sectors such as food cosmetics and healthcare. Their desire for organic and natural products has increased. The demand for botanical ingredients which are safer for the environment than conventional and synthetic ingredients reflects this. Then comes the. In order to create organic foods herbal supplements and natural cosmetics the aforementioned industries need botanical extracts which aids in market growth.

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and China come under the exhibit of high consumption, recording CAGRs of 6.0%, 4.8% and 8.1%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 6.0% |

| Germany | 4.8% |

| China | 8.1% |

The growing demand for low-calorie high-nutrition products is expected to propel the United States to the top of the botanical ingredients market. This trend is expected to continue throughout the forecast period indicating a strong consumer preference for healthier food options and growing knowledge of the nutritional advantages that botanical ingredients provide.

There are many botanical and plant-based ingredients available because of the large geographic area and rich biodiversity. The market is becoming more open to new competitors as domestic production rises in tandem with exports. These elements will therefore hasten the expansion of the Chinese market for plant-based ingredients.

Botanical extracts are needed in Germany as the personal care and skincare industries expand. Organic skincare products are preferred by consumers. Additionally, the nation’s market for natural food ingredients is regulated because of the growing trend of incorporating organic food items.

| Segment | Value Share (2025) |

|---|---|

| Herbs & Spices (Ingredient) | 44% |

Spices and herbs are in high demand due to their numerous health and medicinal advantages. Additionally, it increases the demand for botanical extracts among customers. As the category is comparatively less expensive to cultivate producers can increase their profit margins. These natural ingredients increase food products shelf life which fuels demand in certain market segments.

| Segment | Value Share (2025) |

|---|---|

| Dried Plants (Form) | 70% |

Whole or powdered dried botanical ingredients are available for purchase. As they are more convenient to handle store and transport powdered botanical ingredients are more widely used. They are more efficient because they have a larger surface area.

Large companies in the Botanical Ingredients Market sector are concentrating on growing their product lines and forming strategic alliances in order to obtain a competitive advantage. Leading companies in the botanical ingredients market are spending money on R&D to create fresh creative goods that meet changing consumer demands.

The growing demand for natural and organic products along with the growing awareness of the health benefits of botanical ingredients are driving the growth of the botanical ingredients market.

The market is expected to grow at a CAGR of 7.3% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 61.66 Billion.

Demand for organic Ingredient is increasing demand for Botanical Ingredient.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Martin Bauer Group, Givaudan, Döhler GmbH and more.

By ingredient, methods industry has been categorized into Herbs & Spices, Roots, Leaves, Seeds, Nuts and Berries

By form, industry has been categorized into Plant Extract, Essential Oils and Dried Plants

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.