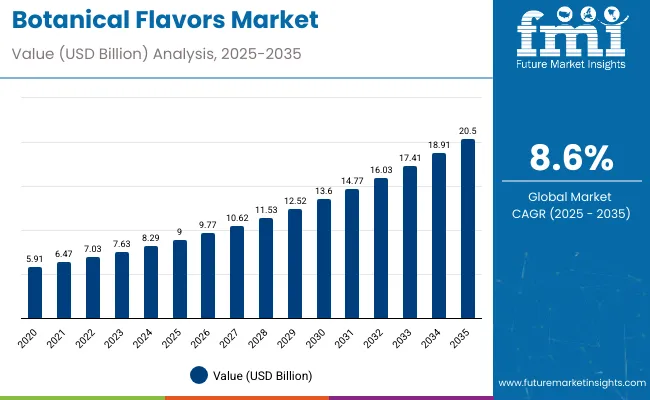

The global botanical flavors market is valued at USD 9.0 billion in 2025 and is expected to reach USD 20.5 billion by 2035, reflecting a CAGR of 8.6%. Factors driving this growth include the rising consumer preference for natural and organic food products, increasing awareness of functional foods, and growing demand for plant-based ingredients in personal care and nutraceutical applications. Moreover, the shift toward clean-label and sustainable ingredients are further contributingto the rapid expansion of the botanical flavors market.

By 2030, the market is forecasted to reach USD 14.2 billion, reflecting steady growth in the first half of the forecast period. The absolute dollar growth between 2025 and 2035 is expected to be around USD 11.5 billion, indicating consistent and reliable expansion. Market growth is anticipated to be back-loaded, driven by increased adoption of botanical flavors in convenience foods, functional beverages, supplements, and natural personal care products during the latter part of the timeline.

Key players such as Givaudan, Firmenich, Parker Flavors, and International Flavors & Fragrances are strengthening their market presence by expanding production capacities and investing in advanced extraction and formulation technologies.

Their innovation pipelines focus on clean-label, organic, and sustainable botanical flavor solutions catering to health-conscious and premium consumer segments. Market success will rely heavily on quality control, sustainable agricultural sourcing, and regulatory compliance, which will influence competitive positioning and growth opportunities across global regions.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 9.0 billion |

| Projected Value (2035F) | USD 20.5 billion |

| CAGR (2025-2035) | 8.6% |

The market holds a significant share across various sectors, driven by increasing demand for natural, clean-label, and functional ingredients in food, beverages, supplements, and personal care products. Botanical flavors are widely valued for their bioactive properties, sensory enhancement, and formulation versatility, making them essential in health-focused and premium offerings. The market contributes substantially to natural flavor solutions and specialty ingredient portfolios, especially in products promoting wellness benefits such as immunity, relaxation, and digestive health.

The market is undergoing structural transformation due to rising consumer preference for natural and functional ingredients across food, beverage, nutraceutical, and cosmetic applications. Advanced extraction and formulation techniques, including encapsulation and sustainable sourcing, have improved flavor stability, bioactivity, and purity, positioning botanical flavors as effective alternatives to synthetic additives.

Strategic collaborations between flavor houses and manufacturers are accelerating innovation for novel, tailored botanical solutions. Regulatory approvals, quality certifications, and sustainability commitments have expanded market access, reshaping supply chains and enabling the market’s premium growth trajectory.

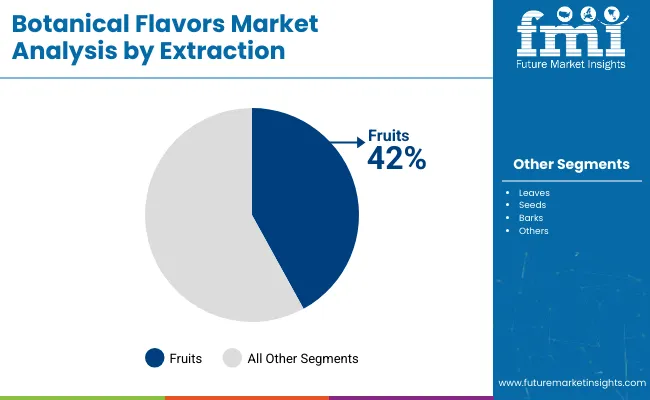

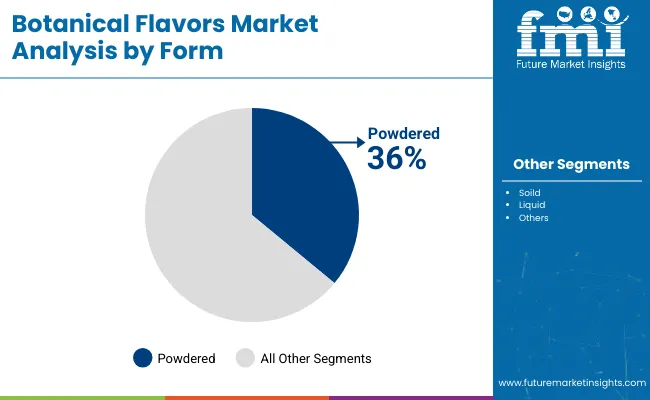

The market is segmented by extraction, form, application, and region. By extraction, the market is divided into fruits, leaves, seeds, barks, and others (stems, roots, flowers). Based on form, the market is segmented into solid, fluid and powdered. In terms of application, the market is categorized into food (bakery, dairy, savory, confectionery products), beverages (alcoholic, non-alcoholic), and the personal care industry (cosmetics, hair care, skin care products). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

Fruits dominated the botanical flavors market in 2025, capturing a substantial 42% share of the overall segment. This dominance is largely attributed to the rich phytonutrient and antioxidant profiles of fruit extracts, making them highly versatile for use across food, beverage, and personal care applications.

Consumer preference for citrus, berry, and tropical fruit notes has steadily increased, strengthening the commercial appeal of fruit-based botanical flavors. Additionally, the rising popularity of superfruits such as acai and goji has further propelled demand, as these ingredients are often associated with health benefits and wellness trends. Fruits provide an ideal balance of flavor complexity and nutritional value, making them a preferred choice among manufacturers for clean-label and functional product development.

Meanwhile, other botanical sources such as seeds and leaves are gaining increasing traction in the market. Leaves are particularly popular with herbal teas and skincare products due to their natural medicinal properties and soothing effects. Seeds offer concentrated extracts rich in bioactive compounds, suitable for supplements and wellness beverages. Barks and other botanical materials cater to niche markets like aromatherapy and Ayurvedic wellness, expanding the diversity of botanical flavors available. This growing interest in varied botanical sources is driving innovation and broadening application opportunities within the market.

Powdered botanical flavors are forecasted to dominate the market with a 36% share in 2025, largely due to their superior stability, extended shelf life, and ease of transportation and formulation. These attributes make them highly favored across multiple sectors, such as nutritional beverages, bakery mixes, dietary supplements, and instant foods. As consumers increasingly prioritize clean-label products and convenient, powdered options for food and health uses, powdered botanical flavors are set to maintain their strong market presence.

The solid powdered form is especially popular for teas and infusions, providing consistent flavor and ease of use. In contrast, fluid extracts, although highly concentrated and potent, often encounter issues with storage stability and handling complexities, limiting their broader application.

Fluids find more niche uses in cosmetics and tinctures, where concentrated botanical properties are needed. Furthermore, the global rise in demand for rehydration-ready powdered beverages is fueling growth in this segment, underscoring the versatility and practicality of powdered botanical flavors in meeting diverse consumer and industry needs.

From 2025 to 2035, rising consumer demand for natural, clean-label, and functional food and beverage products has fueled significant growth in the botanical flavors market. Increasing preference for health-enhancing, organic, and sustainably sourced botanical flavors has pushed producers to invest in advanced extraction and formulation technologies, positioning them as key players in meeting evolving consumer needs and expanding product portfolios.

Growing Consumer Health Awareness Drives Market Growth

The steady rise in consumer interest in clean-label, functional, and nutrient-rich products is a primary growth driver in the botanical flavors market. Consumers are increasingly seeking foods and beverages that offer health benefits such as immunity support, relaxation, and digestive health. Brands are enhancing product quality by using innovative botanical extracts and ensuring transparency in sourcing and production to meet these expectations.

Innovation in Product Development Expands Market Opportunities

Technological advancements in botanical extraction, encapsulation, and formulation have enhanced flavor stability, potency, and shelf life, broadening market applications across food, beverage, supplements, and cosmetics. Development of organic, allergen-free, and sustainably sourced botanical flavors, alongside quality certifications, helps companies appeal to environmentally conscious and health-driven consumers. These innovations create new opportunities for premium products, driving sustained market expansion.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.9% |

| United States | 7.5% |

| Japan | 7.2% |

| United Kingdom | 6.9% |

| Canada | 6.8% |

| Germany | 6.6% |

| France | 6.4% |

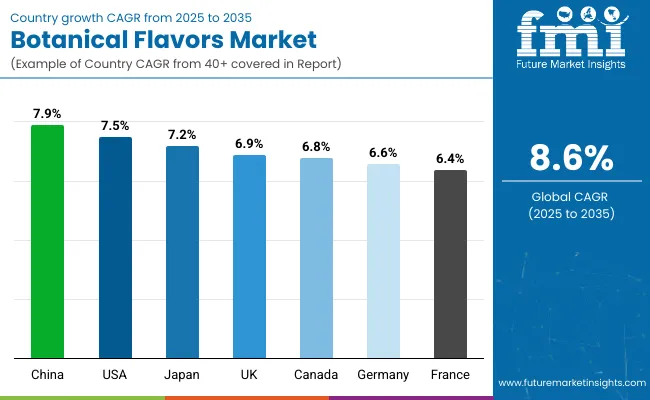

In the botanical flavors market, China leads with the highest CAGR of 7.9% from 2025 to 2035, driven by expanding production capacity and growing health-conscious demand. The USA follows at 7.5%, fueled by clean-label trends and technological advancements.

Japan’s CAGR is 7.2%, supported by functional food integration and an aging population. The UK grows at 6.9%, focusing on premiumization and sustainability. Canada posts 6.8% growth with beverage innovation and diverse flavors. Germany’s 6.6% CAGR reflects herbal tradition combined with modernization, while France’s 6.4% CAGR highlights culinary heritage and premium products. China and the USA lead growth efforts globally.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from botanical flavors in China is forecast to grow at a CAGR of 7.9% from 2025 to 2035. The country is witnessing significant expansion in production capacity, driven by increasing investments in food processing infrastructure and the development of new natural extract facilities. Rising consumer demand for health-oriented and clean-label food products is accelerating the use of botanical flavors across multiple application areas, including beverages, snacks, and ready-to-eat meals.

Urbanization and higher disposable incomes support the adoption of premium and functional products, while domestic and international players intensify competition through innovation. There is rapid scaling of supply chains and distribution networks to meet growing local and export demands.

Regulatory reforms focused on food safety and transparency further incentivize modernization of manufacturing practices. Strategic partnerships and technology transfer between local and global firms are boosting R&D efficiency. All these factors are positioning China as a critical supplier in the global botanical flavors industry.

Demand for botanical flavors in the USA is projected to achieve a CAGR of 7.5% from 2025 to 2035. USA demand is expanding due to substantial consumer focus on clean-label and functional foods, leading brands to ramp up their reliance on botanically derived ingredients.

Mainstream and premium product categories alike prioritize transparency, naturalness, and traceability. Investments in advanced extraction, blending, and encapsulation technologies are helping manufacturers ensure product quality while meeting strict regulatory requirements.

Food and beverage giants are forging strategic alliances with startups to accelerate innovation in botanical flavor blends. E-commerce and direct-to-consumer (DTC) channels are expanding, offering consumers easier access to premium botanical-infused offerings. Marketing emphasizes health benefits, flavor authenticity, and product sourcing. The USA market’s vastness and diversity enable a continuous pipeline of new product launches and niche flavor introductions. Trade and supply collaborations ensure steady imports of rare botanicals from global origins.

Sales of botanical flavors in Japan are expected to register a 7.2% CAGR from 2025 to 2035. The integration of botanical flavors into functional foods and beverages continues to evolve, blending centuries-old traditions with modern dietary preferences. Health-conscious consumers especially in the aging population are gravitating toward products promoting gut health, immunity, and relaxation, fueling steady market momentum. Japanese manufacturers are innovating with botanicals in teas, sports drinks, and healthy snacks to address both wellness trends and sophisticated taste profiles.

Collaboration between domestic firms and multinationals enhances R&D capabilities and encourages the introduction of novel flavor formulations. Packaging innovations, such as resealable and eco-friendly designs, improve both convenience and sustainability. Regulatory approvals for a wider range of plant-derived ingredients support rapid new product launches. The country’s strong focus on functional claims and product efficacy drives marketing and consumer trust. Enhanced distribution to specialty and convenience channels broadens market outreach.

Revenue from botanical flavors in the UK, growing at a 6.9% CAGR, is marked by a strong emphasis on premiumization and product diversification from 2025 to 2035. Consumers continue to show high interest in plant-based, authentic, and ethically sourced ingredients. Brands focus extensively on storytelling, sustainability, and unique provenance to differentiate offerings in categories like beverages, bakery, and savory snacks. The rise of adult soft drinks, non-alcoholic spirits, and custom-infused mixers supports growth in premium product lines.

Emerging brands collaborate with local farmers and ingredient suppliers to ensure transparency and build trust. Retail and online channels expand rapidly, providing more touchpoints for new botanical-infused product trials. Regulatory frameworks push for cleaner ingredient labels and clarity in sourcing. Events and pop-up tasting experiences boost category awareness. Fast-evolving consumer tastes encourage flavor innovation cycles and portfolio expansion.

Sales of botanical flavors in Canada are expected to grow at a CAGR of 6.8% between 2025 and 2035, particularly fueled by rapid innovation in the beverage segments. Rising consumer interest in health, wellness, and exotic flavors drives the popularity of botanical-infused products, including sparkling waters, teas, and functional drinks. The multicultural population brings diverse taste preferences, encouraging experimentation with global botanicals and indigenous plant ingredients. Local beverage startups compete with established companies through unique blends and small-batch, artisanal creations.

Collaboration with indigenous communities expands access to wildcrafted botanicals and enriches product storytelling. Regulatory support for natural products, coupled with transparent labeling, boosts buyer confidence. Distribution networks rely on both brick-and-mortar and increasingly robust online channels. Sustainability commitments shape both ingredient sourcing and packaging standards, reinforcing Canada’s progressive market reputation.

Revenue from botanical flavors in Germany, set for a CAGR of 6.6% to 2035, is defined by the interplay between centuries-old herbal traditions and the modernization of food processing techniques. The longstanding use of botanicals in medicinal and culinary applications blends with today’s demand for natural and sustainable food flavors. Leading German food and beverage producers are overhauling formulations to meet cleaner, plant-based ingredient trends.

Regional specialties like herbal liqueurs and functional baked goods now frequently feature botanical extracts to satisfy evolving consumer palates. Certification for organic and sustainability standards has become a market differentiator. Increased automation and digital quality control enhance manufacturing efficiency and consistency. Companies also focus on sustainable sourcing and circular packaging to reinforce eco-credentials. The German market’s reputation for quality drives strong export growth, with local innovations influencing global trends.

Revenue from botanical flavors in France is projected to achieve a CAGR of 6.4% during 2025 to 2035, shaped by a unique fusion of deep-rooted culinary traditions and evolving premium product trends. French consumers’ appreciation for nuanced, complex flavors drives demand for botanically infused beverages, gourmet snacks, and confectionery. Manufacturers continually invest in R&D to capture authentic herbal and floral notes, emphasizing natural and traceable sourcing.

The expanding popularity of premium sodas, craft spirits, and wellness beverages stimulates both domestic consumption and export opportunities. Collaborations with culinary experts and mixologists foster creative product innovation. Marketing emphasizes provenance, artisanal processes, and elegant packaging to connect with discerning buyers. Regulatory support for organic and origin-labeled botanical ingredients builds further market confidence. Foodservice players increasingly introduce botanical flavors to high-end menus, setting new consumer benchmarks.

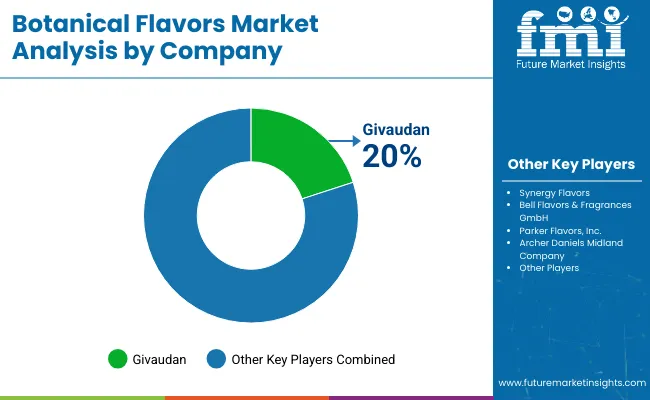

The market is moderately fragmented, with regional players and global giants competing through innovation, ingredient transparency, and rapid product launches. Major companies such as Givaudan, Firmenich SA, ADM, and IFF dominate due to their diversified botanical portfolios, flavor encapsulation technologies, and integration into end-user product lines, including beverages, personal care, and functional foods.

Top suppliers are intensifying competition through natural flavor development, expanding sourcing networks for exotic botanicals, and investing in AI-driven sensory R&D. Partnerships with nutraceutical and beverage brands are also emerging as key strategies. For instance, ADM and Givaudan are prioritizing clean-label solutions by enhancing traceability across botanical sourcing, while IFF and Firmenich are leveraging proprietary extraction techniques to maintain flavor intensity and shelf life in natural applications. Additionally, product localization and regional innovation centers are helping brands cater to specific market preferences more effectively.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 9.0 billion |

| Extraction | Fruits, Leaves, Seeds, Barks, Others (Stems, Roots, and Flowers) |

| Form | Solid, Liquid, and Powdered |

| Application | Food (Bakery, Dairy, Savory, Confectionery Products), Beverages (Alcoholic, Non-alcoholic), Personal Care Industry (Cosmetics, Hair Care, Skin Care Products) |

| Regions Covered | North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia, and Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia , and 40+ countries |

| Key Players | Synergy Flavors, Bell Flavors & Fragrances GmbH, Parker Flavors, Inc., Archer Daniels Midland Company, Kanegrade Limited, Carrubba Incorporated, Sapphire Flavors & Fragrances, Givaudan, Firmenich SA, International Flavors & Fragrances Inc. (IFF) |

| Additional Attributes | Dollar sales and growth by extraction method, form, and application; segment-wise market share analysis; and country-wise market analysis, alongside consumer shifts toward natural/clean-label botanicals, innovations in extraction and encapsulation for stability, and sourcing/traceability practices |

The global botanical flavors market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the botanical flavors market is projected to reach USD 20.5 billion by 2035.

The botanical flavors market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in botanical flavors market are fruits, leaves, seeds, barks and other (herbs and roots) sources.

In terms of form, solid botanical flavors segment to command 54.3% share in the botanical flavors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Botanical Ingredient Business

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Botanical Packaging Market Analysis & Future Outlook 2024 to 2034

Food Botanicals Market Outlook – Growth, Demand & Forecast 2024 to 2034

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Food Flavors Market Insights – Taste Innovation & Industry Expansion 2025 to 2035

Pork Flavors Market Analysis by Form, Packaging and Distribution Channel Through 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Bacon Flavors Market Size, Growth, and Forecast for 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Global Umami Flavors Market Insights – Growth, Demand & Forecast 2025–2035

Turkey Flavors Market Trends Size & Forecast 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA