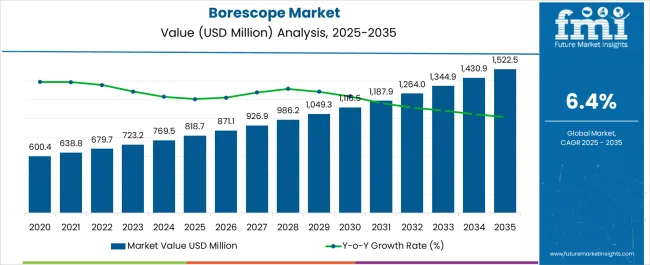

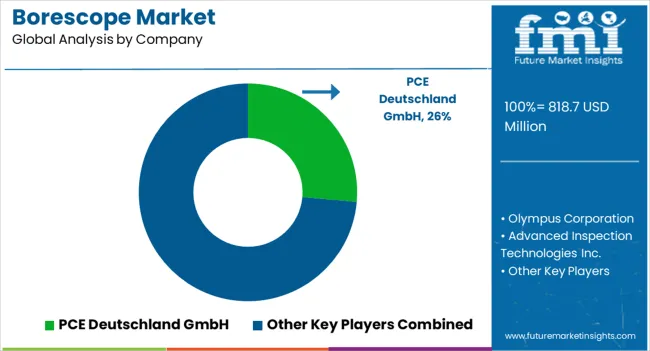

The Borescope Market is estimated to be valued at USD 818.7 million in 2025 and is projected to reach USD 1522.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Borescope Market Estimated Value in (2025 E) | USD 818.7 million |

| Borescope Market Forecast Value in (2035 F) | USD 1522.5 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The borescope market is expanding steadily as industries emphasize precision inspection, preventive maintenance, and safety assurance across critical applications such as aerospace, automotive, power generation, and oil and gas. Increasing reliance on non destructive testing methods is fueling the demand for advanced borescope systems that can access hard to reach areas without disassembly.

Technological improvements in imaging quality, portability, and digital connectivity are further enhancing the scope of application. Integration of features such as high definition video, flexible probe design, and data recording functions has made borescopes an indispensable tool in industrial inspection workflows.

Additionally, growing awareness of cost savings through reduced downtime and early fault detection is accelerating adoption. The market outlook remains positive as industries continue to prioritize efficient maintenance, enhanced safety, and higher productivity through the use of advanced borescope technology.

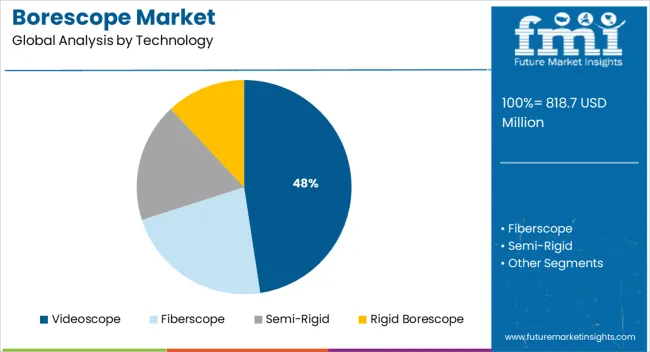

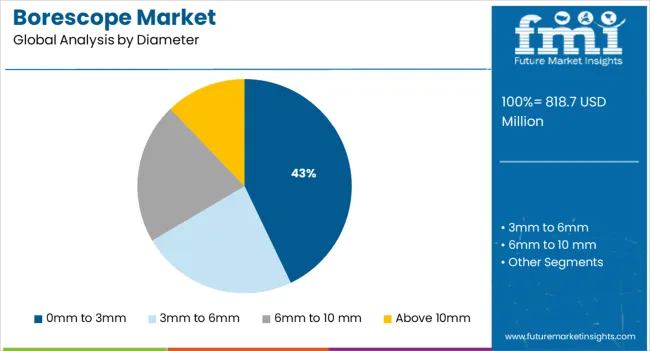

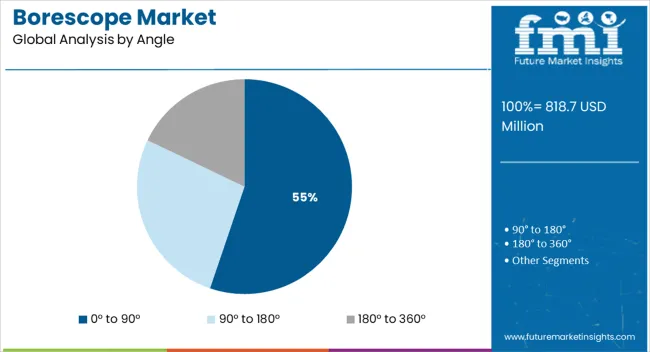

The market is segmented by Technology, Diameter, Angle, and Vertical and region. By Technology, the market is divided into Videoscope, Fiberscope, Semi-Rigid, and Rigid Borescope. In terms of Diameter, the market is classified into 0mm to 3mm, 3mm to 6mm, 6mm to 10 mm, and Above 10mm. Based on Angle, the market is segmented into 0° to 90°, 90° to 180°, and 180° to 360°. By Vertical, the market is divided into Oil and Gas, Energy and Power, Chemicals, Automotive, Metallurgical, Aerospace, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The videoscope technology segment is expected to hold 47.60% of total revenue by 2025 within the technology category, making it the dominant segment. This is due to the ability of videoscopes to provide high resolution imaging, improved maneuverability, and real time video recording, which enhances defect identification accuracy.

Their utility in diverse industries such as aviation maintenance, energy infrastructure, and industrial equipment inspection has reinforced widespread adoption. Moreover, the integration of digital features such as image archiving and wireless connectivity supports advanced reporting and analysis.

As industries seek more precise and user friendly inspection solutions, the videoscope segment continues to secure its leadership in the technology category.

The 0mm to 3mm diameter segment is projected to account for 42.90% of total revenue within the diameter category, positioning it as the leading sub segment. Its dominance is linked to the growing demand for ultra thin probes capable of navigating restricted access areas in complex machinery and components.

The segment has gained traction due to its suitability for inspecting delicate structures without causing damage. Adoption has also been reinforced by advancements in material design that enable durability while maintaining slim profiles.

This combination of precision, versatility, and operational safety has strengthened the 0mm to 3mm diameter segment as the preferred choice across industries requiring high accuracy inspections.

The 0° to 90° angle segment is projected to capture 55.20% of total market revenue within the angle category, making it the largest segment. This growth is supported by its adaptability in offering comprehensive inspection coverage while maintaining operational ease.

The angle range is widely favored for its capacity to balance straight line visualization with flexible directional viewing, ensuring better detection of flaws. Industries with complex equipment layouts have increasingly relied on this angle range to minimize blind spots during inspection.

The functional versatility and inspection efficiency associated with the 0° to 90° category have cemented its leadership within the angle segment.

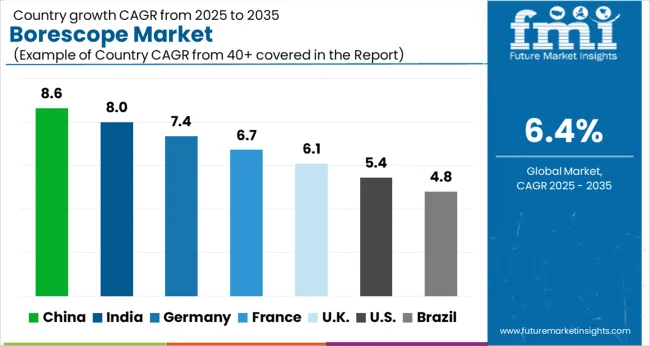

The borescope market is estimated to grow at a CAGR of 6.4% for the forecast period of 2025 to 2035, in comparison to the 4.3% growth of borescope market for the historic period 2020 to 2025.

The borescope market will grow in the future, as it can be affected by a variety of factors such as technological advancements, economic conditions and changes in industry regulations.

However, it is expected that the market will continue to grow due to the increasing demand for non-destructive testing and inspection in various industries such as automotive, aerospace, power generation and oil & gas.

Additionally, the growing use of borescopes in the maintenance and repair of equipment and machinery is also expected to drive market growth.

Increasing demand for non-destructive testing and inspection in various industries such as automotive, aerospace, power generation, and oil & gas. Technological advancements in borescope technology, such as the development of high-resolution cameras and remote control capabilities are the reasons for the demand of the borescope market

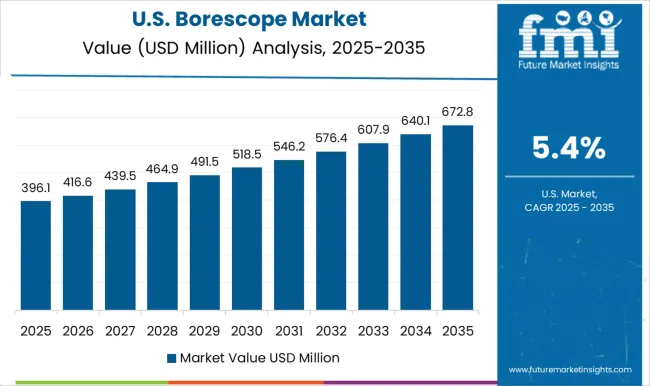

North America is the region that had the largest market share in 2025, with a market share of 19.7%.

The borescope market in North America is a growing industry due to increasing demand for non-destructive testing and inspection in various industries such as oil & gas, aerospace and automotive. The use of borescopes in these industries allows for efficient and cost-effective inspection of hard-to-reach areas, reducing the need for disassembly and downtime.

Advances in technology, such as the development of digital borescopes, have also driven growth in the market. North America is expected to continue to be a significant market for borescopes due to the presence of a large number of key players and the high adoption rate of advanced technologies in the region.

The Pacific region and South Asia are estimated to witness the highest growth of CAGR at 5.7%.

The USA government is investing in upgrading and modernizing its industrial infrastructure, which is boosting demand for borescopes as they are used for non-destructive testing and inspection of industrial equipment and machinery.

Borescopes enable maintenance professionals to perform inspections & repairs quickly, accurately, and with minimal downtime, which can save companies significant amounts of money.

The market is expected to grow in the coming years due to increasing investment in industrial infrastructure and the need for efficient and cost-effective maintenance of equipment.

The USA estimated market share was 57.5% in 2025, with a 5.7% CAGR over the forecast period.

India's economy is growing rapidly and the government is investing in upgrading & modernizing its industrial infrastructure, which is boosting demand for borescopes as they are used for non-destructive testing & inspection of industrial equipment and machinery.

The Indian market is becoming more open to adopting advanced technologies, which is boosting the adoption of borescopes with advanced features such as digital recording and wireless connectivity.

This is the reason why India held the market to grow at a CAGR of 9.4%.

The borescope market in China is a rapidly growing segment of the non-destructive testing equipment industry. The market is driven by a number of factors, including an increasing demand for non-destructive testing equipment in various industries, such as aerospace, automotive, power generation, and petrochemical.

Additionally, the Chinese government's focus on improving industrial safety and environmental regulations has also contributed to the growth of the borescope market in China.

Chinese manufacturers have been able to produce borescopes at a lower cost than many of their foreign competitors, which has helped them to gain a significant market share. Chinese-made borescopes are becoming increasingly popular in both domestic & international markets due to their high quality and competitive pricing.

Due to these reasons, China was estimated to have held a market share of 15.4% in 2025.

The use of videoscope technology in the borescope market is growing because it allows for high-resolution, real-time imaging, which can provide more detailed and accurate information about the condition of the equipment being inspected.

Additionally, videoscopes often have features such as built-in lighting and recording capabilities, which can make inspections more efficient & convenient. Another reason for the growth is the increasing demand for non-destructive testing and inspection in industries such as aerospace, manufacturing, and power generation, where borescopes are commonly used to inspect hard-to-reach or hazardous areas.

Due to the above reason, videoscope type held the higher market share in 2025 at 43.4%

The automotive vertical in the borescope market is growing because of an increasing demand for non-destructive testing & inspection in the manufacturing and maintenance of vehicles.

Borescopes are commonly used to inspect hard-to-reach areas in engines, transmissions and other mechanical systems, as well as for inspecting the condition of vehicle body components and other components that may be hidden from view.

The use of borescopes in the automotive industry allows for more efficient & accurate inspections, reducing downtime & costs associated with traditional inspection methods.

Additionally, the increasing use of advanced technologies such as electric vehicles (EVs) and autonomous vehicles (AVs) is also boosting the growth of the borescope market in the automotive vertical, as these vehicles require more advanced & specialized inspection tools.

The automotive vertical is estimated to have the highest market share in 2025 at 19.7%.

Market participants are concentrating on expansion strategies in order to increase their market penetration in major markets. This included attempting to broaden regional & global distribution channels, releasing new products, leading to the formation of acquisition, partnerships, and coordinating with key players.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 818.7 million |

| Market CAGR 2025 to 2035 | 6.4% |

| Share of top 5 players | Around 30% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | Technology, Diameter, Angle, Vertical and Region |

| Key Companies Profiled | PCE Deutschland GmbH; Olympus Corporation; Advanced Inspection Technologies Inc.; Tech Service Products; RF System Lab.; SKF; Baker Hughes; FLIR; Stanlay; FLUKEVizaar; Gradient Lens Corporation; JME Technologies; Moritex; Lenox |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global borescope market is estimated to be valued at USD 818.7 million in 2025.

The market size for the borescope market is projected to reach USD 1,522.5 million by 2035.

The borescope market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in borescope market are videoscope, fiberscope, semi-rigid and rigid borescope.

In terms of diameter, 0mm to 3mm segment to command 42.9% share in the borescope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Borescope Inspection Camera Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA