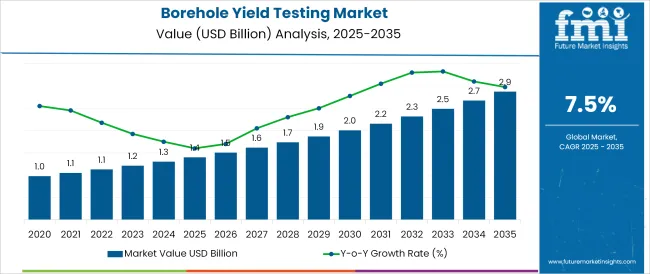

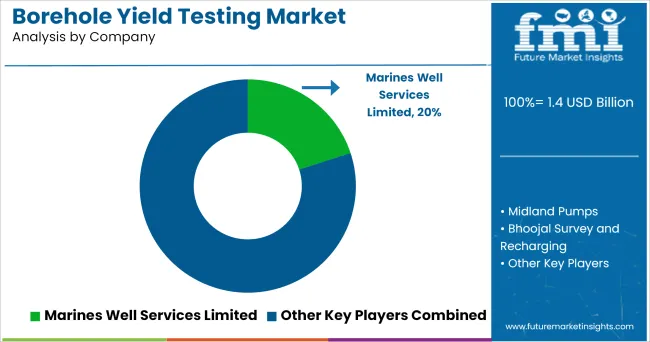

The Borehole Yield Testing Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The borehole yield testing market is advancing steadily as water resource management, infrastructure development, and regulatory compliance continue to drive demand for accurate groundwater assessment methods. Increasing urbanization, industrial expansion, and agricultural activities have intensified the need for sustainable water extraction practices, placing emphasis on scientifically validated yield testing.

Government policies mandating proper borehole testing before exploitation and heightened scrutiny of water rights have been observed in industry publications and regulatory statements, underscoring the market’s critical role. Innovations in pumping technology, data logging equipment, and hydrogeological modeling have enhanced testing accuracy and efficiency, supporting further adoption.

Future growth is anticipated as climate variability, water scarcity, and rising groundwater contamination risks push stakeholders toward robust resource evaluation and monitoring. Collaboration between public bodies, engineering consultants, and technology providers is expected to create new opportunities, while heightened awareness of aquifer sustainability continues to shape market dynamics positively.

The market is segmented by Test Type and End Use and region. By Test Type, the market is divided into Constant Rate Test, Calibration Test, Step Test, Recovery Test, and Other. In terms of End Use, the market is classified into Government Agencies, Construction, Oil and Gas, Power Plants, Geology, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

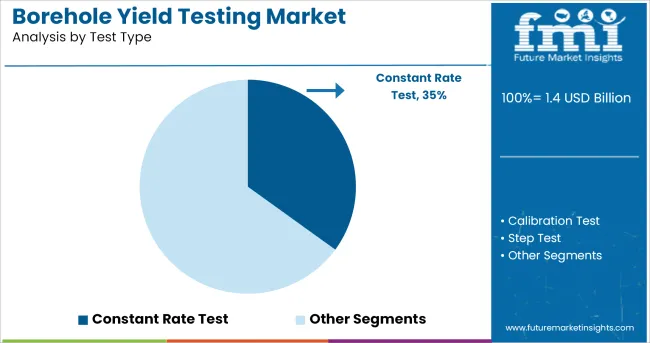

When segmented by test type, the constant rate test is expected to account for 35.0% of the borehole yield testing market revenue in 2025, securing its position as the leading test type segment. This leadership has been shaped by the method’s reliability, simplicity, and widespread acceptance in regulatory frameworks as a standard for determining sustainable borehole output.

According to hydrogeological guidelines and engineering manuals, the constant rate test provides consistent data on aquifer performance under steady-state conditions, enabling more accurate assessment of long-term yield. Its adoption has been reinforced by the minimal specialized equipment required and compatibility with both manual and automated pumping systems, making it practical for diverse field conditions.

Reports from government water agencies and engineering firms highlight its cost-effectiveness and suitability for compliance documentation, which have further supported its prominence. The combination of methodological rigor, operational feasibility, and regulatory alignment has maintained the constant rate test as the preferred choice in borehole yield evaluations.

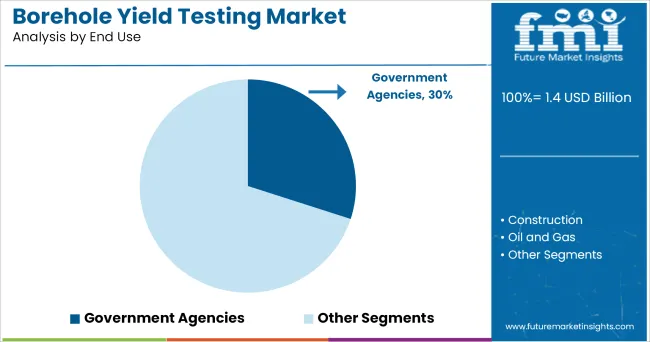

Segmented by end use, government agencies are projected to capture 30.0% of the market revenue in 2025, holding the top position among end users. This dominance has been underpinned by their statutory responsibility for groundwater resource assessment, monitoring, and policy enforcement.

As noted in public sector water resource reports and development plans, government agencies have been actively commissioning borehole yield tests to ensure sustainable allocation of groundwater, prevent over-extraction, and protect aquifer health. Their leadership has also been reinforced by the availability of dedicated budgets, access to technical expertise, and institutional mandates requiring comprehensive site assessments prior to granting water abstraction permits.

Furthermore, government-sponsored programs for rural water supply, irrigation, and disaster preparedness have sustained demand for systematic yield testing. The combination of regulatory accountability, infrastructural projects, and stewardship of water resources has consolidated government agencies position as the primary end users driving the borehole yield testing market forward.

Rapid growth in the oil and gas industries and construction industries in various countries has been a prominent driving factor for the market. Owing to this rapid growth, increased demand has been observed for borehole yield testing in various industries to understand the balance among the maximum quantity of water that can be pumped out of the borehole.

These factors from various countries are propelling the growth of the market across the globe.

Several factors must be considered when boreholes are to be made operational. Two significant guidelines must be followed while measuring the workable yield, i.e., the total abstraction from the borehole must be less than the natural water recharge.

Furthermore, a borehole should be pumped so that the water level never reaches the position of the main water strike. This borehole yield testing helps end users comply with these regulatory information requirements and thus is witnessing demand growth.

This test is one of the most widely used tests for the borehole test. This test increases the pump rate in steps at customary/regular intervals. For example, a hole may be pumped at 1000l/hr for 1 hour, expanded to a rate of 2000l/hr for the following hour, and so on for a few more steps.

This sort of test is especially valuable in deciding the effectiveness of the borehole but not valuable in deciding its long-term sustainable yield. Therefore, this testis more valuable test for knowing its effectiveness

Based on geography, the Asia Pacific is anticipated to hold a considerable share of the global market due to the region's increasing number of oil and gas industries. The Asian Pacific countries, such as China and India, are witnessing increasing activities in the oil and gas industries and power plants.

Thus, the need for borehole yield testing in these regions is growing rapidly. Owing to these factors, the Asia Pacific region is anticipated to witness a high growth rate in the market in the forecast period.

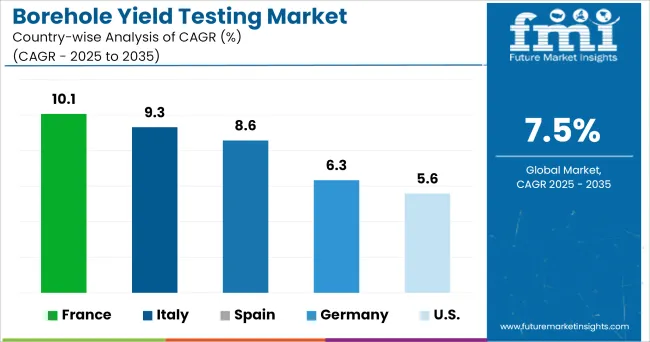

Also, Japan and Europe are projected to observe high growth in the field of borehole yield testing due to the increasing regulatory compliance requirements.

A significant share of the market is concentrated in North America. Countries such as the USA and Canada in North America are witnessing intense oil & gas drilling and production activities, especially after the advent of shale oil & gas extraction technologies. These parameters in North America are fueling the growth of the market.

Further, state and federal organizations in this region are actively regulating ground boring for industrial use. This regulation will optimistically affect the market.

Some of the prominent service providers in the borehole yield testing market are

GEOSS is a prominent South Africa-based borehole yield testing service provider. The company meets the national standard for the test pumping of water boreholes (SANS 10299-4:2003).

Various service providers focus on testing and servicing by the standards and suitable methods.

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macroeconomic indicators, governing factors, and market attractiveness per segment.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global borehole yield testing market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the borehole yield testing market is projected to reach USD 2.9 billion by 2035.

The borehole yield testing market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in borehole yield testing market are constant rate test, calibration test, step test, recovery test and other.

In terms of end use, government agencies segment to command 30.0% share in the borehole yield testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Borehole Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yield Monitor Market Growth – Trends & Forecast 2025 to 2035

Yield Monitoring Systems Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA