BOPP packaging tapes market is increasing at a faster rate with heightened demand from industries all over for strong and trusty packaging. More manufacturing, shipping, and online purchases-both of which entail high-quality adhesive tapes-are the main driving force behind this growth. Manufacturers are developing new adhesive technology, employing green raw materials, and streamlining their manufacturing process in order to match demand.

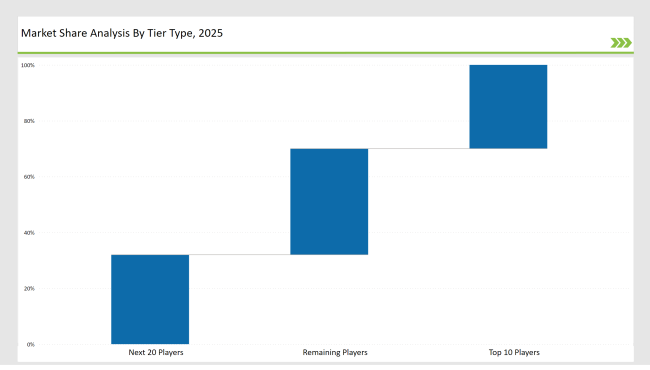

The market leaders holding a 30% market share, such as Tesa SE, 3M, and Intertape Polymer Group, hold most of the market share. They make their success by having huge distribution channels, premium adhesive technology, and ongoing product innovation.

The second tier comprises Avery Dennison, Nitto Denko, and Shurtape Technologies and they have a combined 32% market share. They are all cost-efficient, customized, and offer resilient

Smaller, regional producers that focus on custom packaging solutions make up the remaining 38% of the market. These businesses concentrate on catering to the unique requirements of various industries.These players cater to specialized demands, offering cost-effective and adaptable solutions with localized distribution strategies.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Tesa SE, Intertape Polymer Group) | 12% |

| Rest of Top 5 (Avery Dennison, Nitto Denko) | 10% |

| Next 5 of Top 10 (Shurtape, Scapa Group, Vibac, Zhongshan Crown, IPG) | 8% |

The BOPP packaging tapes market serves multiple industries, each demanding high-performance, durable, and cost-effective packaging solutions.

Manufacturers are developing advanced tape solutions to meet rising industry demands.

The sector is changing as businesses are making investments in high-performance adhesives, automation, and sustainability. Conventional businesses are making use of new technologies to enhance manufacturing processes and selecting sustainable materials to minimize waste and conserve resources. Through their efforts, they can work more efficiently and create less waste

Year-on-Year Leaders

Technology suppliers should focus on improving sustainability, automation, and innovation in adhesive formulations to maintain a competitive edge.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Tesa SE, Intertape Polymer Group |

| Tier 2 | Cor Avery Dennison, Nitto Denko |

| Tier 3 | Shurtape, Scapa Group, Vibac, Zhongshan Crown, IPG |

Companies such as Tesa SE, 3M, and Intertape Polymer Group are coming up with products such as recyclable and tamper-evident tapes. Other companies are focused on coming up with eco-friendly adhesive products and employing artificial intelligence to increase manufacturing efficiency so that they can be competitive in the market.

| Manufacturer | Latest Developments |

|---|---|

| 3M | March 2024: Released a high-performance, tamper-proof BOPP packaging tape. |

| Tesa SE | August 2023: Introduced a sustainable adhesive technology for recyclable tapes. |

| Intertape Polymer Group | May 2024: Developed smart tapes with embedded tracking technology. |

| Avery Dennison | November 2023: Expanded its eco-friendly BOPP tape product line. |

| Nitto Denko | February 2024: Launched a high-adhesion industrial tape for heavy-duty use. |

| Shurtape Technologies | January 2024: Improved efficiency in production with AI-driven systems. |

| Scapa Group | April 2024: Developed weather-resistant BOPP packaging tapes. |

| Vibac Group | June 2024: Introduced low-VOC, environmentally friendly tape adhesives. |

The BOPP packaging tapes market is rapidly evolving, with manufacturers focusing on innovation, automation, and sustainability.

With increased automation, sustainability concern, and technology in adhesives, the BOPP packaging tapes market will grow. AI-driven manufacturing and smart tracking systems will lower costs and improve supply chain efficiency. Production of recyclable and biodegradable tapes will increase as more demand arises for eco-friendly solutions, supporting global sustainability efforts.

Leading players include 3M, Tesa SE, Intertape Polymer Group, Avery Dennison, and Nitto Denko.

The top 3 players collectively control 12% of the global market.

The market is moderately concentrated, with the top players holding 30%.

Key drivers include sustainability, automation, advanced adhesives, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.