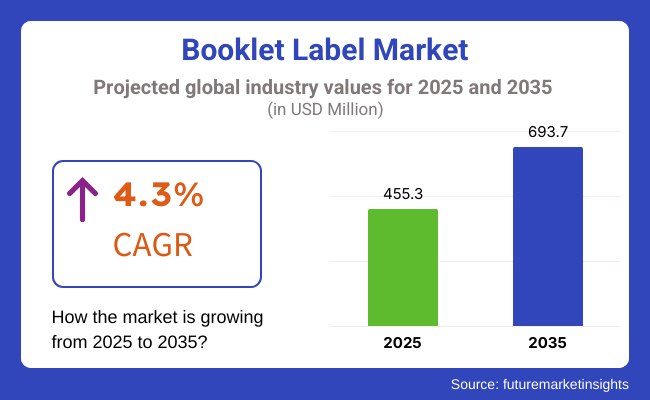

The booklet label market is estimated to generate a market size of USD 455.3 million in 2025 and will increase to 693.7 million by 2035. It is expected to increase its sales at a CAGR of 4.3% over the forecast period 2025 to 2035. Revenue generated from the booklet label market in 2024 was USD 445.3 million.

The largest market share for the global booklet label market lies in the pharmaceutical sector, considering the stringent regulations of product information, safety, and traceability. The regulatory bodies, like the FDA, EMA, and WHO, demand that labeling of pharmaceutical products be complete and include multilingual content, dosage instructions, and safety warnings.

Tamper-evident, contamination-resistant, and high-durability booklet labels are required to ensure compliance and consumer safety. These labels must sustain extreme temperature changes, humidity, and chemical exposure without compromising readability.

Manufacturers are innovating in smart labeling solutions that integrate RFID-enabled, QR code-integrated booklet labels for better tracking and authentication and recyclable and biodegradable options to achieve a benign interface that contributes to the overall goal of environmental responsibility within the industry. As the pharmaceutical industry continues to grow, it is expected that investments in high-quality, compliant, and eco-friendly booklet labels will increase as the regulatory and consumer expectations continue to evolve.

The industry is led by flexography printing, which is high-speed, economical, and flexible over most materials. These make it especially valuable in sectors with big-volume production requirements, such as food and beverages, and pharmaceutical companies with large production orders.

Lithography prints follow since these provide quality image reproduction as well as excellent detail reproduction; for this reason, it finds itself widely applied on premium packages of cosmetics, luxury goods, and specialty chemicals. Meanwhile, digital printing is gaining popularity. The demand for customization, short production runs, and variable data printing cements their rise in the market.

Brands are enabled to create personalized packaging with QR codes and improve regulatory compliance by having detailed, interactive labeling solutions. As sustainability and smart labeling trends continue to rise, digital printing will be integral in permitting environment-friendly and technologically advanced booklet labels.

The booklet label market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 248.4 million and will increase 1.5 times the current value by 2035.

Explore FMI!

Book a free demo

The table below presents the expected CAGR for the global booklet label market over several semi-annual periods spanning 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 4.1% (2024 to 2034) |

| H2 | 4.5% (2024 to 2034) |

| H1 | 3.3% (2025 to 2035) |

| H2 | 5.3% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.1%, followed by a slightly higher growth rate of 4.5% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.3% in the first half and remain relatively moderate at 5.3% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed an increase of 80 BPS.

Growing Demand for Extended Content and Regulatory Compliance

This increase in the demand for more information about the products through booklets is in a wide range of fields, such as pharmaceuticals, food, and cosmetics. The manufacturers increasingly use booklet labels to support the above regulatory bodies where strict labeling compulsions are present, and they have to support multilingual descriptions, safety instructions, and compliance information. Brands also utilize interactive elements like QR codes & augmented reality to increase consumer interaction while keeping it credible and open.

Sustainability & Eco-Friendly Packaging Solutions

The change in trend towards sustainability is forcing booklet labels to modify themselves. Companies are using recyclable and biodegradable materials, as per global environmental norms. Now, water-based adhesives and paper-based booklet labels are in the making so that plastic waste reduction does not compromise durability or functionality. This effort helps brands respond to the needs of eco-conscious consumers and helps reduce their carbon footprint.

Cost of Production and Regulatory Hurdles

Despite growth in the market, there are strong barriers to overcome, such as high production costs and the intricacies of regulation. The multi-layer printing process in booklet labels is more expensive than other label types. Pharmaceutical and chemical industries have a stricter regulatory environment. This raises approval time and pushes up costs again for the manufacturer. Small and medium-sized enterprises find it hard to balance the need for compliance with profitability; hence, they find it tough to enter the market.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-Friendly Materials | Recyclable and biodegradable booklet labels drive investment into sustainable packaging. Companies choose paper-based materials, water-based adhesives, and compostable substrates to comply with regulatory requirements and respond to customer demands. |

| Regulatory Compliance & Extended Content Solutions | Industry regulations for a book size of extended content labeling on booklets, with multi-language instructions and safety warning requirements, mean heavy investments in high-capacity printing and compact labeling solutions. |

| Smart Labeling & Digital Integration | RFID, QR code, and NFC-enabled booklets with enhanced traceability capabilities to deter counterfeit, efficient supply chain management through accurate inventory. Interactive product information reaches consumers. |

| Automation & High-Precision Printing | High-speed digital printing and automated label application processes improve efficiency, reduce costs, and ensure consistency in booklet labels. Precision manufacturing allows companies to meet increasing demand while maintaining high quality. |

| Customization & Branding Innovations | Companies invest in laser-engraved markings, color-coded booklet labels, and tamper-proof designs to enhance brand differentiation, customer engagement, and product identification in competitive markets. |

The global booklet label market achieved a CAGR of 2.2% from 2020 to 2024. Overall, the global booklet label market performed well since it grew positively and reached USD 445.3 million in 2024 from USD 407.4 million in 2020.

The global booklet label market grew steadily from 2020 to 2024, mainly due to increased demand for pharmaceuticals, healthcare, agrochemicals, and consumer goods. The requirement for detailed regulatory information, multilingual labeling, and expanded product instructions was a major driver of market growth, especially in industries that must adhere to stringent safety and documentation regulations.

Technological advancements through smart labels, RFID integration, and digital printing improved the functionalities of booklet labels, making it easier to read, traceable, and prevented counterfeits. Concerns about sustainability and eco-friendly packaging led to the use of biodegradable and recyclable, FSC-certified materials in label production. The waste management policies that became favorable to environmental concerns prompted the manufacturers to make low-impact adhesives and water-based inks, further solvent-free printing techniques.

Meanwhile, growing e-commerce and globalization increased demand for multi-lingual, rugged, and tamper-evident booklet labels to deliver safe and authentic products. The potential in the future market remains huge with ongoing growth in smart packaging innovations, regulatory changes, and more adoption of green labeling solutions.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Steady growth was experienced due to increased demand for extended content labels in pharmaceuticals, chemicals, and consumer goods. |

| Material Trends | Paper-based and synthetic labels are preferred for their excellent adhesive properties. |

| Regulatory Environment | Conformity with FDA, EU, and other global labeling rules that focus on product safety and legal information. |

| Consumer Demand | Growing demand for product information, multilingual content, and adherence to pharmaceutical and food industry regulation. |

| Technological Advancements | Digital and flexographic printing for high-quality, durable booklet labels. |

| Sustainability Efforts | The gradual shift towards environmentally friendly inks, adhesives, and reduced material wastage. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Expansion is due to stringent labeling rules, growing e-commerce, and the need for multilingual and interactive labels. |

| Material Trends | Eco-friendly materials, biodegradable adhesives, and recyclable booklet labels became the new choice to meet sustainability goals. |

| Regulatory Environment | Stricter regulations on sustainability with encouragement to adopt recyclable and low-carbon-footprint packaging materials. |

| Consumer Demand | Smart labels on booklets that use QR codes, RFID, and NFC to enhance traceability and engagement with the consumer. |

| Technological Advancements | Increasing automation, digital printing innovations, and intelligent labeling solutions to increase supply chain efficiency. |

| Sustainability Efforts | Fully recyclable and compostable booklet labels are in use across the globe as part of corporate sustainability efforts. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability, Moisture Resistance, Strength) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Regulatory Compliance & Safety |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability, Moisture Resistance, Strength) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Regulatory Compliance & Safety |

|

| Reusability & Circular Economy |

|

Booklet label demand is expected to rise significantly from 2025 to 2035, led by growing demand from end-use industries such as pharmaceuticals, healthcare, agrochemicals, and consumer goods. Unrelenting regulatory requirements for product labeling, safety information, and multilingual documentation will fuel demand for high-quality booklet labels.

In terms of growing environmental regulations, it will boost opportunities in the label material, particularly the eco-friendly and sustainable one. It includes mainly recyclable, compostable, and biodegradable ones. Efficiency, accuracy, and compliance are furthered through smart labels, digital printing, RFID-enabled tracking, and tamper-evident features. Many industries can be helped with the safety, reliability, and sustainability of the labeling solution with innovation.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series, including recycling and manufacturing, utilizing the latest technology in packaging to meet regulatory standards and provide the highest quality. Prominent companies within tier 1 include CCL Industries Inc., Mayr-Melnhof Karton AG, Schreiner Group, Fuji Seal International, and Faubel & Co. Nachf GmbH.

Tier 2 companies include mid-size players with a presence in specific regions and highly influence the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 Weber Packaging Solutions, Inc., Premium Label & Packaging Solutions, JH Bertrand, Edwards Label, Inc., Advanced Labelworx, Inc., Fortis Solutions Group, and Great Lakes Label.

Tier 3 includes most small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Global | There is increased demand for booklet labels in pharmaceuticals, healthcare, agrochemicals, and consumer goods mainly because of regulatory compliance and multilingual labeling needs. |

| North America | There is a strong demand for FDA-compliant, tamper-proof booklet labels in the pharmaceutical and medical device industries. |

| Asia Pacific (APAC) | Rapid industrialization in China and India also increased the demand for booklet labels in pharmaceutical exports and compliance with international labeling standards. |

| South Asia | Expanded Pharma and Agrochemical sectors have led to increased adoption of booklet labels for regulatory filing. |

| Middle East & Africa | Pharmaceutical and Consumer Goods are seeing expanded focus due to increased adoption of booklet labels, driven by growing retail and healthcare infrastructure. |

| Latin America | The adoption of booklet labels in pharmaceutical and agrochemicals is increasing as applications evolve and grow in compliance with new regulatory requirements. |

| Europe | High-grade booklet labels are used due to tight EU rules about product labeling and safety. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Global | Increased focus on environment-friendly, recyclable booklet labels with governments' imposition of certain rules and changing mindset toward circular economy principles. |

| North America | Transition towards sustainable materials, digital tracking, and RFID-enabled booklet labels with better traceability. |

| Asia Pacific (APAC) | Smart Labeling technology such as QR codes and RFID-integrated with increased local manufacturing to support supply chain efficiency. |

| South Asia | Government Focus on Eco-Friendly Packaging drives demand for biodegradable and sustainable booklet labels. |

| Middle East & Africa | The focus is on durable and heat-resistant booklet labels, besides sustainability-driven innovations. |

| Latin America | Strict regulations on environmental considerations encourage more use of inexpensive, recyclable, and biodegradable labeling options. |

| Europe | Change towards a more closed-loop system for recycling, bio-based materials for labeling, and intelligent tracing systems, aligned with circular economy principles. |

The section below covers the future forecast for the global booklet label market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and MEA, is provided. USA is expected to account for a CAGR of 3.2% through 2035. Spain is projected to witness a CAGR of 3.9% in the European booklet label market by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

| Germany | 2.8% |

| China | 5.2% |

| UK | 2.7% |

| Spain | 3.9% |

| India | 5.4% |

| Canada | 3.0% |

The strict labeling norms followed by the FDA and other regulatory bodies of the USA are one of the major growth drivers for the Booklet Label Market. The pharmaceutical industry demands large amounts of product information and safety details regarding the patient, and multilingual labeling makes booklet labels an absolute necessity for drug packaging compliance.

The demand for more content on the labels has also increased because of the rising demand for biologics, specialty drugs, and over-the-counter medications. Additionally, the growing trend of serialization and digital tracking in pharmaceutical supply chains supports the adoption of booklet labels with RFID and QR code integration.

In Canada, the bilingual and multilingual labeling of the product has provided substantial growth for the Booklet Label Market due to intense pressure from English and French consumers. Pharmaceutical and consumer health products sold in Canada require strict labeling requirements by Health Canada, which requires much paper documentation and safety warnings, making booklet labels the first choice of manufacturers.

Furthermore, the pharmaceutical and consumer goods industries have also seen an upsurge in exports to foreign markets, requiring full-labeling solutions that adhere to international regulatory requirements. In addition, the need for eco-friendly booklet labels from recyclable materials is becoming more prominent as Canadian companies increasingly focus on environmental responsibility in their packaging strategy.

The section contains information about the leading segments in the industry. In terms of container type, flat containers are estimated to account for a share of 55% by 2035. By material type, plastic is projected to dominate by holding a share above 70% by the end of 2035.

| Container Type | Market Share (2025) |

|---|---|

| Flat Container | 55% |

Flat containers own the biggest market share in this category, which is used in food, pharmaceuticals, and household products. They have more surface area for booklet labels, where more information can be provided. Round containers, mainly used in beverages and chemicals, are a special requirement for labeling, such as shrink sleeves and wraparound labels. Although round is the most commonly used container, adhesion and readability become a problem about flat containers.

| Material Type | Market Share (2025) |

|---|---|

| Plastic | 70% |

Plastic is more dominant because of its durability, resistance to moisture, and suitability for various print techniques. Labels are used a lot in industries such as food, beverages, and chemicals since they have to endure temperature extremes and physical damage.

However, the need to be more environmentally friendly has promoted the use of paper labels on premium and conscious brands. Paper labels are biodegradable and recyclable thus appealing for companies that will reduce their environmental footprint.

The global booklet label market is booming rapidly because it has started to drive this demand in its need for innovation, sustainability, and strategic collaboration. Since regulations on these kinds of industries in pharmaceuticals, healthcare, and chemicals continue to rise, they expand the varieties of products used in compliance with efficiency.

There is also a need to be environmentally responsible, hence utilizing biodegradable and recyclable materials to dammish pollution. Improvements in smart labeling, mainly RFID and QR codes, are showing the growing potential to improve product traceability and security. Firms increasingly invest in quality and compliance, along with mergers and partnerships that add scale and technological capability and global reach.

Key Developments in the Booklet Label Market

Vendor Insights in the Booklet Label Market

| Manufacturer | Vendor Insights |

|---|---|

| CCL Industries Inc. | A global leader in booklet labels that offer innovative solutions through smart labeling technologies, including RFID and QR codes that enhance traceability and compliance. |

| Mayr-Melnhof Karton AG | Offers sustainable booklet labels using ecological materials in recyclable packaging for current environmental regulations. |

| Schreiner Group | Offers high-security booklet labels that provide tamper-evident and authentication requirements for pharmaceuticals and other high-risk industries. |

| Fuji Seal International, Inc. | Advanced booklet label solutions use in-line digital tracking and provide required regulatory compliance and increased consumer interaction. |

| Faubel & Co. Nachf. GmbH | I specialize in multi-page booklet labels for pharmaceutical, healthcare, and chemical industries with proper, multilingual regulatory documentation. |

The global booklet label market is projected to witness CAGR of 4.3% between 2025 and 2035.

The global booklet label market stood at USD 445.3 million in 2024.

Global booklet label market is anticipated to reach USD 693.7 million by 2035 end.

East Asia is set to record a CAGR of 5.4% in assessment period.

The key players operating in the global booklet label market include CCL Industries Inc., Mayr-Melnhof Karton AG, Schreiner Group, Fuji Seal International, and Faubel & Co. Nachf GmbH.

The industry is segmented into pressure sensitive labels, in-mould labels, glue-applied labels, sleeve labels, and full base.

The industry is segmented into flexographic printing, lithographic printing, and digital printing.

The industry is segmented into flat containers and round containers.

The industry is segmented into plastic and paper.

The industry is segmented into food, beverages, chemicals, pharmaceuticals, and cosmetics and personal care.

The market is categorized into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.