The bone fixation plates industry is valued at USD 2.38 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 4.6% and reach USD 3.73 billion by 2035. The global bone fixation plates or orthopaedic fixation plates industry witnessed significant momentum in 2024, driven in particular by volumes of orthopaedic procedures growing in developed and emerging countries.

North America led the way, according to FMI analysis, based on hospital spending in trauma centers and early availability of technologically sophisticated implants. At the same time, double-digit growths in urban trauma cases from China and India were reported as a result of increased road traffic accidents, thus directly fuelling increasing implant demand.

Product development remained key in 2024. Titanium alloy designs replaced stainless steel versions due to improved biocompatibility and lower levels of post-surgical rejection. FMI is of the opinion that the methods of minimally invasive plate osteosynthesis (MIPO) experienced growing clinical adoption with the choice of anatomically contoured plates laying the groundwork for improved patient outcomes and quicker recovery.

As we approach 2025, our FMI analysis reveals that positive European reimbursement trends and the growth of new orthopaedic facilities in Asia will continue to drive implant adoption. Companies should aim to develop anatomical customization and intuitive integration of smart sensor technology for real-time feedback on healing.

With elective orthopaedic procedures resuming at normalization, pre-pandemic capacity levels and 2025 is primed for steady, procedure-driven growth. The industry is still being pushed by demographic aging, rising incidence of trauma, and evolving attitudes to surgery.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.38 Billion |

| Industry Value (2035F) | USD 3.73 Billion |

| CAGR (2025 to 2035) | 4.6% |

Explore FMI!

Book a free demo

The bone fixation plates industry is set on a growth path, buoyed by growing trauma cases, aging populations, and evolving orthopaedic surgery techniques. Improvements in technological innovations like anatomically contoured and biocompatible materials are transforming clinical trends. Major medical device companies and trauma care units will gain most, while aged implant companies that lack innovation streams will lose out.

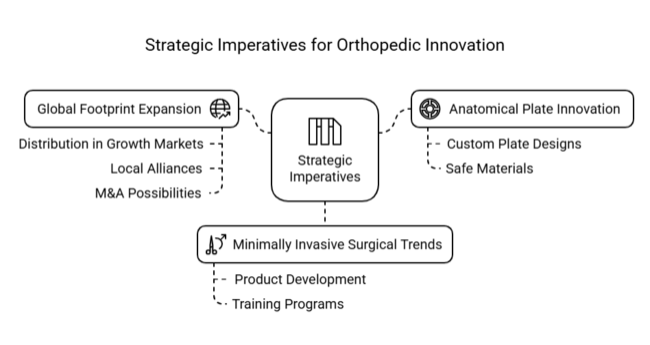

Invest in Anatomical Plate Innovation

Executives need to direct R&D efforts toward creating custom plate designs that fit individual patients, using safe materials like titanium alloys, to meet the growing need for personalized orthopaedic solutions.

Support Minimally Invasive Surgical Trends

Product development and training programs need to keep up with the growing use of minimally invasive plate osteosynthesis (MIPO) techniques to stay important in surgery and gain more acceptance in clinical settings.

Grow a global footprint through strategic partnerships.

Enhance distribution in growth industries, such as Asia-Pacific and Latin America, via local alliances while assessing M&A possibilities to expand manufacturing capacity and acquire regulatory access in broken-up trauma care industries.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays in new implant approvals | Medium - High |

| Supply chain disruptions affecting raw materials | High - Medium |

| Slow adoption of advanced fixation techniques in rural areas | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Evaluate Smart Plate Integration | Run feasibility on sensor-enabled fixation plate development |

| Optimize Product-Industry Fit | Initiate OEM feedback loop on anatomical plate performance |

| Strengthen Channel Reach | Launch afterindustry channel partner incentive pilot |

To stay ahead, companies need to act swiftly to position themselves as a leader in next-generation orthopaedic implant solutions. This report forecasts a trend toward anatomical, minimally invasive fixation systems, which indicates the necessity for speeding up R&D timelines and collaborations on high-growth trauma care industries.

The board needs to command prompt investment in sensor-integrated plate technologies and increase clinical education programs to facilitate adoption. Emphasizing smart manufacturing competencies and accelerating regulatory sailing will protect industry position and unlock sustained competitive advantage in an industry characterized by precision, customization, and convergence of global demand.

| Countries | Policy & Regulatory Impact on Bone Fixation Plates Industry |

|---|---|

| United States | The FDA must approve orthopaedic fixation plates, and the new classification of orthopaedic devices is increasing the demand for extensive clinical data. Alignment of reimbursement with CMS policy is influencing hospital purchasing behaviour. |

| United Kingdom | UKCA replaced CE for home industry sales post-Brexit. MHRA now regulates orthopaedic implant approvals, with small manufacturers facing delays in entering the industry. |

| France | Stringent adherence to EU MDR is mandatory. Strict regulatory oversight on titanium-based implants and growing in-country clinical verification requirements are decelerating product launches. |

| Germany | They are among the most stringent enforcers of MDR compliance. People frequently seek TÜV SÜD certification for its credibility. Surgeons prefer implants with documented biomechanical testing in accordance with ISO 5832 standards. |

| Italy | Regulatory uptake of EU MDR is in progress. Further traceability and labelling requirements in Italian public health facilities are adding documentation burdens to manufacturers. |

| South Korea | MFDS demands local clinical trial data for foreign implants. Under the Innovative Medical Device Act, the nation expedites approval for domestic manufacturers, favoring local players. |

| Japan | PMDA approval is necessary, and manufacturers must submit anatomical design differences separately. Products need to be in conformity with JIS T0301 requirements, and foreign firms encounter long approval durations. |

| China | NMPA requires indigenous clinical trials on most imported implants. Local content mandates and preferences in procurement procedures for Chinese original equipment manufacturers provide barriers for multinationals. |

| Australia-New Zealand | TGA (Australia) and Medsafe (NZ) demand ARTG registration and post-industry monitoring. ANZTPA harmonization necessitates more detailed documentation. While CE-cleared products expedite the process, there is a growing demand for real-world data. |

| India | CDSCO requires the registration of Class C orthopaedic implants, such as fixation plates. Certification by BIS is likely to become mandatory shortly. Local price controls under NPPA can heavily limit the sale of premium products. |

Between 2025 and 2035, compression plates will be the most profitable product segment, driven by their extensive use in the treatment of complicated fractures at anatomical locations. Compression plates provide rigid fixation and encourage more rapid union by neutralizing torsional and bending forces.

With growing instances of global trauma and higher orthopaedic trauma center procedural volume, these systems are gaining wider acceptance in acute and reconstructive surgical procedures alike.

Their convergence with minimally invasive plate osteosynthesis (MIPO) methods further complements their operatory efficiency. FMI estimation revealed that the Compression Plates segment of the industry will expand at an estimated CAGR of about 5.3%, moderately advancing the overall growth rate of 4.6%.

For the period between 2025 and 2035, titanium and its alloys are anticipated to be the most profitable material segment based on their higher biomechanical strength, corrosion resistance, and high biocompatibility. These materials are most preferred in load-bearing procedures and metal-sensitive patient cases.

As a result of the global drift toward high-performance implants, titanium-based fixation systems have emerged as a leading trend in trauma and reconstructive surgeries.

Surgeons also favor titanium due to its compatibility with post-operative imaging and lesser artifact distortion during MRI/CT scanning. FMI opines that this segment will witness a CAGR of 5.7% from 2025 to 2035, making the titanium/alloys segment the fastest-growing material segment.

Between 2025 and 2035, hospitals are expected to remain the most profitable end-user segment, fueled by their leading position in managing complicated orthopaedic trauma cases, access to upgraded surgical facilities, and presence of specialist orthopaedic surgeons.

Since complicated fractures and polytrauma cases require extensive intraoperative treatment, hospitals still dominate the majority of procedural volumes.

Additionally, government initiatives to upgrade trauma care capacity-particularly in developing regions-are funneling significant resources into hospital orthopaedic departments. FMI analysis found that the Hospitals segment will expand at a CAGR of 4.9% through 2035, sustaining its lead across both high-income and emerging economies.

The United States bone fixation plates industry is expected to develop at a 5.2% CAGR between 2025 and 2035. Drivers include a high incidence of trauma, expanding use of intelligent orthopaedic implants, and hospital investment in minimally invasive surgical systems. The FDA's strong regulatory regime under the 510(k) pathway continues to influence industry access.

Hospitals increasingly require sensor-compatible plates, stimulating innovation. Bundled payments and value-based care requirements continue to drive premium pricing pressures. In spite of these headwinds, North America is the biggest innovation center for next-gen implants with high-margin opportunities for differentiated technologies.

For the United Kingdom, the industry for bone fixation plates is projected to expand at a CAGR of 4.5% from 2025 to 2035. Post-Brexit changes have added the UKCA mark, causing friction for non-domestic providers used to CE standards. Although NHS procurement is still cost-sensitive, there is increasing pressure for surgical results associated with high-precision implants.

The MHRA is strengthening post-industry monitoring, which affects distributors. Local players with in-country regulatory knowledge are gaining industry share. As imports have slowed down, it has created a quick chance for flexible UK-based OEMs to establish hospital connections and meet local orthopaedic care needs.

From 2025 to 2035, projections indicate a CAGR of 5.7% for the bone fixation plates industry in France. The nation enjoys universal healthcare reimbursement, strong public hospital infrastructure, and high surgeon preference for CE-certified anatomical systems. France is also a leading adopter of minimally invasive orthopaedic procedures, which drives demand for contoured, low-profile plates.

Despite the elevated regulatory stress from the EU MDR, France has streamlined implant trials through central hospital networks. Local demand is shifting toward hybrid titanium designs, and indigenous innovation clusters centered around Lyon and Strasbourg are becoming essential production and distribution centers.

In Germany, the bone fixation plates industry is predicted to have a CAGR of 5.3% between 2025 and 2035. Germany is the biggest medical device industry in the EU and strictly regulates MDR compliance, dominating in biomechanical testing and standardization. German hospitals are rapidly implementing AI-based surgical planning tools in conjunction with pre-contoured fixation systems.

Demand for highly advanced titanium implants continues to remain constant, particularly in trauma treatment centers. Navigating compliance and obtaining TÜV SÜD certification remains challenging, yet it is considered a mark of superior quality in products. Local industry players continue to enjoy export-targeted subsidies as well as reservoirs of engineers.

In Italy, the bone fixation plates industry is on the verge of growing at a 4.4% CAGR during 2025 to 2035. Hospitals in Italy prioritize cost and operational simplicity, as the majority of procedures are operated in public sectors with tight budget constraints. Enforcement of EU MDR is taking place, though procurement processes for the country remain decentralized with region-specific volatility in demand.

Due to cost-benefit equilibrium, titanium-steel hybrids are gaining popularity in trauma cases. Germany and France lead in innovation, but localized distributors dominate hospital relationships, creating barriers for new industry entrants. Increasing orthopaedic surgery rates among aging populations, however, will drive overall implant volume through 2030.

The industry for bone fixation plates is expected to expand at a CAGR of 5.8% in 2025 to 2035 in South Korea. Advanced hospital infrastructure in the country, aggressive adoption of robotic and minimally invasive surgery, and robust reimbursement support from the National Health Insurance Service (NHIS) are fueling growth.

MFDS approval requires clinical localization, while local players have a fast-track system through the Innovative Medical Device Act. Titanium and intelligent implants are gaining industry share, especially in Seoul's private healthcare industry. Despite Japanese and US import competition, Korean OEMs are starting to ship sensor-integrated fixation systems throughout Southeast Asia and the Middle East.

Japan's bone fixation plates industry is expected to grow at a CAGR of 4.2% over 2035. The PMDA keeps rigorous device approval procedures in place, slowing new technology entry and preferring incumbent local players. As Japan's population ages, demand increases for low-profile, patient-matched implants adapted for smaller anatomical structures.

Yet cost containment continues to be the leading theme in purchasing, with hospitals using traditional stainless-steel systems in numerous instances. Demand for smart plates is still in its infancy due to uncertain reimbursement pathways. But Japanese research and development of corrosion-resistant alloys and smaller implant systems might find greater international relevance by the end of the forecast period.

China’s bone fixation plates industry is likely to expand by a CAGR of 6.4% from 2025 to 2035. The central government's investment in Tier 2 and Tier 3 hospitals, along with the rapid growth in metropolitan trauma treatment, is driving demand.

The NMPA requires in-country clinical trials as a high entry barrier for Western competitors, but it also benefits indigenous manufacturers. Chinese OEMs are ramping up titanium and hybrid plate production to meet national "Made in China 2025" mandates.

Price sensitivity is still high in rural industries, but urban hospitals are increasingly using CE-style implants. Digital procurement platforms are facilitating accelerated device adoption cycles.

The bone fixation plates industry in Australia and New Zealand is expected to grow at a CAGR of 5.1% from 2025 to 2035. The ANZTPA supports the industry through centralized regulatory management, where the TGA and Medsafe mandate ARTG registration and active post-industry surveillance. While CE-marked devices may gain entry more quickly, local real-world experience is now frequently required.

Public hospitals are still cautious with tech uptake, but private institutions are investing in intelligent orthopaedic systems. Demand for titanium and anatomical designs is rising, especially in trauma hospitals. Reimbursement continues to be strong, and the stable policy environment of the region makes it a low-risk entry point for Western OEMs.

The bone fixation plates industry in India is expected to expand at a CAGR of 6.1% between 2025 and 2035. A high rate of road accidents, growing orthopaedic surgery infrastructure, and increasing middle-class access to healthcare are driving the industry. The CDSCO regulates Class C implants, but few hospitals use expensive, reusable stainless-steel plates.

Price regulation under NPPA makes premium global brands uneconomical, forcing many to localize production. However, the expansion of corporate hospital chains and urban trauma centers is creating a new demand for sophisticated systems. India is emerging as a regional export hub for cost-effective orthopaedic implant kits, particularly for Southeast Asia and Africa.

In the orthopaedic fixation plates industry, leading players are competing on a combination of innovation-driven product differentiation, strategic alliances with hospitals and academic centers, and geographic expansion into high-growth emerging economies.

Leaders are heavily investing in lightweight, bioresorbable materials and anatomically shaped designs to enhance clinical results and surgeon satisfaction. Competitive pricing continues to be important in cost-sensitive industries, while premium players target developed economies with technologically advanced plating systems.

FMI analysis revealed that mergers, acquisitions, and local manufacturing partnerships are becoming more integral to gaining industry share, particularly as reimbursement policies become more stringent and surgical volumes increase in outpatient and ambulatory environments.

Johnson & Johnson (DePuy Synthes)

Share: ~25-30%

A leading company in the orthopaedic devices industry, drawing on its extensive product portfolio and robust distribution network.

Stryker Corporation

Share: ~20-25%

Renowned for cutting-edge trauma and orthopaedic solutions, Stryker enjoys a substantial industry share through superior materials and surgical technologies.

Zimmer Biomet Holdings

Share: ~15-20%

One of the leading competitors with an emphasis on customized orthopaedic solutions, having a strong foothold in the bone fixation space.

Smith & Nephew

Share: ~10-15%

Has expertise in advanced wound management and orthopaedic devices, with an increasing focus on minimally invasive fixation solutions.

Medtronic plc

Share: ~5-10%

Bolstering its spine and orthopaedic portfolio, Medtronic competes with specialized fixation plates for severe fractures.

Arthrex, Inc.

Share: ~5-10%

As a sports medicine and trauma industry leader, Arthrex specializes in high-performance fixation systems for sports patients and active patients.

Sales are driven by increasing cases of trauma, more orthopaedic surgeries, aging populations, and expanding use of minimally invasive procedures.

The industry will see consistent growth up to 2035, driven by material technology, improved surgical outcomes, and increased healthcare infrastructure.

Leading manufacturers of orthopaedic fixation plates are Depuy Synthes (J&J), Globus Medical, Smith & Nephew, Stryker Corporation, B. Braun SE, Zimmer Biomet, Lepu Medical Technology, Jeil Medical Corporation, Osteonic, Ulrich Medical, Utheshiya Medicare, Watson Medical, South America Implants, Orthomedic Innovations SDN BHD, Johnson & Johnson (DePuy Synthes), Medtronic PLC, and Arthrex, Inc.

Compression plates are forecasted to be the leading-performing product segment between 2025 and 2035 because of their extensive surgical use.

The bone fixation plates industry is anticipated to reach USD 3.73 billion by 2035.

The industry is segmented into compression plates, arthrodesis plates, osteotomy plates.

The industry is segmented into metals, stainless steel, titanium/alloys, bioresorbable polymers.

The industry is segmented into hospitals, speciality clinics, ambulatory surgical centers.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.