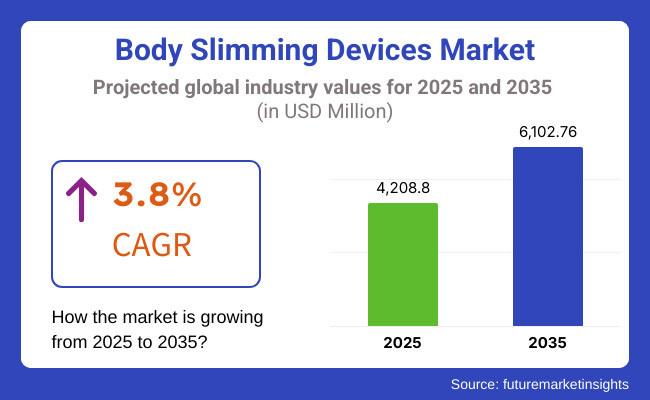

The body slimming devices industry is projected to experience substantial growth during the forecast period 2025 to 2035. The sector’s growth is driven by increasing demand for non-surgical weight loss treatments, an increase in aesthetics technology, and the increasing rate of obesity. Its growth is expected to be approximately USD 4,208.8 million in 2025 and reach approximately USD 6,102.76 million by 2035 at a compound annual growth rate (CAGR) of 3.8% over the forecast period.

Some of the major key drivers in this sector include the increasing need for non-invasive body contouring procedures, increasing disposable incomes, and the influence of social media on beauty ideals. Technological advancements in radiofrequency (RF), cryolipolysis, high-intensity focused ultrasound (HIFU), and laser lipolysis are also driving the body slimming device industry.

High costs of devices, regulatory problems, and variability in treatment effectiveness could challenge adoption. Medical spa growth, home-use slimming devices, and tailored body sculpting treatments are the main opportunities for industry players.

Explore FMI!

Book a free demo

North America has been leading the body slimming device industry, driven by high-end user spending on aesthetics procedures, advanced healthcare facilities, and demand for less invasive body contouring procedures. The United States is the largest country having cryolipolysis and radiofrequency-based fat loss devices. The sector’s growth is also driven by the growth of med spas, influencer marketing, and social media campaigns.

The issues dominating the industry are the potential regulatory oversight by the FDA, the high costs of treatments, and the long-term effectiveness. Implementing AI-based personalized treatment plans and increasing demand for home-use devices for slimming and reinstating are anticipated to facilitate consumer engagement. Further, the increasing adoption of body contouring among men and awareness of body positivity is augmenting the demand for customized solutions among diverse consumer segments.

Europe tends to be a robust body slimming device industry, with a growing focus on wellness, fitness and body aesthetics. Countries including, Germany, the UK, and France are those with a high demand for non-invasive fat reduction technologies, making them leaders in terms of adoption.

Other trends shaping the European economy in aesthetic device manufacturing include a growing emphasis on sustainability and a growing number of combination treatments that bring together several slimming technologies. Furthermore, the collaboration between aesthetic clinics and fitness centres is forming a new distribution channel for offering body contouring solutions.

Similar trends can be observed across Europe as consumers become wiser about personalization and seek body sculpting solutions aimed at developing the right treatment plans, giving rise to a growing demand boost for AI-powered analysis tools to assess body composition and offer customized treatment plans.

Asia-Pacific region is projected to experience significant growth in the body slimming device industry from 2025 to 2035. The country's growth is primarily driven by the increase in disposable income, the growing number of beauty-conscious consumers, and rising rates of obesity. Countries including China, Japan, and South Korea are among the countries with the highest level of innovation and demand for fat reduction by technology.

However, widespread adoption is challenged by inequalities in developing economies, regulatory inconsistencies, and counterfeit products. Rising medical tourism in countries such as Thailand, South Korea, and India for aesthetic treatment is driving the industry’s growth. The growing acceptance rate of non-invasive body composition techniques (aesthetic body treatments) for men and younger consumers is expected to influence industrial trends for the entire region.

Challenges

There are several challenges prevailing in the global body slimming device industry, including high treatment costs, scepticism on treatment efficacy, and regulatory hurdles in various regions. The challenge with non-invasive fat reduction has been consumer scepticism over the long-term efficacy of the procedure, resulting in slower industrial adoption.

Moreover, consumer confidence is also impacted due to concerns regarding side effects such as skin burns, uneven fat removal and temporary numbness. This is further compounded by unregulated online platforms that are flooded with counterfeit or low-quality slimming devices affecting brand reputation and trust.

Moreover, thanks to a growing competitive landscape with newcomers providing cheaper alternatives, traditional players are under increasing pressure to innovate and stand out from the competition. However, the requirement of skilled professionals to use advanced slimming devices can slow down the growth of the industry in a few regions, acting as a barrier for smaller clinics and wellness centres to adopt the devices in developed countries.

Opportunities

Body slimming devices are witnessing innovative technologies like integration with AI and machine learning to offer personalized treatments for fat reduction. Consumers are looking for more tailored solutions based on body composition analysis and metabolic rate instead of a one-size-fits-all approach, driving demand for smart devices for slimming.

The rise of direct-to-consumer models in tandem with subscription-based weight-reducing services is bringing the market reach to new horizons. Also, synergetic outcomes from the growing adoption of combination therapies (pairing body slimming treatments with an accompanying skin tightening and muscle toning solution) are augmenting any clinic treatment outcome.

Due to the increasing demand for convenient aesthetic therapies, the development of non-invasive, pain-free, and portable body slimming devices for home usage is contributing to the growth of the industry. In addition, innovation in energy-based body contouring technologies is enhancing safety, comfort, and efficacy, increasing patient confidence in non-invasive fat reduction procedures.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Emphasis on safety and efficacy of non-invasive body slimming devices, with regulatory bodies facilitating approvals for innovative treatments. | Implementation of comprehensive guidelines ensuring standardized protocols for advanced technologies, including AI-assisted and combination therapy devices. |

| Adoption of cryolipolysis, radiofrequency, and laser-based devices offering non-invasive fat reduction and skin tightening solutions. | Integration of artificial intelligence and machine learning to personalize treatment plans, enhance device precision, and improve patient outcomes. |

| Increased awareness leading to higher demand for minimally invasive procedures with minimal downtime and effective results. | Growing preference for personalized and holistic body contouring solutions that align with individual health and aesthetic goals, supported by digital health platforms. |

| Rising obesity rates, sedentary lifestyles, and cultural emphasis on physical appearance driving demand for body slimming devices. | Expansion of the wellness and aesthetics industry, technological innovations offering enhanced treatment experiences, and increasing disposable incomes facilitating access to advanced body contouring procedures. |

| Initial efforts towards eco-friendly manufacturing processes and reducing the environmental impact of disposable components in devices. | Comprehensive adoption of sustainable practices, including the use of recyclable materials, energy-efficient manufacturing, and initiatives aimed at reducing electronic waste associated with medical devices. |

| Reliance on established distribution networks with a focus on ensuring the availability of devices in clinics and wellness centers. | Optimization of supply chains through digital technologies, enhancing transparency and efficiency, and ensuring timely delivery of devices to diverse settings, including home-use products for personalized care. |

The body slimming device industry in the United States is experiencing steady growth, driven by increasing health consciousness and demand for non-invasive fat reduction solutions. In 2025, the industry is expected to be valued at approximately USD 4.17 billion and is projected to reach USD 5.76 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.8%.

The body slimming devices industry consists of sales of body slimming devices and related services. The obesity rates are increasing which means there is a great demand for effective weight management solutions! New devices are more sophisticated and safer for use, with technical improvements in non-invasive treatment of the skin such as cryolipolysis and radiofrequency.

Furthermore, many individuals seek body sculpting options since such procedures entail little downtime and lowered associated risks. Social media platforms, Instagram and TikTok, are also contributing factor of demand of aesthetic treatment, which is leading people to appearance enhancement. The industry is also being fueled by the increasing availability of user-friendly-at-home slimming machines that can widen the reach of these solutions.

| Year | Industry Size (USD Billion) |

|---|---|

| 2025 | 4.17 |

| 2035 | 5.76 |

China's body slimming device market is poised for significant growth, fueled by urbanization and increasing disposable incomes. In 2025, the market was valued at approximately USD 70.9 million. It is projected to reach USD 163.3 million by 2035, with a

CAGR of 9.5%.

The emergence of several key drivers is boosting the body-slimming device market in China. The changing lifestyle is a significant by-product of rapid urbanization and rising demand for health monitoring and slimming solutions. Growth of Technological Adoption Consumer Smart and Connected Devices for Total Health Tracking.

The market growth is also driven by government health initiatives that promote public health awareness. Their increased availability, due to the growth of e-commerce, also improves their distribution. Furthermore, the increased fitness trend and the upsurge in interest in wellness activities are also contributing to the demand for body slimming devices, as individuals look for an effective and non-invasive solution.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 70.9 |

| 2035 | 163.3 |

India's body slimming device industry is experiencing robust growth, attributed to increasing health consciousness and a rising middle-class population. In 2025, the industry will be valued at approximately USD 54.6 million, holding about 7.3% of the global market share. It is projected to reach USD 139.5 million by 2035, reflecting a CAGR of 11.2%.

Innovative technological advancements in body slimming departments primarily fuel the growth of India's body slimming device market. Growing health consciousness is driving consumers to focus on wellness, thus driving the adoption of health monitoring solutions. Economic growth and increasing disposable incomes enable investment ability towards these devices.

Greater internet access has catalysed the digitalization of the healthcare industry, which, in turn, enables the adoption of smart health devices. Proactive health management is also bolstered by government initiatives and public health campaigns. Also, the expanding fitness and wellness sector and the growth of gyms and wellness centres are contributing to the demand for body slimming devices as many people are looking for effective ways to achieve their fitness goals.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 54.6 |

| 2035 | 139.5 |

Germany's body slimming device industry is set for steady growth, supported by a strong healthcare infrastructure and high health awareness. In 2025, the market is expected to be valued at approximately USD 42.0 million. It is projected to reach USD 63.6 million by 2034, with a CAGR of 4.7%.

Germany's body slimming device market is poised for steady growth due to several factors. The country's advanced healthcare system supports the widespread adoption of health monitoring devices, while the ageing population increases the need for regular health assessments. Technological innovation continuously enhances the accuracy and functionality of devices, attracting more consumers.

A cultural focus on preventive health care further bolsters the demand for slimming solutions. Additionally, Germany’s strong fitness culture fosters an environment where people actively seek effective and precise body-slimming devices to complement their wellness goals, driving continued growth in the market.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 42.0 |

| 2035 | 63.6 |

The United Kingdom's body slimming device industry is poised for growth, driven by increasing health awareness and technological adoption. In 2025, the industry will be valued at approximately USD 39.0 million. It is projected to reach USD 63.7 million by 2035, reflecting a CAGR of 5.8%.

The United Kingdom’s body slimming device sector is growing at a rapid pace, with several key factors contributing to its development. The rise in popularity of non-invasive aesthetic treatments, such as body contouring, over surgical procedures is similar to the trend among consumers toward non-invasive body augmentation. As a slim-down tech, from cryolipolysis to radiofrequency and ultrasound fat reduction comes to the fore.

The growing demand for devices is driven by the expanding wellness & fitness sector which includes increasing gym membership. Slimming devices are easily available on e-commerce platforms, allowing consumers to buy from the comfort of their homes. Moreover, growing consumer inclination toward non-invasive body contouring is supplemented by celebrity endorsements and social media influencer marketing campaigns, which also propel the sector’s expansion.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 39.0 |

| 2035 | 63.7 |

Cryolipolysis or fat freezing is a popular non-surgical fat reduction technique for areas like the abdomen and thighs. It works by freezing fat cells that are naturally disposed of by the body. It is anticipated that fat reduction with minimal downtime will gain electrifying momentum.

It is popular in countries including North America and Europe, growing at a rapid rate in Asia-Pacific with the rise of medical spas. HIFU (High-Intensity Focused Ultrasound) is another comparable criterion where ultrasound waves are focused to reduce fat and wrinkle the skin. In countries like South Korea and Japan, it's getting popular, and the future trends are like AI-powered devices combined with treatment adapted to get even better results.

The body slimming devices are used primarily at plastic surgery and cosmetic clinics for procedures like cryolipolysis, HIFU and diode laser. These serve clients looking for non-invasive body contouring and fat reduction. drivers include the rising demand for non-surgical procedures, higher disposable income, and the trend for combination treatments.

The industry is dominated by North America and Europe, while the Asia-Pacific region is driving growth owing to increasing engagement in medical tourism and cosmetic dermatology. Ambulatory surgical centers (ASCs) are also becoming very popular as they provide an economically feasible, outpatient treatment option associated with less downtime. However, there are trends where AI can provide all help your pre-treatment, treatment and post-treatment.

The body slimming device industry is highly competitive, driven by increasing consumer demand for non-invasive fat reduction treatments, technological advancements, and the growing aesthetic and wellness industry.

Companies are investing in laser-based, radiofrequency, ultrasound, and cryolipolysis technologies to maintain a competitive edge. The industry is shaped by well-established medical device manufacturers, beauty tech firms, and emerging aesthetic solution providers, each contributing to the evolving landscape of body contouring treatments.

Top Companies and Estimated Market Share

Allergan (AbbVie)

Key Product: CoolSculpting (cryolipolysis)

Market Share: ~20-25%

Dominates the non-invasive fat reduction segment due to FDA approvals and strong clinical validation.

Solta Medical (Bausch Health Companies)

Key Product: Thermage (radiofrequency skin tightening)

Market Share: ~10-15%

A leader in radiofrequency-based body contouring.

Cynosure (Hologic)

Key Products: SculpSure (laser lipolysis), MonaLisa Touch

Market Share: ~15-20%

Strong in laser-based technologies and expanding into emerging markets.

Syneron Candela

Key Products: UltraShape, CoolGlide

Market Share: ~10-12%

Focuses on combination technologies (ultrasound + radiofrequency).

Alma Lasers

Key Products: Accent, Soprano

Market Share: ~8-10%

Known for diversified devices for fat reduction and skin tightening.

Lumenis

Key Product: Legend Pro

Market Share: ~5-8%

Strong in multifunctional platforms for aesthetics.

Cutera

Key Product: truSculpt

Market Share: ~5-7%

Specializes in radiofrequency and laser devices.

Zeltiq (Acquired by Allergan)

Integrated into Allergan’s portfolio, contributing to its dominance.

Home-Use Device Brands (e.g., Ziip Beauty, NuFACE, Silk’n)

Collective Market Share: ~10-15%

Rapid growth in consumer-grade devices for at-home use.

North America: Allergan, Cynosure, and Solta Medical lead.

Europe: Syneron Candela and Alma Lasers have strong footholds.

Asia-Pacific: Local players (e.g., WONTECH, Lutronic) compete with global brands due to cost advantages.

Technology: Companies investing in AI, hybrid devices (e.g., RF + ultrasound), and pain-free treatments gain traction.

Medical vs. Consumer Channels: Allergan and Cynosure lead in clinical settings, while brands like NuFACE target direct-to-consumer markets.

Mergers/Acquisitions: Consolidation (e.g., Hologic acquiring Cynosure) reshapes competitive landscapes.

A sector focused on non-invasive technologies (e.g., RF, cryolipolysis) for fat reduction and body contouring, driven by rising demand for aesthetic treatments.

Allergan (CoolSculpting), Cynosure (SculpSure), and Solta Medical (Thermage) dominate with ~50% combined market share.

North America leads (40% share), but Asia-Pacific grows fastest due to rising disposable incomes and beauty standards.

Head and Neck Cancer (HNC) Therapeutics Market - Growth & Drug Developments 2025 to 2035

Healthcare Biometrics Market Trends - Growth, Demand & Forecast 2025 to 2035

Healthcare API Market Growth – Trends & Forecast 2025 to 2035

Glaucoma Treatment Market Overview – Trends & Forecast 2025 to 2035

Gaucher and Pompe Diseases Enzyme Replacement Therapy (ERT) Market - Growth & Forecast 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.