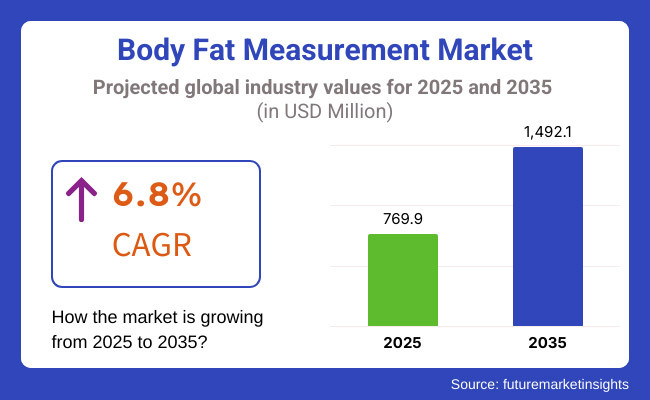

Giant leaps from 2025 to 2035 will be seen in the body fat measurement market because of rising health awareness, increasing obesity rates, and advancements in body composition analysis technologies. The growth of the body fat measurement market will rise from USD 769.9 million in 2025 to USD 1,492.1 million in 2035, implying a CAGR of 6.8% throughout the forecast.

In 2024, advancements in body fat measurement technologies accelerated, driven by manufacturers’ focus on precision, accessibility, and integration with digital health ecosystems. Leading companies like Withings, Tanita, and emerging startups introduced AI-powered smart scales and wearable devices leveraging multi-frequency bioelectrical impedance analysis (BIA) and 3D optical scanning.

These innovations delivered clinical-grade accuracy at home, with real-time data syncing to health apps. Manufacturers also prioritized inclusivity, expanding solutions for diverse body types and integrating metabolic health metrics (e.g., visceral fat, muscle mass). Concurrently, partnerships with telehealth providers and insurers grew, positioning body fat analytics as preventive health tools.

Consumer demand surged, fueled by heightened health consciousness post-pandemic and the rise of personalized fitness regimes. Affordable wearables and subscription-based apps democratized access, while privacy concerns prompted stricter data encryption standards. Consumers increasingly viewed body fat metrics as vital to holistic wellness, alongside glucose monitoring and sleep tracking.

Over the next decade, body fat measurement will evolve into a seamless component of ambient health monitoring. Advances in non-invasive sensors (e.g., millimeter-wave radar, hyperspectral imaging) will enable continuous, contactless tracking via smart home devices. AI will predict health risks using body composition trends, integrating genetic and lifestyle data.

Regulatory frameworks will tighten, ensuring medical validation of consumer devices. By 2034, these tools will be central to global obesity and metabolic syndrome management, supported by insurers and employers. The sector will converge with longevity science, cementing body fat analytics as a pillar of preventive healthcare.

| Era/Device | Evolution & Key Developments |

|---|---|

| 1940s - 1960s: Hydrostatic Weighing | Gold standard: Calculated body fat via underwater displacement. Limited to labs/clinics due to complexity and cost. |

| 1960s: Skinfold Calipers | First portable method: Measured subcutaneous fat at specific sites (e.g., triceps, abdomen). Required trained operators. |

| 1980s: Bioelectrical Impedance (BIA) | First commercial handheld BIA devices (e.g., Omron BF). Used electrical signals to estimate fat via resistance. Home use began, though accuracy was variable. |

| 1990s: BIA Scales | Tanita launched first consumer BIA scales (e.g., Tanita TBF-531). Improved accessibility for households, syncing weight and fat % metrics. |

| 2000s: DEXA Scans | Dual-energy X-ray absorptiometry (DEXA) emerged clinically, offering precise bone, muscle, and fat analysis. Too costly for home use. |

| 2010s: Smart BIA Scales & Wearables | Wi-Fi/BLE-enabled scales (Withings, FitTrack) and wearables (Fitbit, Garmin) integrated BIA with apps. Added metrics like visceral fat and muscle mass. |

| 2020s: AI & 3D Imaging | AI-powered devices (Naked Labs 3D scanner, Styku) combined BIA with 3D body scans for volumetric analysis. Smartphone apps used cameras/AI for estimates. |

| Today (2024): Multi-Sensor Fusion | Devices combine BIA, optical sensors, and radar (e.g., Samsung BioActive) for real-time tracking. Clinical-grade accuracy at home, linked to telehealth ecosystems. |

DEXA (Dual-Energy X-ray Absorptiometry)

BIA (Bioelectrical Impedance Analysis)

Gyms & Fitness Centers

Hospitals & Clinics

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

Key Players:

Market Trends:

Consumer Behavior:

Future Outlook:

The healthcare digital signage system market seems to be growing as medical institutions, diagnostic centers, and wellness centers adopt advanced display technologies to interact more with patients and enhance their business operations. Real-time information, health service promotions, and wayfinding in hospitals-not to exclude patient engagement-are among the functions of digital signage.

Major players emphasize high-resolution displays with AI-driven content management and interactive features to optimize the communication process. The industry is, therefore, benefiting from increased adoption of cloud-based solutions, touchless interaction, and analytics-driven content personalization.

| Company Name | Key Offerings/Activities |

|---|---|

| GE Healthcare | Provides cloud-based digital signage solutions with AI-driven content management for hospitals and medical facilities. Enhances real-time communication and workflow optimization. |

| OMRON Healthcare Co., Ltd. | Develops digital display solutions integrated with biometric monitoring systems. Focuses on enhancing patient education and telehealth services. |

| The Diagnostic Medical Systems (DMS) Group | Specializes in diagnostic medical imaging systems and interactive displays. Expands AI-driven analytics for improved patient engagement. |

| Hologic Inc. | Offers high-resolution digital signage for medical diagnostics and imaging solutions. Strengthens hospital outreach programs through interactive signage. |

| Xiaomi | Develops smart healthcare digital displays and wearable integration. Expands reach in connected health monitoring and consumer wellness devices. |

GE Healthcare (18-24%)

GE Healthcare, which boasts leading digital signage solutions for hospitals, offers cloud-based management and AI-content optimization services. It utilizes real-time medical data paired with digital displays to maximize operational efficiency. GE Healthcare utilizes advanced wayfinding and patient information systems to improve accessibility while providing a lower administrative burden to the hospitals it serves.

OMRON Healthcare Co., Ltd. (14-20%)

OMRON Healthcare uses interactive patient education displays for individualized health recommendations, which enhance its biometric monitoring systems. Adding digital signage into remote consultation rooms and wellness centers of OMRON is one of the brand's methods to extend the scope of telehealth applications. Developing a connection between digital signage and wearable health devices is another innovation of the company.

The Diagnostic Medical Systems (DMS) Group (10-16%)

DMS integrates digital signage and diagnostic imaging solutions. The company has adopted content automation led by AI to enable medical professionals to carry out more precise and efficient diagnostics. By offering real-time display solutions to various departments dealing with cardiology, orthopedic, and radiology queries, DMS builds its market share. It collaborates with research institutions to promote improvement in medical diagnostic data visualization.

Hologic Inc. (8-12%)

Hologic, which is famous for digital signage solutions in medical diagnostics and imaging services, applies AI and high-definition displays to advance patient communications as well as medical outreach. Hologic supports its positioning with women on the health through valuable interactive digital displays containing breast cancer awareness programs and education about diagnostic imaging. The company invests in strengthening its network of providers in healthcare through digital engagement strategies.

Xiaomi (6-10%)

A smart display with wearable health devices is one way that Xiaomi places its footprint in the health segment of digital signage. Cloud-connected digital displays offer health insights together with real-time health monitoring to create wellness offerings to consumers. By providing cost-efficient digital signage solutions for home-based healthcare and remote patient monitoring, Xiaomi solidifies its stake over telemedicine and fortifies its importance in consumer wellness.

Other Key Players (30-40% Combined)

Alongside, several other companies contribute to the pool of digital signage in healthcare where sectors with medical applications have customized solutions. Companies capitalize on affordability, niche integration, and localized health services. Some of these important companies include:

Out Front Digital Communications

The market consists of DEXA and BIA.

It includes Gyms, Fitness Centers, and Hospitals & Clinics.

It encompasses North America, Latin America, Asia Pacific, Middle East & Africa, and Europe.

The Global Body Fat Measurement industry is forecast to generate USD 769.9 million in sales in 2025.

The Global Body Fat Measurement industry is estimated to develop to USD 1,492.1 million by the end of 2035.

The North American region will account for the highest CAGR from the domination of health awareness and technical developments in body fat analysis fields.

The global key players in the body fat measurement industry include GE Healthcare, OMRON Healthcare Co., Ltd., The Diagnostic Medical Systems (DMS) Group, Hologic Inc., Xiaomi, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End-user, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End-user, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End-user, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End-user, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End-user, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 118: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Armor Market Analysis - Size, Share & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Dryer Market

Body In White Market

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA