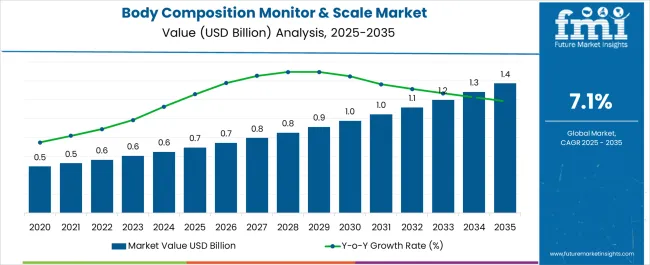

The Body Composition Monitor and Scale Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Body Composition Monitor and Scale Market Estimated Value in (2025 E) | USD 0.7 billion |

| Body Composition Monitor and Scale Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The body composition monitor and scale market is advancing steadily as health awareness, preventive care, and fitness adoption continue to expand across global populations. Growth is being driven by rising prevalence of obesity and lifestyle-related disorders, which has increased the demand for accurate body analysis tools in both professional and personal settings.

Technological improvements in sensors, connectivity, and data integration are enhancing accuracy, reliability, and user experience, making these devices more attractive to a broader customer base. The integration of digital health platforms and mobile applications is further supporting adoption by enabling real-time monitoring and personalized health management.

While premium pricing and limited awareness in developing economies present challenges, market penetration is expected to rise with expanding fitness infrastructure, healthcare investments, and consumer willingness to adopt smart health devices Over the forecast horizon, continuous innovation, growing focus on performance optimization, and the role of body composition monitoring in preventive healthcare strategies will ensure steady revenue growth and broader market acceptance.

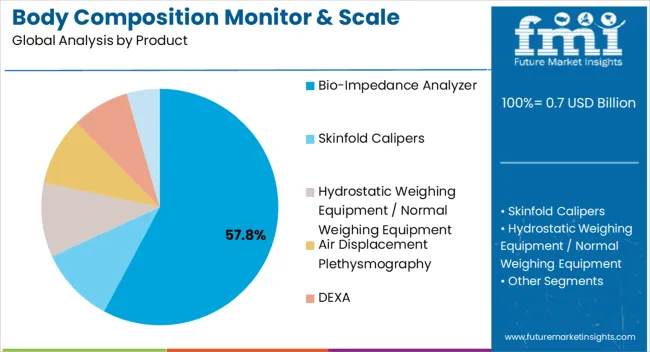

The bio-impedance analyzer segment, accounting for 57.80% of the product category, has remained dominant due to its precision, convenience, and wide applicability across healthcare, fitness, and home-use environments. Its adoption has been driven by advanced electrical impedance technology, which provides reliable measurements of fat, muscle, and water composition.

Enhanced portability, user-friendly interfaces, and integration with mobile health platforms have reinforced consumer and professional preference for this product type. The segment has further benefited from consistent innovation in electrode design and measurement algorithms, improving diagnostic accuracy and reducing variability across diverse user groups.

Commercial fitness facilities, hospitals, and wellness programs have adopted bio-impedance analyzers as a standard, ensuring stable demand Future growth is expected to be supported by rising adoption in home healthcare, increased affordability, and integration with telehealth services, which will continue to strengthen the segment’s market leadership.

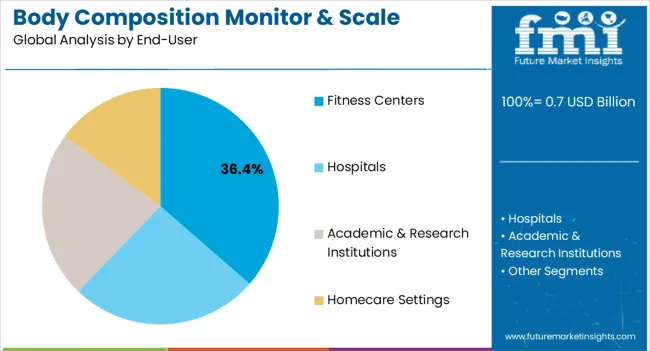

The fitness centers segment, representing 36.40% of the end-user category, has secured a leading position as demand for structured fitness programs and health monitoring services continues to rise. Widespread adoption has been facilitated by the integration of body composition tracking into member assessment routines, enabling gyms and fitness clubs to enhance personalized training programs and client engagement.

This segment has further benefited from growing consumer interest in performance tracking, weight management, and preventive health solutions, particularly among urban populations. Consistent investments in digital infrastructure and connected equipment have supported the effective use of advanced body composition monitors in fitness environments.

The increasing role of data-driven health monitoring in promoting customer loyalty and service differentiation has reinforced the segment’s market share Continued expansion of fitness facilities, coupled with rising memberships in both developed and emerging markets, is expected to support ongoing growth and strengthen the dominance of fitness centers within the overall market landscape.

Body composition analysis is becoming an ideal method for calculating body fat, muscle, and bone mass. For this purpose, devices such as body composition monitors and scales are used. The growing adoption of these devices globally is expected to boost the market.

Analyzing body composition is essential to determining the risks associated with high or low body fat levels. Body composition analyzers offer thorough information for individualized health and fitness consultations. They are set to help calculate the makeup of several body components.

Body mass index (BMI), metabolic rate, and weight percentages from muscle, bone, fat, and water are accurately determined with body composition analyzers. The rising prevalence of diseases such as obesity and overweight is expected to drive demand for fat measurement devices, including body composition monitors and scales.

Other factors influencing market growth include:

Sales of body composition monitors and scales grew at a CAGR of 6.2% between 2020 and 2025. The body composition monitor and scales market contributed a 14.6% share of the orthotics market, which was valued at USD 0.7 billion in 2025. Over the forecast period, the global market for body composition monitors and scales is poised to exhibit a CAGR of 7.4%.

| Historical CAGR (2020 to 2025) | 6.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 7.4% |

Several factors are expected to stimulate the growth of the body composition monitor and scale market. These include an increasing number of obese patients, a rising prevalence of metabolic disorders, and a growing interest in health and fitness.

Obesity is becoming a common metabolic disorder linked to a variety of chronic diseases. Obese individuals are more vulnerable to illnesses, such as cardiovascular issues, gallbladder disease, type 2 diabetes, kidney disease, and certain types of cancer.

According to the World Health Organization (WHO), about 0.6 billion adults 18 and older were overweight in 2024. The rising incidence of these health conditions is expected to drive demand for body composition monitor devices, including fat percentage analyzers.

Fitness enthusiasts and healthcare professionals are placing greater emphasis on using tools such as body composition monitors and scales to counter obesity. This is because these devices can assist in weight management and overall health improvement.

The growing prevalence of musculoskeletal disorders such as arthritis and osteoporosis is also driving the market for body composition equipment. This is because several body composition monitoring products are used globally for monitoring bone density.

For instance, DEXA is used for testing bone density to diagnose osteoporosis and determine the likelihood of developing fractures. As a result, it is anticipated that more hospitals will use DEXA as the incidence of osteoporosis rises.

A positive growth trajectory has been predicted for the global body composition monitor and scale market. This is attributable to the technological advancements in body composition monitors and scales, the growing incidence of chronic diseases, and rising health awareness.

Key companies are incorporating more features in their devices as a result of technical improvements and inventions. Most body composition gadgets today have Bluetooth or Wi-Fi connectivity, allowing users to upload output data to the cloud or to their smartphones.

Growing awareness among people and an increasing number of fitness clubs are anticipated to foster the growth of the body composition monitor & scale market. Similarly, increasing government initiatives will likely play a key role in driving demand for body composition monitors and scales.

Governments are launching several initiatives to give citizens easy access to advanced healthcare. For instance, the National Health Mission (NHM) supports state governments' initiatives to provide equitable, easily accessible, and reasonably priced healthcare services to all citizens on a technical as well as financial level.

Body composition monitors and scales play an important role in terms of measurement of body composition. However, the high cost is becoming an obstacle to the growth of body composition monitor & scale market.

Body composition analyzers cost more because of their sophisticated features and functionality. In addition, due to their tight budgets, academic research laboratories find it challenging to afford these systems.

A handful of accuracy-related problems and limited use can also hinder growth. For example, body fat scales are unable to detect the body fats around the waistline, which is a risk factor for CVD and type 2 diseases. The result of the skinfold caliper can vary according to the expertise of the person who is taking the measurement.

The table below shows the anticipated growth rates of the top countries. China and India are set to record higher CAGRs of 9.2% and 11.2%, respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

| India | 11.2% |

| China | 9.5% |

| United Kingdom | 5.8% |

| Germany | 4.7% |

The United States is anticipated to lead the global body composition monitor and scale market during the forecast period. It held a total market share of about 14.5% in the global market in 2025.

Over the forecast period, the United States body composition monitor and scale market is set to register a CAGR of 4.3% through 2035. This is attributable to the rising prevalence of chronic diseases such as osteoporosis, the growing adoption of advanced medical technologies, and an increasing number of fitness enthusiasts.

According to the data published by the osteoporosis workgroup in 2024, 0.6 million people in America aged 50 and older suffer from osteoporosis. Technologies such as body composition monitors and scales are used to tackle this burden. These devices provide an estimate of bone density, which is necessary for assessing bone health and detecting diseases such as osteoporosis.

The growing interest in preventive healthcare is another key factor expected to drive demand for advanced body composition monitoring solutions. Similarly, increasing the influence of social media and fitness trends will improve the United States' body composition and monitor market share.

With a valuation of USD 1.4 million, China accounted for a share of about 9.8% in the global body composition monitor and scale market in 2035. Over the assessment period, sales of body composition monitors and scales are predicted to rise at a 9.5% CAGR.

Rising cases of obesity in China are expected to drive the demand for body composition equipment. According to the study published in the journal Circulation, China overtook the United States as the country with the most obese people.

In China, more than one in seven people and one in three people fulfill the threshold for abdominal obesity. Due to the increased diagnosis-related body mass index in the country, the market for body composition monitors and scales shows lucrative growth.

India is expected to emerge as the most lucrative market for body composition monitors and scales. This is attributable to the growing awareness about health and fitness, favorable government support, and increasing prevalence of chronic diseases, and the high popularity of portable health monitoring systems.

In 2025, India’s body composition monitor and scale market value totaled USD 44.0 million, holding a market share value of about 7.3% globally. Over the forecast period, demand for body composition monitors and scales in India is predicted to rise at an 11.2% CAGR.

The rising public consciousness regarding health and the implementation of several government initiatives are expected to contribute to the expansion of the market in India. People in India are becoming aware of the importance of maintaining a healthy body composition, thereby driving demand for body composition monitors and scales.

In Delhi and Haryana, government hospitals, along with the Central Council for Research in Yoga and Naturopathy (CCRYN), have established eight yoga outpatient departments, thereby raising health awareness among the population. As a result, the demand for body composition monitor equipment has surged in these yoga centers and health facilities, leading to increased sales of such equipment.

The United Kingdom body composition monitor and scale market size reached USD 0.7 million in 2025. Demand for body composition monitors and scales in the country is set to surge at a 5.8% CAGR throughout the assessment period.

Several factors are expected to uplift body composition monitor and scale demand in the United Kingdom. These include the surging popularity of wearable technology, growing fitness & wellness trends, and rising demand for personalized nutrition.

Body composition monitors and scales allow users to monitor changes in their body composition, thereby aiding in fitness planning and progress tracking. Hence, the growing emphasis on fitness and wellness in the United Kingdom will likely create demand for tools such as body composition and scales.

Sales of body composition monitors and scales in Japan are anticipated to soar at a CAGR of around 4.7% during the assessment period. In 2025, total valuation in Germany reached USD 22.75 million.

There is a rising trend in Germany toward preventive healthcare. This is expected to drive sales of body composition monitoring devices as they can provide valuable insights into an individual’s risk for several health conditions.

Ongoing technological advancements in body composition monitoring devices will further improve Germany's body composition monitor and scale industry share. Key companies across Germany are utilizing technologies such as dual-energy X-ray absorptiometry and bioelectrical impedance analysis to develop more sophisticated and accurate body composition monitors and scales.

The below section shows the bio-impedance analyzer segment dominating the body composition monitor and scale market. It is set to rise at a CAGR of 7.2% during the forecast period.

Based on end-users, the hospital segment is expected to hold a prominent market share. It will likely thrive at a CAGR of 6.7% between 2025 and 2035.

Market Growth Outlook by Product

| Product | Value CAGR |

|---|---|

| Bio-impedance Analyzer | 7.2% |

| Skinfold Callipers | 5.7% |

| Hydrostatic Weighing Equipment | 8.9% |

| Air Displacement Plethysmography | 7.7% |

| DEXA | 7.6% |

| Others | 6.3% |

The bio-impedance analyzer segment accounted for a prominent market share of 25.4% in 2025 and is expected to expand with a CAGR of 7.2% during the forecast period. This is due to several advantages of bio-impedance analyzers, including cost-effectiveness and non-invasive nature.

Bio-impedance analyzers are non-invasive, as they do not require needles, blood samples, or any invasive procedures. This non-invasive feature attracts a wide range of users, including individuals who may be uncomfortable with invasive procedures.

The materials used in bioimpedance analysis devices, such as medical-grade plastics, ensure user comfort and safety during the measurement process. Bioimpedance analyzers are convenient and can be used in a variety of settings, such as fitness centers, clinics, and hospitals.

Growing usage of bioimpedance analyzers in-home devices such as smart scales is expected to further boost the target segment. To gain maximum benefits, key players are expected to upgrade their bioimpedance analyzers portfolio by launching novel solutions.

Market Growth Outlook by End-user

| End User | Value CAGR |

|---|---|

| Hospitals | 6.7% |

| Fitness Centers | 8.6% |

| Academic & Research Institutions | 6.6% |

| Homecare Settings | 8.0% |

As per the latest body composition monitor and scale market analysis, the hospital segment will retain its market dominance through 2035. It accounted for a revenue share of 36.4% in 2025 and is expected to surge with a CAGR of 6.7% during the forecasted period.

The rising number of hospitals globally is expected to drive demand for body composition monitors and scales. Similarly, the increasing preference of patients toward opting for treatments and diagnostic procedures in hospitals will boost the target segment.

Governments worldwide are investing huge amounts in upgrading medical technologies in hospitals. This will create lucrative growth prospects for body composition monitor and scale manufacturers during the assessment period.

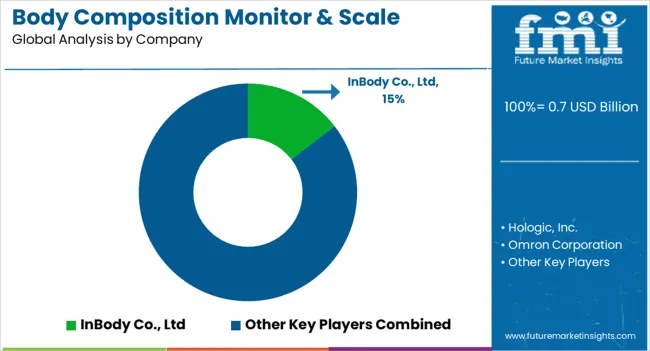

Key manufacturers of body composition monitors and scales are introducing novel solutions and apps to meet consumer demand and boost their revenue. They are also implementing strategies such as collaborations, partnerships, alliances, mergers, and acquisitions to expand their global footprint.

Recent Developments in the Body Composition Monitor & Scale Market:

The global body composition monitor and scale market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the body composition monitor and scale market is projected to reach USD 1.4 billion by 2035.

The body composition monitor and scale market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in body composition monitor and scale market are bio-impedance analyzer, skinfold calipers, hydrostatic weighing equipment / normal weighing equipment, air displacement plethysmography, dexa and others.

In terms of end-user, fitness centers segment to command 36.4% share in the body composition monitor and scale market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Body Armor Market Analysis - Size, Share & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Dryer Market

Body In White Market

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA