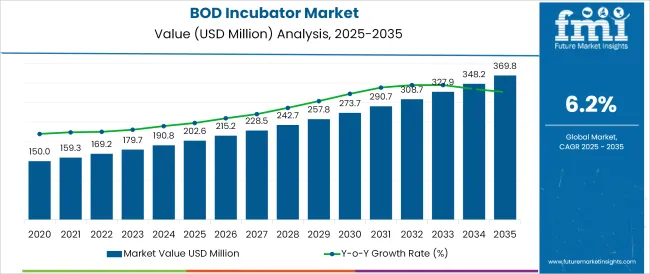

The BOD Incubator Market is estimated to be valued at USD 202.6 million in 2025 and is projected to reach USD 369.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The BOD incubator market is witnessing steady growth as precision, compliance, and innovation become central to laboratory infrastructure. Rising emphasis on accurate microbial testing, coupled with the expansion of pharmaceutical, biotechnology, and environmental testing industries, has propelled demand for reliable incubation solutions.

Increased regulatory scrutiny around quality control processes in research and production environments has encouraged laboratories to adopt advanced incubators offering consistency and efficiency. Innovations in temperature uniformity, energy efficiency, and user friendly interfaces are improving operational productivity and reliability, which in turn is driving market expansion.

Future growth is anticipated to be supported by investments in life sciences research, environmental monitoring initiatives, and modernization of testing facilities, all contributing to broader adoption of technologically advanced incubation systems.

The market is segmented by Number of Trays, Operation Type, Volume, End-user, and Sales Channel and region. By Number of Trays, the market is divided into 4, 2, 3, 5, 6, 7, 9, and 11. In terms of Operation Type, the market is classified into Digital and Manually. Based on Volume, the market is segmented into 100-500 liter, 50-100 liter, 500-1000 liter, and 1000 Above liter.

By End-user, the market is divided into Research and Development labs, Educational Institute, Hospitals, and Food and Beverage. By Sales Channel, the market is segmented into Modern Trade, Franchised Outlets, and Online Channel.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

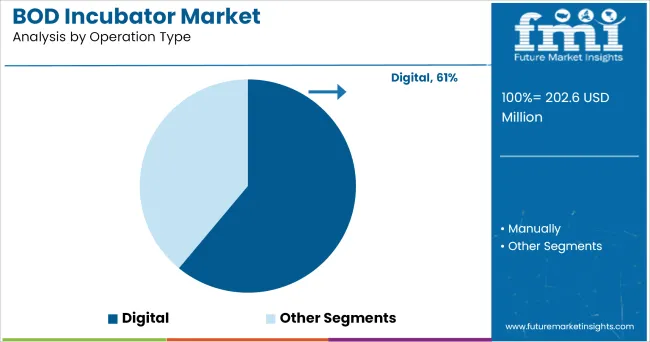

When segmented by operation type, the digital segment is expected to hold 61.0% of the total market revenue in 2025, establishing itself as the leading operational choice. This dominance has been shaped by laboratories’ preference for precision and ease of monitoring, which digital systems have successfully delivered.

Enhanced accuracy of temperature and timing controls in digital incubators has addressed the growing need for reproducibility in testing environments, especially under stringent quality standards. Digital models have also improved data logging and compliance readiness, enabling operators to meet audit requirements efficiently.

The intuitive interfaces and programmable features of digital incubators have reduced operational errors and labor intensity, fostering greater confidence in experimental outcomes. This combination of operational efficiency, regulatory alignment, and user friendliness has reinforced the segment’s position as the preferred choice among modern laboratories.

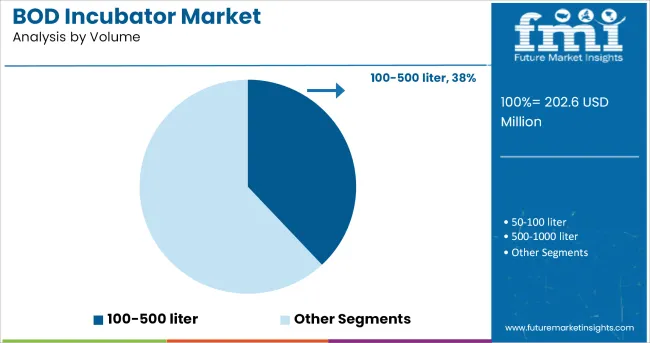

Segmenting by volume shows that the 100-500 liter category is projected to account for 38.0% of the market revenue in 2025, making it the leading volume segment. This leadership has been underpinned by its optimal balance between capacity and space utilization, meeting the needs of both mid-sized and larger laboratories.

The 100-500 liter range has been particularly favored in environments where batch testing of samples is common, yet floor space remains a constraint. This segment has effectively catered to diverse applications, providing sufficient room for multiple shelves and trays without imposing excessive energy consumption or maintenance overheads.

Flexibility in accommodating various experimental setups and its compatibility with modular laboratory designs have further strengthened its position as the most widely adopted size range in the market.

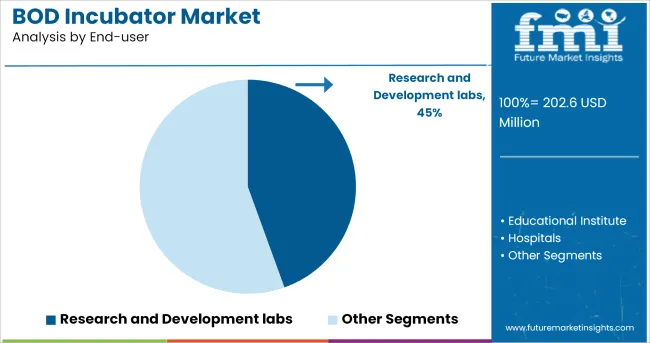

When segmented by end-user, research and development (R&D) laboratories are expected to hold 44.5% of the total market revenue in 2025, ranking as the leading user category. This predominance has been driven by the critical role of incubation in experimental workflows within pharmaceutical, biotechnology, and environmental research settings.

R&D labs have demonstrated higher adoption of advanced incubators to ensure precision and compliance with evolving scientific and regulatory standards. The need to maintain controlled environments for microbial growth, stability testing, and quality assessment has made BOD incubators indispensable in these settings.

Additionally, the competitive nature of research enterprises has incentivized investment in reliable, efficient, and easy to monitor equipment, further solidifying R&D laboratories as the primary driver of demand in the market.

BOD Incubators are the biological oxygen incubators used for the growth of culture in any scientific lab or research lab. The inflation in the demands of products is seen due to a heightening case of microbial infection among humans.

The medicinal industry has witnessed a noteworthy investment in the past few decades for the development of economic and fast replicating organisms to develop medicines. Howbeit, the high cost of the device which is larger than maintenance cost and acquisition cost has led to an overall increase in device cost and ownership.

The diversified application of incubators for preserving the vaccine, for life cycle testing, refrigeration and storage of microorganisms has increased its deployment in hospitals and research centres.

The advancement of technology in the healthcare industry is expected to become a significant market growth factor. Increased consumer discretionary income, cost benefits, and an ageing population base are all anticipated to bode well for the global healthcare equipment industry in the near future.

Expected growth in end-use sectors would undoubtedly boost demand, resulting in rapid penetration. The market is expected to open up significant potential opportunities as a result of the aforementioned considerations.

The prominent region included in the report is North America, Latin America, Europe, East Asia, South Asia and MEA. North America is the leading region in the field of healthcare and research spending.

The USA is the highest spending on healthcare per person, making it the world leader. The health consumption expenditure per capita, in the USA in 2020 was USD 10,966. The USA is holding approximately more than 65% of the market share in North America.

Following North America is Europe and East Asia. Switzerland in Europe is having USD 7,732 for health consumption expenditures per capita. Another reason for the rising demand in the region is the growing old age population which are prone to various diseases.

South Asia and Latin America are expected to gain market share due to the rise in government spending and growing biotech industries in the region.

Whereas the Middle East and Africa show stringent growth due to more adoption of other industries in the region.

USA and Germany are considered smart economies having huge investments in constructing new medicines. According to the National Science Foundation USD 51 billon is being spent on the R&D sector in the USA The same trend has been noticed in Germany according to the Federal Statistical Office USD 150 Million was been spent in the 2020 R&D sector of Germany.

This is due to an increase in chronic diseases in this region, such as asthma, high blood pressure, diabetes, and others. However, due to an increase in disposable income and increased public knowledge of new medicines, these nations are expected to grow at the quickest rate during the projection period.

According to the National Diabetes Statistics Report 2024, 190.8 million people in the USA of all age groups have diabetes. This has increased the demand for insulin which can be easily obtained from the bacteria which are being cultivated in the labs.

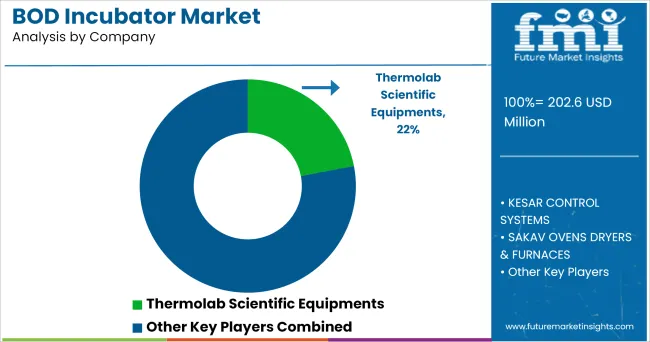

The key players in the market are

The market is estimated to be top consolidated and bottom fragmented only too few prominent players in the market. The players are opting for organic and inorganic growth strategies such as acquisition, merger, product launch and regional expansion.

However, the regional player in the industry will be facing huge competition from the leading players due to the amalgamation of new technologies for the enhancement of the product.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global bod incubator market is estimated to be valued at USD 202.6 million in 2025.

The market size for the bod incubator market is projected to reach USD 369.8 million by 2035.

The bod incubator market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in bod incubator market are 4, 2, 3, 5, 6, 7, 9 and 11.

In terms of operation type, digital segment to command 61.0% share in the bod incubator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA