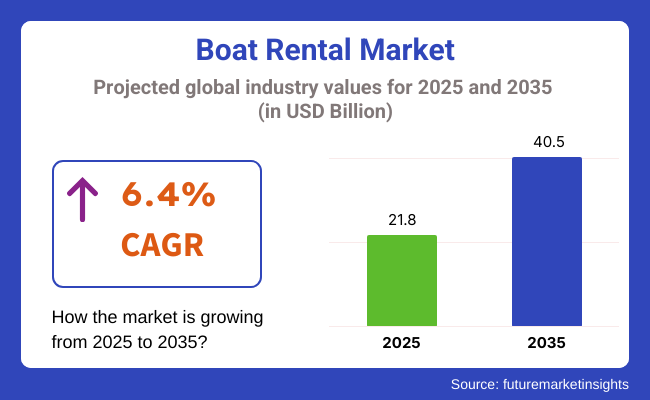

The boat rental market size is estimated to be USD 21.8 billion in 2025 and is expected to grow at a 6.4% CAGR from 2025 to 2035. The global market for boat rentals is expected to reach USD 40.5 billion by 2035.

A major key driver of this growth is the increasing consumer preference for experiential and recreational travel, especially among younger demographics seeking personalized, flexible maritime leisure. Shifting travel behaviors and rising disposable incomes are encouraging travelers to explore short-term, water-based recreational experiences without the financial burden of boat ownership.

The increasing popularity of peer-to-peer boat-sharing platforms and mobile booking apps is improving accessibility and transparency, fostering consumer confidence and enabling hassle-free rentals globally.

Technological integration is redefining the user journey, with operators offering real-time boat availability, route planning tools, and AI-powered safety analytics. Enhanced user interfaces and mobile compatibility are simplifying the booking process and broadening participation among tech-savvy customers.

Furthermore, the incorporation of electric and hybrid propulsion systems into rental fleets supports both sustainability goals and evolving environmental regulations. Coastal tourism hubs in Europe, North America, and Southeast Asia continue to drive a large portion of the industry, supported by favorable marine infrastructure, tourism policies, and operator incentives.

However, emerging regions in Latin America and the Middle East are also showing positive trends, driven by strategic investment in marina development and the expansion of local tourism ecosystems.

Diversity is boosting, with offerings ranging from luxury yacht rentals to small motorboats, sailboats, and personal watercraft. This segmentation enables providers to cater to distinct customer groups from casual tourists to premium clientele. As customer expectations evolve, rental services that combine luxury, convenience, and environmental awareness are set to lead innovation through 2035.

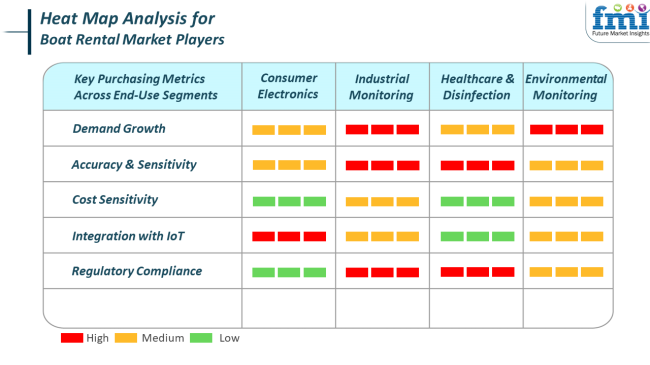

The increasing adoption of digital interfaces in rental operations is having a substantial impact on consumer electronics engagement in the industry. GPS-based fleet tracking to remote monitoring systems, consumers and operators require smooth technology integration, which promotes safety, simplicity of navigation and user autonomy.

Such technologically advanced features also increase real-time data collection and user feedback loops. Industrial monitoring crosses over into the rental industry in fleet maintenance, vessel performance analysis, and predictive servicing models.

High sensitivity and accuracy in monitoring boat engine health, as well as maritime compliance, are critical to maintaining operational continuity and customer safety, particularly in commercial-scale or high-turnover operations.

In the environmental observation sector, utilizing electric or hybrid rental boats supports reducing emissions and bringing services in line with conservation policies. The operators of rental vessels are becoming increasingly subject to meeting eco-laws, which has led to cleaner onboard waste management and propulsion technologies. Such environmental demand is now being influential as the key selection parameter for regulators as well as environment-minded travelers.

The industry is vulnerable to certain operational and environmental risks that may impact its long-term scalability. One of the main concerns is whether dependence and seasonality in demand volatility will hinder the generation of uneven income streams for operators beyond tropical markets. Volatility poses a significant risk to guaranteeing fleet profitability and staffing levels during the year-round period.

Regulatory complexity is broad, and it also poses a risk, particularly on the coastline and cross-border areas where maritime compliance, insurance, and licensing are extremely diversified. Non-compliance with local and global standards of safety could lead to fines, vessel seizure, or suits alienating customer trust and brand equity.

Another key threat is the over-reliance on peer-to-peer models and web platforms with poor operator screening or safety testing. Inconsistent service quality or inadequate preparedness for emergencies can hamper business and restrict further adoption.

Between 2020 and 2024, there was progress in the industry as there were more individuals interested in recreational boating. Peer-to-peer boat rental websites and web-based booking websites made boat rentals easier and more appealing to more consumers. Coastal tourism and river exploration became fashionable, with buyers demanding novel experiences but not the long-term burden of ownership.

Trends were seen towards environmentally friendly practices, with operators increasingly providing options for ecologically sound approaches to meet ecological issues. During the forecast period, the evolution is expected toward integration through technology and customized customer experience.

Advances in artificial intelligence technology and data science will enable highly personalized products and, hence, greater satisfaction for customers. Hybrid and electric boat penetration will rise with global standards of sustainability. Maritime tourism expansion in developing economies will open new avenues.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased popularity of recreational boating and peer-to-peer leasing. | Rise of technology and individualized customer experiences. |

| Digital booking sites have become available. | Use of AI and data analytics for the provision of individualized services. |

| Incorporation of green rental alternatives. | Increased adoption of electric and hybrid boats. |

| Development of inland and coastal tourism and growth in mature markets. | Economic growth and development in new markets and increased sophistication in mature markets. |

| Increased demand for flexible, no-commitment boating experiences. | Increased need for personalized, high-value services and sustainable solutions. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.6% |

| Germany | 5.2% |

| Italy | 5.4% |

| South Korea | 4.7% |

| Japan | 4.9% |

| China | 6.4% |

| Australia-NZ | 5.8% |

The USA will expand at 6.8% CAGR during the forecast period. The country's affluent boating culture, vast coastlines, and growing interest in eco-tourism significantly drive growth. A huge number of domestic and international tourists indulge in high-end water leisure activities, driving demand for motorboats, yachts, and sailboats for day and hourly charters.

In addition, the growing popularity of peer-to-peer boat rental websites is transforming access and affordability, particularly in coastal metros and vacation spots such as Florida, California, and New England. Government policies that promote marine tourism and investment in marina and coastal facilities also encourage sales growth.

Increased disposable incomes and an ethnicity towards water and outdoor recreation have improved boat rental activities. Furthermore, the USA has witnessed an increase in eco-conscious consumers choosing electric or hybrid boat rentals, and companies are reacting by adding fleets with green options.

The maturity of the USA offers opportunities and competitive challenges where differentiation of services, online booking systems, and flexible pricing models are growth drivers. With deep digital penetration and consumer confidence in shared economy platforms, the USA is poised to be a key leader in the boat rental industry worldwide.

The UK is expected to grow at 5.9% CAGR over the forecast period. The country has a rich maritime heritage and emerging demand for boat rentals in coastal and inland waters. Large regions such as the Lake District, Norfolk Broads, and the South Coast are increasingly sought after by tourists and locals alike for water-based leisure activities.

This recurring demand for short-term and self-skippered rentals is driving sales, especially from younger generations who enjoy flexible, experience-based travel. The growing number of boat rental platforms with customized packages has boosted customer convenience and accessibility.

Sectors such as investments in new marinas and extended navigational amenities also play an important part in shaping the way forward. Whilst traditional sailboat and narrowboat rental remains in demand, there is increasing pressure towards more commodious and 'green' substitutes, in step with broader eco-tourism trends.

Regulatory conditions offer a guarantee of safety levels and are conducive to consumer confidence, underpinning the prognosis for growth. In London and Bristol, river cruises and charter trade are experiencing higher levels of demand.

France will expand at a 5.6% CAGR during the research period. France, with extensive coastlines along the Atlantic Ocean and the Mediterranean Sea, is a major destination for individuals who enjoy boating. Primary coastal regions such as Côte d'Azur and Brittany attract both domestic and international travelers seeking world-class boating experiences. Inland waterways with sections of the Canal du Midi also possess a strong industry for houseboats and canal boat rentals, bringing geographical diversity.

France is supplemented by a well-developed marine tourist industry, complemented by harbors and marina centers of the highest standard. Improved digital platforms with multilingual booking and online availability have widened the access. Collaboration between local tourism boards and rental companies also promotes boating as a major recreational activity.

Demand from consumers is spilling over from peak-season months, made possible by elastic price strategies, off-season promotions, and eco-friendly boat choices. France's regulatory framework also promotes the use of sustainable watercraft, positioning the market for long-term stability. With tourism trends moving towards experiential travel, France is a European powerhouse for boat hire, with a combination of cultural appeal, natural beauty, and service innovation.

Germany is expected to grow at 5.2% CAGR during the research period. More famous for its inland water systems than for access to the sea, Germany enjoys a robust set of lakes and rivers to sustain an active boat hiring industry. The attractions of destinations such as Mecklenburg Lake District and Rhine River have been steadily rising, especially for internal tourists in search of recreational activities within easy reach. Rental options vary from sailboats and motorboats to houseboats to suit all abilities and duration of stay.

A culture of meticulous safety and control underpins consumer trust, and the growing demand for wellness and nature breaks perfectly complements boating as a low-impact immersion holiday experience. The industry's digital revolution has facilitated online booking, real-time pricing, and simple mobile apps.

Sustainability trends are also impacting fleet compositions, with solar and electric boats gaining popularity. Urban regions like Berlin have seen increasing demand for boat rental on city rivers and canals, merging leisure with urban tourism. Germany's growth rate is moderate compared to that of coastal nations, but its organized and diversified inland water product is a strong point it has in the European market.

Italy is expected to grow at a CAGR of 5.4% during the forecast period. With an extensive Mediterranean shoreline and numerous iconic tourist destinations such as the Amalfi Coast, Sicily, and Sardinia, Italy offers a thriving setting for the boat hire industry.

The country's tourism-led economy, supplemented by heavy overseas tourism, contributes to robust seasonally driven demand for luxury yacht charters, sailboats, and day cruises. Boating is deeply engraved into Italian coast culture, and the combination of scenic seascapes and maritime heritage acts as a growth factor.

Growth is also facilitated by growing infrastructure in marinas and harbors, especially in desirable locations. Peer-to-peer rental websites and tour operators offer diverse options, appealing to tourists seeking short excursions and longer cruising holidays. Italy's attraction for high-end tourists and honeymooners fuels the premium segment, but value-driven options for group rentals are also gaining momentum.

Also, favorable climatic factors during extended seasons allow for an extended season of boat renting compared to other countries in Europe. An increased demand for computerized reservations, crewed operations, and green initiatives characterizes the market growth. Italy continues to be a strategically located country in the Mediterranean boat rental industry.

South Korea is anticipated to grow at 4.7% CAGR during the period of study. The industry in South Korea is accelerating ahead with increased domestic demand for sea-based recreational activities and growing government support. Busan and Incheon cities and Jeju Island are emerging as hotspots for yacht and boat renting operations. Increasing prosperity, changing trends in recreational activities, and augmented exposure to global sea-based tourism are key growth drivers.

Infrastructure expansion in the form of marina developments and new recreation sites is offering a basis for more extensive adoption of boat hire. Furthermore, local authorities are encouraging public-private partnerships to make water-based tourism more prominent and appealing.

Younger consumers look for rented boats to gain experience. Bookings are made easy through mobile applications and websites. In spite of the complexity of regulations and education concerning market demand patterns, the targeted investment reflects the direction of steady growth. The rental business will be motivated by sustainability and digitalization, with South Korea set to take charge of the Asia-Pacific marketplace.

Japan shall grow during the study period with a CAGR of 4.9%. Japan has an extensive coastline and culture, which are rich with waterways. Although traditionally focused on fishing and commercial maritime activities, the recreational boating trend is gradually gaining popularity. Cities like Tokyo and Yokohama and coastal regions in Hokkaido and Okinawa are seeing growing interest in chartered boat excursions.

Japan's elderly population, combined with increasing overseas tourism, presents a unique mix of opportunities for domestic and inbound-sourced boat rental. Technological innovation is also playing a significant role, with web portals for reservation and navigation software improving the customer experience.

Government initiatives promoting regional recreation and tourism infrastructure are contributing to industrial maturity. Furthermore, cultural interest in tranquility and nature is augmented by the peaceful and stimulating nature of boating. Even though the industry is hampered by the problem of awareness and seasonal demand limitation, prospects are optimistic due to planned expansion and consumer growing receptivity towards water sports.

China is expected to evolve at a CAGR of 6.4% over the study period. With one of the world's fastest-growing consumer leisure markets, China is experiencing a surge in demand for unique travel experiences. Coastal provinces such as Guangdong, Hainan, and Zhejiang are leading the charge, with heavy investments in marinas and nautical tourism facilities. The growing upper-middle-class population and increasing urban affluence are driving aspirations for luxury travel and customized experiences, offering fertile ground for the rental services of boats.

Digitalization and expansion in online lifestyle platforms have made boat rental services more available to digitally literate consumers. Besides that, supportive government policies to boost domestic tourism, particularly post-pandemic, are facilitating regional tourism development, including sea-based activities.

Ultra-high-net-worth individuals are keen on yacht charters and high-end boat experiences, while peer-sharing models are expanding their reach to broader consumer bases. Environmental sustainability, which is increasingly on the minds of Chinese consumers, is encouraging operators to invest in cleaner technologies and new service formats. With its huge population base and rising leisure spending, China is one of the most promising regions for boat rentals over the next decade.

The Australia-New Zealand market is expected to grow at 5.8% CAGR during the study period. Australia has stunning coastlines, high marine biodiversity, and a robust adventure tourism culture. Australia's Great Barrier Reef, Sydney Harbour, and New Zealand's Bay of Islands are globally recognized spots for boating, drawing significant international and domestic demand for charter boats, yachts, and eco-tourism cruises. Both countries have high-quality marina facilities and policy-supportive environments for marine recreation.

Seasonal stability, particularly in northern Australia and the majority of New Zealand, maximizes a long boating season, making the most of rental revenue opportunities. Innovation in digital platforms is making it easier for consumers to browse, book, and manage rental activity.

Sustainability is becoming a uniting theme, with increased consumer demand for low-emitting boats and eco-certified marinas. The sector is also responding with fleet renewal and alliances that align with green tourism goals. With a tradition of outdoor discovery stretching back generations and a growing proportion of experience-based tourists, Australia and New Zealand are in an excellent position to maintain a substantial proportion of the industry.

Outboard boats account for an expected revenue share in 2025 of 35%, with inboard boats trailing by a slight margin at 30% percent. The 35% balance is typically shared among other types, such as stern drive or jet boats.

It is expected that outboard boats will dominate the industry because such ships can easily be used in various types of water conditions. Outboard motors are also fuel-efficient and maneuverable, thus ideal for activities such as fishing, water sports, and coastal cruising.

Companies like Yamaha and Mercury Marine prove to be some leading players producing outboard boats. They provide boat rental services and marine tourism for ever-increasing numbers of boat enthusiasts and recreational users. Outboard boats are often hired in coastal areas and lakes since they can run in very shallow as well as deeper waters.

Inboard boats have engines located within the hulls, which provides better balance and power for larger vessels. Because of this feature, these boats are usually preferred for trips and tend to be a choice for those who want to ride smoother and faster.

Inboard boats are used more in yacht rentals, and they are given to clients who are looking for valuable experiences such as private cruising and corporate events. For example, Sea Ray and Bayliner are companies that are in the inboard motor manufacturing business and supply luxury rentals for high-end consumers.

Engine-powered boats are expected to account for about 55% of the share. Man-powered boats hold around 20%. The remaining market share usually cuts across other boat types and propulsion methods, such as sailboats or hybrid-powered boats.

Engine-powered boats have taken the lion's share of the market simply because of their convenience in accommodating an extensive range of activities with regard to boating, from casual boating to professional water sports. Most boat users rent them for recreational activities like fishing, cruising, and water skiing. Speed, reliability, and wider operation range are offered by engine-equipped boats, making them ideal both for leisure, even day trips, and for more intensive activities on the water.

Major engine manufacturers, such as Yamaha, Mercury Marine, and Honda, are key players in making engine-powered boats popular, given that the most reliable outboard and inboard motors are commonly found in rental fleets globally. Engine-powered boats also provide opportunities for commercial boating services, such as sightseeing and private charters, where features like convenience and speed become more meaningful.

It is projected that man-powered boats, including kayaks, canoes, and rowboats, will hold 20% of the market share. Rentals usually hire man-paddlers for fun activities, mainly calm water activities such as kayaking, paddle boarding, and canoeing.

The concept behind man-powered boats is love for the environment, cheap methods, and physically engaging the user. Old Town Canoes & Kayaks and Pelican International are manufacturers of man-powered boats, rent them to lots of outdoor recreation companies, and will make that possible. Well-suited to adventurers and nature lovers in search of an experience up close and personal with their environment.

The Boat Rental Market has become an amalgamation of the digital platform ecosystem and legacy yacht manufacturers that offer direct-to-consumer services. The app-based sector is dominated by Boat setter, GETMYBOAT Inc., and Sailo on the real-time booking app, extended along with its peer-to-peer model and localized fleet.

An AI trip planner card was then incorporated by Boat setter in all its glory in 2024 by mixing weather patterns with availability as well as crew recommendations. In contrast, GETMYBOAT adapted the mobile app for instant booking in luxury categories.

Globe sailor and Nautal's expansion continues throughout Europe with marina management systems and new Mediterranean locations. In early 2025, Globe sailor expanded its curated fleet across the Med in Croatia as well as Turkey, while Nautal ramped up its B2B booking pursuits even further through travel agency partnerships.

Traditional players are cementing their positions with branded charter divisions. Groupe Beneteau is enhancing digital bookings via the Band of Boats platform. At the same time, Brunswick has created value through acquisitions of regional charter companies, expanding its service offering across the USA and the Caribbean.

Rapidly emerging platforms like Zizooboats, Boatjump, and Blue Boat Yacht Entertainment are now making their offerings more competitive with multilingual platforms, VR yacht tours, and flexibility for short-term rentals. Such strategies as digitalization and user personalization are reshaping the entire boating experience.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Boatsetter | 16-20% |

| GETMYBOAT Inc. | 14-18% |

| Globesailor | 11-15% |

| Nautal | 9-12% |

| Groupe Beneteau | 7-10% |

| Other Players | 25-30% |

| Company Name | Offerings & Activities |

|---|---|

| Boatsetter | Launched AI-driven trip planner; expanded peer-to-peer boating in new coastal cities. |

| GETMYBOAT Inc. | Improved instant booking and multilingual support; expanded into Southeast Asia. |

| Globesailor | Focused on curated charter experiences in Europe and marina tech integrations. |

| Nautal | Launched B2B services and strengthened Mediterranean offerings. |

| Groupe Beneteau | Scaled its Band of Boats platform and added proprietary fleet chartering services. |

Key Company Insights

Boat setter (16-20%)

Leading North American player leveraging AI tools, insurance integration, and flexible peer-to-peer rentals to drive customer retention and coastal expansion.

GETMYBOAT Inc. (14-18%)

Strong in global coverage with mobile-first experience and diversified fleet categories; recently expanded into premium and electric boats.

Globe sailor (11-15%)

Highly active in Europe with curated itineraries, real-time availability, and strategic partnerships with European marinas and tourism boards.

Nautal (9-12%)

B2B focus and extensive local partnerships make Nautal a go-to for travel agencies, expanding digital bookings across Spain, Greece, and France.

GroupeBeneteau (7-10%)

Blends manufacturing with rentals via owned fleet platforms; a key player in integrating traditional marine operations into the rental economy.

Other Key Players

The segmentation is into Inboard Boats, Outboard Boats, Sail Boats, and Others.

The segmentation is into Less than 30 ft, Between 30 and 79 ft, and Greater than 79 ft.

The segmentation is into Engine Powered, Man Powered, and Sail Propelled.

The segmentation is into Sailing and Leisure, Fishing, and Others.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 4: Global Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 5: Global Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 6: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 8: North America Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 9: North America Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 10: North America Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 14: Latin America Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 15: Latin America Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 16: Western Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 19: Western Europe Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 20: Western Europe Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 31: East Asia Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 34: East Asia Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 35: East Asia Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Billion) Forecast by Boat Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Billion) Forecast by Boat Size, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Billion) Forecast by Power, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Billion) Forecast by Activity, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by Power, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 12: Global Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 15: Global Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 18: Global Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 21: Global Market Attractiveness by Boat Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Boat Size, 2023 to 2033

Figure 23: Global Market Attractiveness by Power, 2023 to 2033

Figure 24: Global Market Attractiveness by Activity, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 27: North America Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 28: North America Market Value (US$ Billion) by Power, 2023 to 2033

Figure 29: North America Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 30: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 37: North America Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 40: North America Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 43: North America Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 46: North America Market Attractiveness by Boat Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Boat Size, 2023 to 2033

Figure 48: North America Market Attractiveness by Power, 2023 to 2033

Figure 49: North America Market Attractiveness by Activity, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 53: Latin America Market Value (US$ Billion) by Power, 2023 to 2033

Figure 54: Latin America Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 55: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 68: Latin America Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Boat Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Boat Size, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Power, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Activity, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Billion) by Power, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Boat Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Boat Size, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Power, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Activity, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Billion) by Power, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Boat Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Boat Size, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Power, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Activity, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Billion) by Power, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Boat Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Boat Size, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Power, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Activity, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 153: East Asia Market Value (US$ Billion) by Power, 2023 to 2033

Figure 154: East Asia Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 155: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 165: East Asia Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 168: East Asia Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Boat Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Boat Size, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Power, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Activity, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Billion) by Boat Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Billion) by Boat Size, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Billion) by Power, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Billion) by Activity, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Billion) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Billion) Analysis by Boat Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Boat Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Boat Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Billion) Analysis by Boat Size, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Boat Size, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Boat Size, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Billion) Analysis by Power, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Power, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Billion) Analysis by Activity, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Activity, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Activity, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Boat Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Boat Size, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Power, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Activity, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The industry valuation is estimated to reach USD 21.8 billion by 2025.

By 2035, the industry size is expected to grow to USD 40.5 billion, fueled by increasing interest in recreational boating, tourism, and shared economy models.

The USA is projected to grow at a rate of 6.8%, driven by a high demand for leisure boating and well-established marine infrastructure.

Outboard boats are leading the segment due to their flexibility, affordability, and popularity for both personal and commercial use.

Major companies in the industry include Globe sailor, Sailo, Boat setter, Incrediblue, Nautal, Blue Boat Yacht Entertainment Company, Groupe Beneteau, GETMYBOAT Inc., Zizooboats GmbH, Boatjump, and Brunswick Group.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA