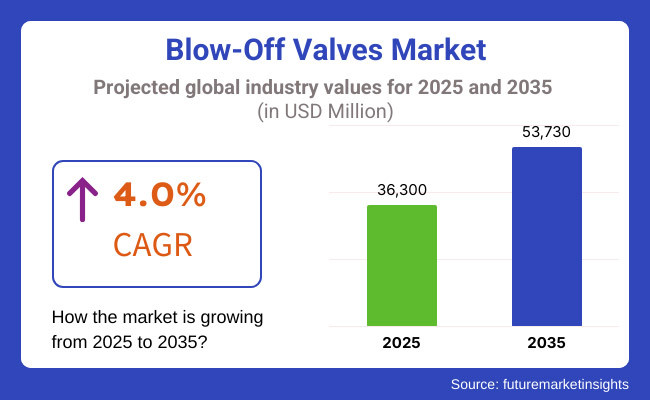

The market for blow-off valves will progress continuously from 2025 through to 2035, bolstered by demand expansion in auto performance improvement, efficiency in turbocharged engines, and industrial processes. The market should be worth USD 36,300 million by 2025 and will rise to USD 53,730 million by 2035 at a compound annual growth rate (CAGR) of 4.0% during the forecasting period.

This simple component enhances the efficiency of the turbocharger, minimizes compressor surge, and optimizes the performance of the engine. An increase in the demand for sports cars, high-performance vehicles, and aftermarket car modifications is driving the growth of the market. Moreover, the rising incorporation of turbocharged engines in passenger and commercial vehicles is also propelling the demand.

Technological breakthroughs such as advanced electronic and hybrid blow-off valves, durable materials advances, and noise reduction innovations are projected to provide new growth grounds. Additionally, the increasing automotive aftermarket industry and the performance tuning industry is leading to the higher adoption of blow-off valves.

Nevertheless, the emergence of ever stricter emission standards, expensive aftermarket performance components, and competition from alternative turbocharger technologies may hinder its technological forwardness. Faced with these barriers, industry players are focusing on cost-effective solutions, strategic partnerships, and expanding product portfolios to overcome them and enhance market reach.

Explore FMI!

Book a free demo

North America has the highest market share for the blow off valves market due to the increasing commercial and passenger vehicles segment and the massive demand for the performance-enhancing components and turbocharged vehicles. While the United States and Canada dominate, major market players concentrate on innovative designs, and durable materials and compatibility to various vehicle models.

The growing aftermarket automotive sector also contributes to market growth, driving vehicle enthusiasts to search for performance upgrades that can enhance engine efficiency and sound quality. Stringent emission regulations further encourage the adoption of advanced turbocharging solutions, supporting blow-off valve market indirectly. However, high installation costs and design complexity could limit widespread adoption.

Brands are running economics on lightweight material, customizable pressure settings, and digital integration to improve product performance and consumer attraction.

Blow-off valves are also in high demand in Europe, especially in countries such as Germany, France, and the United Kingdom, where the automotive segment has a solid history. There will be additional thrust for the market growth as the presence of leading car manufacturers and aftermarket tuning companies aids the economy.

Tough EU emissions laws means more turbocharged motors, creating greater demand for reliable and efficient blow-off valves. In terms of product development, there is increasing influence from the growing market of electric and hybrid vehicles, as well as interest in ground-up solutions that integrate right into hybrid turbocharging systems.

USD 2.5 million per unit, high manufacturing costs and regulatory constraints could be some pain points. To keep pace with the changing industry standards, companies are directed towards use of high-quality components, noise-reducting technologies, and increased durability.

Asia-Pacific represents the fastest-growing region in the blow-off valves market and is expected to witness huge growths due to the rapid growth of the automotive industry along with increasing disposable income of the population and rising inclination of the population toward vehicle modifications specifically in developing countries such as China, Japan, South Korea, and Australia. Market growth is fueled by the increasing demand for high-performance vehicles and aftermarket performance tuning parts.

Increasing production of turbocharged vehicles, which are a government-mandated fuel-efficient and emission-lowering solution, has made blow-off valves a hot commodity. Complementary to this, a burgeoning motoring culture across the region enhances the desire for performance bolstering components.

However, problems like fake products and differing regulations between nations could make market penetration difficult. Carmakers are putting more money toward localized production, key partnerships with automotive manufacturers, and retail product customization to meet the varied needs of consumers.

Challenges

Regulatory Compliance and Emissions Control

One of the significant factors restraining the growth potential of the blow-off valves market is the rising strictness of emissions regulations and noise control standards in different regions. These continuous environmental policies and vehicle effectiveness standards do not come without a cost for manufacturers, resulting in additional production costs, and may leave them in search of lower-risk design elements.

These regulations might result in changes to the valve design as the must comply with emissions and noise limitations, affecting products performance and market adaptation.

Market Competition and Counterfeit Products

Several manufacturers have developed competing products in different price ranges in the blow-off valves market. Moreover, the increasing presence of fake and subpar blow-off valves in the market also poses a challenge for established brands. Their performance is often low-grade, and they may even pose a personal risk to the customer, which can degrade consumer trust in the market.

Opportunities

Growing Demand for Performance and Turbocharged Vehicles

Surging demand for performance-friendly and turbocharged cars businesses is a lucrative opportunity the blow valve market. Both enthusiasts and auto manufacturers are opting to turbocharging technology to improve their efficiency and outputs. Essential for protecting turbo systems and enhancing engine lifespan, this automotive component is an integral part of this burgeoning segment.

Advancements in Smart and Electronically Controlled Valves

Smart technologies and electronically controlled blow off valves are growing opportunities for market growth. These new performance valves provide faster response times, adjustable setup, and better reliability for both aftermarket customers and OEM clients alike.

Blow-off valve systems embedded with IoT are also integrated with AI-driven diagnostics that allow manufacturers to improve the efficiency of the system with predictive maintenance, thereby contributing to the growth of the market in the coming years.

The blow-off valves market continued to expand from 2020 to 2024, as more consumers sought to enhance their vehicles' performance and adopt turbocharged engines. Nonetheless, strict emission regulations and the prevalence of fake goods impeded the growth of the market. There was also a change within the industry with hybrid and electric vehicles slowly making their way into the market affecting the traditional blow-off valve demand.

First up for 2025 to 2035, we can expect major market transformation, including tech innovations, sustainability measures and switching over to electric and hybrid powertrains. The manufacturers would focus on developing lightweight, high-performance materials, increasing the durability and efficiency.

Moreover, the trend is toward electronically controlled and smart blow-off valves that incorporate AI-driven diagnostics and real-time performance monitoring. There will also be a growth in the aftermarket sector, since car enthusiasts will always be on the lookout for high-end additions to their turbo power plants.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter emissions and noise control regulations |

| Technological Advancements | Incremental improvements in traditional blow-off valve design |

| Industry Adoption | High demand in the performance and aftermarket sectors |

| Supply Chain and Sourcing | Dependence on metal-based manufacturing |

| Market Competition | Presence of counterfeit and low-quality alternatives |

| Market Growth Drivers | Rising adoption of turbocharged engines and aftermarket modifications |

| Sustainability and Energy Efficiency | Initial efforts towards eco-friendly components |

| Consumer Preferences | Demand for traditional blow-off valves in performance vehicles |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Increased compliance with eco-friendly and hybrid vehicle standards |

| Technological Advancements | Smart, electronically controlled, and AI-integrated valve systems |

| Industry Adoption | Expansion into hybrid and electric vehicle applications |

| Supply Chain and Sourcing | Development of lightweight, durable, and sustainable materials |

| Market Competition | Increased brand differentiation through advanced and reliable products |

| Market Growth Drivers | Technological advancements, fuel efficiency improvements, and AI-driven monitoring |

| Sustainability and Energy Efficiency | Increased focus on sustainable materials and hybrid vehicle adaptation |

| Consumer Preferences | Shift towards smart, adjustable, and electronically controlled blow-off valves |

The USA holds a considerable share of the blow-off valves market owing to the robust automotive and aftermarkets industry. As more and more passenger and commercial vehicles come equipped with turbocharged engines, the demand for high-quality blow-off valves has only increased.

The aftermarket sector is also healthy, backed by Kenya-based car enthusiasts and tuners, who further grow the market. As engines evolve and consumers' interest in more fuel-efficient cars increases, manufacturers are working to create high-performance, lightweight-yet-durable blow-off valves that work in harmony with your engine.

The market also benefits from the growing trends of motorsports and automotive customization.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

In the UK, the blow-off valves market is also witnessing steady growth owing to rise in demand for performance cars and motorsports culture. Tuning and aftermarket upgrades are vital in cities like London, Manchester, and Birmingham that have hot spots. Moreover, the increasing usage of turbocharged engines, in accordance with emission regulations and efficiency enhancements, is fueling the need for advanced blow-off valves.

The market is expected to be fueled by stringent environmental regulations that push manufacturers to develop more durable and sustainable valve designs.

The UK market, with its combination of a solid automotive engineering base and ongoing investment in research, continues to be an important market for blow-off valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

The blow-off valves market throughout Europe is dominated by this region primarily attributed to the booming automotive sectors of Germany, France, and Italy. As many vehicles in Europe continue to be manufactured with turbocharging technology, the need for high-performance blow-off valves is also growing.

Increasing emission norms in the region have forced a major changeover towards turbocharged downsized engines which need durable blow-off valve systems. Furthermore, the rising electric and hybrid vehicle sector is driving companies to incorporate innovative valve solutions suited for the latest engine architectures.

These factors are further aided by premium automobile manufacturers being founded, along with an increasing enthusiasm for vehicle modifications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

Japan's Automobile industry, which leads to innovative high performance vehicles, increases the market for automotive related supplements. For the record, Japan has at least three major carmakers Toyota, Nissan and Honda and all three had already been rolling out turbocharged engines throughout their line-ups in recent years.

In addition, Japan's aftermarket scene shore is a wind watermelon with an energetic party, particularly in cities like Tokyo and Osaka, where the car adjustment community is large enough to support a market for bolt-on lysos.html. An increase in popularity of the motorsports as well as development in the turbocharging technology is estimated to contribute to the growth of the market.

As a cherry on top of the delicious cake, Japanese standards for precision engineering assure the development of high quality, durable blow-off valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

The South Korean blow-off valves market is growing steadily owing to the presence of major automotive Manufacturers which include Hyundai and Kia. The rising pressure on fuel economy and vehicle performance has created a demand for turbocharged engines and, consequently, high-performance blow-off valves.

The aftermarket segment has also been bolstered by the rising penetration of car tuning culture, especially among the youth. Moreover, the South Korean government is assisting the automotive sector, along with investments in eco-friendly vehicle technologies, which in turn is expected to open new doors for advanced blow-off valve designs to suit contemporary engine needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Rising adoption of turbocharged engines in automotive, motorsports, and industrial applications has been driving the growth of the blow-off valves market at a robust pace. They are essential components in controlling and alleviating excess boost pressure, preventing compressor surge, and improving turbocharger efficiency.

Indeed, as vehicle manufacturers and performance fans focus on engine longevity, fuel efficiency, and power optimization, high-quality blow-off valves are in demand.

In forced induction applications, blow-off valves are important components that will guarantee your turbo operates without interruptions and your throttle response is as immediate as possible. Novel materials, pressure management drivers, and intelligent valve technology have ushered in a period of innovation in the market to improve durability, response time, and sound properties.

Moreover, the escalating trend for aftermarket modifications and high-performance tuning is also pushing up market growth.

Two types of pressure signal and one pressure signal blow-off valves account for the most prominent product types in the Blow-Off Valves Market, which are further used considering various turbocharged engine requirements. Dual pressure relief valves are common in high-performance vehicles, motorsports applications, and other heavy-duty applications such as turbo diesel engines.

They employ two separate pressure source profiles, manifold pressure and turbo pressure, to fine-tune boost release in order to eliminate turbo lag and improve throttle response. This type of boost management is favoured by automakers and aftermarket suppliers because it limits boost spike, compressor surge, and enhances airflow dynamics.

On the flip side, pressure signal blow-off valves enjoy widespread popularity in daily-driven vehicles, entry-level performance cars and factory-installed turbo peg wheels. These valves work off the singular pressure source of intake manifold pressure, which allows them to vent excess boost pressure when the throttle is closed.

So they are even easier to work with and is immensely more cost-effective, with many automotive manufacturers, performance tuners, and DIY turbos entering the market, it is a no-brainer.

Advances in silicone familiars in the year 2023 are giving birth to electronic actuation, adjustable venting, and variable boost feedback, all designed for a lower, more content targeted with hybrid, electric manifold African roots, or turbo fat engine.

With the growing need for improved turbo performance, noise suppression, and increased durability, manufacturers are increasingly focusing on pushing the boundaries of design to develop versatile high-performance blow-off valves to meet a wide range of application requirements.

Re-circulating blow-off valves and vented/atmospheric blow-off valves (hybrid) are among leading segments for the Blow-Off Valves Market, based on function type. They serve various payload needs, sound concerns, and tailpipe standards.

Recirculation or re-circulating blow-off valves are the type found on OEM turbocharged vehicles, fuel-efficient vehicles, and compliance applications where regulations restrict emissions to the atmosphere - instead of venting excess boost pressure to the atmosphere, this type redirects that air back into the intake system. This functionality improves efficiency, reduces lag, and increases gas mileage.

The industry prefers re-circulating valves because they satisfy noise requirements, emission standards, and OEM engine management systems.

Alternatively, vented/atmospheric (hybrid) blow off valves are the popular choice for performance car enthusiasts, race teams and aftermarket tuners. Such valves vent excess boost pressure directly to the atmosphere, producing an audible hiss or whoosh that is often associated with high-performance turbocharged engines. They increase engine response, help prevent compressor surge, and they provide an aggressive turbo noise.

Hybrid configurations (that can be switched to re-circulating or atmospheric venting) are becoming popular as consumers seek dual-purpose blow-off valve solutions. As the industry pushes toward customization, enhanced performance tuning, and turbo system optimization, vented and hybrid blow-off valves remain in high demand in the aftermarket performance sector.

Furthermore, the introduction of adjustable spring mechanisms, electronic control, and high-strength, lightweight materials have made contemporary blow-off valves smarter, more reliable, and better performing. The rising trend for turbo engines in modern EV, hybrid and performance gasoline powertrains is also driving innovation in blow-off valve design and smart actuation systems.

The primary factors impelling the growth of the global blow-off valves market include a boost to high-performance automotive components, increasing trends for vehicle customization, and rapid development of turbocharger technology. Blow-off valves (BOVs) are a crucial component in maintaining optimal performance in turbocharged engines, as they help stave off compressor surge, mitigate turbo lag, and enhance throttle response.

Furthermore, increasing adoption of turbocharged engine in passenger & commercial vehicles and the rising motorsports and aftermarket tuning industry are additional factors to drive the market. Moreover, the detection of vehicle performance triggered by smart and electrically actuated BOVs is further improving fuel economy.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Turbosmart | 20-25% |

| HKS | 15-20% |

| Tial Sport | 10-15% |

| GReddy Performance Products | 8-12% |

| GFB (Go Fast Bits) | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Turbosmart | Use high-performance blow-off valves, waste gates, and boost control solutions. |

| HKS | Active works specializes in designing cutting-edge BOVs and valve technologies that boost turbocharger efficiency. |

| Tial Sport | Focuses on precision-engineered BOVs for motorsport and high-performance applications. |

| GReddy Performance Products | Offers a wide range of aftermarket tuning parts, including BOVs for turbocharged vehicles. |

| GFB (Go Fast Bits) | Manufactures high-quality BOVs with electronic control features for enhanced vehicle performance. |

Key Company Insights

Turbosmart (20-25%)

Turbosmart is an industry leader when it comes to high-performance turbocharger components including electronically controlled, adjustable blow-off valves designed for motorsports & street performance use. With its precision-engineered designs and patented boost control technology, the company offers unparalleled turbocharger response and efficiency.

HKS (15-20%)

HKS is a worldwide renowned brand in the automotive aftermarket industry with high-end BOV and turbo accessories products. The company offers a range of products, including its SSQV (Super Sequential Blow-Off Valve) series, which is noted for its strength, reliability, and high-performance capabilities.

Tial Sport (10-15%)

Tial Sport focuses on motorsports-grade BOVs, offering lightweight aluminum and stainless steel designs that withstand extreme performance conditions. The company’s spring-based valve technology enhances turbo efficiency while minimizing lag.

GReddy Performance Products (8-12%)

GReddy is known for performance-driven automotive components, including universal and vehicle-specific blow-off valves designed for improved boost response and longevity.

GFB (Go Fast Bits) (5-10%)

GFB specializes in electronically controlled BOVs, enabling adaptive boost control and noise adjustment features for enhanced driving experiences.

Other Key Players (30-40% Combined)

The market also features emerging and established players focusing on performance tuning and innovation, including:

The overall market size for the blow-off valves market was USD 36,300 million in 2025.

The blow-off valves market is expected to reach USD 53,730 million in 2035.

The blow-off valves market is expected to grow at a CAGR of 4.0% during the forecast period.

The demand for the blow-off valves market will be driven by the increasing adoption of turbocharged engines, rising demand for high-performance automotive components, advancements in valve technology, expanding automotive and industrial sectors, and growing emphasis on fuel efficiency and emission control.

The top five countries driving the development of the blow-off valves market are the USA, Germany, China, Japan, and South Korea.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.