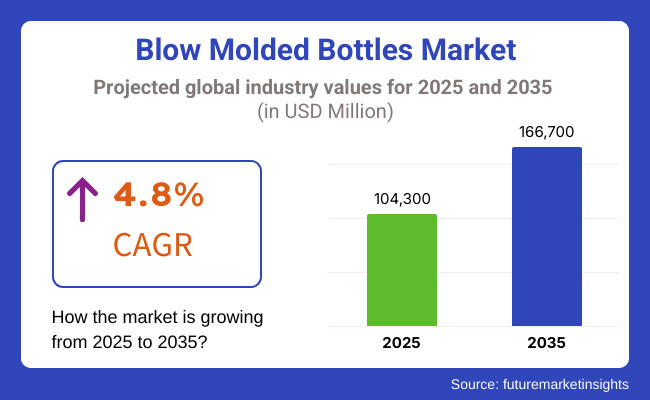

The blow molded bottles market is anticipated to witness high growth between 2025 and 2035, fueled by growing demand in packaging uses among industries like food & beverages, pharmaceuticals, personal care, and household items. The market is anticipated to grow from USD 1,04,300 million in 2025 to USD 1,66,700 million in 2035, at a compound annual growth rate (CAGR) of 4.8% during the forecast period.

Manufacturers prefer blow molded bottles for lightweight, cost efficient and durable packaging. Key trends supporting the growth of the market include the increasing consumption of bottled beverages and growth of e-commerce, along with rising demand for sustainable and recyclable packaging materials. The market is also growing on the back of development of biodegradable and bio based plastics.

Nevertheless, the growth of the market might be impeded owing to stringent environmental regulations against plastic waste, volatile prices of raw materials, and rising threats from alternative packaging solutions. Well, industry players are focusing on sustainability initiatives and innovative product designs along with expanding their production capacities to remain competitive in the changing market landscape.

Explore FMI!

Book a free demo

Food and beverage, pharmaceutical, and personal care industries are widely driving its demand in North America, holding the major share of blow molded bottles market. The United States and Canada dominate the regional market owing to the strategic focus of prominent industry players on measures such as sustainable packaging solutions, lightweight bottle designs, and enhanced recyclability.

Market trends are being influenced by a focus on sustainable packaging and government efforts to promote biodegradable and recycled materials. Higher precision, automation, and energy-efficient blow molding processes are also enhancing production efficiency.

But the rise in raw material costs and stringent regulatory requirement does hinder the market growth. To deliver sustainability and product appeal, companies are leaning toward bio-based plastics, advanced bottle designs, and circular economy initiatives.

In Europe, the market for blow molded bottles is largely focused in Germany, France, and the United Kingdom, with the presence of stringent packaging regulations and aggressive sustainability targets serving as significant motivators for demand. The region’s strong commitment to plastic waste reduction has been a catalyst for both recycled PET (rPET) and bio-based/range of alternative materials.

Furthermore, the need for lightweight, strong, and economical packaging solutions among companies is further projected to fuel the market growth across the beverage and cosmetics industries. Nevertheless, requirements related to changing EU environmental regulations and competition from other packaging types could be challenges.

To align with their regulatory requirements and expectations from consumers, companies are focusing on - conducting research across sustainable packaging, enhancing production efficiency and embracing closed loop recycling systems.

Asia-Pacific is the quickest expanding market for blow molded bottles due to the increasing demand for packaged consumer goods, as well as rapidly speeding up industrialization and growing urban populations within nations such as China, India, Japan and Australia. The growing trend of e-commerce and convenience packaging is also enhancing the market growth.

Government regulations concerning plastic waste management, in addition to increasing consumer awareness about the importance of eco-friendly packaging, are driving sectors to adopt recyclable and biodegradable materials. However, the presence of inconsistent waste management infrastructure and the cost constraint in adopting eco-friendly substitutes can hinder the growth of the market.

Local production plants, innovative material solutions, recycling company’s partnerships increase company’s market visibility and sustainability efforts.

Challenges

Environmental Concerns and Sustainability Regulations

There is growing scrutiny of the blow molded bottles market in regards to environmental issues pertaining to plastic waste and recycling. With increasing regulations globally on single-use plastics, manufacturers are being pushed towards sustainability. The compliance with these regulations escalates the production expenses and demands investments in the different materials (like biodegradable and recyclable plastics) to sustain in the market.

Fluctuating Raw Material Costs

Raw material pricing is very volatile especially for petroleum-based plastics, which significantly affect production costs for blow molded bottle manufacturing companies. Cost predictability and profit margins present challenge due to supply chain disruptions, geopolitical instability and dynamic crude oil price. Manufacturers will have to look for cost-effective material alternatives or optimize production efficiencies to reduce such risks.

Opportunities

Growing Demand for Eco-Friendly Packaging Solutions

Sustainable best practice in blow molded bottles, as the entire industry is moving towards sustainability and we are all dedicated to make the world a better place, the versatility of the blow molding process is remarkable with its ability to produce all types of plastic products in a sustainable way.

Packaging: Towards recycled PET or biodegradable plastics or plant-based resins companies that invest in green technologies and closed-loop recycling systems early will have a competitive advantage in tomorrow's packaging landscape.

Expanding Applications in Emerging Industries

Growing importance of blow molded bottles in different industries such as pharmaceuticals, personal care, food and beverages, and household chemicals is expected to boost their demand during the forecast period. In an ever-evolving e-commerce landscape, there is an increasing requirement for durable, lightweight, and tamper-proof packaging. Since technology has improved, manufacturers will have extensive options for creating customized and innovative bottles.

During 2020 to 2024, the blow molded bottles market gained significant revenue with growing consumption of packaged products and enhancing disposable packaging but most importantly the awareness on sustainable packaging. Regulatory pressures pushed the industry toward recyclable and bio-based plastics, and technology made production more efficient and changed the shape of bottles.

In the future 2025 to 2035, the markets will experience a trend towards more circular economy principles, cutting-edge material science innovations and more kidnappings. This approach will provide higher barrier protection in a reduced weight for lighter packaging profiles, leading to a reduction in the weight of empty packages and environmental footprint. These technologies include RFID-enabled bottles and QR code consumer traceability, which will enhance supply chain transparency and consumer engagement.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter policies on plastic waste and recycling |

| Technological Advancements | Improved efficiency in blow molding techniques |

| Industry Adoption | Expansion in food, beverage and pharmaceutical packaging |

| Supply Chain and Sourcing | Reliance on petroleum-based plastics |

| Market Competition | Presence of conventional plastic packaging manufacturers |

| Market Growth Drivers | Increased demand for convenient and durable packaging |

| Sustainability and Energy Efficiency | Initial Adoption of Recyclable Materials |

| Consumer Preferences | Move towards vaccines that use reusable and recyclable bottles |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased adoption of biodegradable and compostable materials |

| Technological Advancements | Smart packaging integration with tracking and authentication features |

| Industry Adoption | Expansion into sustainable packaging for personal care and household products |

| Supply Chain and Sourcing | Diversification into bio-based resins and recycled plastics |

| Market Competition | Rise of sustainable packaging firms with innovative solutions |

| Market Growth Drivers | Investment in green technology and circular economy initiatives |

| Sustainability and Energy Efficiency | Widespread, full-scale conversion to carbon-neutral production methods |

| Consumer Preferences | High demand for environmentally-friendly and biodegradable packaging |

The United States blow molded bottles market is driven by the growing demand for lightweight, durable, and cost-effective packaging solutions in various industries, such as food & beverages, pharmaceuticals, and personal care. The growing retail industry and evolving consumer preference in the country toward easy to use and recyclable packaging drive the market in the estimated period.

Also, strict regulations on single-use plastics have made it mandatory for manufacturers to look for sustainable alternatives like biodegradable and recycled plastic bottles. The country is expected to maintain its position as one of the most lucrative End user for blow molded bottles as continuous development of molding processes and increasing investments in sustainable packaging solutions are undertaking within the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

Demand for bottle molding in the UK is growing, owing growth in eco-friendly packaging restrictions by the UK government on plastic waste and increasing consumer awareness of sustainable packaging have driven the shift towards recycled and bio-based plastic bottles.

The rise of the beverage and personal care industries is equally important in driving demand. Additionally, lightweight and high-barrier packaging solutions revolutionizing manufacturers to meet changing market demands are making the UK a major player in this field.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The largest market for blow molded bottles in Europe was held by the countries of Germany, France, and Italy which remain dominant globally. Stringent packaging waste directives and circular economy initiatives drive manufacturers across the region to spend on sustainable materials and advanced blow molding technologies.

Also, growth is being driven by the increasing utilization of PET and HDPE bottles in food, beverage and pharmaceutical industries. Manufacturers are increasingly adopting lightweight packaging materials to lower material usage and carbon footprint, which is further propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

The market Darwinism of blow molded bottles market in Japan is thriving with high demand for precision engineered and innovative packaging. There is a rich beverage industry in the region dominated by bottled tea, soft drinks, and functional beverages, all of which helped contribute to market growth in this country.

Moreover, Japan emphasizes sustainability and has an advanced recycling infrastructure, resulting in the prevalent use of recycled plastic bottles. Rising popularity for high-end and visually satisfying packaging, especially across personal care and cosmetics, is also impacting the market landscape causing innovation in bottle aesthetic designs along with implementation of offers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The food and beverage sector, personal care sector and household product sector are the biggest end-users for the Attention to market blow molded bottles in South Korea. Because of the country’s robust technology in plastics manufacturing and packaging innovation, companies have been able to produce high-quality, light-weighted, durable bottle solutions.

Additionally, the government’s initiative for waste reduction with plastic and the growing demand for green packaging are influencing the market trends. The blow molded bottles market is projected to witness moderate growth, as companies discontinue traditional plastic bottles in favour of more sustainable and biodegradable alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Growth in the blow molded bottles market is driven by the growing demand for lightweight and economical packaging solutions in various end-use industries. Manufacturing bottles with blow molding technology has changed the bottle-making industry by providing high-quality, flexible, customized, and recyclable packaging solutions at scale.

Flint glass bottles are most commonly used in beverages, personal care, pharmaceuticals and household products, driving the modern packaging trends.

Manufacturers are innovating to increase production efficiency, enhance packaging design flexibility, and promote material sustainability as consumer preferences shift toward environmentally sustainable and recyclable packaging materials.

Methods to manufacture bottles (extrusion blow molding, injection blow molding, and stretch blow molding) are advanced in nature, leading to improved structural integrity and functionality of bottles, continuing to meet different application requirements. The growing popularity of biodegradable and eco-friendly plastics is also driving the evolution of the market.

Under different capacity segments, lower than 100 ML and 100 to 500 ML blow molded bottles contribute significantly to the blow molded bottles market to meet packaging requirements across various end-use industries.

Blow molded bottles below to 100 ML is widely used in pharmaceutical, personal care and sample-size packaging applications. They are so little that they can fit into travel-sized containers, single-use medicine bottles, and cosmetics samples, all of which are very strict with respect to travel size and airline travel.

They are also favored in packaging diagnostic reagents as well as in essential oils and specialty liquids in which accurate dosing is of utmost importance. Input: The manufacturers are emphasizing the enhancement of small-cap capacity blow molded bottles by improving barrier properties, tamper-proof features, and child-resistant caps to boost safety and usability.

Whereas, 100 to 500 ML bottles are widely used in beverage, personal care, and household products. These machines bring versatility to brands, enabling them to sell shampoo, liquid detergents, soft drinks, sauces, or even hand sanitizers in consumer-friendly formats. Due to the convenience, price point, and shelf life, these bottles of product are among one of the most produced sizes on the shelf.

The lost cost of hen, cloakroom, marvellous materials: The designers are giving new life to old products by incorporating lighter-weight (and more eco-friendly) materials into their design; designing bio-based plastics, high-density polyethylene (HDPE) recycling, and a whole range of other innovations that not only use however achieve ten carbon footprint, if it comprised remains relevant.

Driving Forces in the blow molded bottle industry: Emphasis on sustainability with sustainability concerns on the rise, post-consumer recycled (PCR) plastics, bio-based resins, and refillable packaging alternatives are gaining more prominence in the blow molded bottle market. To align with global environmental goals, companies are pouring investments into closed-loop recycling systems, circular economy initiatives, and material consumption reduction.

By material type, Plastic and Glass Blow molded bottles remain principally in the lead in blow molded bottles market due to their diverse advantages in terms of cost, durability and suitability to application.

Plastic blow molded bottles the largest segment in the market, due to their lightweight, inexpensive, and breakage-resistant characteristics. It has a good extent of customization, excellent impact resistance, and high mass production utility making it widely popular amongst the beverage, personal care, pharmaceutical, and chemical packaging industries.

Versatile templates, often recyclable, HDPE, PP, and PVC are bench-marking materials for producing plastic bottles. As environmental concerns from plastic usage intensifies, there is a shift in the manufacturing from plastics to bio-friendly solutions such as biodegradable plastics, recycled PET (rPET), and bio-based polymers that not only contributes towards reducing plastic waste but, also, carbon emissions.

On the contrary, glass blow molded bottles continue to be the most favourable form of packaging for premium, pharmaceutical, and food-grade applications. The glass-type bottles have high chemical resistance, good barrier properties, and a premium look perfect for alcoholic beverages, perfumes, essential oils, and luxury cosmetics.

Due to their non-toxic, reusable, and 100% recyclable properties, glass bottles are extremely popular and go along with trends of sustainability. However, issues of elevated production costs, fragility, and transportation limitations hamper their uptake compared to plastics. Breakthroughs in lightweight glass technologies, tempered glass material durability, and returnable bottle systems are addressing some of these hurdles, reigniting enthusiasm for glass packaging.

Both plastic and glass blow molded bottles are being innovatively evolved as the focus on eco-friendly consumer purchase, supply chain regulations emphasizing sustainable materials, brand efforts to reduce packaging waste intensifying. Looking ahead, the trend is moving towards hybrid packaging solutions, biodegradable composites, and intelligent packaging that adds convenience for the user while reducing environmental impact.

The blow molded bottles market is witnessing significant growth, driven by the increasing demand for lightweight, cost-effective, and durable packaging solutions across various industries. Blow molding technology enables the production of bottles with high strength, flexibility, and resistance to breakage, making them ideal for applications in food & beverages, pharmaceuticals, personal care, and household products.

Additionally, the growing emphasis on sustainable packaging and the rising adoption of recycled and biodegradable plastics are further fueling market expansion. Advancements in blow molding techniques, such as extrusion, injection, and stretch blow molding, are improving production efficiency and customization options, catering to diverse industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 18-22% |

| Berry Global Group, Inc. | 15F% |

| ALPLA Group | 12-16% |

| Gerresheimer AG | 8-12% |

| Plastipak Holdings, Inc. | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor Plc | Offering sustainable lightweight blow molded bottles for food, beverage and pharmaceutical applications. |

| Berry Global Group, Inc. | Custom and recycled-content bottles, specializing in high-performance plastic packaging. |

| ALPLA Group | Cutting edge of blow molding technology, in order to produce sustainable and decorative packaging solutions. |

| Gerresheimer AG | Production of plastic and glass bottles for pharmaceutical and healthcare industries. |

| Plastipak Holdings, Inc. | Polyethylene Terephthalate (PET) High-Density Polyethylene (HDPE) blow molded bottles for consumer packaging and industrial use. |

Key Company Insights

Amcor Plc (18-22%)

Offers sustainable and lightweight blow-molded bottles for food, beverage and pharmaceutical applications.

Berry Global Group, Inc. (15-20%)

Amcor is at the forefront of the blow molded bottles market and provides sustainable and light weighted plastic packaging solutions. The company's emphasis on recyclable or bio-based materials is consistent with growing sustainability trends worldwide.

ALPLA Group (12-16%)

ALPLA is dedicated to cutting-edge plastic packaging solutions, harnessing advanced blow molding techniques for product customization and sustainability.

Gerresheimer AG (8-12%)

Gerresheimer stands for high-quality plastic and glass bottles for pharmaceutical and healthcare applications, offering precision and compliance with industry standards.

Plastipak Holdings, Inc. (5-10%)

Feeding from the print packaging stream, Plastipak specializes in PET and HDPE blow molded bottles for food, beverage and industrial solutions while making an emphasis on circular economy practices.

Other Key Players (30-40% Combined)

The market also includes emerging and established manufacturers, such as:

The overall market size for the blow molded bottles market was USD 1,04,300 million in 2025.

The blow molded bottles market is expected to reach USD 1,66,700 million in 2035.

The blow molded bottles market is expected to grow at a CAGR of 4.8% during the forecast period.

The demand for the blow molded bottles market will be driven by the growing demand for lightweight and durable packaging solutions, increasing use of plastic bottles in the food and beverage industry, rising adoption of sustainable and recyclable materials, expanding pharmaceutical packaging needs, and technological advancements in blow molding techniques.

The top five countries driving the development of the blow molded bottles market are the USA, China, India, Germany, and Brazil.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Ultra High Bond (UHB) Tape Market Analysis by Type, Thickness and End Use Through 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.