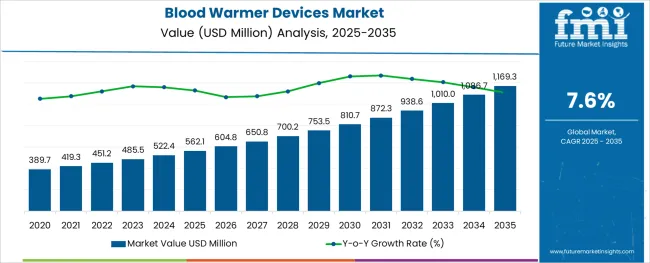

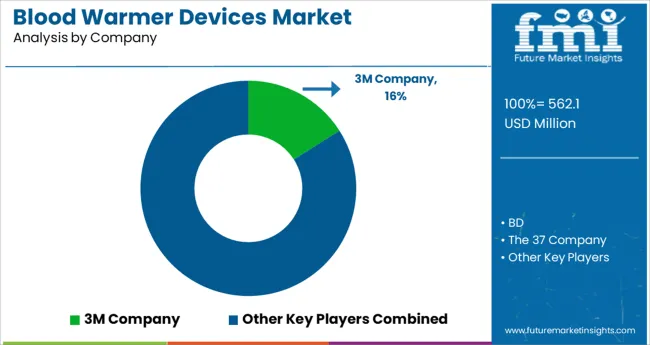

The Blood Warmer Devices Market is estimated to be valued at USD 562.1 million in 2025 and is projected to reach USD 1,169.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Product Type, Application Type, and End User and region. By Product Type, the market is divided into Intravenous Warming System, Surface Warming System, and Blood Warming Accessories. In terms of Application Type, the market is classified into Acute Care, Preoperative Care, Home Care, New Born Care, and Others.

Based on End User, the market is segmented into Hospitals and Clinics, Ambulatory Services, Blood Banks, Home Care Settings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

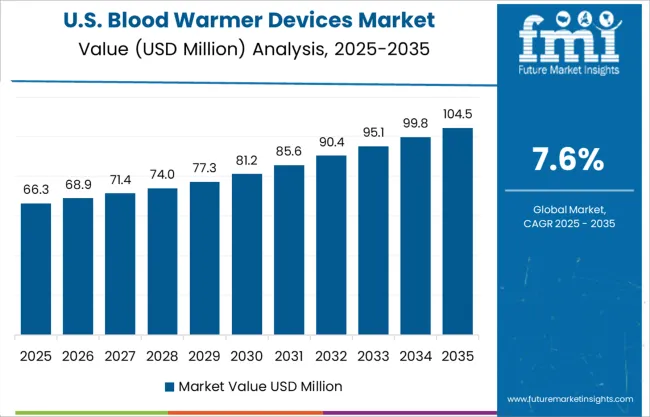

Government agencies in the North American region are ordering blood warmer devices in a number of countries to provide good treatment in emergency scenarios. North America is one of the leading markets for Blood Warmer Devices products, driven largely by the USA with a total market share of about 93.3% in 2024, and a similar trend is expected over the forecast period.

In the USA, the adoption of technologically advanced products is quite higher which is why it is a dominating region. The increasing trauma cases in the USA lead to hypothermia which in turn increases the adoption of blood-warmer devices. As per LERN, Louisiana Emergency Response Network, the number of trauma cases in the USA accounts for about 37 million emergency department visits in hospitals. Hence, the sales of blood warmer devices are quite high in the USA and are anticipated to grow in the forecast period.

The presence of major industry players like 3M, BD, ICU Medical Inc., (Smith Medical, Inc.) and others are quite high in the USA market and this has also increased the availability of blood warmer devices in the USA For instance, in March 2024, MEQU, a medical technology business, won a public tender to offer portable blood warmers to the Norwegian National Air Ambulance Services. Most of the time, air ambulance services deal with crisis circumstances. Before administering to the patient, all solutions should be warmed up. Hence, ambulance services are equipped with blood warmers to facilitate this practice.

Major technological shifts in healthcare infrastructure and the rising use of advanced machinery are expected to positively affect the growth of Blood Warmer Devices production over the forecast period. The manufacturers are penetrating into various market segments by introducing Blood Warmer Devices-based products. Further, a number of international market participants are entering into acquisitions and mergers to gain a major revenue share.

For instance, in January 2025, QinFlow Inc. received a group buy agreement from Premier, Inc. for blood and fluid warming products. This arrangement will give healthcare organizations access to their next-generation blood-warming technology, which has been fine-tuned to suit the stringent requirements of emergency departments, intensive care units, operating rooms, and trauma bays. Thus, the industry is expected to grow rapidly in the coming years.

The growth of the blood warmer devices market is inclined to the prevalence of conditions like hypothermia in which the body temperature drops. The situation arises when the body loses heat faster than it can produce heat, and the temperature drops below 35 C. Hypothermia is generally caused by prolonged exposure to very cold temperatures. It is also common in the neonatal period, old age as well as in medical conditions like dementia, hypothyroidism, and low blood sugar. Trauma patients are also highly susceptible to hypothermia.

As per the Centers for Disease Control and Prevention, from 2020 to 2024, death rates caused by hypothermia were about 0.40 per 100,000 for rural area females and 0.93 for men in rural areas.

It is also predicted that the number of untracked hypothermia deaths is also on the rise. To overcome the conditions of hypothermia there are different devices used to warm the blood to minimize the risk of hypothermia because in many instances hypothermia can lead to abnormal functioning of the heart, nervous system, and respiratory system, even in extreme cases it can lead to complete failure of the heart or respiratory system. Thus the use of blood warmers is quite a necessity in this aspect and so there will be growth in the blood warmer devices market in the forecast period

The global blood warmer devices market holds approximately 5.0% of the global fluid management systems market, which was worth ~USD 522.4 Billion in 2024. Sales in the blood warmer devices market expanded at a CAGR of 6.4% from 2020 to 2024.

The increasing neonatal and geriatric population globally is a leading driver of the blood warmer devices market. Rising cases of neonatal hypothermia are mainly attributed to the high surface area as per their body weight, less subcutaneous fat, and increased body water content. With advancing age, people lose their ability to endure long exposure to cold, which usually leads to hypothermia. This is set to positively impact the blood warmer devices market in the upcoming decade.

Technological advancements can also be considered to be a recognizable driver for this market. There are different types of blood warmers that could be useful for various medical conditions. For instance, ICU Medical, Inc. provides technologically advanced products for surgical procedures.

There are also devices such as Snuggle Warm Blankets that reduce the risk of surgical site infection and fluid warmers with air detectors that allow for quick removal of air and restoration of flow without disconnecting from the patient. Thus, technological advancement is set to lead to the wider adoption of blood-warmer devices globally. Owing to the aforementioned factors, the global blood warmer devices market is expected to grow at a CAGR of 7.6% during the forecast period from 2025 to 2035.

Increasing Prevalence of Hypothermia to Drive Demand by 2035

The global market is set to exhibit an assertive outlook owing to increased awareness about the care of hypothermia in countries where awareness is low. For instance, the Faculty of Medicine, Menoufia University, Egypt has analyzed the effect of designed guidelines on nurses′ performance to prevent hypothermia in preterm infants as hypothermia is a major factor causing neonatal death in developing countries.

Increased research and technology development, as well as rising awareness among people, would thus contribute to growth in the adoption of blood warmer devices across hospitals and clinics. These devices help to maintain one’s overall body temperature. This can be considered to be an opportunistic factor for growth in the blood warmer devices market.

The cost linked with advanced blood warmer products is quite high for certain settings like home care. The individual cost is higher for low and middle-income countries. For instance, the price range in India is from 50,000 to 1, 50,000 INR per piece. These high costs, along with no reimbursement rate can hamper growth in the blood warmer devices market in certain developing countries.

Apart from this, strict regulations in various countries concerning the efficacy and safety of blood warmer devices may hamper the market to a certain extent. For instance, in September 2024, the USA Food and Drug Administration (FDA) identified blood warmer devices that possess the potential risk of aluminum leaching and instructed a voluntary recall action. Thus, the above-mentioned factors collectively propose a negative effect on growth in the blood warmer devices market.

Rising Number of Trauma Cases in the USA to Push Sales of Blood Warmer Machines

The USA dominates the North American blood warmer devices market and held a total share of about 93.3% in 2024. In the USA, the adoption of technologically advanced products is quite high, which is why it is a dominating country. An increasing number of trauma cases in the USA would lead to hypothermia, which in turn, can push the adoption of blood-warmer devices.

As per Louisiana Emergency Response Network (LERN), the number of trauma cases in the USA accounts for about 37 million emergency department visits in hospitals. Hence, sales of blood warmer devices are quite high in the USA and are anticipated to grow in the forecast period. The presence of major industry players like 3M, BD, ICU Medical Inc., (Smith Medical, Inc.), and others in the USA market has also increased the availability of blood warmer devices in the country.

Demand for Medical Fluid Warmers to Soar in the UK with Growing Cold-Related Deaths

The UK is set to hold a share of 5.1% in the global blood warmer devices market during the forecast period. In 2024, the UK held a share of about 16.3% in the Europe blood warmer devices market, finds FMI.

As per the London School of Hygiene and Tropical Medicine, in England and Wales, the number of cold-related deaths was around 60,500 between 2000 and 2020. It is mainly because of the extremely cold weather conditions in the region and accordingly, the adoption of blood-warmer devices is also increasing. Hence, the blood warmer devices market in the UK is set to be very lucrative.

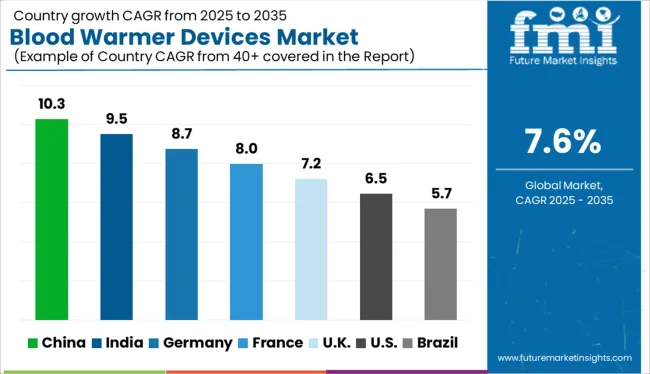

Chinese Blood and Fluid Warmer Manufacturers to Offer Portable Devices by 2035

China held approximately 4.3% of the share in the global blood warmer devices market in 2024. The market is estimated to grow at a CAGR of about 8.0% in the next decade. The country is considered to be a growing market in terms of the adoption of blood warmer devices.

There are several Chinese manufacturers such as Wuhan Union Medical Technology Co., Ltd, Suzhou Power Biotech Co., Ltd, and Anjue Medical Equipment Co., Ltd. providing products such as portable and hospital-use devices. This factor has contributed to the high growth of the blood warmer devices market in China.

Demand for Portable Blood Warmers and Intravenous Warming Systems to Grow by 2035

By product, the intravenous warming system segment is expected to showcase high growth at a CAGR of 7.4% by the end of the forecast period. As per FMI, the segment held a steady share of nearly 47.1% in the global blood warmer devices market in 2024.

The use of intravenous warming systems has a direct and immediate effect on the patient prior to surgery or prior to blood transfusion, and thus their utilization is more. This further helps the patient to reduce shivering and increase their overall comfort. Therefore, the intravenous warming system segment is significantly dominating in terms of products.

Medical Fluid Warmers Are to Be Extensively Used for Preoperative Care

Preoperative care accounted for a revenue share of 36.5% globally in 2024 and is expected to display a CAGR of 7.4% over the forecast period. The use of blood warmers is highest during preoperative care because the temperature of the human body generally drops during this period. There are symptoms of shivering and drops in blood pressure, which often lead to the urgent need for blood warmer devices prior to blood transfusion and surgery. Thus, preoperative care holds the highest market share in terms of application.

Hospitals and Clinics to Highly Prefer Fluid Warming Devices for Acute Care

The hospitals and clinics segment held the highest market share of 49.8% in the year 2024. The use of blood warmer devices is highest in such settings because of the increased patient flow, including preoperative cases, acute care, surgical procedures, and neonatal care. Usage is the highest in the surgery department of hospitals. Thus, the hospitals and clinics end-user segment is estimated to generate the largest market share in the forecast period.

To strengthen their presence around the globe and improve their business strategies, key players are involved in various product launches, expansions, collaborations, and mergers & acquisitions. Below are some of the key promotional strategies adopted by key players in the global blood warmer devices market:

| Attribute | Details |

| Estimated Market Size (2025) | USD 562.1 million |

| Projected Market Valuation (2035) | USD 1,169.3 million |

| Value-based CAGR (2025 to 2035) | 7.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (million) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Argentina, UK, Germany, Italy, France, Spain, Russia, BENELUX, China, Japan, South Korea, India, Indonesia, Malaysia, Thailand, Australia, New Zealand, GCC Countries, Turkey, South Africa, and North Africa. |

| Key Market Segments Covered | Product, Application, End User, and Region |

| Key Companies Profiled | 3M Company; Becton Dickinson (BD); The 37 Company; Emit Corporation; GE Healthcare; Stryker Corporation; Barkey GmbH & Co. KG; Geratherm Medical; Stihler Electronic GmbH; Belmont Instrument; Biegler GmbH; Baxter International Inc. (Gambro); Keewell Medical Technology Co. Ltd.; ICU Medical Inc. (Smiths Medical); Vyaire Medical, Inc.,; The Surgical Company; Life Warmer; MEQU; Estill Medical Technologies, Inc.; Smisson-Cartledge Biomedical |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global blood warmer devices market is estimated to be valued at USD 562.1 million in 2025.

It is projected to reach USD 1,169.3 million by 2035.

The market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types are intravenous warming system, surface warming system and blood warming accessories.

acute care segment is expected to dominate with a 31.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Pressure Monitor Market Analysis by Product, Indication, End User and Region: Forecast for 2025 to 2035

Key Players & Market Share in the Blood-Based Biomarker Industry

Competitive Landscape of Blood Temperature Indicator Providers

Blood Meal Market Analysis – Applications, Demand & Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA