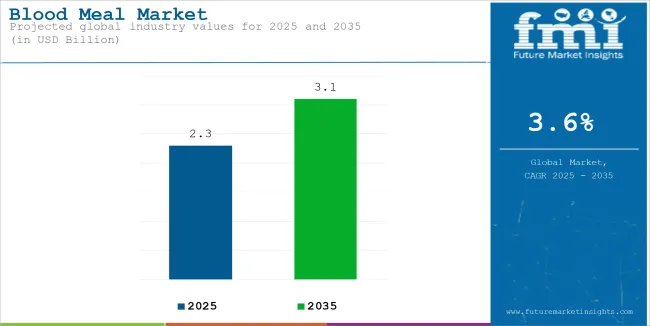

The global Blood Meal industry is estimated to be worth USD 2.3 billion by 2025. It is projected to reach USD 3.1 billion by 2035, reflecting a CAGR of 3.6% over the assessment period 2025 to 2035.

Blood meal is the high-protein agricultural product obtained from the dried blood of slaughtered animals, especially cattle and hogs. It is enriched with nitrogen (13.25%), phosphorus (1%), and potassium (0.6%) - the primary nutrients-an essential blend for an efficient and natural fertilizer. Blood meal is of importance both in livestock feeds and garden applications. Its unique characteristic features improved soil fertility and increased plant growth due to the provision of nitrogen-that critical energy-producing element in plants.

Blood meal market growth rates significantly accelerate as the demand for animal feed has increased. As meat production skyrockets around the world, there has risen a demand for high-quality protein sources in animal diets. Blood meal is a cheaper alternative to conventional proteins like soybean and fishmeal.

Organic farmers also turn to blood meal more for a natural source of nitrogen amendment, which is also in line with their practices toward agriculture. This trend towards organic agricultural practice also boosts the market since farmers look for natural ways to improve soil health without recourse to synthetic fertilizers.

The blood meal market is mainly driven by the increasing need for animal protein, adoption of sustainable agricultural practices, and cost-effectiveness. Increasing population and change of diets encouraging high consumption of meat increase the need for nutritious animal feed.

Organic farming trends, which prefer natural fertilizers, enhance soil fertility without synthetic additives, also favor blood meal. Blood meal is also one of the least costly organic fertilizers, making it competitive for all categories of farmers.

However, there are a few challenges; overapplication may lead to soil acidity, which could damage plants, and some countries have restrictions placed on blood meal because of health issues concerning animal-derived products. The Asia-Pacific led the blood meal sector and is expected to continue dominating this region owing to the size of its population and to the increasing overall per capita consumption of meat. India and China are regarded as among the major countries contributing to the blood meal market.

In North America, several companies like Darling Ingredients, West Coast Reduction Ltd., and Valley Proteins Inc. are working on feed and organic fertilizer applications. Overall, blood meal plays a major role in global agriculture because it helps feed the livestock sustainably while increasing crop production and addressing environmental concerns arising due to the applications of synthetic fertilizers.

Though blood meal has many pros, its market growth is associated with hindrance factors. Over application may cause soil acidity, which eventually harms plants and reduces harvest quality. The Blood Meal industry analysis highlights these dynamics while emphasizing the opportunities for sustainable agricultural practices.

| Attributes | Description |

|---|---|

| Estimated Global Blood Meal Industry Size (2025E) | USD 2.3 billion |

| Projected Global Blood Meal Industry Value (2035F) | USD 3.1 billion |

| Value-based CAGR (2025 to 2035) | 3.6% |

In addition, there are regulations prevailing in some geographies based on health concerns regarding animal-derived products, which will inhibit access to the market. The above factor is likely to hold back the market from further growth for the forecast period.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Blood Meal industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.9% (2024 to 2034) |

| H2 | 3.5% (2024 to 2034) |

| H1 | 3.4% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.9%, followed by a higher growth rate of 3.5% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 3.4% in the first half and remain considerably high at 3.6% in the second half.

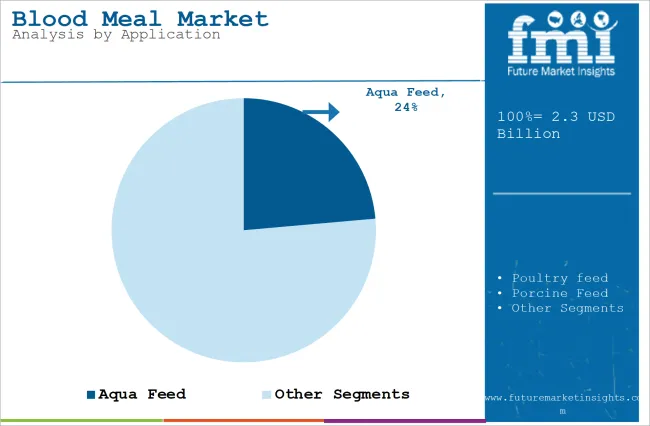

| Segment | Aqua Feed (By Application) |

|---|---|

| Value Share (2025) | 23.6% |

Bloodmeal is fast growing into a recognized ingredient in aqua feeds since it has proven to be a rich protein and essential amino acids source for different aquatic species. The high protein content in the above 80% range, high iron, and low zinc levels make good and health-grown fish, which will produce high feed efficiency consumption.

The increased inclusion of blood meal into aqua feed not only brings out the nutritional profile and aids the immune system, but at its best, it makes the fish more tolerant to diseases. For this reason, blood meal has become popular in aquaculture, as those producers seek some of the sustainable and lower-cost alternatives to traditional fishmeal. With blood meal becoming quite established in aqua feed, it should keep on attracting such interest within the forecast period.

The latest data, published in 2024 by FAO, shows that overall the amount of terrestrial animal by-product meals being used in compound aquafeeds, including blood meal, is still very low. Thus the vast potential for further uptake can be clearly seen. The blood meal has been shown to enhance feed formulations while meeting the concerns of sustainability in fish-farming practices as the aquaculture industry expands rapidly to meet the global protein requirement.

| Segment | Poultry feed (By Application) |

|---|---|

| Value Share (2025) | 43.6% |

It is a very important use of blood meal in poultry feed as it is one of the vital components of the poultry diets such as chickens, turkeys, and ducks. Blood meal is highly nutritional feed supplement, providing all essential proteins, iron, and lysine, which are important for the poultry production and development.

The increased demand for poultry products, which is due to the preference of consumers worldwide for more protein diets, has further contributed to the escalating use of blood meal in poultry feed. Blood meal is a cost-effective substitute for many conventional feedstuffs and enhances pepsin digestibility. Therefore, it is an excellent supplemental source of protein compared to plant-derived feeds.

The United States is one of the largest countries and other major contributors include China and Brazil. Production of poultry meat has increased dramatically over the last five-decade period and continues to do so, as reflected in growing consumption for poultry products. The forecasts of the USDA show a very steep rise in global poultry imports. Therefore, such imports will be a bulwark to the increasing demand for blood meal and other high-quality feed ingredients.

Therefore, blood meal holds great potential in terms of increasing production and consumption of poultry, contributing significantly to the sector's activities in fulfilling the nutritional needs of livestock toward the continued market growth.

Global Growth in Demand for Blood Meal by Associated Meat Consumption and Sustainable Agriculture Presenters

Notably, the growing need for meat products and meat consumption in countries worldwide has stimulated the demand and consumption of blood meal powder in animal feed, thereby increasing market growth. Blood meal is the dried form of blood from animals and serves as a rich source of proteins as well as other important nutrients.

As an input in agriculture in the form of feed and fertilizer, it is projected to increase further demand for the product in the next decade. Again, blood meal is a quick application of liquid protein because of its very high amino acid content, particularly lysine, doing away with many plant proteins that should be a viable source but fail to meet the needs of this essential amino acid.

Also, blood meal is a good, non-synthetic nitrogen source for effective natural fertilization, while it is also practiced in under organic farming techniques. All of these issues are why industry participants are aggressively pursuing research and development programs to innovate organic and green products through which agricultural solutions can better match current consumer preferences for a sustainable agricultural future. Blood meal will be an integral part of delivering the growing global demand for quality animal protein.

The Function of Organic Fertilizers: Blood Meal and Its Influence on Market Demand

As indeed about 10-13% of organic nitrogen, blood meal has been included in high-nitrogen organic fertilizers. This makes it effective for soil fertility enhancement. Primary haemoglobin composition is particularly iron rich, and it supplements effective plant growth. From recent studies, blood meal improves the soil organic matter but then enhances the availability of the essential nutrients, such as iron, during soil incubation.

Meanwhile, as the consumption of organic food products keeps rising, blood meal as natural fertilizer becomes more important. It serves a legitimate alternative to synthetic fertilizers by which consumers' demand for green agriculture will also be satisfied.

Furthermore, blood meal will have value in increased yields for plants such as onions that perform better against conventional fertilizers. The Blood Meal industry analysis suggests that this growing awareness and demand for organic farming solutions are likely to boost the sector significantly in the coming years.

Increasing Slaughterhouse Operations and Blood Collection Supporting Blood Meal Market Growth

The increasing slaughterhouse activities triggered by soaring consumption of animal-based products increase blood production which stands now as huge amounts for collecting disposal. The more blood can be bottled; the more opportunity suppliers have for transforming waste into good blood meal. In slaughterhouses, excessive blood volume oftentimes makes waste disposal burdensome, thus necessitating its separation and processing.

As an excellent organic fertilizer and supplement with bioactivator properties in processes such as composting, blood meal is high in nitrogen and other needed elements. Its highly nitrogenous condition stimulates metabolic activity in microorganisms to break down organic matter into a better fertilizer.

Increased slaughterhouse activities during the forecast period may likely lead to an upsurge of blood meal industry segments as trends of organic farming catch on. Incorporation of blood meal in compost will not only enhance the nutrient profile containing nitrogen, phosphorous, and potassium but also solve issues on waste disposal regarding the environment.

Start-up companies are increasingly realizing these opportunities and investing in the research and development of innovations in organic fertilizers, which customers increasingly demand today. The coming together of increased slaughterhouse activities and the push for organic products will then bring forth substantial fuel in the Blood Meal industry analysis.

Global sales increased at a CAGR of 2.9% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 3.6% CAGR.

The blood meal sector was able to grow tremendously from 2020 to 2024, mostly due to the increased demand for animal protein and sustainability regarding food production. The increased meat consumption led to more blood from slaughterhouses that were later converted by suppliers into a precious by-product known as blood meal. Darling Ingredients Inc., West Coast Reduction Ltd., and Valley Proteins Inc. were just some companies that benefited from the trend, for example, expanding their organic fertilizer and high-protein animal feed offerings.

Growing consumer awareness of blood meal as a good natural source of nutrients also improved its use in livestock diet and home gardening applications. However, the market was encumbered with challenges of waste management in slaughterhouses in terms of cost-effective processing methods for optimized blood utilization.

Growth in the blood meal industry outlook, at least from 2025 to 2035, will result from advances in precision nutrition and technology with good utilization available advantages in feed efficiency and blood meal optimization usage across all life stages of animals under improved growth in livestock and aquaculture. More will develop for blood meal supplies as a natural fertilizer in agricultural practices and organic farm consumption.

Demand for quality animal protein is expected to grow as many people are joining the global populace and people become more health conscious. With R&D investments by companies with much attention in the blood meal sector, the blood meal industry is going to be therein. Such a pattern is going to be seen through changing customer tastes and demands in the form of industry standards.

The primary tier blood meal companies are the global key players with huge market shares. These are some of the major players in the industry, namely Darling Ingredients Inc., West Coast Reduction Ltd. to mention a few, that are involve in providing innovative research and development into blood meal products.

They have set forth distribution networks to meet the demands of the market in delivering high-quality blood meal products applicable both to animal feeds and as organic fertilizers, with sustainability values. These companies do not only set trends but also improve processing efficiency and standards when it comes to product quality in the industry.

Some companies are what you call Tier 2 companies which would operate on a narrow geographical range to have products that will be designed for specific market needs. Among the typical examples of this is Terramar Chile SpA and Allanasons Pvt. Ltd., which both have strong blood meal offers selling specialized local products in terms of agricultural use and regulatory environment.

These are the companies that try to see everything from a qualitative perspective and sustainability strategies to be addressed by a product against specific conditions that are faced by farmers from the concerned or particular regions. They may be smaller in comparison with Tier 1 companies, but the way they have gone localized ensures that they take care of specific markets and thus contribute to the overall building of the blood meal industry.

Tier 3 Companies are basically the smaller companies that operate in a local market or a regional one. Though they do not have their R&D facilities like the bigger players, these companies have a very important role to play in the community.

Companies like Ridley Corporation Limited, The Boyer Valley Company, and FASA Group see how these small companies are coping with working effectively in their area through customer service and innovations targeted at within-their-industry solutions. Despite being Tier 3 companies, they play an invaluable role in the market by providing basic services to aid local agriculture and improve blood meal applications across various avenues.

The following table shows the estimated growth rates of the top three territories. China and Germany are set to exhibit high consumption, recording CAGRs of 7.1% and 4.3%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.2% |

| Germany | 4.3% |

| China | 7.1% |

| India | 8.2% |

| Japan | 6.8% |

USA blood meal industry outlook has been growing at significant rate as a result of converging consumer consideration for the sustainably produced animal products and organic farming techniques. Increased demand for meat-and-fish-based products has resulted in an increase in the amount of blood produced at slaughterhouses, providing extensive opportunities for blood meal manufacturing. Among the market leaders in this transfiguration from waste to blood meal are Darling Ingredients Inc. and Valley Proteins Inc.

These two giants are manufacturing high-value blood meal, a very rich source of protein and nitrogen used in animal feed and organic fertilizers. Blood meal's market valuation is nearly USD 1,100 per metric ton since it plays an imminent role in livestock nutrition as a lysine supplement.

Looking into the future, the USA blood meal sector takes a very bright view to enrich and ensure a prominent share of the market, given the emerging developments in processing technologies, combined with increased focus on sustainability.

The increasing realization of the health benefits in soil and crop establishment presented as new avenues for growth. The market for blood meal is expected to flourish with both factors-an environmental consideration and a commitment to sustainable agriculture-in the era of increasing health consciousness among consumers searching for natural and organic food.

The blood meal industry outlook in China is undergoing phenomenal growth as the country stands as one of the largest producers and consumers of animal-derived products in the Asia-Pacific region. Livestock production witnessed a significant upsurge, accompanied by the emerging demand for quality animal protein, thus giving blood meal prominence as an essential ingredient in animal feeds.

The blood processing by way of dry rendering from slaughterhouses proves very useful for such high protein materials, which can contain fecund nutrients like heme iron. Blood meal thus becomes an excellent choice, not merely from the nutrition of animals but also within clearly-defined sustainable agricultural practices. Such programs further add impetus toward the establishment of manufacturing capacities as well as sustainable agricultural practices.

With FAO-most likely demand increasing for livestock produce, prosperity from the blood meal industry is assured. It is also opening opportunities for blood meal in the course of time as much as possible, due to the rising demand on consumer awareness about animal health and nutrition. Thus factors bring China, thereby putting it in the front row of Europe, and at the same while showing good potential for further growth during the forecast period.

Germany is one of the major countries in the European blood meal sector because it attracts a really promising share of revenue from it since a strong demand is in place for animal protein and as far as the utilization of slaughter by-products is concerned. This country is home to a very developed meat processing industry, which puts the treatment of blood with such impressive volumes with each slaughtering of livestock.

Nothing could be further from reality because this blood is processed into high-quality blood meal, which is known for its rich nutritional value and draws much of its appeal from having high levels of protein and essential amino acids, making it a preferred alternative to plant-based proteins. Consumer craving for protein sources that promote animal health and growth is driving blood meal's characterization as a preferred ingredient in animal feed formulations.

The growth stems from rapidly developing public awareness of the health benefits of blood meal and its low-cost alternative compared with other sources of protein. The rapidly increasing demand for meat commodities promises a wide opportunity for blood meal's enlargement in its share of the feed market, which has indeed opened new avenues in Germany as well as the rest of Europe.

With the markets being increasingly geared toward sustainable agricultural practices and organic farming, blood meal will have an increasing value as both a feed supplement and fertilizer. Thus, the market in Germany looks further brightening, offering these conditions that are supportive with changing consumer tastes.

Blood meal is the sector of a very competitive marketplace at the top of which lays the key players such as Darling Ingredients Inc., West Coast Reduction Ltd. and Valley Proteins Inc. These companies spend a lot on research and development for varied innovative and sustainable feed solutions that would produce good feed performance for animal health and growth rate while taking care of environmental issues.

All these have been a source of competitiveness directed into acquiring and forming strategic partnerships to expand market reach and improve their products.

The blood meal is becoming an important raw material in the feed formulation as now-more demands-of-animal feeds with high protein content keep rising from world competition in meat consumption and ever-growing exposure to nutritional information. Thus, agency essentials are established as market drivers in their terms as manufacturers cater to consumer needs while portraying a green image in agriculture.

For example:

As per Source, the industry has been categorized into Poultry Blood, Porcine Blood and Ruminant Blood.

As per process, the industry has been categorized into Drum Drying, Spray Drying, Ring & Flash Drying and Solar Drying.

This segment is further categorized into Poultry Feed, Aqua Feed, Porcine Feed, Natural Pest Deterrents, Ruminant Feed and Organic Fertilizers.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global industry is estimated at a value of USD 2.3 billion in 2025.

Sales increased at 2.9% CAGR between 2020 and 2024.

Some of the leaders in this industry include Darling Ingredients Inc., West Coast Reduction Ltd., Terramar Chile SpA, Valley Proteins Inc., Allanasons Pvt. Ltd., Ridley Corporation Limited, The Boyer Valley Company, APC Inc., FASA Group, Spelsa Guadalajara SA de CV and Sanimax.

The North America territory is projected to hold a revenue share of 42.3% over the forecast period.

The industry is projected to grow at a forecast CAGR of 3.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Pressure Monitor Market Analysis by Product, Indication, End User and Region: Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA