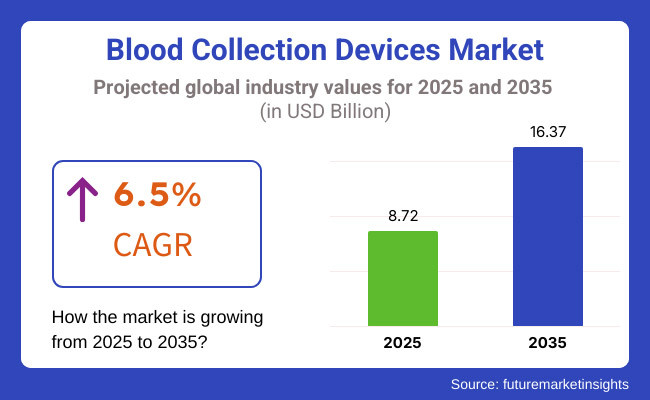

The blood collection devices market will experience steady expansion from 2025 to 2035 through growing demand for diagnostic testing, chronic disease escalation, and increased medical technology progress. The industry will grow from USD 8.72 billion in 2025 to reach USD 16.37 billion by 2035, attaining a compound annual growth rate (CAGR) of 6.5% during this period.

Overall growth of the market is also attributed to factors including limited infrastructures for collection purposes of blood, increased use of the healthcare services and a theoretical increase in blood donations. The blood collection devices like vacuum blood collection tubes, lancets, needles, micro containers are at the core of any diagnostic and therapeutic procedures around the globe.

Such advancements include automated blood collection systems and safety-engineered devices as well as point-of-care blood sampling methods which, together, improve efficiency and reduce the incidence of contamination and enhance risks safety for patients. Moreover, increasing number of minimally invasive procedures is other factor that driving the growth of market.

However, strict regulatory approvals, the possibility of needle stick injuries, and the high cost of advanced collection devices are anticipated to hamper the market growth. However, there are several key players present in the blood collection market and they are aggressively adopting the strategies such as product innovation, investments in research and development, merger and acquisition among competitors.

Explore FMI!

Book a free demo

North America accounts for a significant share of the global blood collection devices market due to the existence of advanced healthcare infrastructure, increasing prevalence of chronic diseases, and growing requirement for blood donation. Key innovation trends include safety-engineered blood collection needles, vacuum-based systems, and minimally invasive sampling techniques, with the US and Canada accounting for the lion's share of the regional market.

The increasing implementation of automated systems for routine blood collection and diagnostics also drives market growth. Moreover, based on the stringent FDA and Health Canada guidelines, blood collection devices are manufactured under strict safety and quality standards. However, concerns still exist, including the high price of such advanced collection systems and the possibility of needle stick injuries. To improve your best effort and patient satisfaction, companies are investing in easy-to-use, pain-reducing, and contamination-preventing technologies.

Europe contributes significantly to the blood collection devices market, with nations like Germany, France, and the UK leading in blood testing demand propelled by advanced healthcare facilities. The integration of novel technology and R& D of devices for clinical care to gain better diagnoses permeates the market growth.

Stringent EU medical device regulations and blood safety policies have fostered innovative solutions for sterile single-use blood collection devices. The focus on sustainability also leads manufacturers to design more with eco materials and reduced-waste. Yet, instability in the prices of raw materials and regulations are likely to obstruct the growth of this market. Hence, companies are concentrating on automation, digital integration, and improving patient experience to fall in line with healthcare trends.

Due to increase in healthcare expenditure, growing testing diagnosis and increasing awareness of safe blood collection practices in regional countries such as China, India, Japan and Australia, Asia-Pacific is fastest growing blood collection devices market. The increasing government initiatives to promote blood donation and disease screening along with their expanding healthcare infrastructure are further augmenting the market demand.

However, the mobility factor in point-of-care testing and mobile health initiatives is now offering new avenues for the growth of blood collection device manufacturers. Nonetheless, factors like restricted availability of sophisticated medical technology in rural regions and cost limitations will hamper the market saturation. Though investments are being made in cost-effective, user-friendly devices, localized manufacturing and strategic alliances with healthcare providers for greater availability and affordability.

Challenges

Risk of Contamination and Safety Concerns

One of the major obstacles in the blood collection devices market is to guarantee the safety of healthcare professionals and patients. The constant risk of needle-stick injuries, potential contamination, and transmission of pathogens means there is still a real need for improved safety features.

High Costs and Limited Access in Developing Regions

Vacuum-based and automated advanced blood collection devices can be quite expensive, leading to lack of availability in the developing regions. Few healthcare facilities and affordability issues prevent mass adoption, and limit US market growth to lower-income areas.

Opportunities

Technological Advancements in Blood Collection Systems

Technologies including painless blood extraction processes, microfluidic devices, and smart blood sampling systems create chances for market progress. Devices that are minimally invasive and automated improve efficiency and comfort for the patient, further fuelling their uptake.

Growing Demand for Blood Donations and Diagnostics

High prevalence of chronic diseases, an aging population, and improved blood donation awareness are some of the factors facilitating the need for efficient blood collection devices. Advanced collection tools will be necessary in healthcare facilities and diagnostic labs to enhance efficiency and accuracy in the testing process.

From 2020 to 2024, the blood collection devices market grew at a consistent rate, thanks to the increasing need for diagnostic procedures, the growing awareness towards blood donation and the overall improvement of safety features. Nonetheless, cost barriers and accessibility challenges restricted-adoption in resource-constrained settings.

In the next 10 years (2025 to 2035), market will be driven by smart blood collection technologies, automation and AI powered diagnostic integrations. Other factors that will shape the market’s future include the expansion of home-based blood collection services and a drive towards eco-friendly, single-use devices.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter guidelines for sterility and safety |

| Technological Advancements | Improved safety needles and vacuum tubes |

| Industry Adoption | Growing use in hospitals and diagnostic centers |

| Supply Chain and Sourcing | Dependence on plastic-based disposable devices |

| Market Competition | Dominated by leading medical device manufacturers |

| Market Growth Drivers | Rising diagnostic procedures and chronic disease prevalence |

| Sustainability and Energy Efficiency | Limited adoption of eco-friendly alternatives |

| Consumer Preferences | Preference for safety and minimal discomfort |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased focus on sustainability and eco-friendly materials |

| Technological Advancements | AI-powered blood collection, microfluidic technology, and automated sampling |

| Industry Adoption | Expansion into home-based and telemedicine-integrated blood collection services |

| Supply Chain and Sourcing | Shift toward biodegradable and reusable collection materials |

| Market Competition | Emergence of innovative start-ups focusing on smart blood collection solutions |

| Market Growth Drivers | Increased demand for decentralized testing and personalized healthcare |

| Sustainability and Energy Efficiency | Development of energy-efficient, waste-reducing blood collection systems |

| Consumer Preferences | Demand for painless, quick, and home-based blood collection solutions |

The USA blood collection devices market is growing in a stable manner, fuelled by the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer which involve the need for frequent blood testing. Rising number of diagnostic laboratories and blood donation centers, as well as demand for advanced blood collection techniques, are driving the blood collection market growth.

Moreover, the USA Food and Drug Administration (FDA) regulatory initiatives encouraging the use of secure and efficient blood collection devices also boost foray. The market is also being fuelled due to technological advancements like vacuum-assisted blood collection and capillary blood sampling would result in reduced discomfort to the patient and increased efficiency in diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

Moreover, in the United Kingdom, the market for blood collection devices is primarily influenced by the growing volume of blood donations as well as the growing burden of infectious diseases, which has led to the need for routine tests of blood. The National Health Service (NHS) has been investing in modernizing blood collection & transfusion services and also encouraging the adoption of automated & minimally invasive blood collection methods. Increasing focus towards home healthcare and the gradual development of diagnostic testing facilities are the other key factors contributing to the market growth. The market will also be driven by the adoption of point-of-care blood collection devices and microfluidic-based sampling methods according to the report.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

A strong healthcare infrastructure along with rigorous safety regulations about blood handling and transfusion, sustains an active demand for blood collection devices in the European Union market. Germany, France and Italy dominate the market with higher healthcare purchase and increased demand for diagnostic testing.

Innovation in the market is being fostered by the rise in minimally invasive and patient-friendly blood collection techniques like capillary blood sampling, and safety-engineered collection devices. Furthermore, the European Blood Alliance (EBA) is engaged in the harmonization of blood collection procedures between member states, facilitating market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

The aging population and a high prevalence of lifestyle-related illnesses that necessitate blood monitoring on a regular basis are driving growth in Japan's blood collection devices market. Blood collection technology in the country is evolving with the increased adoption of advanced blood collection technologies, which are expected to comprise a dominating share of the market due to the introduction of closed system vacuum blood collection and other automated blood sampling devices, which can provide enhanced efficiency while minimizing the contamination risk.

Additionally, government initiatives supporting voluntary blood donation along with investment in blood banking infrastructure further propel the market demand. The growing utilization of telemedicine and home-based diagnostic solutions is likely to drive the demand for easy-to-use blood collection devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The market for blood collection devices in South Korea is expanding due to advancements in healthcare technology, increased awareness about blood safety, and a rise in chronic disease cases. Government of the country is actively promoting blood donation programs and also improving the national blood banking system, which are the major factors contributing towards the market growth.

The increasing adoption of digitalized diagnostic platforms, as well as the expansion of private pathology labs, are contributing to the demand for automated and safe blood collection devices. Additionally, pain-free blood sampling technologies and micro-needle-based collection systems are growing in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The blood collection devices market is expanding steadily with the growing demand for accurate and effective blood sampling techniques in the healthcare sector. Increase in chronic diseases, a rise in diagnostic testing, and expanding infrastructure of healthcare are the other factors responsible for the increasing adoption of blood collection devices across the world. It includes a wide range of devices intended to safeguard and facilitate clean, effective, and hygienic blood collection for diagnostic, therapeutic, and research purposes. As medical technology advances, healthcare providers and laboratories increasingly emphasize the need for new blood collection devices any more so because patient safety, as well as accurate diagnostic results, are critical.

In addition, technological advancements provide an opportunity for self-contained systems for blood draw and transport, further propelling the market forward. Modern blood collection devices are also driven by the need for strict quality control and safety standards promoted by regulatory agencies and healthcare organizations. Furthermore, increasing awareness about blood donation and the need for efficient blood management also fuel the market growth.

Blood collection tubes and needles & syringes dominate the market among blood collection devices due to, widely used in clinical diagnostics, transfusion medicine, and research laboratories. Blood collection tubes are a convenient way to preserve and stabilize the blood samples for analysis. Variety of blood-tube products are used in the diagnosis and treatment of disease these tubes come in various forms, including serum-separating tubes (SST), EDTA tubes, heparin tubes, citrate tubes, etc. Also, growing demand for accurate diagnostic results in diagnosing infectious diseases, hematological disorders, and chronic ailments, like diabetes and cardiovascular diseases is also boosting the demand for specialized blood collection tube.

Moreover needles & syringes are still an integral part of blood collection, allowing safe and efficient sample withdrawal. Healthcare personnel are highly exposed to needle stick and cross-contamination injuries, however, the availability of safety-engineered needles and retractable syringes considerably minimizes such occurrences. Patient comfort and procedural efficiency are also significantly improved with the increasing adoption rate of butterfly needles and evacuated blood collection systems. In addition, an increasing number of outpatient diagnostic tests, home-based blood sampling, and blood donation programs are also driving the growing utilization of these devices.

Technological improvements have created vacuum-assisted sample collection tubes and automated blood collection systems that decrease manual errors and assure repeatable sample quality. With growing emphasis on personalized medicine and genomic advancements, the demand for these innovations in blood collection tubes and syringe technology is anticipated to continue, thereby positioning them as critical elements of modern health care.

As the end users, the major share of blood collection devices is adopted in hospitals and diagnostic & pathology laboratories where all the major diagnostic tests such as routine testing, operative tests and disease diagnosis are performed. Blood collection devices are used by hospitals for a variety of purposes from emergency medicine to chronic disease management. Factors such as rising prevalence of diabetes, cancer, infectious diseases and hematological disorders is resulting in an increased use of diagnostic blood tests, which will in turn create a demand for quality blood collection products in hospital settings.

The increase in the number of multi-speciality hospitals and the critical care units has risen the demand of the efficient system for blood samplings. This requires the importance of closed blood collection systems to minimize contamination risk and ensure the integrity of samples and tests. Moreover, the need for portable and rapid blood collection equipment is transitioning due to the developments in point-of-care testing (POCT) and bedside diagnostics. To further improve workflow and sample collection accuracy, many healthcare facilities are adopting automated phlebotomy, robotic blood sampling, and other blood sample collection devices into their operations.

In recent years, manufacturers have been aggressively restricting access to these blood tests due to old practices and high profit margins, and diagnostic & pathology laboratories are the lead for alternative laboratory-based blood tests across biochemical, hematology, serology, and molecular tests. High-Throughput Solutions, Laboratory Informatics, and Automated Sample Processing Created an Imperative for Advanced Blood Collection Solutions in Pathology Laboratories Diagnostic labs are expanding their services to fit a much larger patient population through the use of telemedicine, at-home sample collection services, and decentralized testing models.

In addition, the liquid biopsy technology, as well as molecular diagnostics, have acted to sustain the importance of pure blood collection devices in laboratories. With the rise of precision medicine and targeted therapies, pathology labs need specific blood collection tubes that have been optimized for use in cell-free DNA (cfDNA), RNA, and biomarker preservation. Innovation in these areas is likely to determine how blood collection devices develop in future enabling samples to be stabilized and stored seamlessly in a variety of conditions.

The market for blood collection devices will be boosted by the increased need for blood donation, the rising incidence of chronic diseases, and the growing use of advanced blood collection devices. Increasing demand for blood products in surgeries, trauma, and disease management is helping in the innovation of collection devices. Automation, minimally invasive collection techniques, and safety features including needle-stick prevention are among the major trends that are impacting the market. The adoption of advanced blood collection solutions is further supported by regulatory policies and improvements in healthcare infrastructure.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Becton, Dickinson and Company (BD) | 25-30% |

| Terumo Corporation | 15-20% |

| Fresenius Kabi | 10-15% |

| Haemonetics Corporation | 8-12% |

| Greiner Bio-One | 5-10% |

| Other Industry Players (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Becton, Dickinson (BD) | Market leader in blood collection needles, tubes, and vacuum-based collection systems. |

| Terumo Corporation | Specializes in safety-engineered blood collection systems and closed-loop devices. |

| Fresenius Kabi | Provides automated blood component separation and apheresis collection solutions. |

| Haemonetics Corporation | Focuses on blood management systems, including whole blood and plasma collection. |

| Greiner Bio-One | Offers vacuum blood collection tubes with advanced coagulation and separation properties. |

Key Company Insights

Becton, Dickinson and Company (BD) (25-30%)

BD has the largest market share and a broad product range in the BD blood collection devices field, which includes vacuum systems, syringes and capillary blood collection systems. Its focus on safety, efficiency, and regulatory compliance has reinforced its global leadership.

Terumo Corporation (15-20%)

Specialized in automated and soft blood collection systems with a focus on user friendliness and safety to prevent needle stick injury/readiness for contamination, Terumo is a market leader in the fields of minimally invasive blood collection systems.

Fresenius Kabi (10-15%)

Fresenius Kabi has a strong focus on blood component separation and transfusion technology, aiming to provide automated solutions for the collection of plasma, red blood cells, and platelets.

Haemonetics Corporation (8-12%)

Haemonetics is a next-generation leader in blood management solutions utilizing automated capabilities for whole blood and plasma collection systems to maximize efficiency and donor comfort.

Greiner Bio-One (5-10%)

Greiner Bio-One is known for their vacuum blood collection tubes with improved separation and coagulation properties, with application in clinical laboratories and diagnostic centers around the world.

Other Key Players (25-35% Combined)

Multiple new and seasoned players are pushing blood collection technology forward. Notable players include:

The overall market size for the blood collection devices market was USD 8.72 billion in 2025.

The blood collection devices market is expected to reach USD 16.37 billion in 2035.

The blood collection devices market is expected to grow at a CAGR of 6.5% during the forecast period.

The demand for the blood collection devices market will be driven by the increasing prevalence of chronic diseases, rising demand for blood donations, advancements in blood collection technologies, growing healthcare infrastructure, and government initiatives promoting safe blood collection practices.

The top five countries driving the development of the blood collection devices market are the USA, Germany, China, Japan, and India.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.