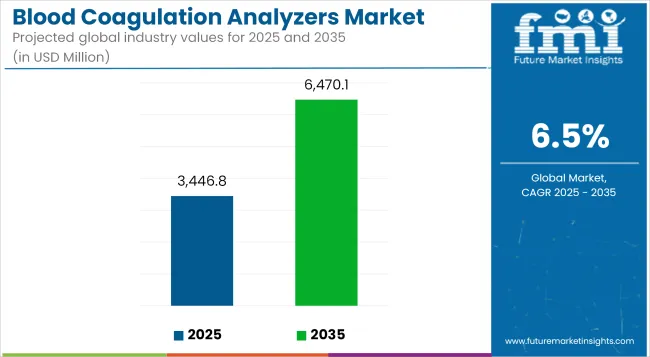

The blood coagulation analyzers market is expected to reach USD 3,446.8 Million by 2025 and is expected to steadily grow at a CAGR of 6.5% to reach USD 6,470.1 Million by 2035. In 2024, blood coagulation analyzersmarket have generated roughly USD 3,236.4 Million in revenues.

Blood coagulation analyzers measure the coagulation function of blood.The main application of coagulation analyzers are they are majorly used is diagnosis of bleeding disorders and monitoring of anticoagulant therapy. Ageing geriatric populations are other critical driving forces since the age of the patient is one of the crucial risk factors for sustainability in developing clotting disorders.

The technological advancement in point-of-care (POC) analyzers has also succeeded in increasing speed and efficiency in getting results and, in all, enhancing the quality of care extended to patients. Automation and integration systems will enable less complexity in their workflow process within the hospital and diagnostic lab environments.

Rising preventative medicine and screening activities above blood are another support factor for improving this market. More drug development and clinical tests will also contribute to more utilization of blood coagulation analyzers

Key Market Metrics:

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,446.8 Million |

| Industry Value (2035F) | USD 6,470.1 Million |

| CAGR (2025 to 2035) | 6.5% |

Increasing requirement for testing for coagulation derangements during COVID-19 outbreak significantly attributed to the growth of the market during 2020-2024. Increased instant thrombotic complications; intensified demand for D-Dimer and PT/aPTT within hospitals and laboratories. Also, the pandemic has ushered in a wave of usage of point-of-care (POC) analyzers, which, in turn, fast tracked and decentralizes testing.

Additionally, routine coagulation monitoring has been endorsed considering the commonality of cases in the world today concerning cardiac diseases, venous thromboembolism, and hemophilia. The advancing number of elderly patients requiring routine clotting tests also contributed to thegrowth of the market.

The rising popularity of using blood coagulation analyzers in North America is due to the high incidence rates of cardiovascular diseases, deep vein thrombosis (DVT), and bleeding problems such as hemophilia associated with increasing adult population patients.Further improvements include new specialized diagnostics technologies, such as high-throughput analyzers, which have increased operation effectiveness and accuracy associated with testing.

These public and private partnerships build innovation and accessibility through supportive reimbursement policies and availability of established players in the market. Besides, developed health infrastructure in this region, increased use of laboratory automation, and strong regulatory approvals (Health Canada and FDA) further drives adoption

Due to increased prevalence of thrombosis, stroke, and other cardiovascular disorders, European blood coagulation analyzers are in demand. Aging populations with chronic diseases such as diabetes and hypertension lead to the need for regular coagulation testing, while high penetration of diagnostic companies and a well-established laboratory infrastructure supplement market growth.

Due to strict regulatory requirements (EMA, CE Mark) of high reliability and accuracy, blood coagulation analyzers are easy to adopt. Rising attention to personalized medicine, and monitoring of anticoagulant therapy, these conditions too lead to increased acceptance of blood coagulation analyzers across Europe

Aging populations and unhealthy living styles have increased the demand for coagulation testing. China, Japan, and India set on a path to boost healthcare infrastructure and diagnostic technology investments that feed the growth.

Adoption rates grow with greater awareness of early disease diagnosis and growth in private diagnostic labs. Growing demand for advanced diagnostic equipment is driven by increased point-of-care testing in rural and remote areas, technological improvements in portable and automated analyzers, and increased medical tourism in the region..

High Cost of Advanced Blood Coagulation Analyzers Hinders the Adoption of Blood Coagulation Analyzers

Among the biggest barriers to the blood coagulation analyzers market is a prohibitively high cost on advanced instrumentation and reagents, thus barring access to those instruments in low- and middle-income countries. Competing highly multiplexed assays require huge investments from diagnostic laboratories and hospitals, and thus, they are, after all, expensive.

Besides, the cost of operation becomes a heavy burden too-small healthcare establishments in terms of recurring expenses on reagents, maintenance, and software updating. There is a little reimbursement in some regions, and thus the adoption becomes all the more difficult.

On the other hand, lack of training programs and laboratory facilities to train personnel to operate those sophisticated analyzers in developing countries has limited mass adoption of the technology in these countries, thereby keeping a gap in market penetration.

Growing Demand for Point-of-Care (POC) Testingposes significant opportunity for blood coagulation analyzers

Growth in demand for point-of-care blood coagulation analyzers is a notable opportunity for the market. Small, portable machines allow immediate, rapid coagulation testing bedside, in the event of emergencies, or for home care. With increased disease burden from diseases such as chronic cardiovascular disease and thrombosis, there is an increasing demand for real-time monitoring solutions for improved diagnosis and adjustment of treatment.

Telemedicine in integration with point-of-care analyzers also enables easier remote monitoring by hospitals on their patients without a formal visit. Government initiatives promote health coverages to low-rural locations, and improvement in cost-effective miniaturized POC analyzers also boosts its adoption.

While health systems make the shift toward decentralized or preventive care, demands for coagulation testing from portable, cheap, and accessible solutions will grow further, promising a mammoth business opportunity.

Growing Adoption of Fully Automated Blood Coagulation AnalyzersSurges the Growth of the Market

Automated means that one can use it to make the work more efficient by giving quick, accurate and flawless results whereby reducing manual burdens and turnaround time. These instruments talk to laboratory information system (LIS) and electronic health records (EHRs) which have made data handling easier and streamlined clinical decision-making.

In addition, automation reduces reagent usage and operational costs, hence making such systems cost saving in the long run. As there will be an increase in the older population and the occurrence of bleeding disorders, healthcare professionals are putting their priorities in completely automated systems for improving diagnostic capacity and addressing increasing patient demand.

Expanding Role of Blood Coagulation Analyzers in Personalized Medicine Anticipates the Growth of the Market

Personalized medicine has increasingly depended on blood coagulation analyzers for personalized anticoagulation therapy management in cardiovascular and thrombotic disease. All the anticoagulants from warfarin to heparin to novel direct oral anticoagulants (DOACs) need to be monitored accurately to prevent over-bleeding or over-clotting of patients.

Clinicians will begin to develop an individualized anticoagulation therapy through the better calibration, biomarker-based testing, and patient-coagulation profiling. Moreover, the development of pharmacogenomics with anticoagulation analyzers will advance personalized treatment methods by predicting patients' possible reactions to certain anticoagulants. The growing momentum of precision medicine will drive demand for advanced blood coagulation analyzers equipped with the latest diagnostic capabilities.

Shift Towards Point-of-Care (POC) Coagulation Testing is an Ongoing Trend in the Market

The market is moving from the centralized laboratory testing to point-of-care (POC) where rapid bedside diagnoses are done by POC analyzers. Results can be obtained immediately from POC analyzers in emergency, operating room, and homecare settings, which will hasten evidence-based clinical decision-making.

Miniaturized, handheld devices carry on-board connectivity to telemedicine platforms for remote real-time monitoring of bleeding disorders or patients on anticoagulation therapy. Progress in microfluidic technology and biosensors will also help boost accuracy and speed in POC testing. As the demand for decentralized health care increases, driving up growth, so too will POC blood coagulation analyzers come to prominence as the principal market driver.

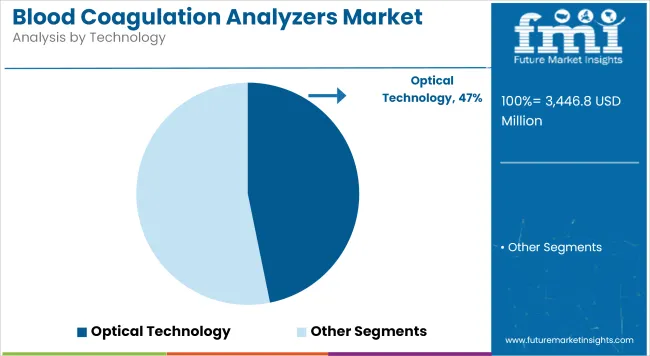

Advancements in Optical and Electrochemical Detection Technologies

he improvements in optical and electrochemical detection technologies are refining the accuracy and effectiveness of blood coagulation analyzers. Next-generation optical sensors, including turbidimetric and fluorescence-based detection, will enable clot formation monitoring in real time and with increased sensitivity. Simultaneously, electrochemical biosensors are improving the precision in measuring clotting factors, platelet activity, and anticoagulant activity.

Such improvements reduce test variability and enhance reproducibility; thus miniaturization of devices is possible, which is important for point-of-care and home-based testing. As the focus turns more towards early diagnosis and tailored treatment, it is expected that new detection technologies will propel the next stage of development in blood coagulation analyzers.

The market for blood coagulation analyzers experienced steady growth during the time span from 2020 to 2024, primarily owing to the increased burden of cardiovascular diseases, improvements in the number of surgical interventions performed.Another catalyst of the growth in adoption was technological innovation, including but not limited to automated tests and point-of-care instruments.

Going forward into 2025 to 2035, AI integration for predictive analytics, personalization in medicine, and home-based monitoring will drive growth within the market. Infrastructure expansion in healthcare in emerging markets and innovative regulatory adaptations will also contribute to a wider application of coagulation testing in the future.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent quality standards, better compliance levels, and increased validation of automated coagulation analyzers. |

| Technological Advancements | Evolution of totally automated analyzers, better optical and mechanical clot detection, and better reagent stability. |

| Consumer Demand | Growing demand due to increasing surgical procedures, cardiovascular conditions, and anticoagulant therapy monitoring. |

| Market Growth Drivers | Growing incidence of coagulation disorders, more hospitalizations, and increased investments in diagnostic facilities. |

| Sustainability | Transition towards environmentally friendly reagents, energy-saving devices, and less laboratory waste. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global standardization of diagnostic procedures, wider reimbursement policies, and more stringent quality control of reagents. |

| Technological Advancements | Miniaturized high-speed analyzers, real-time monitoring integration, and greater accuracy in clotting tests. |

| Consumer Demand | Increased use in home care, increased demand for decentralized testing, and increased geriatric patient care. |

| Market Growth Drivers | Increased growth in personalized medicine, growth in emerging economies, and ongoing hemostasis testing advancements. |

| Sustainability | Large-scale application of recyclable materials, lower energy use models, and eco-friendly reagent formulations. |

The high cost of medical care, heavy reliance on point-of-care testing, and an increasing number of patients under anticoagulant treatment all support the U.S. market. It will be propelled into the future by innovation in laboratory automation and stringent FDA regulation. The expansion in the future will be driven by personalized hemostasis testing and increased integration with hospital information systems.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Blood coagulation analyzers demand in Germany is generated by the highly developed health care system, growing proportion of the aged, and increasing number of cardiovascular diseases. High government funding for research and testing and stringent regulatory requirement lead to the technology's growth. Keeping the precision medicine and decentralized testing of coagulation, the market seems to broaden up.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

India's flourishing market will be stridden by the increasing awareness regarding blood disorders, improved access to health care, and government policies towards diagnostic advancements. Investments in private healthcare and increasing diagnostic chains fuel adoption. Future growth will result through better rural healthcare penetration and availability of low-cost coagulation tests.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

China High strong market development in China resulted from the aging population, increasing number of stroke and thrombosis cases, and large investment in health care infrastructure. Local manufacturing support from the government and advancements in laboratory automation drive adoption. The future dominance would likely come from the broader availability of high-throughput analyzers and increased penetration of private laboratories.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

The modernization in healthcare facilities is transforming into market demand, with the increasing elderly population and chronic disease incidences in the country. The diagnostics machinery largely comes from technology dominance coupled with stringent regulatory control and affinity towards precision diagnosis. The future market will grow with the improvement of reagents in terms of efficiency, miniaturized analyzers, and increased home coagulation testing.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

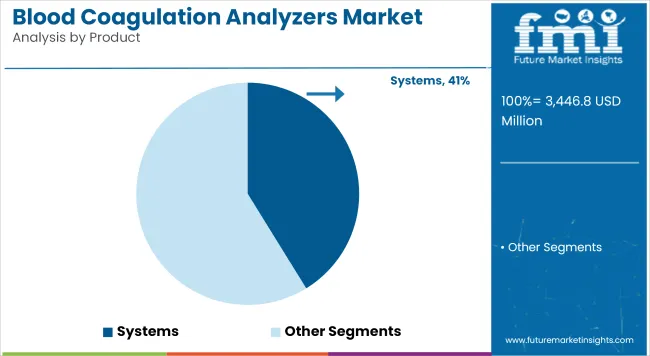

The Systems segment dominates due to the increasing need for automated, high-precision diagnostic tools in clinical and hospital laboratories

Automated blood coagulation analyzers are optimized to streamline the workflow, eliminate manual errors, and provide timely test results while ensuring accurate test results. The increased prevalence of the coagulation disorders of thrombosis and hemophilia has fostered the requirements for more effective testing solutions.

Moreover, technological advances such as high-throughput testing and improved connectivity to lab information systems have promoted the use of semi-automated and automated analyzers. The regulations enforcing accuracy and accreditation of laboratories further justify the dominance of this segment.

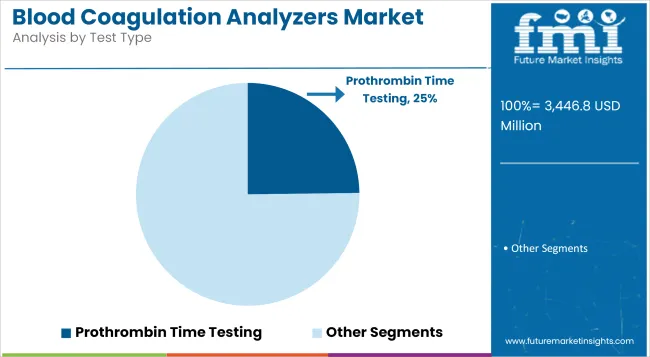

The Reagents segment holds a substantial share due to the recurring need for consumables

Reagents such as prothrombin time (PT)-activated partial thromboplastin time (aPTT), fibrinogen, and D-dimer reagents are consumed on an ongoing basis. As the incidence of cardiovascular diseases and blood clotting disorders increases, the demand for coagulation tests has increased, resulting in more coagulation tests being performed.

The testing volume is further increased by advancements in specific reagents for expanded test parameters and personalized medicine. Also, the cooperation of the automated and semi-automated systems in dependence on compatible reagents for their functioning solidifies the growth of this segment.

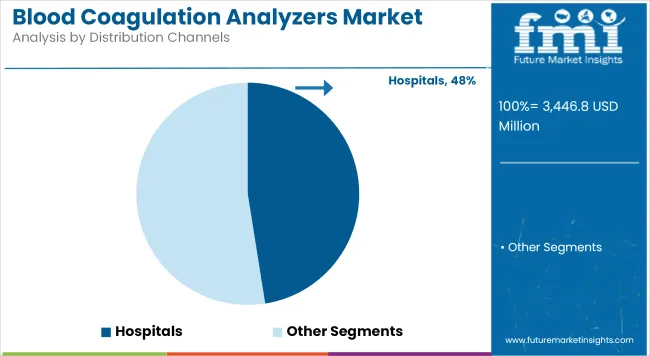

The Hospitals segment dominates the market due to the high volume of patient admissions.

Large patient population that requires coagulation tests before surgeries, in cases of trauma, and for the management of chronic diseases that hospitals have emerged as the market leaders in blood coagulation analyzers. Additionally, having good diagnostic facilities, fully automated machines, and qualified staff allows for quick and reliable coagulation tests. Bloode Coagulation Parameters are also monitored frequently in intensive care units (ICUs) and emergency departments for critically ill patients.

All tests are then done according to the increase in prevalence of cardiovascular diseases such as hemophilia, deep vein thrombosis, etc. Coagulation tests are still called the gold standard in coagulation testing, especially when hospitals and regulatory forces support and encourage such tests, along with the reimbursement initiatives they're set forth through hospital-based diagnosis.

Clinical laboratories hold a significant market share due to their high-throughput capabilities

Clinical labs form a significant portion of the entire market, particularly in terms of cost-effective testing systems and volume throughput. Most of these hospitals or outpatient departments do best and have their coagulation tests done on an outsourced model to specialized laboratories for mass diagnosis. Furthermore, technological improvements of automatic and semi-automatic analyzers and independent laboratory settings benefit independent laboratories with high efficiency and precision.

Additionally, increased demand from patients with bleeding disorders for regular assessment of routine blood coagulation and the monitoring of anticoagulant therapy further push toward lab-based tests. Clinical laboratories dominate the scene, especially in non-urgent, high-volume coagulation testing, with large economies of scale and aggressive pricing strategies, given rising outsourcing of diagnostics.

Progressive technological improvement as well as regulatory designations along with collaborative alliances induces strong competition in the marketplace. Regulatory agencies like FDA and EMA establish high standards on precision, automation, and reliability for coagulation diagnosis. Market consolidation involves partnerships of industry leaders with hospitals and diagnostic laboratories, as well as pharmaceutical companies, to ensure continuous application of state-of-the-art analyzers.

With the onset of automated and point-of-care testing solutions, competition becomes fiercer, forcing market giants to further broaden their product portfolios. Regional manufacturers, on the other hand, focus more on cost-effective solutions and local distribution networks, forcing established players to offer affordable high-performing options in emerging markets.

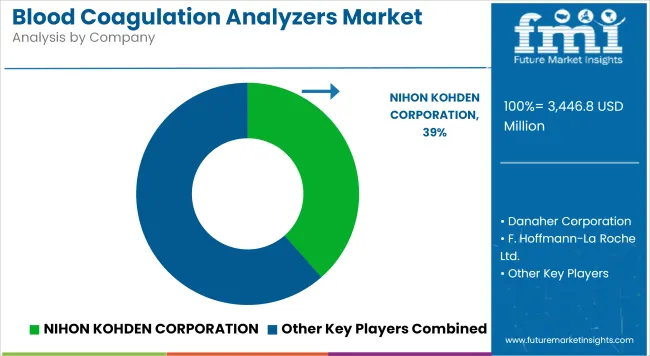

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NIHON KOHDEN CORPORATION | 33.6% to 38.5% |

| Danaher Corporation | 20.4% to 22.6% |

| F. Hoffmann-La Roche Ltd. | 15.1% to 17.2% |

| Sysmex Corporation | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| NIHON KOHDEN CORPORATION | Nihon Kohden specializes in high-end, high-precision hemostasis technology blood coagulation analyzers intended for hospitals and clinical laboratories. Its areas of focus are automation, real-time monitoring, and improved diagnosis with seamless integration into workflow |

| Danaher Corporation | Danaher Corporation and manufactures automated and high-throughput analyzers for blood coagulation analysis employing artificial intelligence in analysis to ramp up efficiencies in clinical diagnostics. The company is still aligning its coalition efforts with health providers and developing software for maximizing efficiency in coagulation testing |

| F. Hoffmann-La Roche Ltd. | Roche states that advanced coagulation analyzers offer high-quality features with the concept of precision medicine and laboratory automation in mind. From multi-nodal integrated hemostasis analyzers to departmental/institutional laboratory workflow automation, the offer extends to work automation in hospitals and clinical laboratories |

| Sysmex Corporation | Sysmex has been a pioneer in blood coagulation diagnostics in the world, offering fully-automated analyzers with improved reagent compatibility . I ncreasing accuracy in testing thrombosis and bleeding disorders, extensive aggressive expansion into growth markets and developing supply and service networks worldwide are also undertaken by Sysmex |

Key Company Insights

Systems, Automated Systems, Semi-Automated Systems, Manual Systems, Reagents and Accessories

Optical Technology, Mechanical Technology and Electrochemical Technology

Prothrombin Time Testing, Fibrinogen Testing, Activated Clotting Time Testing, Activated Partial Thromboplastin Time Testing, D-Dimer Testing, Platelet Function Tests, Anti-Factor Xa Tests and Heparin & Protamine Dose Response Tests for ACT

Hospitals, Clinical Laboratories and Point-of-Care Testing

The overall market size for blood coagulation analyzers market was USD 3,446.8 Million in 2025.

The blood coagulation analyzers market is expected to reach USD 6,470.1 Million in 2035.

Rising prevalence of blood disorders and increasing surgical procedures anticipates the growth of the blood coagulation analyzers market.

The top key players that drives the development of blood coagulation analyzers market are NIHON KOHDEN CORPORATION, Danaher Corporation, F. Hoffmann-La Roche Ltd., Sysmex Corporation and Thermo Fisher Scientific Inc.

Automated Systems segment by product is expected to dominate the market during the forecast period.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 04: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 06: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 07: Global Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 08: Global Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 09: Global Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Test Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Test Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channels, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channels, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 04: Global Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 05: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 06: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 07: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 08: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 09: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Test Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Test Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channels, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Test Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Test Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channels, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channels, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channels, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channels, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Test Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channels, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Blood Volume Analyzer Market – Demand, Growth & Forecast 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Blood Pressure Monitor Market Analysis by Product, Indication, End User and Region: Forecast for 2025 to 2035

Competitive Landscape of Blood Temperature Indicator Providers

Key Players & Market Share in the Blood-Based Biomarker Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA